4 Mins Read

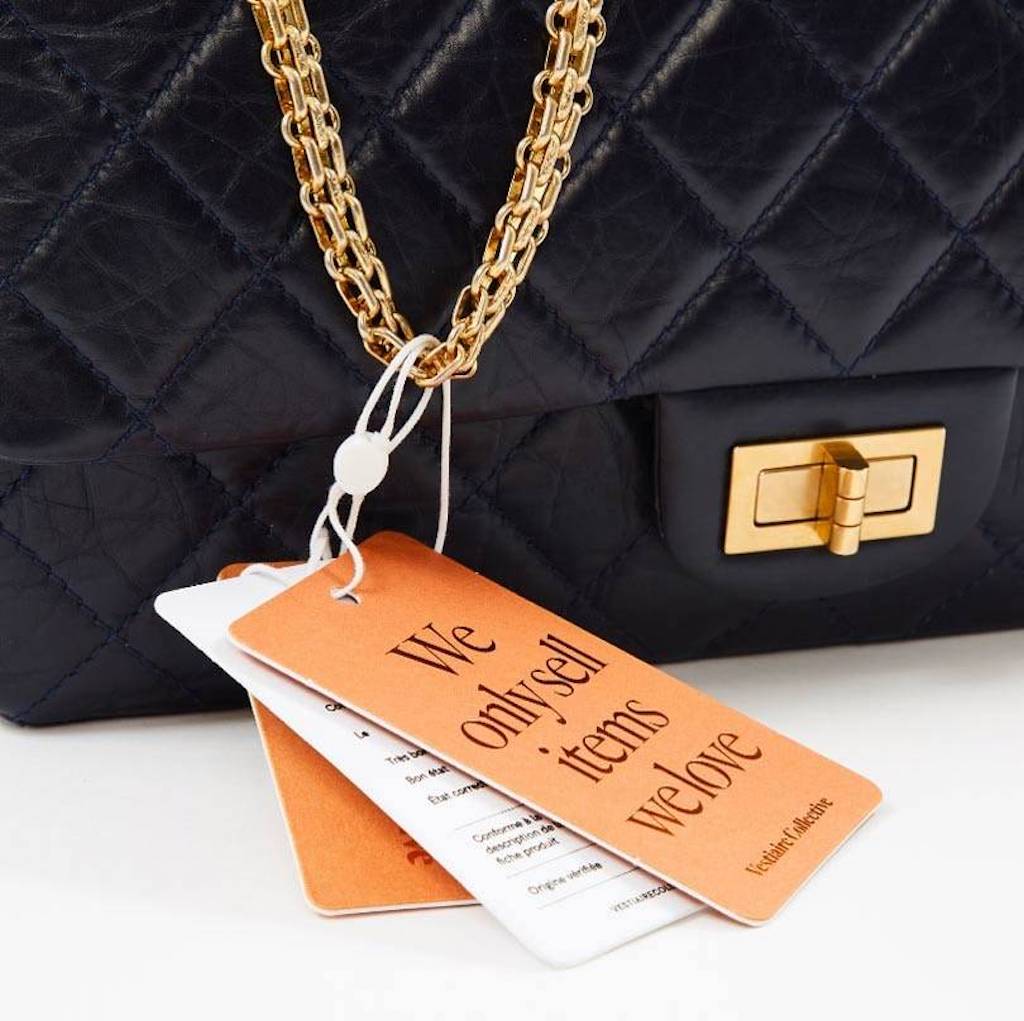

Vestiaire Collective, the Paris-headquartered global resale site for premium pre-owned fashion, has announced the closing of a €178 million (US$216 million) financing round, led by luxury group Kering and New York-based investment firm Tiger Global Management. The funding, which propels the startup to unicorn status, will be used to accelerate its global expansion plans amid the coronavirus-boost in the sustainable fashion industry.

Secondhand fashion platform Vestiaire Collective has raised €178 million (US$216 million) in a funding round backed by Kering and Tiger Global, the company announced on Monday (March 1). Existing investors including Condé Nast, Bpifrance, Naver-backed Korelya Capital and Vestiaire Collective CEO Maximilian Bittner, among others, also joined the round, which officially grants the startup unicorn status.

The Paris-based firm, whose online marketplace has attracted over 9 million users across 90 countries since its inception in 2009, says that the capital will be used to “position it for its next cycle of accelerated growth” internationally. The financing saw Goldman Sachs serve as a strategic advisor and private placement agent for Vestiaire Collective.

In a statement, Vestiaire Collective CEO Bittner said that the financing “confirms the incredible trajectory” of the firm, adding that its business model has “clearly demonstrated its ability to continue to thrive during challenging conditions” amidst the pandemic, which saw the platform’s transaction volume grow over 100% year-on-year and its membership base expand by 90% in 2020.

“The resale sector as a whole is experiencing rapid growth, especially amongst millennial and Gen Z consumers, which will come to shape the retail landscape of the future. We are incredibly excited to welcome Kering and Tiger Global Management, both of which will be instrumental in our mission to build a more sustainable fashion industry and further grow our incredible global community,” Bittner continued.

Market research suggests that at the current rate of growth, driven by consumer awareness of sustainability and the digitalisation of fashion, the number of preloved items in wardrobes will grow from 21% in 2021 to 27% in 2023.

The resale sector as a whole is experiencing rapid growth, especially amongst millennial and Gen Z consumers, which will come to shape the retail landscape of the future.

Maximilian Bittner, CEO, Vestiaire Collective

A recent report released by the Circular Fashion Summit led by blockchain-powered traceable circular fashion platform Lablaco, predicts that the sustainable fashion industry as a whole, which includes resale, rental, recycled and secondhand sectors, could grow from its current size of US$3 trillion to US$5 trillion, powered by the growth of digital and tech-forward models and rising consumer demand for eco-friendly options.

Commenting on the decision to back Vestiaire Collective, François-Henri Pinault, chairman and CEO of Kering, the group that owns the likes of Gucci, Bottega Veneta, Balenciaga and Alexander McQueen, said: “Pre-owned luxury is now a real and deeply rooted trend, especially among younger customers. Rather than ignoring it, our wish is to seize this opportunity to enhance the value we offer our customers and influence the future of our industry towards more innovative and more sustainable practices.”

Pre-owned luxury is now a real and deeply rooted trend, especially among younger customers.

François-Henri Pinault, Chairman & CEO, Kering

“This fits naturally with our entrepreneurial spirit, our pioneering sustainability strategy, and our modern vision of luxury,” added Pinault.

Tiger Global partner Griffin Schroeder described the investment as timely, as Vestiaire Collective strives to double down its presence in fast-growing international markets, including in the U.S. and across the Asia-Pacific region, a strategy that the startup announced back in April 2020 following its previous US$64 million funding round. “As of January 2021, local sellers in those regions had increased their items sold by more than 250% year-over-year,” Schroeder noted.

Among some of the specific projects that the newly-awarded unicorn startup says they will use the financing for include scaling up its data innovation roadmap, expanding its team with 155 new positions across engineering and tech development, offering a “brand approved” service, and growing its community of “fashion activists”. The company also said that it plans to work on its own sustainability goals, from becoming B Corp certified to reaching carbon neutrality by 2026.

Amid the preloved fashion boom, other platforms that offer a similar service have also caught the eye of investors, such as preowned and rental handbag startup Rebag who raised US$15 million in May 2020, and more recently, Hong Kong-based luxury childrenswear resale firm Retykle, bagging seed funding last month to expand its operations to Singapore and Australia.

All images courtesy of Vestiaire Collective.