APAC AgriFood Report: Funding Hits A Low, But Farm Tech & Novel Foods Are On the Rise

5 Mins Read

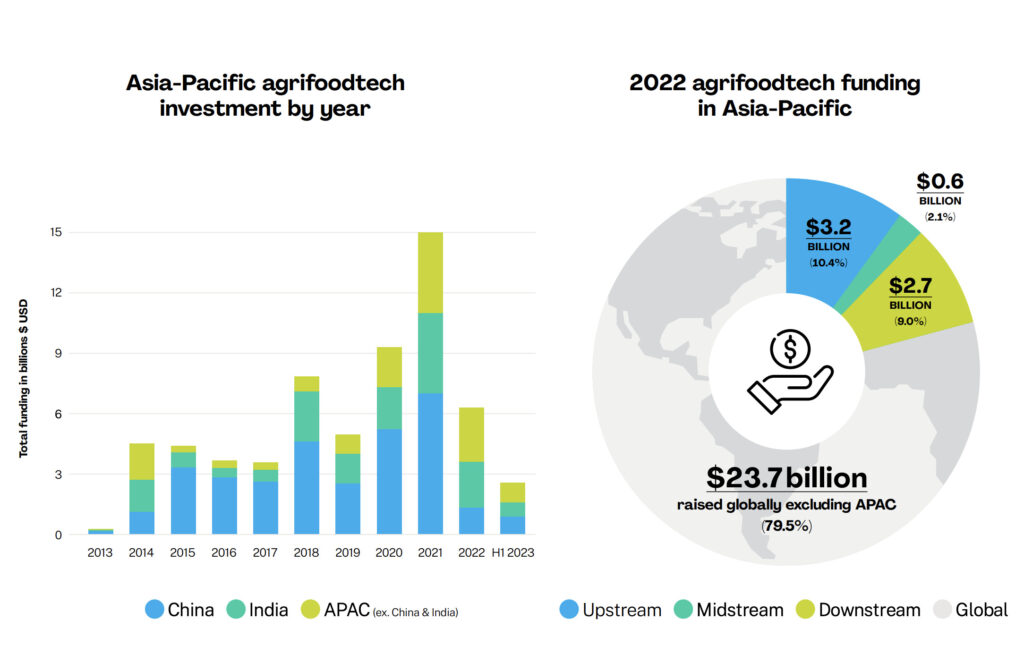

Agrifood tech startups in Asia-Pacific saw an investment of $6.5B in 2022, a 58% fall from the year before – but agtech funding for farmers and primary novel food production increased by 24% year-on-year, according to a new report by AgFunder.

A new report by AgFunder – in collaboration with the Bill & Melinda Gates Foundation, venture capital fund Omnivore, and AgriFutures Australia – has revealed that downstream food tech funding in APAC has been hit by the global VC fallout from 2022. However, the financing of startups supporting farmers and primary production (upstream) has increased.

‘Upstream’ generally refers to agricultural biotech, farm management and robotics systems, as well as novel farming tech, while ‘downstream’ covers technologies removed from farms and primary production – i.e., food delivery, restaurant, meal kit startups, etc. The latter usually attracts much higher amounts of cash injections in the region, though that is no longer the case.

