Alternative Protein Funding Down by 20% in 2025, Falling Below $1B for First Time in 7 Years

The investment downturn in alternative proteins continued in 2025, falling by 20% and totalling under $1B for the first time since 2018. The gap between well-capitalised and struggling startups is set to continue this year.

Investors’ appetite for planet-friendly proteins continued to diminish in 2025, with plant-based, fermentation-derived and cultivated food companies collectively witnessing a 20% dip in year-on-year funding.

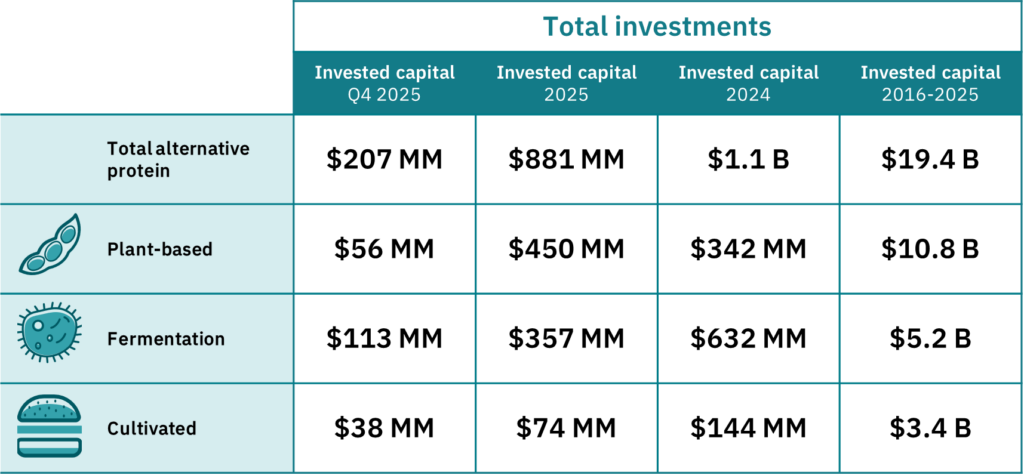

The alternative protein category only attracted $881M last year, falling below the $1B mark for the first time in seven years, according to the Good Food Institute’s (GFI) analysis of data from Net Zero Insights. Overall, this industry has raised $19.4B over the previous decade.

Plant-based was the only segment that surpassed its 2024 total, while European businesses outperformed those in North America for the second year running.

“In 2025’s tight funding environment, the largest checks for alternative protein companies primarily went to later-stage companies generating meaningful revenue through established retail, foodservice, or B2B channels – or with a clear path to doing so,” Daniel Gertner, GFI’s lead economic and industry analyst, tells Green Queen.

“It’s also important to put this in context, as investment was heavily concentrated in artificial intelligence last year, limiting the capital available to deploy to other sectors,” he adds.

Plant-based startups beat 2024 total, but other segments struggle

Startups in the plant-based sector had already overtaken their overall 2024 numbers by Q3 2025, and after securing another $56M in the final quarter, their total for 2025 reached $450M (a 31.5% jump from the previous year).

The caveat here is that $100M of this came from a single round, Beyond Meat’s debt financing, which also ended up being the largest investment across the alternative protein industry in 2025. Without it, funding for the plant-based category would have only improved by 2%.

Meanwhile, fermentation came crashing down from the highs of 2024, with investment dipping by 43.5% to reach $357M. That said, it was the most attractive alternative protein pillar in Q4 2025, garnering $113M in funding, led by The Every Company’s $55M Series D round and Matr Foods’s $23.2M Series A financing.

However, cultivated meat continued to face the biggest contractions. Investors only pumped $74M into startups working with this technology, a 49% decline from 2025. And even this was helped by an end-of-year bump – the category attracted $38M in the October-to-December period alone, exceeding the previous three quarters.

“Amid this evolving funding landscape, the gap widened between companies with sufficient runway to execute against near-term milestones and those facing near-term financing constraints,” Gertner wrote in GFI’s investment newsletter. “This divergence is likely to persist into 2026, shaping both capital allocation and company strategy.”

He alluded to the widespread trend of consolidation in the industry. Since September 2024, more than 60 businesses have either been acquired, merged, fallen into insolvency, or shut down altogether – some closures involved leading names like Believer Meats, Meatable, and Yves Veggie Cuisine.

Why Europe continues to outpace North America

GFI noted how well-performing companies, especially those operating in supportive regional ecosystems, have continued to attract investors.

