Next-Gen Sustainable Materials To Follow Alt Protein, Become $2.2 Billion Industry By 2026, Predicts New Report

6 Mins Read

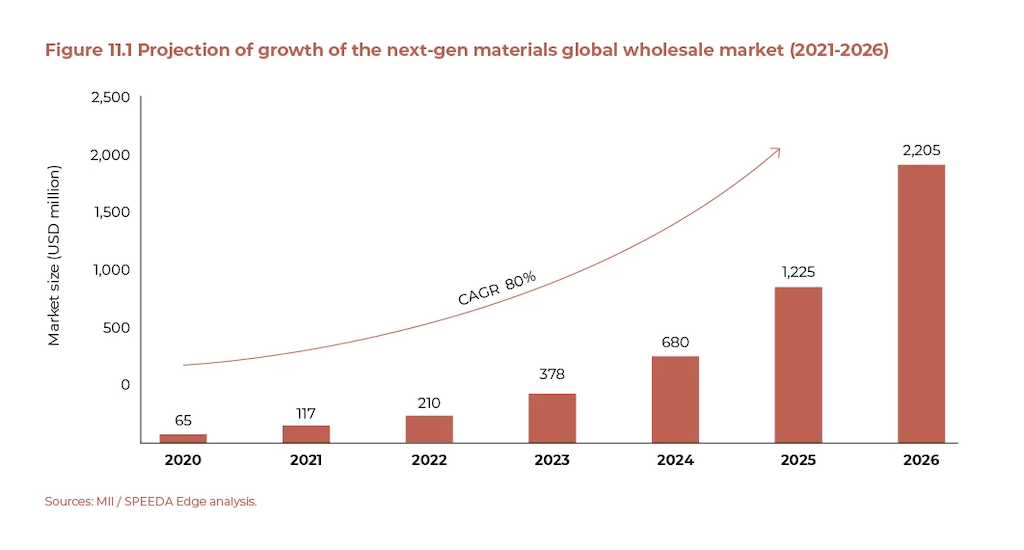

Next-gen materials, a term describing high-performance sustainable alternatives to animal-based materials, is a nascent industry. But a new report from the Material Innovation Initiative (MII) say it will follow a similar trajectory as the explosive alternative protein industry. By 2026, next-gen materials are set to become a US$2.2 billion market.

Released on Tuesday (June 22), the new State of the Industry Report: Next-Gen Materials is a first-of-its-kind overview of the small but fast-growing sector of players creating sustainable, high-performance materials to displace its animal-derived counterparts like leather, fur and silk. It is published by the nonprofit MII, which was set up in 2020 to accelerate innovation in the animal-free material space, from cell-cultured exotic skins to plant-based fabrics.

Disrupting 3% of the US$70 billion market by 2026

MII’s new overview of the key players, driving forces and development of the next-gen materials industry predicts that while the sector is still in its infancy, it’s potential for disruption is huge. According to their analysis, the global wholesale market size for next-gen materials is projected to reach US$2.2 billion in 2026—representing 3% of the global materials market of over US$70 billion.

The rise of next-gen materials will be fuelled by three main factors: rapid advancements in science and technology behind developing these materials, shifts in consumer preferences for more sustainable and ethical alternatives, and regulatory trends.

While gaining a 3% share of the market appears small, MII notes that their estimate measures the wholesale market, rather than the retail market. Speaking to Green Queen Media, MII’s chief innovation officer and author of the report, Elaine Siu, explained that retail-based predictions tend to be “many times bigger” but are “not helpful for what we are trying to accelerate—talent and investment into the material supply space.”

Moreover, MII’s projections do not include current-gen replacements, such as plastic-based leather or “pleather” materials, which are still produced using fossil fuels and not considered a viable sustainable alternative to animal-based products.

Next-gen materials will grow ‘at a faster rate’ than alternative proteins

Honing in on the figures, Siu says that their predictions for the next-gen materials market in fact reflects a faster growth rate than the trajectory history of the alternative proteins industry, a sector that has undergone explosive growth in the past few years.

“We see the next-gen materials industry as 5-10 years behind the alternative proteins industry,” said Siu.