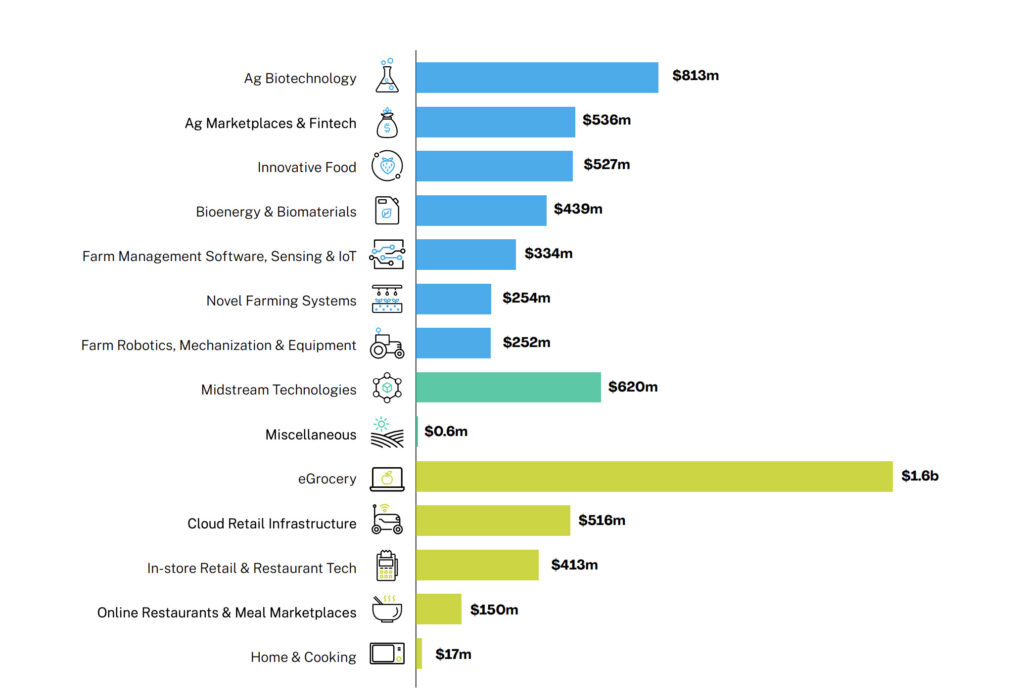

Meanwhile, companies working with midstream technologies – which connect farmers and food producers to retailers, agro-processors and other clients – raised $620M million in 2022, with India’s Waycool and China’s Mojia Biotech receiving big checks.

As for this year’s trends, the report found that total agrifood tech financing in the first half of 2023 ($2.6B) was down by nearly 50% from the same period last year, but the number of deals remains similar.

Overall funding decline

AgFunder’s analysis showed that agrifood tech startups received $6.5B in funding in 2022 – a 58% decline from the $15.2B they raised in 2021, which was a record-breaking year. A report published by AgFunder and Temasek earlier this year highlighted that the global agrifood tech sector saw record-breaking raises of $51.7B that year thanks to “cheap money” and “increasingly outlandish tech valuations”.

In terms of upstream startups, year-on-year funding grew by 24% from 2021-22, marking the first time in years that upstream funding ($3.2B) overtook downstream investment ($2.7B). This is a win for the over 450 million smallholder farmers who are responsible for 80% of APAC’s food production.

Within the downstream sector, e-groceries continue to be the largest category, attracting $1.6B in funding. Indian startup Blinkit – an app-based instant grocery delivery service – received an injection of $150M, before being acquired by restaurant aggregator and food delivery giant Zomato.

The decline in downstream deals mirrors global trends analysis by Pitchbook last month, which found that in Q2 this year, food tech VC funding dropped by 75.1% year-on-year, while the number of deals (1,207) was down by 39.3% annually. But while quarterly funding also dropped by 13.9%, the deal count grew to 268 in Q2.

Pitchbook suggested that this could indicate a “return of investment activity after a pause due to caution surrounding the closure of Silicon Valley Bank at the end of Q1”. However, the declining deal sizes “may reflect a new, more careful paradigm”.

According to the AgFunder-Temasek report, the global decline between 2021 and 2022 could be short-lived as many of the world’s macro challenges – including inflation, food insecurity and labour shortages – are driving interest in agri-food tech investments. “With more discipline from founders (and investors too!), the industry can capitalise on the growing interest in using technology to transform our food and agriculture system to be better for people and our planet,” read the report. “[2023] could be a vintage year to invest in agrifoodtech.”

Upstream on the up

Within APAC, upstream agtech companies attracted 1.6% more investment in the first half of 2023 compared to the same period the year before as well, reaching $1.7B.

In 2022, agricultural biotech startups received the largest share of upstream financing, commanding $813M of the total – that’s nearly half of the overall investment in this category globally. “While a couple of very large deals contributed to these totals, there was also greater deal activity in this segment, which includes on-farm inputs for crop and animal agriculture, confirming investors’ growing interest in this space,” AgFunder says. China’s Zhongxin Breeding – which provides breeding services for pigs – secured the year’s largest deal with its $327M seed round.

