Govt Investment in Alternative Proteins Could Bring €111B to EU Economy Each Year

With a mere €1.4 billion in public funding, supportive policies for alternative proteins could add €111 billion a year to the EU economy by 2040.

Plant-based, fermentation-derived and cell-cultured foods can meet 10% of the EU’s meat demand and 25% of its dairy demand by 2040, creating a market larger than the GDP of Lithuania, a new report has found.

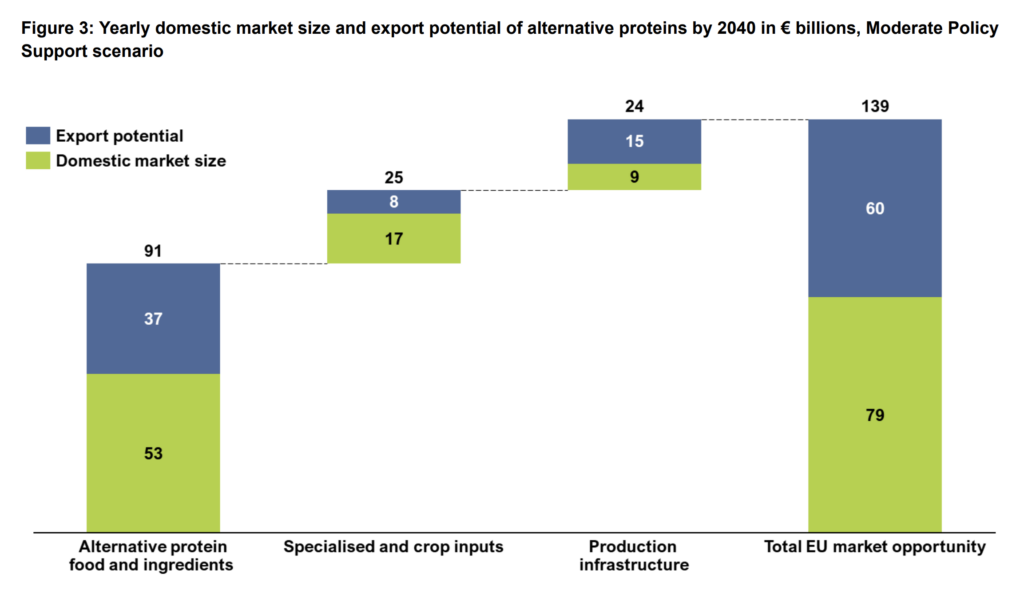

With supportive policies, the total market opportunity for these alternative proteins could reach €79B in the next 15 years, and their export potential would hit €60B, positioning the EU as a global biomanufacturing hub.

The analysis, carried out by Systemiq with support from the Good Food Institute (GFI) Europe, reveals that if alternative proteins are treated as a strategic priority, they could generate €111B in annual gross value added to the EU, and support 414,000 high-quality jobs across arable agriculture, R&D, manufacturing, logistics, and marketing.

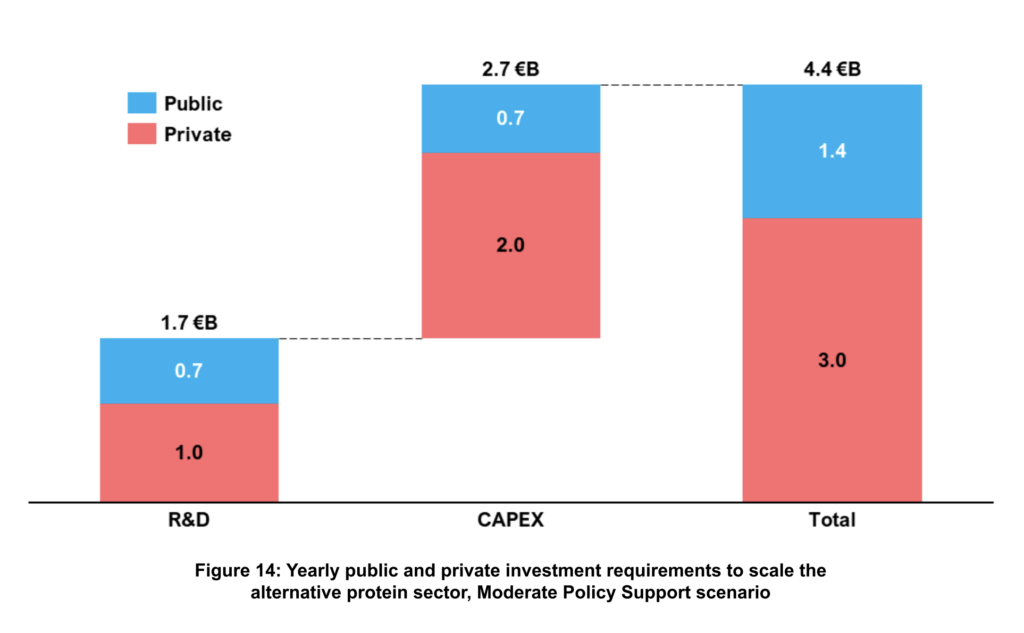

To do so, though, the EU and national governments need to invest €690M in R&D each year to enhance the flavour and price of alternative proteins, and another €720M annually to scale up their production. This will help catalyse private investment and subsequently boost consumer uptake.