“The market size for alternative proteins was approximately $2.2 billion of a global meat market of $1.7 trillion in 2019; we estimate the next-gen materials industry will grow at a faster rate and reach approximately $2.2 billion of a global animal-based material market of $70 billion USD in 5 years.”

We see the next-gen materials industry as 5-10 years behind alternative proteins…We estimate the next-gen materials industry will grow at a faster rate.

Elaine Siu, Chief Innovation Officer, MII

Small, but growing cohort of material innovators

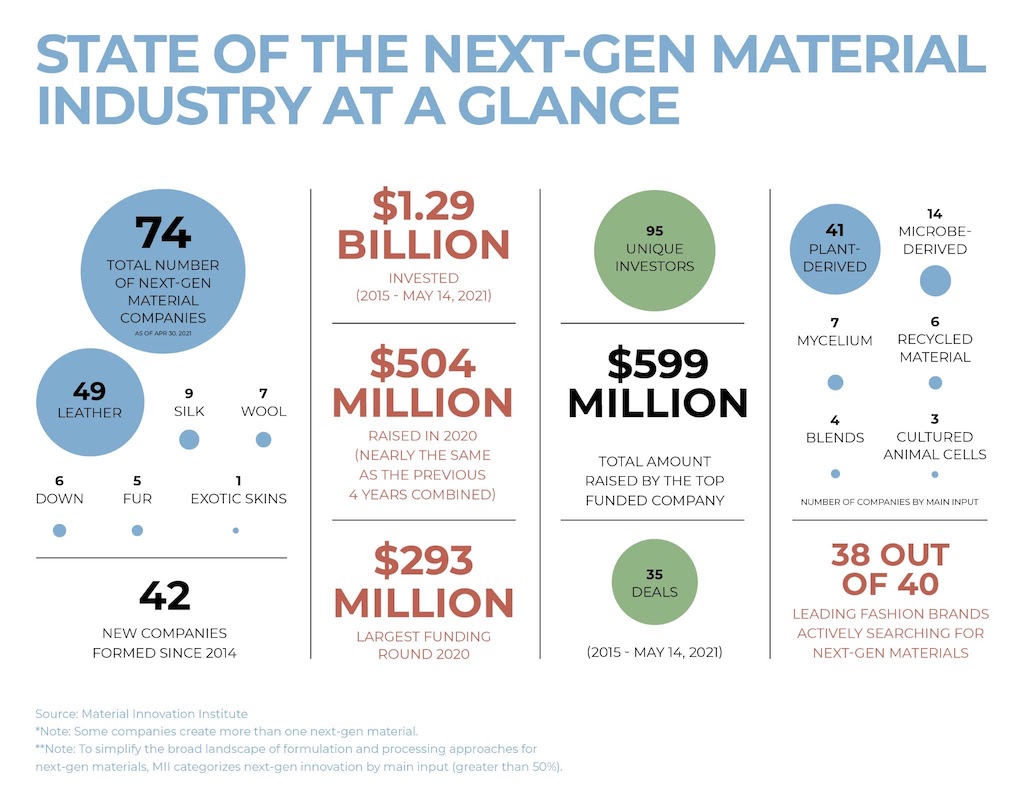

There’s now a growing group of companies working on material innovation. Of the total 74 next-gen material companies identified in the report, more than half of them (42) were formed from 2014 onwards.

At present, the majority of these companies are focused on developing animal leather, with 49 players in the space in total and 30 of them being formed within the last 7 years. Company names in this sector include mycelium leather startup MycoWorks and lab-grown leather company Modern Meadow.

Meanwhile, there are 9 companies biomimicking silk, 7 dedicated to wool, 6 working on down alternatives, 5 developing fur replacements and just one, VitroLabs, innovating animal-free exotic skins.

Given the “white space” of alternatives for non-leather animal-based materials, the report says that “innovators looking to enter the space should consider next-gen silk, wool, down, fur and/or exotic skins.”

In terms of the technology that startups are using, plant-based ingredients remain the predominant input to develop leather replacements, but the MII report notes that more companies are now using mycelium and microbe-derived materials to “better replicate the performance and esthetic of animal-based leather.” There are also players using lab-grown technology to grow real animal materials directly from cells.

