4 Mins Read

Americans are embracing sustainable fashion choices by buying more resale goods than ever before, driving the rise in secondhand fashion. Within the next five years, the market is expected to reach a whopping US$77 billion. In the new report, analysts say that a convergence of driving forces are making shoppers “think secondhand first”.

Using data collected by retail analytics firm GlobalData, new research estimates that the secondhand apparel market in the U.S. will double within the next five years to US$77 billion. The report was commissioned by the online consignment startup thredUP and involved more than 3,500 adults in the country.

33 million new secondhand shoppers

Looking into the emerging trends driving the rise of resale, the report found that a record 33 million people bought secondhand for the first time in 2020. Of these first-time buyers, more than three-quarters (76%) plan on increasing their share of resale purchases in the next five years.

“Consumers are prioritising sustainability, retailers are starting to embrace resale,” commented thredUP co-founder and CEO James Reinhart. “We are in the early stages of a radical transformation in retail.”

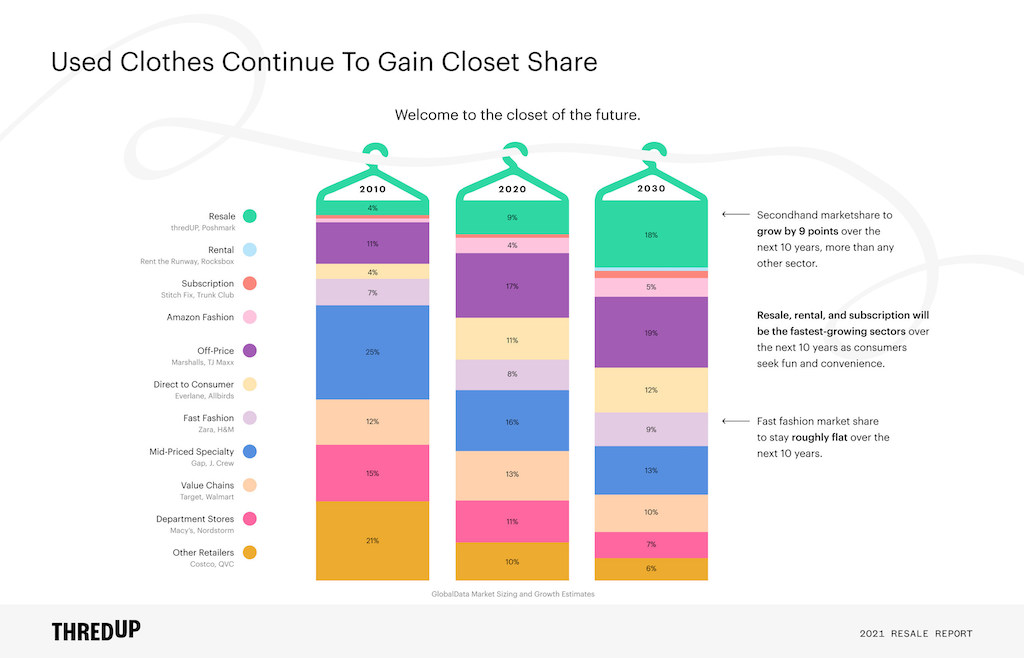

At present, the secondhand market is valued at US$36 billion. But analysts say it’s going to grow 11-times faster compared to the retail clothing sector to reach the projected US$77 billion.

Much of the demand is stemming from changing consumer values amid Covid-19. According to the survey, 1 in 3 shoppers say they care more about sustainable apparel now than in pre-pandemic times. 51% of those polled are now more opposed to environmental waste overall.

We are in the early stages of a radical transformation in retail.

James Reinhart, Co-Founder & CEO, thredUP

Retailers are adapting to resale

Given the strong growth of secondhand, even during the pandemic-stricken economy, retailers are quickly shifting their business models.

According to the survey, a third of retail executives polled said resale was becoming “table stakes”. Meanwhile, 42% said resale is going to be vital to their growth strategy in the next five years. Nearly two-thirds (62%) say their customers are already buying resale.

“As we emerge from the pandemic, the resale market is stronger than ever. Consumers are refreshing their closets and turning to resale as a way to sustainably discard garments and acquire new ones,” said Neil Saunders, managing director at GlobalData. “Retailers recognise this shift, which is why so many of them are now looking to get into resale.”

Fast fashion is getting phased out

One of the key findings of the report was the fast pace in which consumers are displacing fast fashion purchases with resale.

Driven by the greater awareness in ethics and sustainability, consumers are “switching to thrift” as a way to drive down harmful production. With around 40% of consumers saying they are actively displacing fast fashion with secondhand, GlobalData analysts predict that resale will become two-times larger than fast fashion by 2030.

Of those shoppers already thrifting, they’re buying 7 items on average each year. Together, they are preventing more than 542 million new apparel items being sold.

“These trends will make resale the most dynamic and fast-paced part of the apparel market over the next decade,” said Saunders.

Consumers are also ramping up their demands for brands to adopt resale models. According to the poll, 43% saying they are more willing to shop with a brand if allowed to trade in old clothing for store credit.

Read: 5 ways conscious consumers are driving the resale trend

These trends will make resale the most dynamic and fast-paced part of the apparel market over the next decade.

James Reinhart, Co-Founder & CEO, thredUP

Government to incentivise resale

The report further highlighted the growing pressure from consumers and retailers for the government to step in and incentivise the industry.

58% of retail executives indicated they would be more likely to implement retail with financial incentives. Nearly half (44%) of consumers also believe that the government should play a role in promoting sustainable fashion.

Reinhart believes that this is going to be a strong driver that will push the retail industry towards circularity. “Pollutive industries have the power to transform when technological innovation collides with the motivations of consumers, businesses and government.”

“Policymakers are getting on board,” he added. “We’ve seen it with electric cars and solar energy, and we believe circular fashion is next.”

Lead image courtesy of thredUP.