Forget Recent Sales, Widespread Vegan Meat Adoption Is Inevitable, Says Report

5 Mins Read

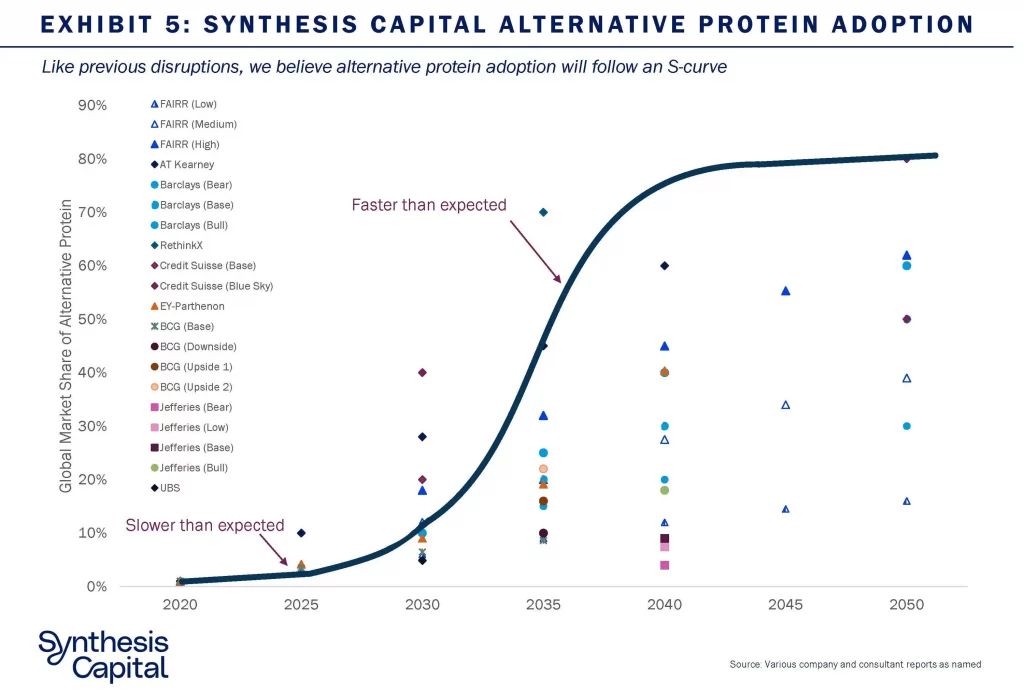

New analysis suggests alternative protein and vegan meat is in the early phase of an “S” adoption curve. And by the next decade, there will likely be a tipping point.

The new findings come as plant-based meat sales have waned; a recent analysis found a ten-percent drop in sales in the 52-week period ending September 4th. But that’s not likely to signal the end for sustainable protein, according to Dr, Catherine Tubb, Director of Research at Synthesis Capital. Tubb also co-authored the RethinkX report, Rethinking Food & Agriculture 2020-2030 The Second Domestication of Plants and Animals, the Disruption of the Cow, and the Collapse of Industrial Livestock Farming.

“History is littered with examples of technological products and services that were adopted with the famous ‘S‑curve,'” writes Tubb. “This adoption shape is ubiquitous, with products as diverse as refrigerators, cars, color TVs, and smartphones all showing that same familiar S-shaped curve.”

According to Tubb, S-curve adoption isn’t limited to information technologies; ingredients and pharmaceuticals have experienced the same adoption profile. She cites insulin, which saw two concurrent adoption S-curves with animal insulin disrupted by human insulin which was disrupted by synthetic human insulin.

Novel protein technology, both in the plant-based sector and cultivated meat, is experiencing a similar trajectory, Tubb says. The S-curve happens typically in two phases: the first is the period before the tipping point—where rational consumers make a switch based on cost and capabilities, and the second phase follows with exponential growth.

Phase One

“During Phase One, which is where we are today for alternative proteins, early adopters are driven by social or environmental reasons rather than cost and taste,” says Hubb.

“However, these products are yet to fully enter the mainstream; the costs are still high relative to traditional methods, or the quality, (in this case, taste, and texture), is not as good. Absolute sales numbers and the market share percentages are still very low (market share estimates for alternative proteins are only around one percent). While the market shows strong potential, this phase can be marked by volatile growth, which is expected so early on in a product’s lifecycle: absolute numbers are small and therefore growth can be disproportionately large or small. In addition, alternative products are still more expensive and cannot compete on taste and functionality with conventional products. We are seeing this today for plant-based meat in the U.S. which is seeing a significant slowdown in growth in 2021 versus 2020 (and the preliminary numbers indicate a further slowdown in 2022).”

Price parity is a key factor in widespread adoption, particularly as recession fears grow. Hubb says price parity will likely come within the next few years.

But plant-based meat as well as bio-fermented and cultivated meat (that latter is not yet approved for sale in key markets such as the U.S.), also face the challenge of taste and texture. Cultivated meat has an advantage on taste and texture for the most part, but it’s battling other factors, including acceptance of the technology; biofermentation also faces similar challenges—these misunderstood technologies have been widely met with criticisms, GMO comparisons, and safety concerns.

Further complicating the tipping point goal is the artificially low cost of conventional animal products. “The traditional animal agriculture system is protected by sunk costs in infrastructure, benefits from large economies of scale and is supported by legislation and policy,” says Hubb. “Value chains are mature, and public opinion remains, for the most part, supportive, as customers are accustomed and attached to their roast dinner or BBQ steak. We still have work to do to get to the tipping point for alternative proteins. Products still need to be cheaper, more convenient and taste better.”

Phase Two

But once these barriers have been broken, adoption happens exponentially faster. This is the second phase. Hubb says that while the tipping point can vary, it typically happens when market share for a new product or tech reaches between ten to 20 percent saturation.

“At this point,” she says, “growth accelerates, as not only is one industry growing, but another is imploding as it struggles to capture investment, sees revenues and profits fall, and generally undergoes a ‘death spiral.'” The factors that once served to slow widespread adoption accelerate the category’s growth.

“Lower costs and better products drive demand, investment in capacity and infrastructure drive supply and regulation can move in favour of the new system,” Hubb says.

“Imagine in ten years the introduction of a ‘meat’ tax. Just like we have for sugar in the UK, and many countries around the world, from Mexico to South Africa. These will all act as powerful accelerators to the alternative protein industry and also act as brakes to the incumbent industry. Traditional animal-based products will face a death spiral of increasing costs, lower demand, and a loss of investment, and the companies will consequently face bankruptcy. For alternative proteins, we expect the exponential adoption phase will be reached through the 2030s.”

On this path growth can stagnate, as we’ve seen over the last year, says Hubb. And animal agriculture won’t disappear entirely, it will just slowly decline.

And, she says, there will be laggards and non-adopters, “as we see for other technological disruptions.”

But, Hubb says the analysis reinforces a conviction in the “significant opportunity” in investing in alternative proteins and the transformation of the food system. “The speed of technological development in the sector demonstrates that we are well on the way towards a tipping point, and that exponential growth will follow.”

Lead photo courtesy Polina Tankilevitch via Pexels