4 Mins Read

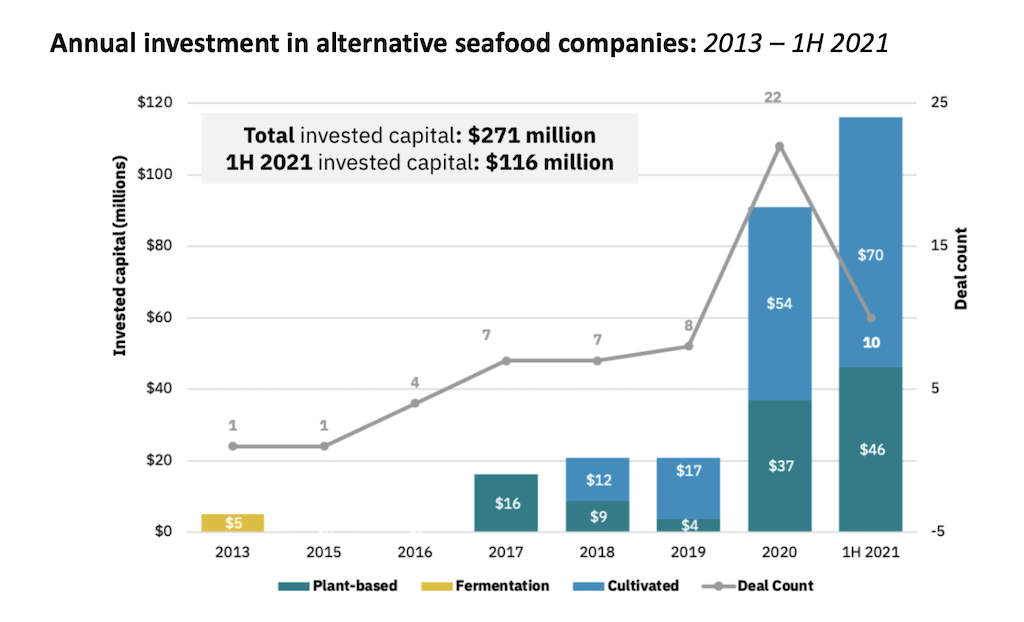

New data shows record-breaking funding pouring into the alternative seafood sector, amid growing concerns over the environmental and human rights impact of the seafood industry. In the first half of 2021 alone, companies developing plant-based, cell-based and fermentation-derived alternatives to seafood raised $116 million, exceeding the total figure recorded in 2020.

According to a new State of the Industry report published by the Good Food Institute (GFI), the alternative seafood industry has attracted more funding within the first 6 months of 2021 than over the entire year in 2020. Collectively, startups using plant-based, cultivated and fermentation technologies to develop alternative seafood products raised $116 million through June 2021.

Alternative seafood sector growth

While the entire alternative protein industry has undergone dramatic growth, with funding tripling to $3.1 billion globally in 2020 and US plant-based retail sales topping $7 billion for the first time, GFI’s latest industry report on alternative seafood shows “promising” signs for the burgeoning sector.

Of the $116 million invested into alternative seafood startups within the first half of 2021, most of the financing, which was spread across seven disclosed deals, was directed to plant-based companies. There were 10 total deals in the sector, with 3 deal sizes remaining undisclosed.

Plant-based players securing significant funding included Gathered Foods, the makers of the plant-based tuna brand Good Catch, New Wave Foods, as well as Revo Foods and Kuleana. Cell-based players also saw strong investment rounds, including BlueNalu, which bagged $60 million in the cultivated fish sector’s largest round to date.

Other cultivated seafood startups that attracted major funding included Hong Kong’s Avant Meats, Shiok Meats, the Singapore startup that recently debuted the world’s first cultured crab, US-based Cultured Decadence, Finless Foods and Wildtype.

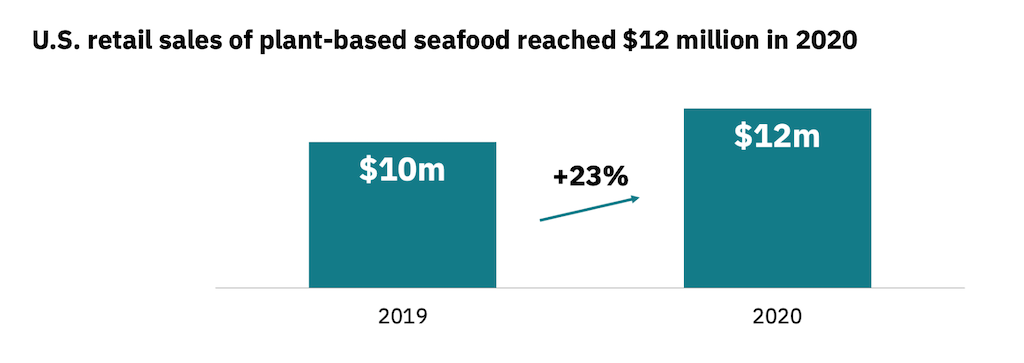

23% surge in alternative seafood sales

Aside from raising record-breaking funding in 2021, the alternative seafood space has seen sales skyrocket, with US sales data from January 2020 to December 2020 indicating a 23% surge to reach $12 million. Currently, alternative seafood products on the market are dominated by plant-based players, with cell-cultured seafood products yet to be commercially available.

Among some of the top plant-based players in the sector include Good Catch Foods, Plant Based Seafood Co. and the most recent entry is Hong Kong-based OmniFoods, which launched its OmniSeafood line earlier this year. There is only one fermentation-enabled seafood brand on the market, Quorn, which offers mycoprotein-based fishless fingers.

In terms of the number of food techs and brands in the sector, the GFI report revealed that the figure had grown from just 29 in 2017 to more than 85 firms by June 2021.

And while their fermentation seafood alternatives remain the smallest segment, there have been significant breakthroughs, with players like Aqua Cultured Foods debuting the world’s first microbial fermentation whole-muscle seafood this year, as well as Enough’s 3D-printed mycoprotein tuna steak prototype.

Major innovation opportunities

The GFI report emphasises that despite the “promising” signs of early growth, the sector is still in its infancy and novel food technologies will have enormous potential to disrupt the traditional seafood industry.

“There is arguably no category more urgent and ripe for innovation than seafood,” said the report. “Alternative seafood remains a market whitespace, and is a fraction of the size of the alternative protein market, which is, in turn, a small slice of the overall meat and seafood market.”

Some of the key opportunities highlighted in the report include developing more varieties of seafood to capture niche market demand, as well as widening the net of textures when it comes to existing plant-based seafood products, which tend to come in breaded or minced formats.

It also noted refrigerated products as a market gap, with most plant-based seafood analogues currently coming as shelf-stable or frozen items, and the chance to get onto fridges and seafood counters will help “increase the visibility” of the category.

Lead image courtesy of New Wave Foods.