Europe forms a key example here. Startups in this region attracted $418M in 2025, outperforming those headquartered in North America ($347M) for the second consecutive year. This may reflect “differences in public funding and ecosystem support”, Gertner wrote, and these will remain relevant this year.

“Europe had several companies positioned to meet investors’ higher bar, driven by a resilient plant-based sales environment and the growing role of public investment for alternative proteins,” he tells Green Queen.

“As investors concentrated capital in later-stage rounds, Europe-based companies out-raised North American companies for the second year in a row. Across Europe, public investment has helped derisk scale up and expand manufacturing capacity,” he continues.

“European companies have also used a broad mix of financing tools to extend runway and limit dilution during capital-intensive scale-up. Together, these public-private mechanisms reduce execution risk and strengthen Europe’s pipeline of later-stage companies.”

Paths to profitability, M&As and IPOs will drive investment trends in 2026

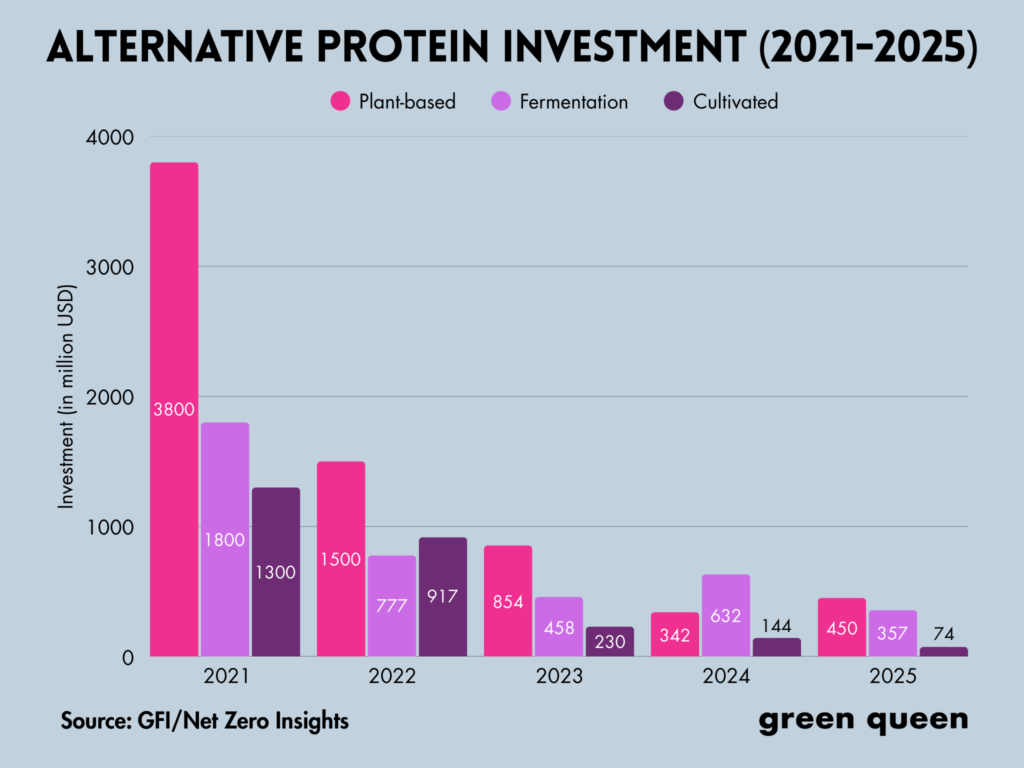

The alternative protein sector has now witnessed a decrease in funding for four years in a row now, with last year’s total making up just one-eighth of the 2021 high of $6.9B.

GFI suggested that the market is entering a phase defined by “leaner operations, more targeted commercialisation, and phased scale-up better aligned with near-term demand”, given the acceleration in consolidation.

“In parallel, strategic partners, public capital, and innovative financing structures are increasingly critical to de-risking pathways to scale – a shift we expect to deepen rather than reverse in the year ahead,” Gertner wrote in the newsletter.

Looking ahead, he expects capital to continue to flow to businesses that demonstrate continued functionality and cost innovation, a line-of-sight to profitability, and a credible path to an acquisition or IPO.

“For many, the next stage of scale-up will require a blended capital stack of public and private investment to de-risk infrastructure and technology. The fundraising mix raised by European companies in 2025 offers an early proof point of this approach,” he tells Green Queen.

“Over the longer run, broader funding trends will rely on robust mergers, acquisitions, and IPOs that validate those pathways and allow capital to be redeployed into the next wave of category building.”