Swedish cultivated meat startup Re:meat has struck a deal to establish a pilot facility in Lund, which will be the first such factory in Scandinavia.

Months after securing $1.1M in funding, Malmö-based firm Re:meat has signed a partnership to establish Scandinavia’s first cultivated meat facility.

The firm has teamed up with Biotech Heights, a biotech innovation hub supporting future food systems at Kemicentrum in Lund. Co-founded by Lund University, packaging giant Tetra Pak, and Sweden’s national innovation agency, Vinnova, it is located alongside the Lund University Pre-Pilot Plant (LUPPP).

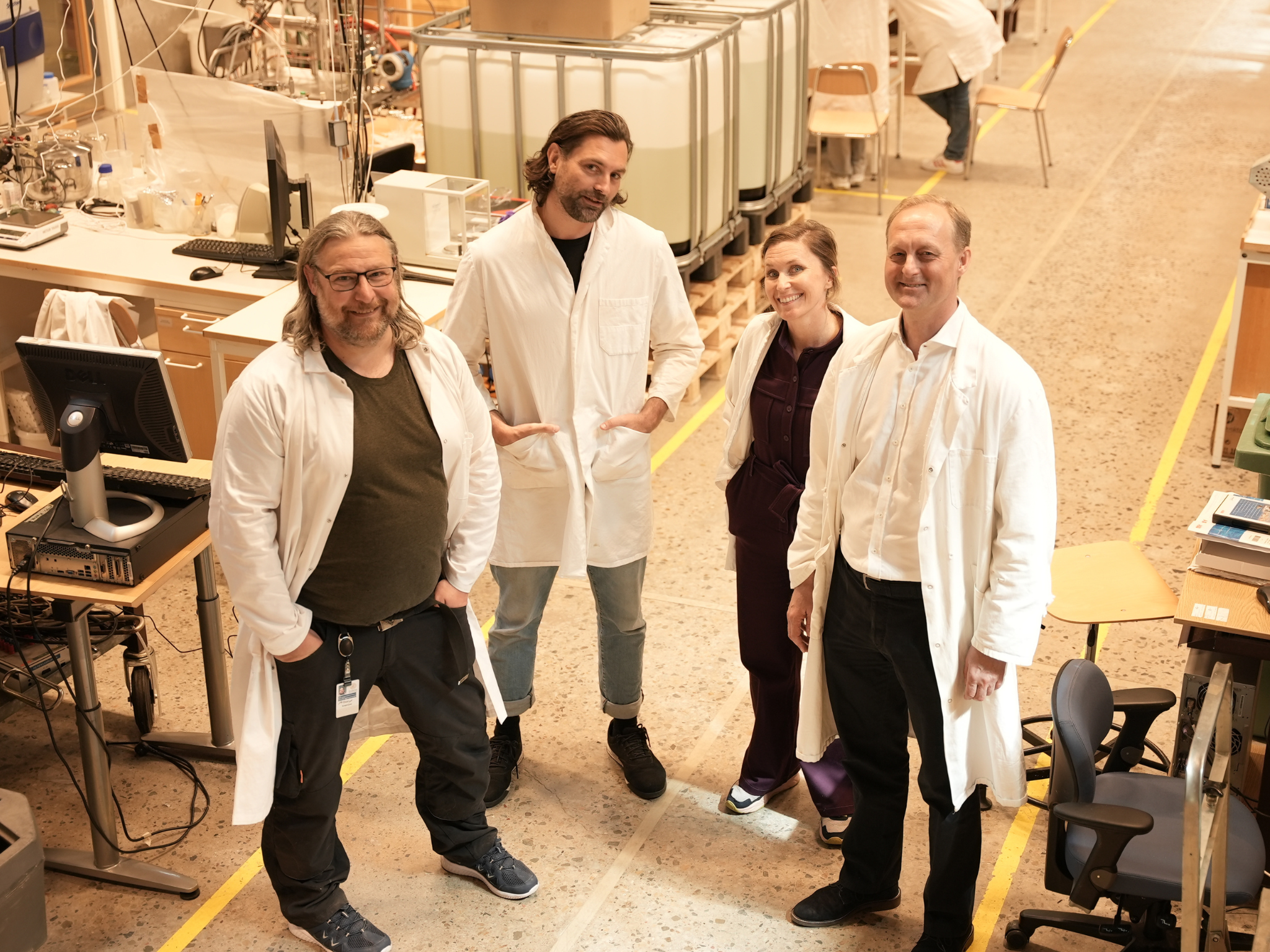

Re:meat has become Biotech Heights’s first startup member, which will launch its first pilot at the LUPPP. “Collaboration is necessary to advance the development of fermentation and apply bioprocess technologies to new industries,” said Emma Nordell, managing director of Biotech Heights.

“Re:meat will be our first start-up to pave the way for collaboration between academia, start-ups and industry players within biosolutions,” she added.

