4 Mins Read

Shoppers in China are turning away from traditional leather and are instead eyeing novel “next-gen” animal-free leather alternatives. In a new consumer poll, 90% of urban Chinese consumers said they prefer leather alternatives over their conventional counterparts, an indication of the lucrative business opportunities that lie ahead for material innovators in the world’s fastest-growing major economy.

Chinese consumers are making the shift away from leather, according to a new survey conducted by the Material Innovation Initiative (MII) in collaboration with research firm North Mountain Consulting. The poll, which involved respondents based in urban China, found that 90% preferred animal-free leather alternatives over conventional emissions-intensive and non-cruelty-free leathers made from animal skin.

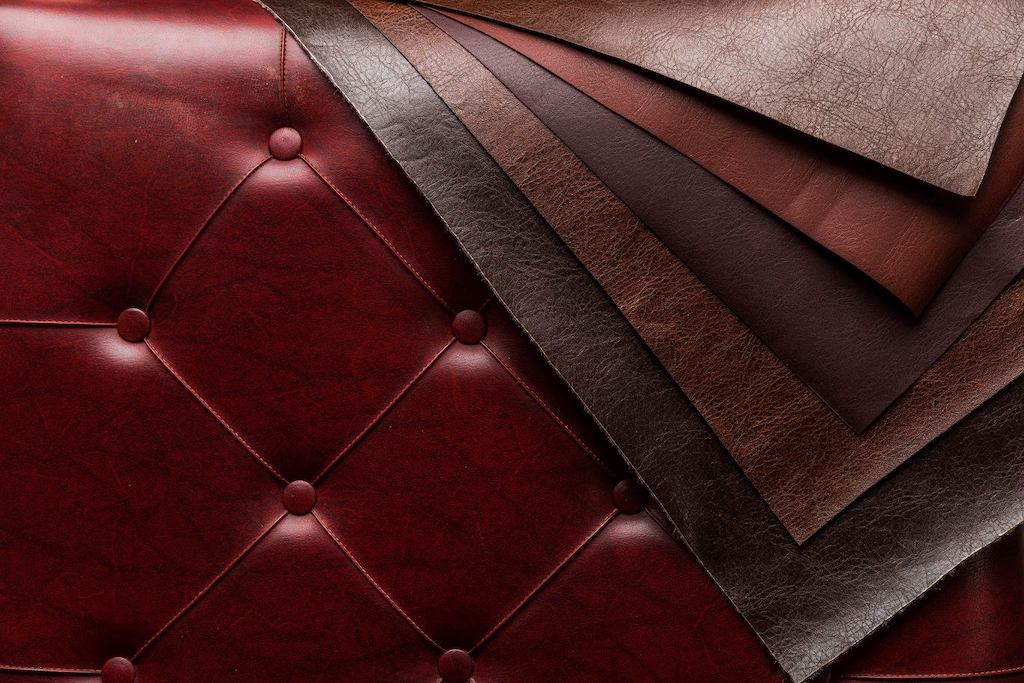

Leather alternatives in the study were dubbed “next-gen leather”, a term describing high-performance sustainable alternatives to traditional animal-based leather materials. These substitutes are different from current-gen replacements, plastic-based PU leather or “pleather” materials, which are still produced using fossil fuels and not considered a viable sustainable alternative to animal-based products.

9 in 10 prefer next-gen leather

In addition to finding that 9 in 10 Chinese shoppers would prefer next-gen leather, the study also revealed that 70% would be “very” or “extremely” likely to purchase these products. The main reasons cited include concerns about the environment, with 72% saying they would choose leather alternatives as they were more sustainable.

72% said that quality was their top reason, while animal welfare (63%), personal expression (61%), and cost (56%) were also major factors driving the consumer shift. A lesser cited reason, though still significant, was shoppers’ belief that next-gen leather was “more fashionable”.

Commenting on the findings, the principal researcher and founder of North Mountain Consulting Keri Szejda said: “The study showed the highest rate of acceptance toward a new technology I have yet seen. This study suggests there will be wide acceptance of next-gen leather in urban Chinese markets once at scale.”

The demand for material alternatives in China will present major opportunities for current innovators and entrepreneurs in the material innovation space, an industry that MII predicts will follow the growth trajectory of the alt-protein industry to become a $2.2 billion market by 2026.

China is a massive market eyed by companies all over the world, with the country’s fashion sector representing one of the world’s largest revenue generators. It is expected to reach $383 billion this year, making up 44% of the global total, according to the latest MII report.

Related: Synbio to reshape food and fashion industries with double digit growth – report

Younger Chinese consumers would pay premium

The poll also pinpointed younger Chinese consumers as the most enthusiastic demographic to adopt next-gen animal-free leather in the country. Of the 62% who said they would be willing to pay a premium for leather alternatives, millennials expressed the greatest preference with around three-quarters saying they would be “highly likely” to purchase these products.

“Consumers want to buy products that are in alignment with their values, and they are becoming increasingly aware that animal leather is not,” shared MII co-founder and CEO Nicole Rawling.

“Leather production contributes to greenhouse gas emissions, harmful chemical pollution, and negative health impacts for workers and surrounding communities. Creating next-gen leather alternatives that outperform leather both functionally and ethically could lead to a total transformation of the leather market away from animal options.”

Next-gen leather startups

In a previous report, MII identified 49 players in the global leather alternatives space. Some of the companies in the sector include mycelium leather startups MycoWorks and Bolt Threads, and lab-grown leather company Modern Meadow.

Companies are also making natural plant-based leathers, such as pineapple leaf-based Piñatex or cactus-based Desserto leather, though these still contain a small percentage of blended non-bio-based components that make them not 100% biodegradable or compostable.

The remaining 10% of consumers polled in the MII-North Mountain survey who remain unconvinced about next-gen leather cited higher quality, safety and familiarity of conventional leather as their reasons for avoiding novel products. MII analysts say that these concerns highlight the primary obstacles for brands and innovators to consider to reach mass market.

Lead image courtesy of MycoWorks.