4 Mins Read

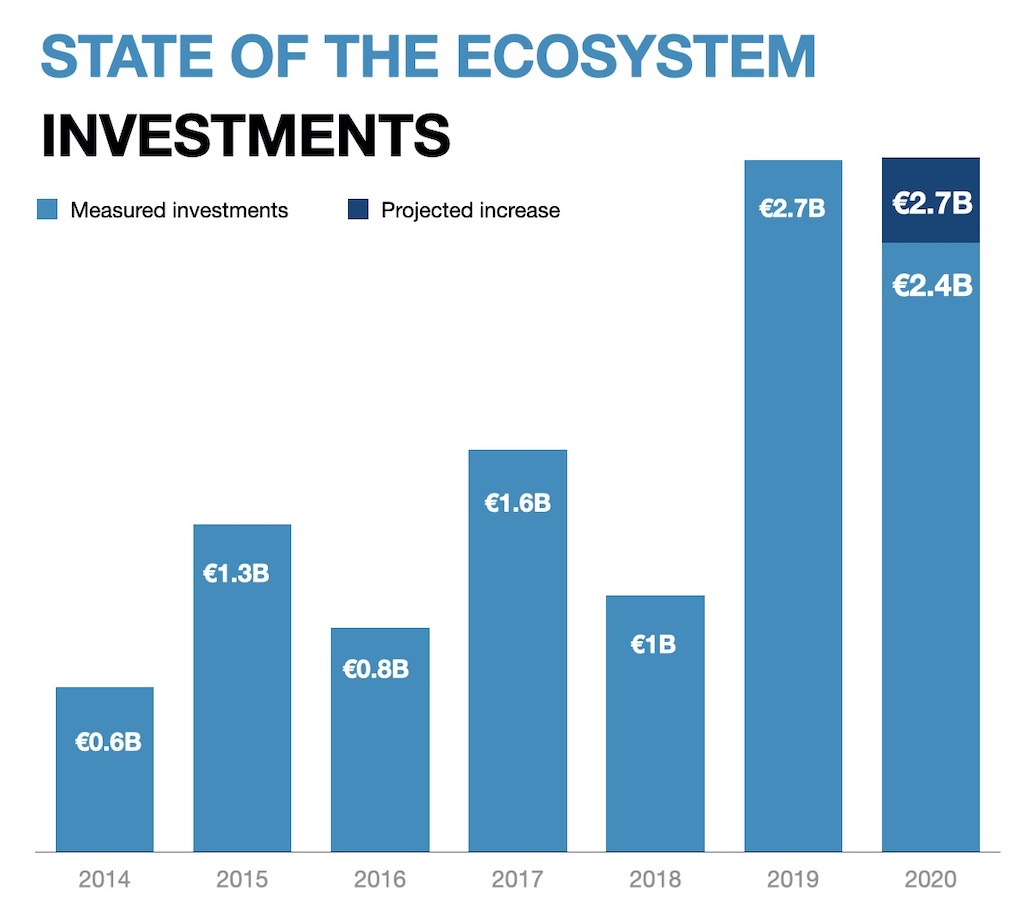

A new report detailing the European food tech landscape has revealed that despite the pandemic, the industry raised a whopping €2.7 billion (US$3.2 billion) in 2020. Much of the investment was driven by the alternative protein sector, with funding recording triple-digit growth. Novel foodservice technologies and experiences also saw a major step up in capital inflows.

Investment into European food techs remained stable at €2.7 billion (US$3.2 billion) in 2020, maintaining the figure recorded in 2019, a new report released on Wednesday (April 7) by Paris-based food tech insight consultancy DigitalFoodLab reveals. The 69-page analysis, supported by data and food giants Google Cloud and Nestlé, details the funding and trend shifts over the pandemic-stricken year, and provides insights into geographical and category changes in the food tech landscape in Europe.

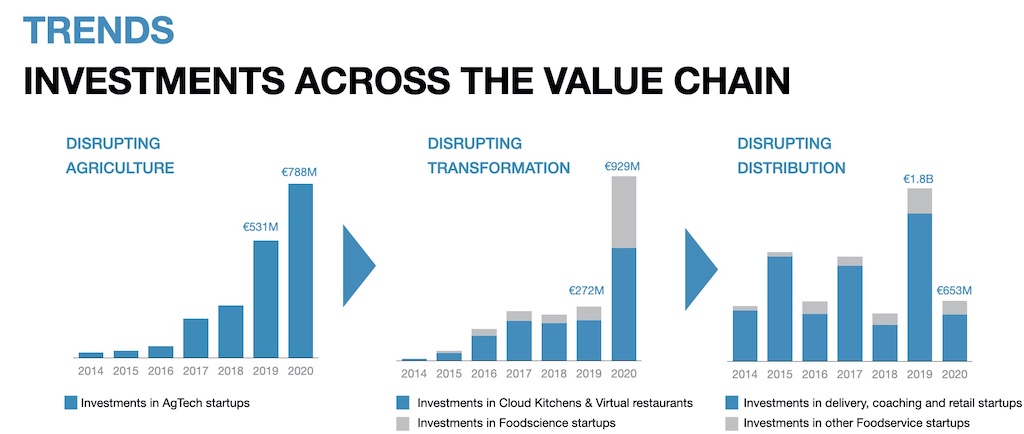

Describing the stable funding as a “feat in the midst of a pandemic”, the report finds that much of the investment was propped up by a “big acceleration” into alternative protein startups, representing a move away from disruption into agriculture and distribution.

