3 Mins Read

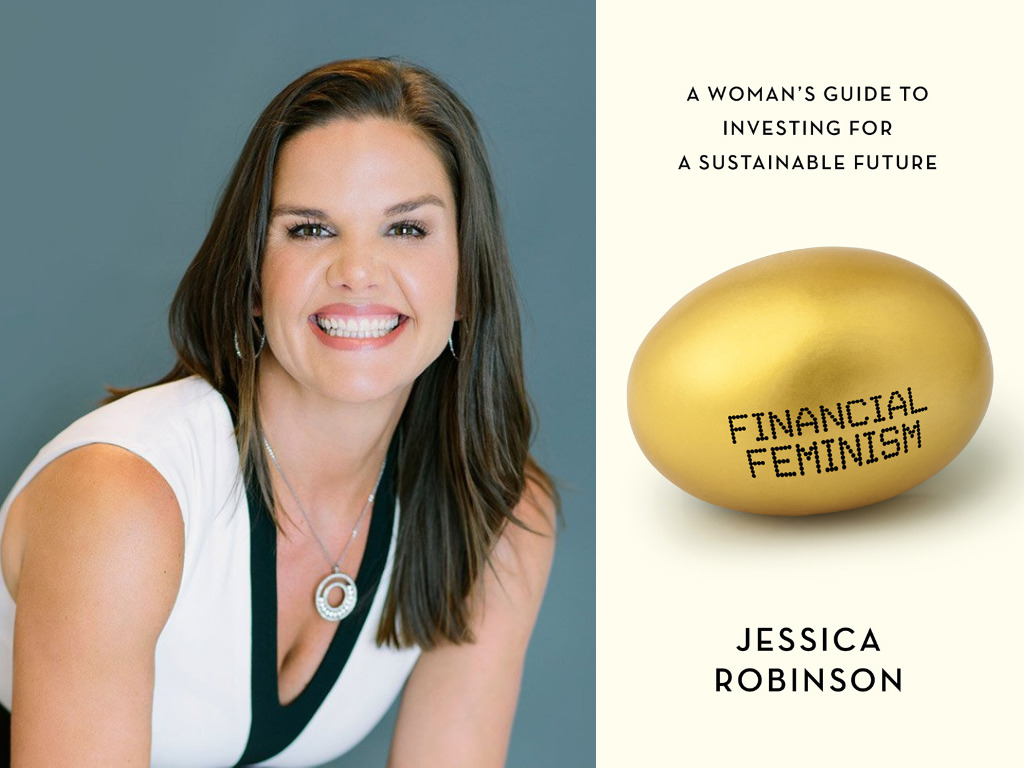

A newly published book aims to remedy the gender investing gap by empowering women to invest in a sustainable future. Authored by sustainable finance expert Jessica Robinson, who formerly led the United Nations-backed Principles for Responsible Investment (PRI) in Asia, Financial Feminism: A Woman’s Guide to Investing for a Sustainable Future comes with step-by-step explainers and jargon-busting tips for women embarking on their ESG-forward financial journey.

Landing on shelves last month, Financial Feminism is a new guide for women containing practical advice, tips and explainers to sustainable investing. Here to prove that “investing isn’t just for big-wig Wall Street millionaires,” the book challenges the gender investment gap and the cascading societal and environmental impacts as a result of ongoing inequality.

“The harsh reality is that many women face a glaring gender investing gap. They’re not investing to the same extent as men, saving less for retirement and parking more in cash, which results in a significant shortfall,” explains author Jessica Robinson on Moxie Future, a community platform she founded to empower female impact investors.

“The pay disparity compounds this shortfall, but it also means that women are missing out on making the money they do have work better for them.”

Billed as an accessible step-by-step guide, Robinson takes readers through real-world examples, jargon-free explanations and a breakdown of what the now-trendy sustainable investing really is about and why it matters for the planet and people. Prior to founding Moxie Future, Robinson headed the Asia bureau of the PRI and formerly led the think tank Association for Sustainable and Responsible Investment in Asia (ASrIA).

We are beginning to have conversations about how financial feminism is not just about getting women to invest more. It is also about empowering women to invest in the type of future they want to build.

Jessica Robinson

But Robinson says that Financial Feminism is more than about addressing the gender gap in investing and finance in general, but it is also about how getting women into the investing world can mean building a planet that is cleaner, fairer and more sustainable while also being profitable – an approach that has taken off as ESG-forward investments demonstrated their superior risk-adjusted returns amid the pandemic-driven market volatility.

Read: U.N. report – how the pandemic is reversing progress on gender equality, poverty & education

“We are beginning to have conversations about how financial feminism is not just about getting women to invest more. It is also about empowering women to invest in the type of future they want to build,” says Robinson.

“We can do this by investing in companies and sectors that are aligned with our sustainability values and beliefs – for example, companies that consider their environmental footprint and take action to reduce it; companies that have strong labour practices and protect their employees; and companies that are open and transparent in the way that they operate.”

Financial Feminism: A Woman’s Guide to Investing for a Sustainable Future is available at Amazon, Barnes & Noble, WHSmith and more.

Lead image courtesy of Moxie Future / Financial Feminism.