5 Mins Read

£2.1 billion is on the line for the UK economy, and it depends on whether the government will greenlight its burgeoning cell-based meat sector. In a new report, Oxford Economics researchers find that the industry could add as many as 16,500 new jobs by the end of the decade, warning that Britain risks “falling behind” current leaders like Singapore and Israel if regulatory developments are stalled.

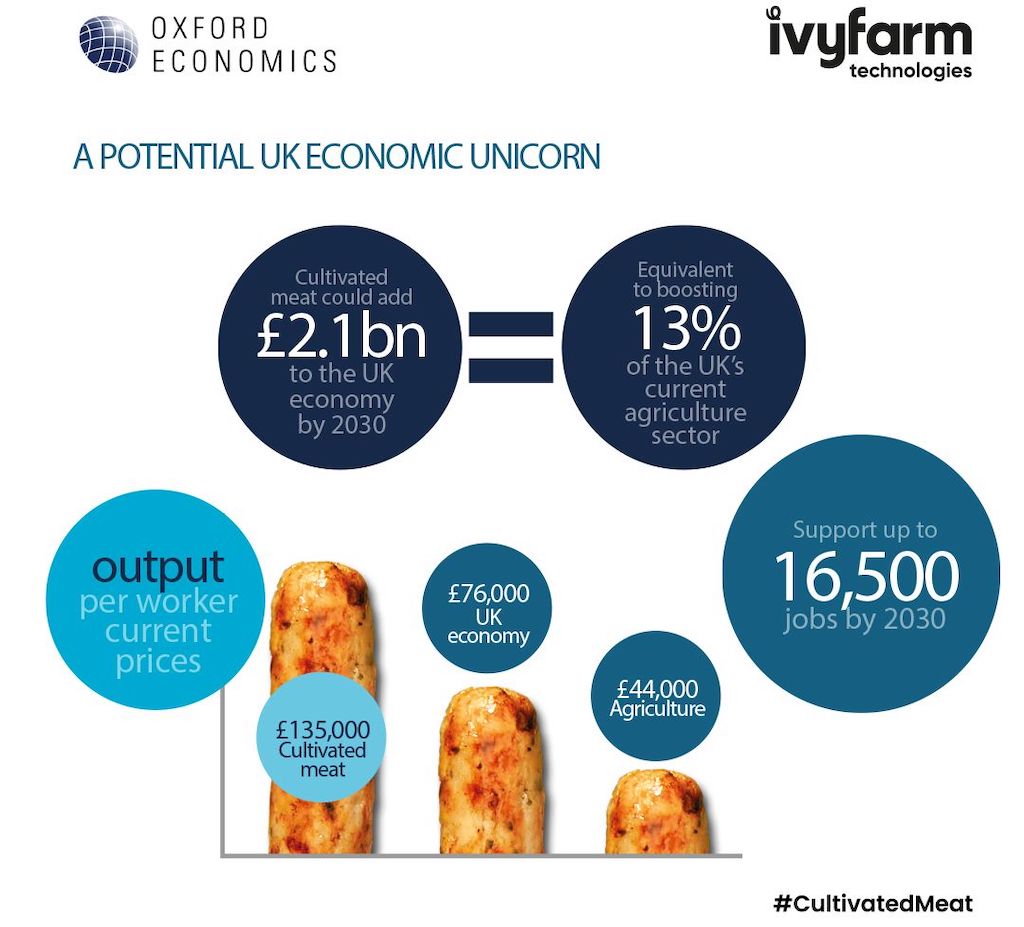

New data from an Oxford Economics study warns the UK government that failing to support the cultivated meat sector could mean missing out on a £2.1 billion economic windfall. The research, commissioned by Oxford spinout cell-based food tech Ivy Farm, estimates that with the right support, cell-based meat could make up 13% of the country’s agricultural sector and add 16,500 new jobs by 2030.

Oxford Economics is a commercial venture under Oxford University’s business college, which provides data forecasting and modeling to financial institutions and UK companies.

£2.1 billion on the line

Examining the economic contribution of the cell-based meat sector by looking at domestic consumer spending by the end of the decade, researchers estimate that the industry could reach £1.7 billion in the UK, supporting up to £2.1 billion of the country’s GDP when considering its entire associated value chain.

The industry will bring positive ripple effects across the wider British economy too, with experts expecting a GDP multiplier of 3.6-fold by 2030. That means for every £1 million the cultivated meat industry creates in a year, a further £2.7 million will be added to support the rest of the UK economy in the same year.

Of the 16,500 jobs that the cell-based protein industry will support by 2030, around half—8,300 workers—are expected to be directly employed by cultivated meat makers. It will also have an “employment multiplier” of 2, meaning that for every 100 new jobs created by the sector, another 100 will be added to different industries across the UK.

Approving cell-based meat as a ‘win-win’ scenario

Commenting on the findings, Oxford Economics director of economic consulting Henry Worthington said that there was a clear conclusion that the cell-based meat economy has “strong potential for growth within the UK and the substantial economic footprint that the market will support through the value chain.”

“Strikingly, from whichever angle you look, the public policy rationale for regulatory approval of cultivated meat appears compelling, from “net zero” to the war against obesity to building a more research-intensive economy, this industry aligns seamlessly with stated government policy objectives,” Worthington added.

At the moment, Singapore remains the only country to have given the go-ahead for the commercial sale of cultivated meat. In December 2020, the country became the first to approve Eat Just’s cultured chicken bites, and has since granted local firm Esco Aster the ability to manufacture cultured animal cells meat for commercial sale.

According to the Oxford Economics report, the cultivated meat industry in the UK could also help bolster tax coffers by as much as £523 million—but that’s only if the regulators, the Foods Standards Agency (FSA), gives approval to the commercial sale of cultivated proteins by the end of 2022, keeping up with developments elsewhere internationally.

While Singapore is the only country with approval right now, countries like Israel, Qatar and the US have a supportive regulatory environment and have made several indications that approval is forthcoming.

Related: US and European cell-based meat regulation critical to ‘unlock mass market’ – report

‘We need to move quickly’

Ivy Farm CEO Rich Dillon says that the report represents a strong warning to the UK government to stay ahead of its global competition if it wishes to become a leader in an industry set to transform the world’s food system.

“This is the first time a definitive economic dataset has been calculated for the UK’s cultivated meat industry and we’re urging the government and the FSA to study the report carefully,” said Dillon. “If we don’t move quickly, countries like Singapore that have already approved cultivated meat for consumption will leave us in their wake.”

“The environmental benefits of producing real meat without livestock farming are well understood, as are the animal welfare and human health advantages,” he continued.

Ivy Farm’s technology is a non-GMO process, where animal cells are placed in a bioreactor and fed a mix of minerals and vitamins needed to replicate and grow. Within four weeks, muscle and fat cells can be harvested in its proprietary continuous system, and used to develop cell-based meat that requires a fraction of the environmental resources compared to livestock farming production methods.

The Oxford startup wants to be able to put its cultivated sausages and pork on the market by 2023, potentially making it the first in the country.

Fellow British startup CellulaREvolution, a spinout of Newcastle University, has come up with a similar continuous manufacturing system for cell-based meats. Over in Cambridge, Animal Alternative Technologies (AAT) has developed an AI-powered “Renaissance Farm” system to help other businesses make cultured meat, co-founded by a former employee at cultivated pork belly maker Higher Steaks, also based in Cambridge.

Dillon says that the emerging cultivated meat ecosystem in the UK can make the country a “powerhouse for alternative proteins, exporting our products and technology across the globe and reducing the UK’s reliance on imported meat.”

Lead image courtesy of Ivy Farm.