Investment picking up speed

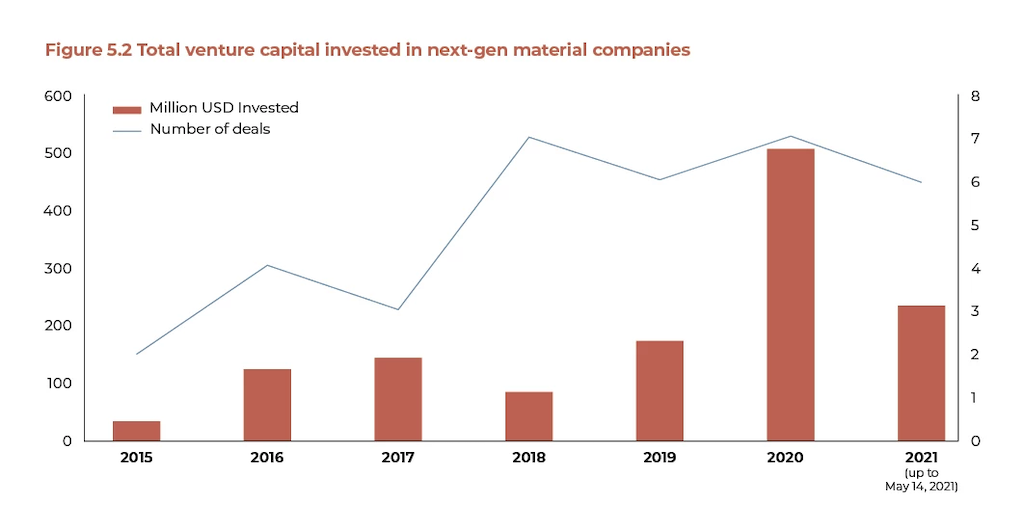

According to MII’s analysis, US$1.29 billion has already been invested in next-gen material companies since 2015, from 95 different sources, from venture capitalists to banks, private equity firms, fashion brands and angel investors.

Of that amount, US$504 million was raised during the pandemic-stricken year of 2020 alone. That’s comparable to the amount raised in the previous four years combined, indicating a strong surge in investment interest in the space. Among some of the top funded companies include microbially-fermented “silk” maker Spiber, lab-grown leather firm Modern Meadow, and Bolt Threads, the startup behind mushroom leather.

Other major brands that have won big investment rounds include wood-based materials company Spinnova and Save The Duck, a brand making duck-free down.

Significant investments, partnerships, and additional material companies and scientists tackling the issues facing the industry are desperately needed.

Nicole Rawling, Co-Founder & CEO, MII

But MII believes that far more funding is still needed to accelerate innovation and support the ecosystem’s growth and impact on the predominantly animal-based material industry.

“As we face potentially dire climate change, the next-gen material industry must be accelerated. Significant investments, partnerships, and additional material companies and scientists tackling the issues facing the industry are desperately needed,” shared Nicole Rawling, co-founder and CEO of MII.

Fashion brands to play a vital role in next-gen material adoption

Beyond financing, MII researchers say that fashion brands are going to be a major driver of the adoption of next-gen materials. Already, a number of labels have indicated interest in using or even creating their own next-gen materials, such as Gucci, who are internally developing a leather alternative.

Fashion brands recognise the trend toward more sustainable and animal-free materials.

Jacqueline Kravette, Chief Brand Officer, MII

Kering, Adidas, Lululemon and Stella McCartney, on the other hand, have all partnered with Bolt Threads and will be churning out new products featuring the mushroom leather alternative.

“Fashion brands recognise the trend toward more sustainable and animal-free materials,” explains Jacqueline Kravette, chief brand officer at MII. “We have met with 40 fashion, automotive, and home goods brands, and all but two are actively searching for next-gen materials to integrate into their supply chains.”

By working with next-gen material startups, brands are likely to foster more support and awareness of animal-free alternatives—and they’ll be able to capture the influential group of younger Gen Z consumers who are increasingly turning to ethical and sustainable products.

“Collaboration on sustainable innovation will result in both a prosperous future for successful material companies, brands, investors, and a liveable future on Earth,” said Rawling.

Lead image courtesy of Modern Meadow.