Investors are Neglecting Food Tech, While Supply Chains Battle Global Disruption

6 Mins Read

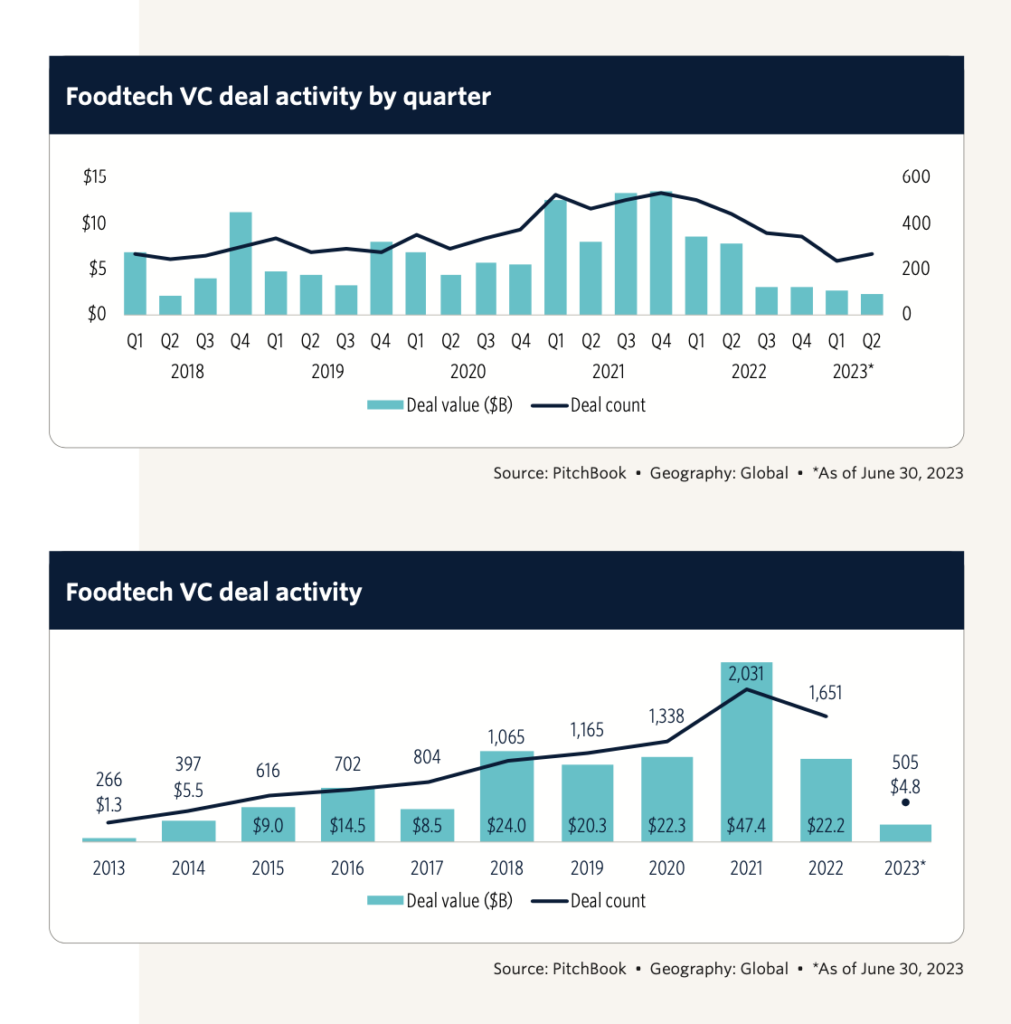

The median food tech venture capital deal size has declined for the first time in seven years, falling to $3M in Q2 – a 12.4% drop from 2022 – according to Pitchbook. This was also the sixth consecutive quarter of decline for total VC funding, but the number of deals was up by 13.1% over Q1, indicating a potential return to investment in this space.