“Alternative proteins are a growth opportunity for Europe. With public investments of just €1.4B a year, the EU and its member states can increase food security, create jobs and add economic value in excess of €100B,” said Rupert Simons, partner at Systemiq. “We urge European leaders to recognise the potential of this industry and put in place the regulations and investment to support it.”

In a country-specific deep dive, the report suggests that if governments choose to lead the protein transition, Spain, France and Italy would emerge as big winners.

Alternative proteins could surpass Spain’s coffee sector

According to Systemiq, Spain’s future food industry is evolving from early hype to a phase of steady growth, driven by established food companies, regional leaders, engaged investors, and the government-led strategy of blending food tradition and innovation.

A protein transition could help ease pressure on land and water systems, boost climate resilience, and support the long-term sustainability of Spanish agriculture. In addition, its domestic plant protein value chain could help link rural producers to food innovation markets, reduce import dependence, and build agricultural resilience.

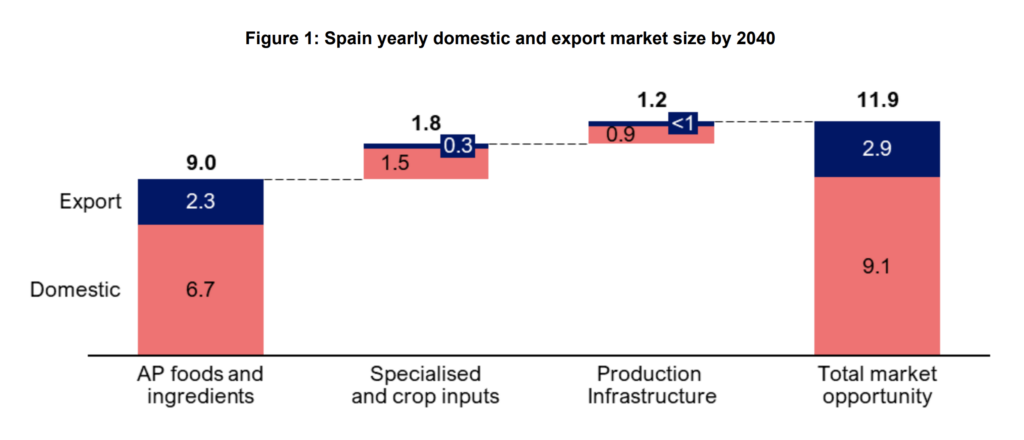

With the right conditions, alternative proteins could contribute €10B annually in gross value added, 20% of which would come from the broader value chain. The Spanish market for alternative protein end products would reach a value of nearly €6.7B, larger than the domestic coffee sector (€5.6B).

Moreover, the future food sector drives value chains in crops, feedstocks, bioreactors, and processing equipment, so when accounting for the full value chain, the total market opportunity could rise to €9B.

Trade opportunities could reach €3B by 2040, comparable to the value of Spanish olive oil exports, and the sector could support 34,000 jobs across R&D, manufacturing, logistics, marketing and arable agriculture.

Italy’s alternative protein opportunity could match its pasta exports

Although Italy’s culinary heritage shapes how food innovations are received, its plant-based meat and dairy market has witnessed steady growth in recent years, as the alternative protein ecosystem enters an

“exciting formative stage”.

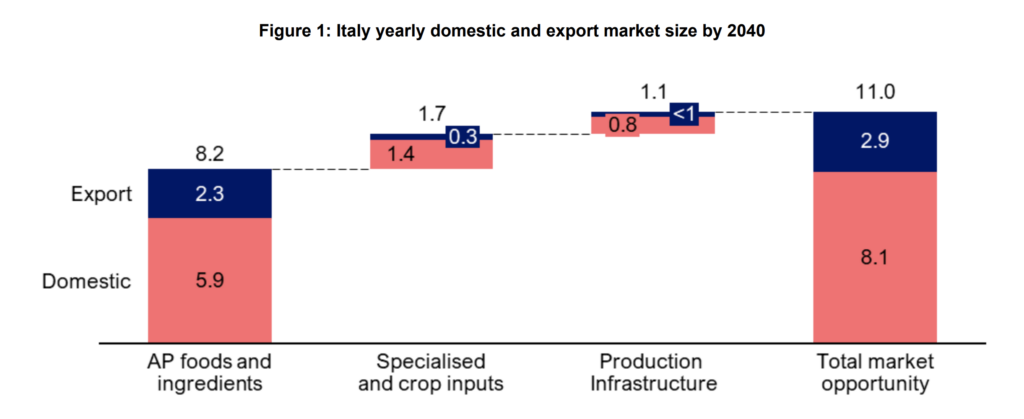

The country is particularly dependent on protein imports – nearly 70% of it soy demand was brought in from other countries in 2023 – so a shift to alternative proteins could boost Italy’s protein self-sufficiency and climate resilience. These foods could add €10B in gross value annually by 2040.

