Cultivated Meat Regulation: The 10 Most Supportive Countries, From Funding To Policy

8 Mins Read

When it comes to cultivated meat, these ten governments are the most active in terms of funding, regulatory frameworks and research resources.

Cultivated meat is one of the key food solutions in our climate crisis-fighting arsenal. There are now over 100 startups globally working on this technology and 2022 saw some huge strides in the sector, from the largest funding round ever recorded to key product firsts.

As pundits continue to debate the topic of whether cultivated meat will become a common reality (It can’t scale! It definitely will scale!), one major issue that needs more attention is government support. From policy to subsidies, more needs to be done to boost the industry. Certain forward-thinking governments are making moves in terms of regulation and government funding, both of which are largely seen as the crucial next step to finally getting sustainable protein grown using cellular agriculture to diners’ plates. From regulatory updates in the US to more greenlights from Singapore authorities, we take a look at the ten most active governments across the globe that are helping to make cultivated meat a reality.

Editor’s Note: While this list focuses on countries that have allocated the most funds and/or made the biggest regulatory moves, this list is not exhaustive. There are a handful of other countries that are pushing ahead with regulatory frameworks and economic support- a few to watch include South Korea, India, Canada and the United Arab Emirates.

1) Singapore

Singapore famously became the world’s first country to approve the sale of cultivated meat in December 2020 when it gave the go-ahead for Eat Just’s chicken nuggets. It has since approved a slew of the food tech’s products, including chicken breast, as well as a food processing license to Esco to manufacture foods using cell-ag tech. Aussie firm Vow says it is also expecting Singapore regulators to give the go-ahead for its cultivated quail soon. Cultivated meat products are approved by the Singapore Food Agency (SFA) on a case-by-case basis, with producers submitting safety assessments to grant pre-market approval.

Aside from setting up its regulatory framework, which has been continually revised (four times and counting) to include new feedback from industry stakeholders, Singapore’s government has also poured money into the sector as part of its ‘30% by 2030’ local food production goal. Now housing an entire batch of homegrown startups like Shiok Meats, and foreign startups like Eat Just and Hong Kong’s Avant who have chosen the city as its Asia base, Singapore is likely to continue its lead in paving the way for global cultivated meat adoption.

2) Israel

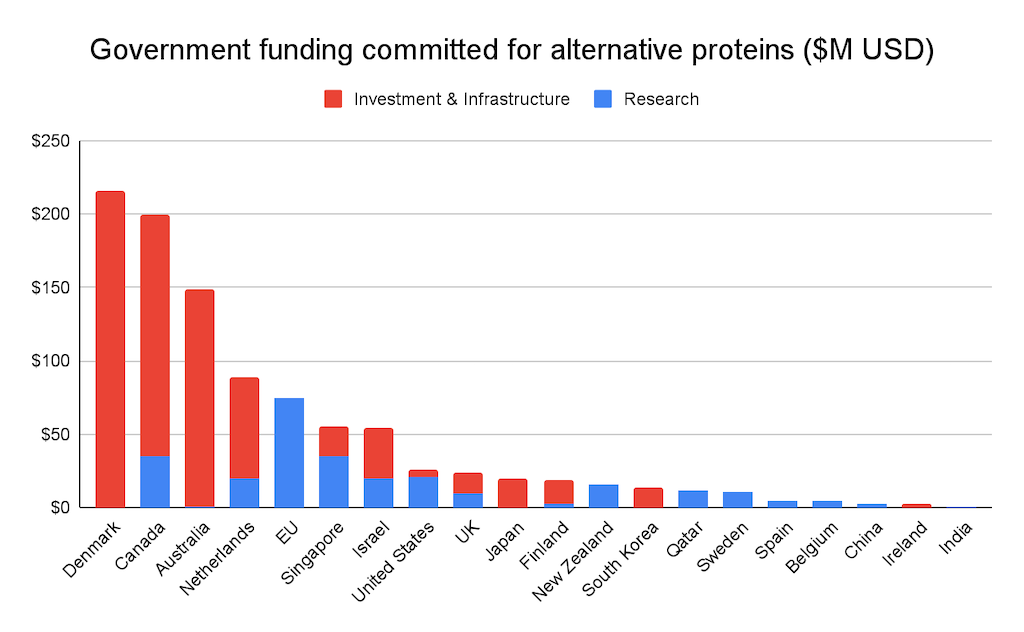

Israel is another global leader in the cultivated industry, with its Innovation Authority demonstrating clear support with its latest $18M injection into a nationwide cultivated meat consortium. The group is made up of 14 companies and 10 universities and research bodies in the country. Aside from research funding, the government has also poured public funds into the sector, contributing over $13M to early-stage startups and infrastructure to the overall alt-protein industry.