Pitchbook’s Q2 Foodtech Report revealed that food tech VC funding declined by 75.1% year-on-year, while the number of deals (1,207) was down by 39.3% annually. And while quarterly funding also dropped by 13.9%, the deal count grew to 268 in Q2. Pitchbook said this could represent a “return of investment activity after a pause due to caution surrounding the closure of Silicon Valley Bank at the end of Q1”. But, it added, the declining deal sizes “may reflect a new, more careful paradigm”.

It follows a report by Temasek and AgFunder earlier this year, which found that agrifood tech investments were down by 44% in 2022, reaching $29.6B – albeit with 2021’s numbers being ascribed to “increasingly outlandish tech valuations”. The report added that the drop in funding might be short-lived.

But the wider food tech space is still feeling these effects. Pitchbook’s report said a higher number of startups have attracted attention from early-stage investors in the last few months, mostly in the fermented protein category. Early-stage startups saw the largest quarterly increase in value (65.5%), as companies look to scale up their production processes.

Fermentation is attractive, while cultivated protein needs more funding

According to the alt-protein think tank the Good Food Institute, the fermentation sector reeled in $840M in funding in 2022, with all-time investment reaching $3.7B. It added that the number of companies working on fermentation for alternative proteins across the supply chain rose to 136 – a 12% rise from 2021. Pitchbook’s report namechecked US biotech firm Debut’s $34B Series B raise and Californian startup Air Protein‘s $74.9M VC funding as key early-stage deals in Q2 2023.

Cultivated protein, on the other hand, which raised $896B last year (according to GFI), is in need of more VC funding and support if it is to become profitable, according to Pitchbook. While the industry saw a major advancement in Q2 – the US approved the sale of cultivated meat in June – it is still in its early stages and must overcome challenges associated with cost, scalability and consumer acceptance, the report stated.

Pitchbook said larger production vessels and cheaper cell-growing feed materials are paramount to profitability for cell-cultured meat – earlier this month, Upside Foods broke ground on a mass production facility for its cultivated meat (one of the two companies who cleared the regulatory hurdle in June). But questions have been raised about its capability to scale.

These challenges could make cultivated protein startups dependent on investment to operate, and one solution put forward by Pitchbook is collaboration with existing meat companies, which “could hold the key to a profitable and sustainable future for cultivated meat”. This could suggest a potential market for products that combine cultivated proteins with conventional meat – though consumer acceptance would be key here.

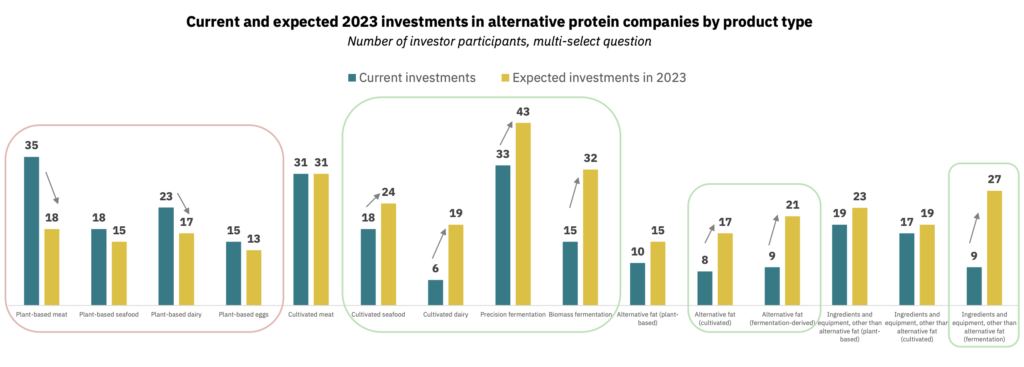

A decline against expectations, amongst supply chain shortfalls

The current decline in food tech VC funding is in contrast with an alt-protein survey conducted by GFI in December 2022. It included 125 investors, 40% of whom were venture capitalists. The results found that 81% of those polled were already financing alt-protein startups or funds, and 87% expected to make investments in 2023 – with VCs being the most prolific in both metrics. Meanwhile, investment in precision and biomass fermentation, as well as cultivated seafood and dairy, was expected to increase.

