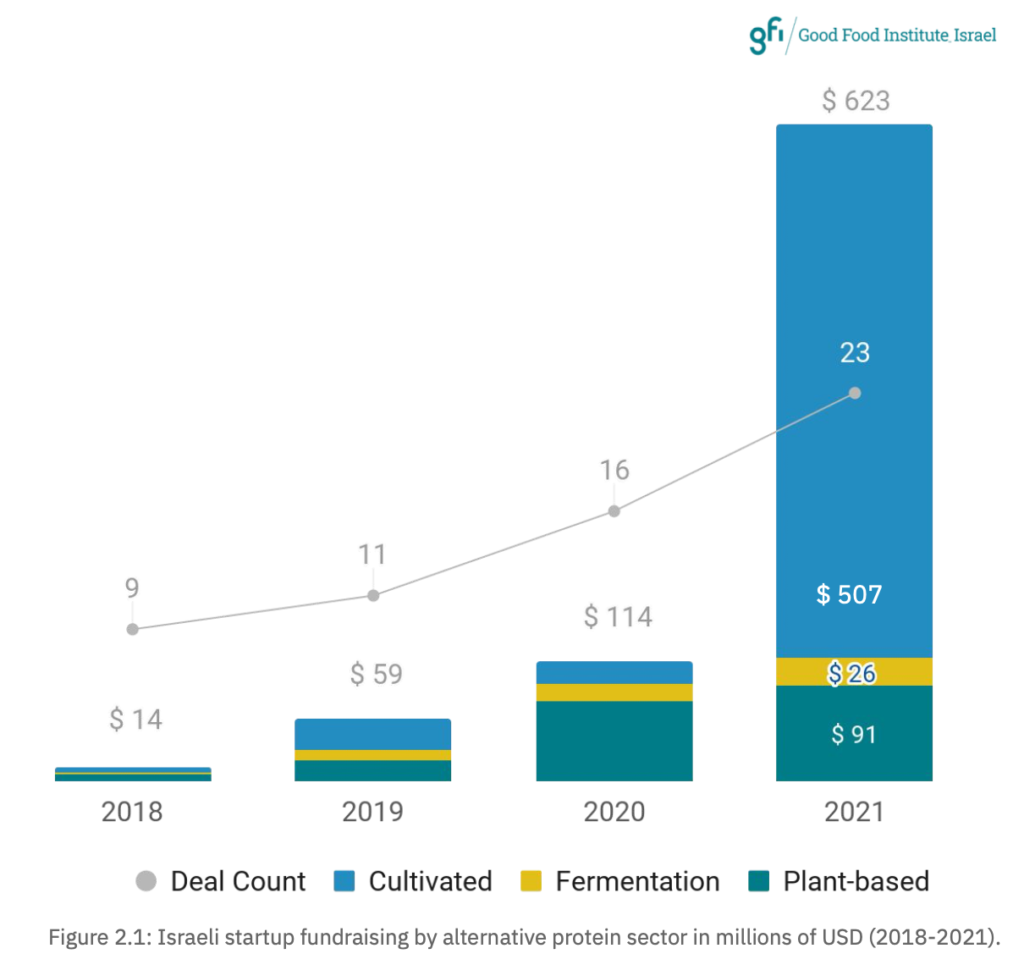

Israel’s alternative protein sector has experienced its biggest investment year on record, according to a new report. Industry startup raised $623 million last year, a 450 percent increase from 2020’s $114 million. The jump secured Israel the second spot on the global investment leaderboard. New Good Food Institute Israel (GFI Israel) data highlights growth across all sectors. Previous startups are shown to now be reaching commercialisation and international distribution phases, leading to larger investment rounds.

The cultivated protein sector remain Israel’s forte, scooping $507 million of the total investments declared in the just released report– in fact, more than 36 percent of all global investment into cultivated meat went to Israeli companies and the country welcomed six new cultivated startups this past in 2021.

Plant-based protein funding came in second, with $91 million and fermentation innovation scooped $26 million. Further, For the first time, alt-proteins constituted more of the overall food tech investments made in Israel, accounting for 72 percent.