Meanwhile, Innovative Food – the segment that includes alternative protein – “bucked the global decline in funding to the segment”, with year-on-year investment increasing to $527M, albeit with a smaller deal count. This aligns with industry think tank the Good Food Institute APAC’s recent report that revealed that sector funding in the region grew by 43% from $293M to $562M – though the two largest funding rounds took place in Q1 2021.

Startups working with farm management software, sensing and IoT ($334m), farm robotics ($252m) and novel farming systems ($254m) – which include indoor farming, aquaculture and insect farming – brought in more investment across fewer deals as well.

Country-wide figures

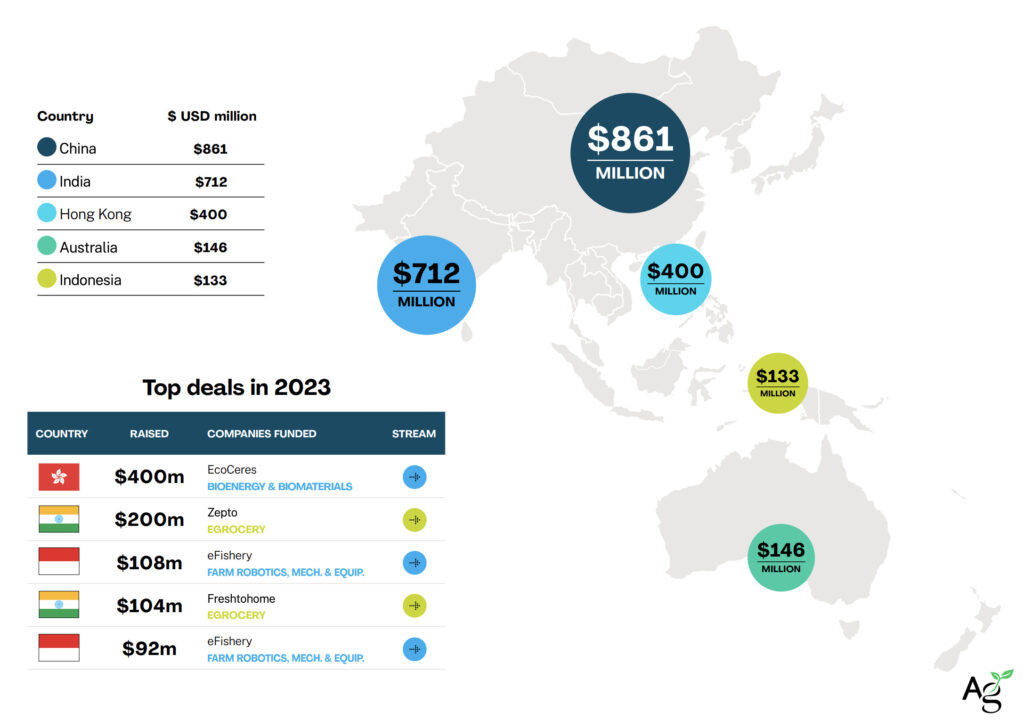

Across APAC, India ($2.3B) surpassed China ($1.3B) as the country with the highest cash injection in this sector last year, largely due to the loss of downstream mega-deals that propelled China’s agrifood tech industry in 2021. These nations were followed by Indonesia ($716M) and South Korea ($461M).

But this looks to be short-lived, with China overtaking India to grab the top spot with $861M in investment in the first half of 2023. Indian startups have received $712M, followed by Hong Kong ($400M) and Australia ($146M).

Overall, Southeast Asian startups commanded $1.7B in funding in 2022, while Australian companies saw total investment reach $316M – a rate that was maintained in the first half of 2023 with $146M in financing. Meanwhile, agrifood tech startups in Japan brought in $212M in 2022.

Finally, while debt, early and growth-stage deals numbers have increased steadily since 2018, late-stage funding declined from 2021.

“Few readers will be surprised that funding for Asia-Pacific’s food and agriculture startups has fallen significantly over the past year and a half, much like the rest of the world,” said AgFunder Managing Editor & Head of Media & Research Louisa Burwood-Taylor. But she added: “Seeing the rise of categories like Ag Biotech, which haven’t typically been a strength across the region, as well as growing early-stage deal activity, is promising.”

Read AgTech’s full Asia-Pacific AgriFoodTech Investment Report 2023 here.