The overall decline in funding is a blow to food tech companies that are already reeling from the supply chain disruptions over the last few years. The industry has been battling the after-effects of Covid-19, Russia’s invasion of Ukraine and the subsequent food shortages, export bans and energy crisis, as well as the continued effects of climate change (which include widespread crop destruction). In fact, extreme heat and water shortages could significantly disrupt the global food supply.

While food prices were already soaring, these issues have collectively exacerbated the strain on manufacturers and brands. Within alt-protein, companies have been forced to raise prices despite the race to reach price parity with conventional meat and dairy, and shift production strategies due to supply chain turbulence.

In December 2022, a CNBC survey found that half of logistics managers at major companies and trade groups don’t expect the supply chain to return to normal until 2024 or after. More worryingly, an additional 29% said it will come back to normal in or after 2025 – or never. It’s a serious issue for companies across industries, but especially food manufacturers and a decline in investment is unlikely to help their cause.

Signs of hope: deals are smaller, but still happening

It’s not just food tech that has seen a decline in investment. According to Sifted, VC funding for climate tech in Europe declined by 43% in Q1 2023. In fact, across the board, while Q2 ended a six-month investment decline, VC funding still remained low at €14.6B – a 44% drop from Q2 2022.

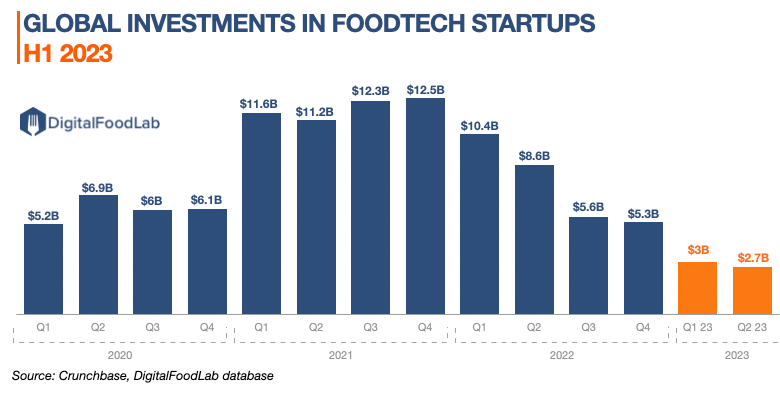

There are still some signs of hope for food tech. According to food tech consultancy DigitalFoodLab, global investments in this space are stabilising “at low levels”, as Q2 saw only a 10% decrease. Europe, meanwhile, saw a marginal increase from €700M to €800M.

“The absence of mega deals (multiple hundred million rounds) has a notable impact on the ecosystem’s overall health,” its founder Matthieu Vincent wrote. “To put it more bluntly: the companies that should be raising these rounds are either shutting down or downsizing and hoping for better days,” he added, referring to Perfect Day’s pivot from a planned IPO to shuttering its consumer-facing brands as an example.

DigitalFoodLabs echoed Pitchbook’s latest findings, noting a steep decline in the median size of food tech VC deals. “Even from Q1 to Q2, the median deal decreased by 15% in size,” Vincent said, before concluding optimistically. “Deals are still happening, notably in early-stage startups. That’s maybe the best news of all!”

However, a report published last month found that only 4% of all climate funding goes to agrifood systems, despite the sector accounting for a third of all global greenhouse gas emissions. Moreover, elements that are crucial for climate mitigation – food loss, waste and low-carbon diets – receive less than 1% of all climate funding. Conversely, only 10% of VC funding in agrifood tech went to climate-focused businesses.

This echoes a media reporting gap around the food system’s role in global GHG emissions: 93% of climate stories don’t discuss animal agriculture – and those that do rarely touch upon its impact on the environment. It’s led to a shift in consumer perception about meat and its effects on climate change – and not for the better. Readjusting the investment gap – whether it’s VC funding or otherwise – is crucial if we’re to adapt our food systems and avoid further ecological disaster.