2 Mins Read

ADB Ventures, a new venture platform to support and invest in startups offering tech-based impact solutions to contribute to the Sustainable Development Goals (SDGs), has just announced that it will start making investments. It follows the success of its first inaugural investment fund, which raised US$50 million, exceeding its target. As the world begins to slowly recover from coronavirus, ADB Ventures will also screen projects that seek to address both the pandemic and resilience to future health and climate crises.

Set up in late January, ADB Ventures has achieved the close of its first inaugural investment fund with US$50 million earlier this month, which will allow it to start investing in SDG-focused tech startups based in Asia-Pacific. It is supported by the Clean Technology Fund, South Korea’s Ministry of Economy and Finance, Finland’s Ministry of Foreign Affairs and the Nordic Development Fund.

“These commitments by some of the world’s most forward-thinking development funders will be catalytic in achieving ADB’s vision to convene one of the region’s largest impact venture platforms,” said Mike Barrow, ADB director general for private sector operations.

The inaugural investment fund under ADB Ventures has a 17-year fund life, and will specifically target early stage and growth stage cleantech, agriculture technology and health technology businesses that are working on climate and gender innovations.

Current projects under ADB Ventures Labs include The Building Energy Challenge, a ASEAN-based program encouraging efficient energy management and smart buildings, Singapore-based water technology accelerator Imagine H2O Asia, circular economy and waste management solutions focused Travel Lab Asia, and the Future Food Asia Awards 2020, which works to identify agritech and food security solutions.

As the world continues to adapt to Covid-19-related challenges, ADB Venture’s mothership, the Asian Development Bank (ADB) says it will support sustainability-focused recovery efforts in Asia-Pacific. It announced earlier this month that it will triple its coronavirus response package to US$20 billion, and will be aimed at delivering funding to both public and private sector solutions that tackle the pandemic-induced economic downturn and health crisis resilience.

Amidst the coronavirus crisis, investors in Asia have been demonstrating greater interest in sustainable investments as concerns about public health and the environment reach an all time high. The Swiss multinational investment firm UBS’s private banking unit in Asia, for instance, recorded a doubling of assets in sustainable investments since the beginning of the crisis, with the majority coming from the Greater China region.

Many of these investments have paid off. In a recent research note, HSBC said that companies with a strong environmental, social and governance (ESG) record have outperformed the broader stock market, and that ESG stocks represent an opportunity for investors to defend against the pandemic-induced economic downturn.

Update May 2020: This article has been updated to correct a mistake and accurately reflect that it is ADB, not ADB Ventures, that will triple its coronavirus response package.

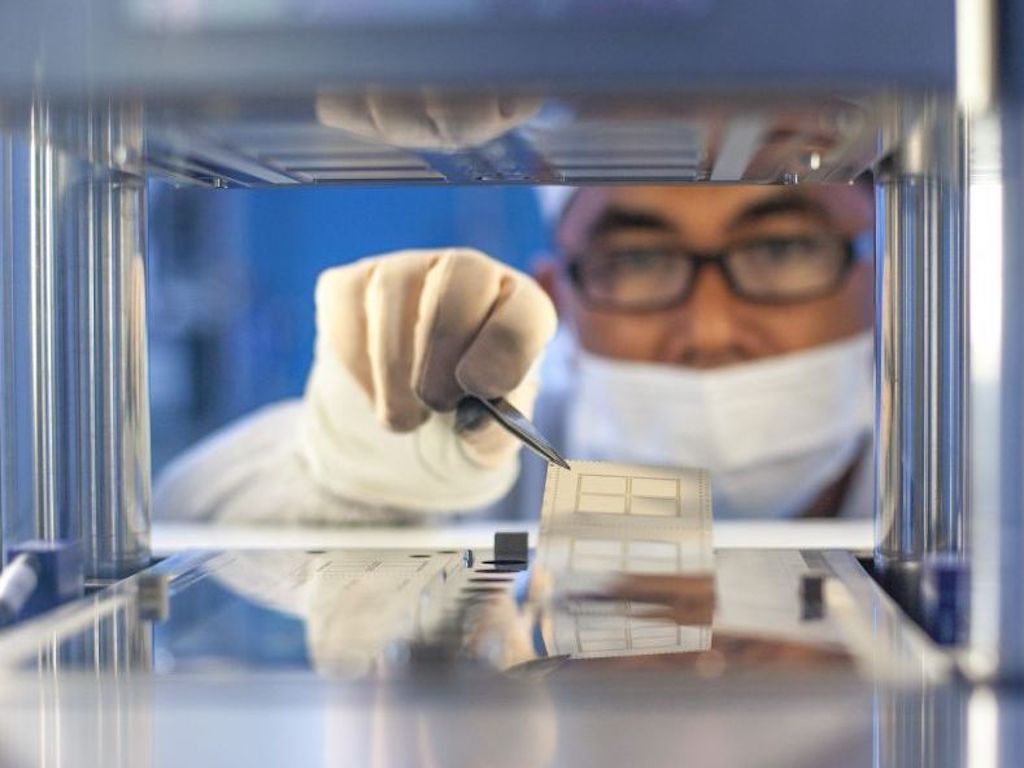

Lead image courtesy of ADB Ventures.