Food System Set to Be Second Fastest-Growing Green Economy Sector, But More Funding Needed

The global green economy is outpacing all industries except tech, and within the sustainability sector, food and agriculture is poised to be the second fastest-growing segment.

Despite what headlines might suggest, the global sustainability market is thriving, according to a new report by the World Economic Forum (WEF) and Boston Consulting Group (BCG).

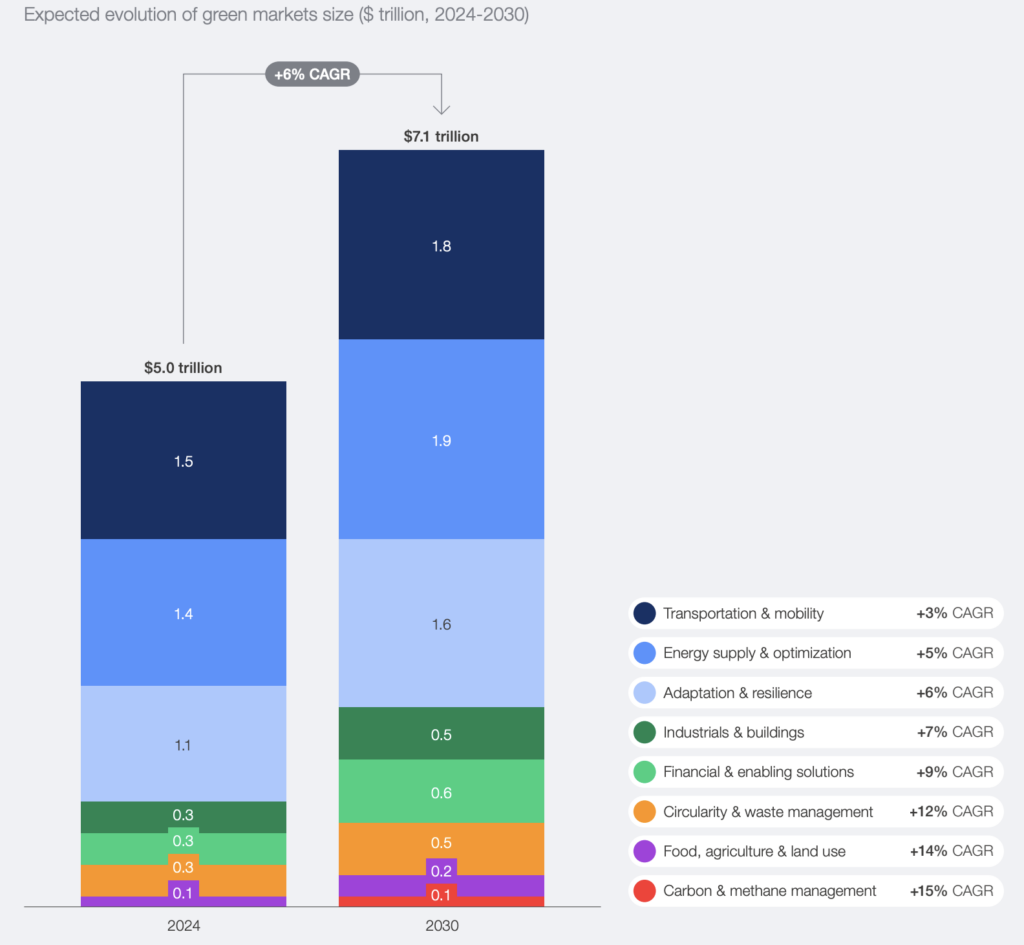

The green economy, which the organisations describe as “commercial solutions with a clear environmental purpose or solutions that are a direct response to environmental challenges”, is already a $5T market, having outperformed all other sectors except tech in the last decade.

The report suggests that companies embracing low-carbon and climate-resilient solutions often deliver above-market growth, attract lower-cost capital, and command higher valuations. It’s why the industry is expected to surpass a valuation of $7T by 2030.

And though the agrifood system is a vital part of this green economy, it is one of its lowest-value segments. That said, it is set to be the fastest-growing, behind only carbon and methane management.

“The breadth of commercial opportunities in the green economy crosses industry and regional divides. With $2T in growth expected in the next five years, there are plenty more opportunities for companies to harvest,” said co-author Patrick Herhold, BCG’s managing director.

Why the food system must be central to the green economy

The majority of the green economy’s value comes from the climate mitigation vertical (78%), led by transportation and mobility, which account for 30% of the overall sustainability market. Adaptation and resilience have gained traction too, responsible for 22% of total demand, driven primarily by climate-adapted agricultural inputs, resilient construction materials, and cooling technologies.

The green market’s growth will increasingly come from industries beyond transport and mobility. These include carbon and methane management, set for the most nimble growth between 2024 and 2030 (at +15% annually), followed by food, agriculture and land use (+14%), and circularity and waste management (+12%).

The focus on the agrifood system is critical because it accounts for a third of global greenhouse gas emissions; plus, it takes up 70% of our freshwater resources and half of all habitable land. Research suggests that even if all emissions from energy and industry are stopped, food emissions alone will surpass the 1.5°C limit.

Decarbonising this industry involves, among other things, the advancement of bio-based fertilisers, improvements to farming infrastructure and food packaging, and the widespread adoption of alternative protein. As the report points out, the latter includes scaling up bioreactors and production technologies for plant-based protein, cultivated meat, and other future-friendly foods.

The importance of a shift to alternative proteins cannot be overstated. Livestock farming alone accounts for nearly 60% of the food system’s emissions (and up to a fifth of the global total), and requires around 80% of the planet’s farmland. But it’s highly inefficient, supplying just 17% of our calories and 38% of our protein intake.