Alternative protein end products could represent a domestic market of nearly €6B – for context, that’s twice the size of Italy’s domestic olive oil market. And when considering the full value chain, the total market opportunity could rise to €8B.

Trade opportunities, on the other hand, could reach €3B in 2040, which is comparable with the value of Italy’s pasta exports in 2022. Plus, the industry could help create 31,000 jobs across the value chain.

France can lead the EU’s food transition

France could end up being the biggest beneficiary of the EU’s backing of alternative proteins, with its plant-based meat and dairy categories outpacing those of most of its European neighbours. The country remains a cornerstone of the region’s agriculture, and is home to one of the continent’s most diverse alternative protein startup communities.

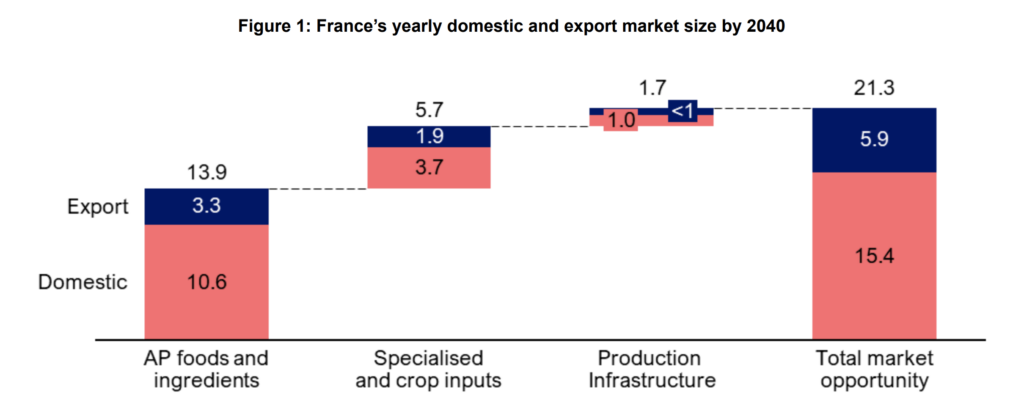

That said, reducing France’s reliance on protein imports is a central goal of safeguarding it from global supply shocks. So a transition to alternative proteins could boost its food security and environmental resilience, boosting the economy with €18B in gross value added.

The end products emanating from this industry could be worth over €10B (as much as the French coffee market), while the full value chain could take this market’s value past €15B.

Additionally, trade opportunities could total €6B by 2040, equivalent to the average value of French cereal exports between 2017 and 2021. Alternative proteins could also support 64,000 jobs by this year (higher than the local beverage manufacturing sector).

How alternative proteins could strengthen EU agriculture

Systemiq’s report highlights how the EU had a plant protein deficit of nearly 19 million tonnes of crude protein in 2024, and that broader climate risks are costing farmers upwards of €28B a year. Alternative proteins could strengthen arable agriculture by creating three enabling factors.

First, a strong domestic plant-based sector would boost demand for food-grade legumes and pulses – field peas, fava beans and chickpeas could see double the demand, and lentils a sevenfold increase. This would serve as a key incentive for farmers looking to transition, as well as reduce critical import dependencies and enrich soils through nitrogen fixation.

Next, a shift to alternative proteins could shrink the protein deficit by supporting an expansion of domestic crop supply, and reducing demand for high-protein feed imports in the first place. Finally, a scaled-up future food sector could generate demand for cereals, sugar crops, pulses, soy, and oilseeds as feedstock, offsetting the expected 45-50% decline in demand for biofuel and feed crops by 2035.

“To unlock these benefits, the EU must treat alternative proteins as a strategic priority,” said Elena Walden, research lead at GFI Europe. “Europe’s leaders need to modernise regulations so that innovative products can be brought to market while meeting the EU’s world-leading food safety requirements, and invest in the research and infrastructure needed to make these foods available to everyone.”

Systemiq outlined the need for a more predictable, harmonised, and transparent regulatory framework to spur innovation, bolster investor confidence, and ultimately help commercialise novel foods in a faster and cheaper way.

Each alternative pillar requires significantly more processing facilities to meet future demand. The analysis predicts capacity increases of 20% each year for plant-based foods, 26% for biomass, 21% for precision fermentation, and 60% for cultivated proteins. The production base can be scaled up through greenfield development and retrofitting.

Finally, public investment would be essential to unlocking private finance for alternative proteins. The sector needs around €1.7B in total R&D funding every year, and an additional €2.7B in capex scale-up financing.

“The question is not whether the EU can afford to invest, but whether it can afford not to,” the report states. “With the right policies, the EU can deliver prosperity from farm to factory, shaping a sustainable and innovative food future.”