According to the report, capital flowing into the cell-based and plant-based alternative protein startups rose by 178%, with a number of high-profile companies elevated to unicorn status, such as Swedish oat milk giant Oatly.

Foodservice technologies such as cloud kitchens and virtual restaurants also made significant inroads over 2020, notably with British startup Karma Kitchen bagging the biggest European food tech investment round of €290 million (US$317 million) in its Series A in July.

2020 has been a tipping point; with more than a doubling of investments made in transformation, both for the creation of new foods (foodscience) and for new foodservice experiences.

DigitalFoodLab

Large food corporations have particularly eyed this category to pivot to the pandemic, with the likes of Nestlé taking a majority stake in Mindful Chef, the meal kit startup that has since partnered with fellow food tech Better Nature to expand its plant-based protein recipe kit offerings.

“2020 has been a tipping point; with more than a doubling of investments made in transformation, both for the creation of new foods (foodscience) and for new foodservice experiences,” wrote the authors.

Two big changes: less investments in restaurant delivery and more in grocery delivery, much more investment in alternative protein startups.

DigitalFoodLab

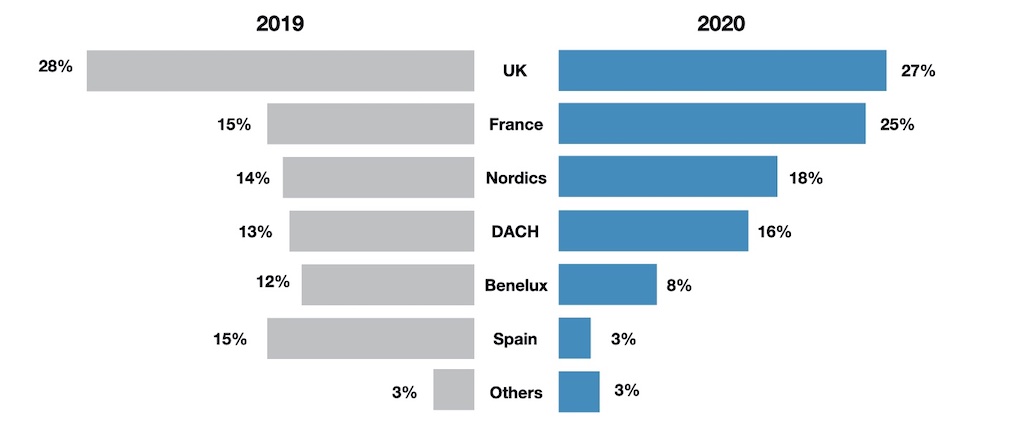

European food tech investments were primarily concentrated within five key “hubs” in the region, namely the U.K., France, the Nordics, the DACH region comprising Germany, Austria and Switzerland, and the Benelux, which includes the Netherlands, Belgium and Luxembourg.

Overall, the report noted that the primary two stories for the food tech landscape in Europe – alternative proteins and online retail.

“Two big changes: less investments in restaurant delivery and more in grocery delivery, much more investment in alternative protein startups,” it summarised.

Looking ahead, the analysts believe that the outlook for the European food tech industry remains strongly positive, especially as investors continue to bank on startups to bring in much-needed disruptive technologies amid concerns about global health, food safety, security and supply chain resilience.

“The first indications about 2021 are very positive and we can expect a record year due to multiple “super deals” of more than €100M in Europe,” the authors wrote.

The first indications about 2021 are very positive and we can expect a record year due to multiple “super deals” of more than €100M in Europe.

DigitalFoodLab

Similarly bullish predictions about the food tech space have been made in a recent Swiss VC Blue Horizon commissioned report, which projects that alternative proteins could be capturing as much as 22% of the global protein market by 2035. Researchers said the protein transformation represented a “prime ESG opportunity” for investors to “make their moves early”.

Alternative proteins startups also saw record-breaking funding growth globally, with recent GFI data showing the industry bridging in US$3.1 billion in 2020, triple the number in 2019. Notably, the investment growth was driven by a major surge in Asia-Pacific, with the amount of capital raised in the region rising six-fold year-on-year.

Lead image courtesy of Vivera.