One of the primary pain points of this industry is methane, a gas 86 times more potent than CO2 over a 20-year period, which is released into the atmosphere as a result of cattle’s digestive processes. Analysis shows that methane emissions from 29 major livestock producers rival those of the fossil fuel industry’s 100 biggest emitters.

When using updated GHG metrics, animal agriculture has been found to be the leading cause of climate change. Alternative proteins, meanwhile, largely have a much smaller climate, land and water footprint, and are often a lot more efficient when scaled up.

In one recent study, scientists argued that fully replacing meat and dairy with alternative sources by 2050 is now the only way to keep the food system from eating up its carbon budget.

Lack of food tech investment hindering cost-competitiveness

“This report is a reminder that the green transition continues to be one of the biggest growth opportunities of our time, contributing to job generation, innovation, resilience and sustainable prosperity,” said Pim Valdre, head of clmate and nature economy at the WEF.

The authors’ analysis of over 6,500 publicly listed companies between 2020 and 2024 suggested that green revenues expanded twice as rapidly as conventional ones, with growth strongest among firms where eco products made up a material part of their business.

More than half of the companies with an annual growth rate higher than 30% over this period earned at least 10% of their revenues from green products in 2024. Firms with significant green revenues also enjoy valuation premiums of 12-15% above their peers, and they benefit from better financing terms when raising or borrowing capital.

A leading driver of the green economy growth is the dramatic fall in costs of some clean technologies, like solar energy or lithium batteries, both of whose costs have declined by around 90% since 2010. As a result, 55% of global emissions can now be abated using cost-competitive technologies.

This is a key lever for the food industry too. Alternative proteins are largely still more expensive than industrially produced meat, with scalability the main bottleneck for this industry. This can be addressed with a greater amount of targeted investment in these technologies.

These future foods were the darling of venture capitalists at the turn of the century. However, investors have since cooled on them. In 2021, this category attracted $6.9B in funding. Last year, however, this totalled just $1.1B.

This is reflective of a wider problem. Climate tech venture funding took a 38% dip in 2024, reaching $32B (compared to $52B in the 12 months prior), as investors hedged their bets on artificial intelligence (AI) instead, pumping in over $100B towards the tech.

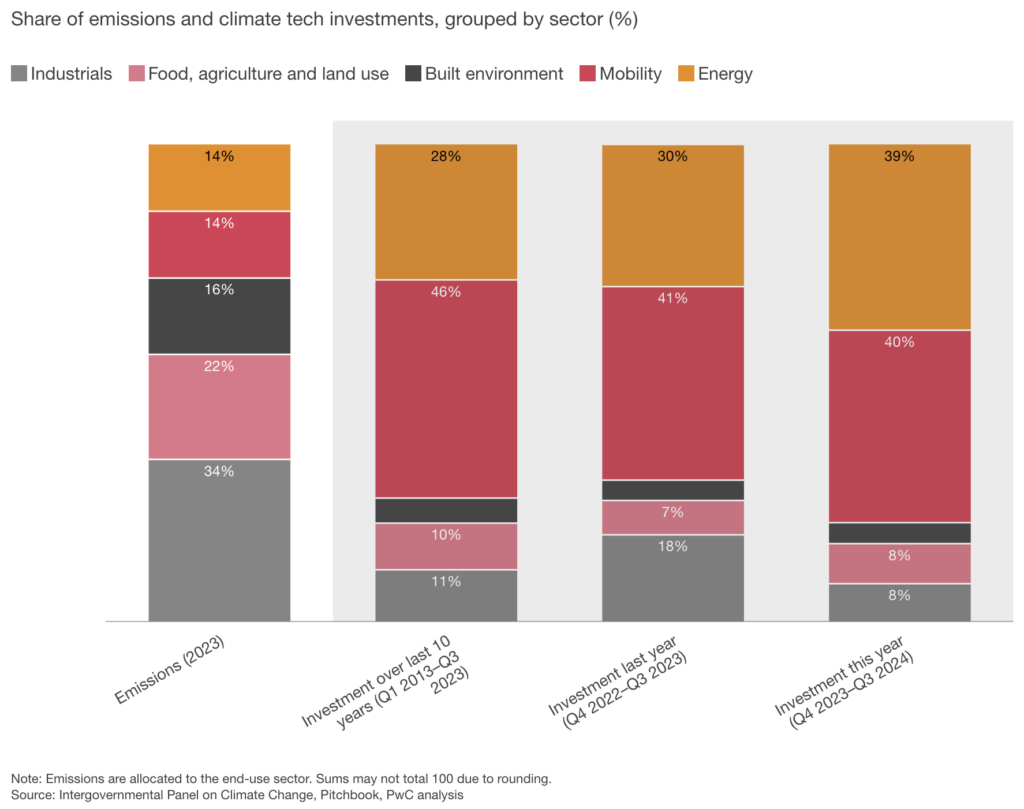

Food tech bore the brunt of this. PwC reported that technologies decarbonising the food, agriculture and land use segment only received 8% of climate tech dollars in 2023-24, creating a large “emissions-funding gap”. So while the green economy (and the agrifood system) may be ascendant, a lot more money needs to be poured into the way we grow what we eat.

WEF and BCG identified several critical growth accelerators for business leaders, including pushing cost curves down, tapping a range of funding sources, and working closely with infrastructure partners and regulators. Policymakers, the report said, should create decarbonisation targets, de-risk private capital, remove obstacles for green technologies, and generate early demand through public procurement.