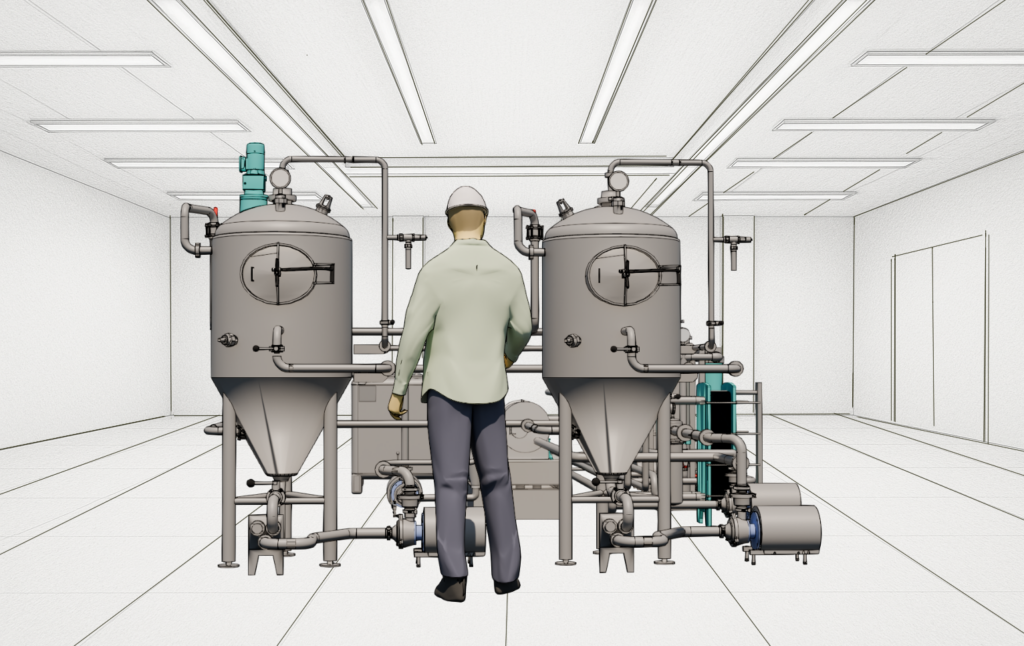

The pilot plant, titled Re:meatery, will be installed by the end of 2025 and validated with partners and clients in spring 2026.

Re:meat bets on food-grade bioreactors to lower costs

Founded in 2022 by Jacob Schaldemose Peterson and Gittan Schiöld, Re:meat emerged from stealth a year later with cultivated Swedish meatballs that received “overwhelmingly positive” feedback in taste tests.

It sources non-GMO cells through a biopsy of healthy free-range livestock. These are immortalised cells, meaning they can differentiate and multiply indefinitely. They’re fed a mix of nutrients and vitamins under an ideal temperature in fermentation tanks called bioreactors.

Once they grow to the desired density, the cells are harvested – this process currently takes three weeks. Re:meat’s initial focus is on minced meat, but it is working towards whole-cut products in the long term.

The company says its patented core technology radically lowers the cost of hardware for cultivated meat, an important step towards scaling cultivated food. It has developed an alternative to the controversial and expensive fetal bovine serum, and uses food-grade equipment instead of pharmaceutical bioreactors to meet the lower margins in this industry.

It’s an approach being championed by companies like cultivated pork producer Mission Barns, cultivated pet food startup Meatly, and AI-led biotech firm Arsenale Bioyards.

“Inspired by our many years in the brewing industry, combined with our R&D team in cell biology, we have developed a food-grade bioreactor that still meets the high standards and parameters to cultivate sensitive mammalian cells,” said Re:meat CTO Marten Schmidt.

“This means that our Re:meatery also fits for yeast, and bacteria-based processes, such as precision fermentation. So, the potential really extends beyond cultivated meat,” he added.

Re:meat plays into Swedes’ support for domestic production

While Re:meat is Sweden’s only dedicated cultivated meat startup, it doesn’t mean there’s a lack of appetite for these proteins in the country.

Polling by the Good Food Institute (GFI) Europe has found that 55% of Swedes are open to trying cultivated meat, with 57% supporting its availability if approved by regulators.

“Swedes are typically keen on new things,” Thomas Kalling, professor of strategic management at Lund University, told GFI Europe last year. “Their balanced perspective underscores the potential for cultivated meat to not only enhance our competitive edge, but also tackle pressing global challenges related to health, ecology, nutrition, and affordability.”

Re:meat’s Schmidt noted: “We identified the need to design equipment that costs a fraction of today to be able to scale and industrialise alternative foods production and all its connected processes. This could enable a food revolution.

“Biotech Heights is a great partner supporting our common goal of bridging academia and commercialisation by providing the perfect combination of available infrastructure and scientific know-how,” he added.

“It is really inspiring that Re:meat wants to establish a pilot in our environment,” said LUPP manager Martin Hendström. “It will open up exciting new opportunities for innovation, research and education.”

The GFI Europe survey showed that three in five Swedish consumers back domestic production to bolster the national economy. Re:meat’s new factory will lean into that. And it isn’t the only major alternative protein facility being built in the country.

In April, agricultural cooperative Lantmännen received €50M from the European Investment Bank in part financing for a pea protein isolate factory. It will manufacture plant proteins for use in applications like protein bars, drinks, breads, as well as non-dairy alternatives and meat analogues.