3) United States

The US is making moves towards approving the sale and consumption of cultivated meat, which will likely come in 2023. Industry watchers are eyeing the milestone after California’s Upside Foods got through the first hurdle. In November, the startup received FDA GRAS status for its cultivated chicken, becoming the first American company to have its products deemed safe to eat. Eat Just received the same “no questions” letter last month. This is the initial pre-market step of the country’s joint framework to regulate cultivated meat products, with the USDA then in charge of the processing, packaging and labeling steps for certain products which fall under its oversight.

In terms of funding, the US government has backed the sector in several different ways. Most notably, the USDA awarded a $10M grant in 2021 to Tufts University for the creation of a new National Institute for Cellular Agriculture, which was the first-ever government-funded research project. The Biden administration doubled down on its promise to support alt-proteins in September 2022: the biotech program includes funding for “foods made with cultured animal cells”. More assistance came in the way of the administration’s Global Food Security Research Strategy released in October, as part of Biden’s plan to end hunger and foster food resilience.

4) European Union

For cultivated meat products to be sold in the EU, regulators at the European Food Safety Authority (EFSA) will have to test the products as with any other novel foods. In addition to a pre-market safety evaluation, cultivated meat products that may use genetically modified ingredients will need to comply with the region’s GM foods regulations.

While the EU’s food safety rules are among the world’s most stringent, which may mean a slower pace for cultivated products to reach the market, the region is investing in the sector as part of its climate plan. In 2020, the EU’s Farm to Fork strategy included alternative proteins as a “key area of research” for a “fair, healthy and environmentally-friendly food system”, a sentiment lawmakers doubled down on within its 2021 Strategic Foresight Report. The EU’s core innovation and research funding program Horizon Europe also mentioned cultivated meat and seafood as one out of three of its core pillars, with around €7M set aside specifically for the sector. This means more money going into projects that will help make cultivated meats more cost-efficient, such as the necessary infrastructure and materials or ingredients, and scale-up efforts.

5) European powerhouses: The Netherlands and Norway

Across Europe, some of the leading governments accelerating cultivated meat includes the Netherlands, which has injected €60M into the Cellular Agriculture Netherlands consortium, and Norway, where authorities have set up a five-year research project into cellular agriculture with €2M in annual public funding.

6) United Kingdom

Right now, the UK will require any cultivated meat products to go through pre-market authorization from the Food Standards Agency (FSA) as with any other “novel foods” in order to be sold on the market. There have been some signs that a novel regulatory framework “distinct” for cultivated foods could be on the horizon, with one government policy paper suggesting that adopting these changes would be a part of the country’s successful post-Brexit economic plan.

Some public funding has been injected into the industry, with the UK Research and Innovation (UKRI) awarding £14M to nearly a dozen projects in May this year, one of which is the Royal Agricultural University’s research into transitioning livestock farmers towards cultivated meat. Previously, the UKRI has backed London-based Multus Biotech, a startup focused on developing cost-effective animal-free growth media to help scale cultivated meat production.

7) Australia and 8) New Zealand

In Australia and New Zealand, regulators say their existing Novel Foods Standard will already be able to accommodate foods made through cell-ag tech. This will include cultivated foods that may have used genetic modification technology, which will have to comply with additional regulations. Companies will have to submit their application to the FSANZ for pre-market approval. The capability of the existing standards and labeling requirements to cope with new cultivated meat products was accepted at the Food Ministers Meeting (FMM) in November 2022.

Read: 10 reasons why cultivated meat is the future of protein

9) Japan

Japan is poised to see a new regulatory framework for cultivated meat, with its government stating it has already put together an expert team to begin assessing the safety of these products in June 2022. This will be spearheaded by the country’s Health, Labor, and Welfare Ministry, whose panel is tasked with deciding the necessary safety precautions for the sector. These moves came after the Japanese Ministry of Agriculture, Forestry, and Fisheries launched a forum in 2020 made up of industry stakeholders, including companies and government agencies, to compile a strategy for building Japan’s alt-protein ecosystem.

In terms of funding, the Japanese government has supported homegrown startup IntegriCulture, awarding it a ¥240M (US$2.2M) grant in 2020 to build its first commercial bioreactor.

10) China

China recently hinted that it will ramp up its investment in cultivated meats. Its latest five-year agricultural plan specifically included cultivated meat and “artificial protein” for the first time. Under the plan, the Ministry of Agriculture & Rural Affairs outlined the development of “synthetic biology technology” as key to its goal of “upgrading of the food industry, and reduc[ing] the pressure on environmental resources brought about by traditional aquaculture”. According to state media Xinhua News, Chinese President Xi Jinping reiterated the need to develop new sources of protein. He commented that “developing biological science and technology” to supplement traditional livestock would be key to the country’s food resilience.

Lead image courtesy of Upside Foods.