The big winners

Global investment into alt-protein grew by 60 percent from 2020 to 2021, totalling a record-breaking $5 billion. Israel can second only to the U.S. in terms of value of investments secured, despite the E.U. concluding more deals. Israel is catching up to the U.S. in terms of cultivated meat investment. The former snared $699 million, compared to Israel’s fast-closing $507 million, which is 24 times more than funding secured in 2020.

Of the 47 alt-protein startups in Israel, Future Meat secured the biggest round with a $347 Series B in December last year. It is the largest ever raise for cultivated meat, globally. Microbial fermentation dairy startup Remilk came in second with a $120 million Series B. Aleph Farms has been making plans for a commercial launch and scooped $105 million. Redefine Meat completed a $29 million Series A for its 3D printed whole cuts. Each company cited global expansion as a motivating factor for raising.

Eleven new companies were founded in Israel in 2021, five of which are seafood-focused. This pushed the country to the top spot for the number of alt-seafood enterprises founded last year. Plantish is amongst those making the biggest splash so far. It remains number two in the world for quantity of cultivated and fermented startups, with 12 of each. The U.S. is in first position.

When it comes to diversity, Israel is a world leader. Twenty-five women are listed as founders for the 47 operational alt protein startups (over 50%) and 12 companies are led by a female CEO, a far better state of affairs than other tech sectors in the country and other alt protein .

Stage-by-stage analysis demonstrates the levels of complexity involved with bringing different verticals to market. While plant-based protein companies are numerous and with plenty already at commercial sale and growth stage, fermentation has just one, NextFerm. Cultivated companies remain stuck in the pilot and scale-up stage, though three are progressing well. SuperMeat, Aleph Farms, and Future Meat all hope to gain regulatory approval by the end of 2022.

Israel’s opportunity to support the sector

GFI Israel‘s report underlines that no country has a national plan in place to promote alt-proteins as of yet, though Singapore leads in terms of regulatory approval and China has mentioned the sector in its five year plan for the first time. The non-profit says that this is an opportunity for the Israeli government to get out in front, by investing in research and infrastructure, while establishing a transparent framework for regulation. Government and consortium funding accounted for $28 million of 2021’s total investments. There is scope for this to significantly increase, with support from the Israeli Innovation Authority (IIA).

“The IIA works to enable, grow and position Israel as a leader in the food-tech sector, and in the field of alternative proteins in particular, and invests in startups at every stage of their development,” Dror Bin, CEO at the IIA said in a statement. “We are excited to see startups which were supported by the authority at the beginning of their journey now in very advanced stages after significant raises and becoming a large and prosperous industry in Israel.”

Israel retail insights showed that the plant-based sector is showing two-year growth over seven times that of animal product sales. Plant-based milk reached a value of $106 million, accounting for 16 percent of the total milk market. Similarly, animal-free meat reached $104 million, representing 6 percent of the retail meat market.

The view ahead

The alt-protein sector is expected to continue attracting larger investments, especially as regulatory approvals become more likely for the cultivated arena.

“At GFI Israel we help entrepreneurs, startups and investors identify opportunities and challenges in the field and thus direct innovation and investment to accelerate the field in the right direction,” Aviv Oren, director of business engagement and innovation at GFI Israel said in a statement. “This year we saw mainstream tech and institutional investors beginning to see the huge potential of alternative proteins to transform our food system and managing climate risks, as well as the strong potential to meet their target returns. Israel is a global leader in innovation, but in recent years also in the growth of unicorns and global companies. This year for the first time this growth has reached the alternative protein sector as well. There are several more interesting companies in Israel that will soon move from pilot to scale-up, so I anticipate 2022 being another record-breaking year.”

Large-scale partnerships are likely to impact 2022 investment figures. Future Meat has announced a collaboration with Nestlé, Aleph Farms will be working with big meat producer BRF and SavorEat is partnering with Sodexo.

Lead photo by Future Meat.