6 Mins Read

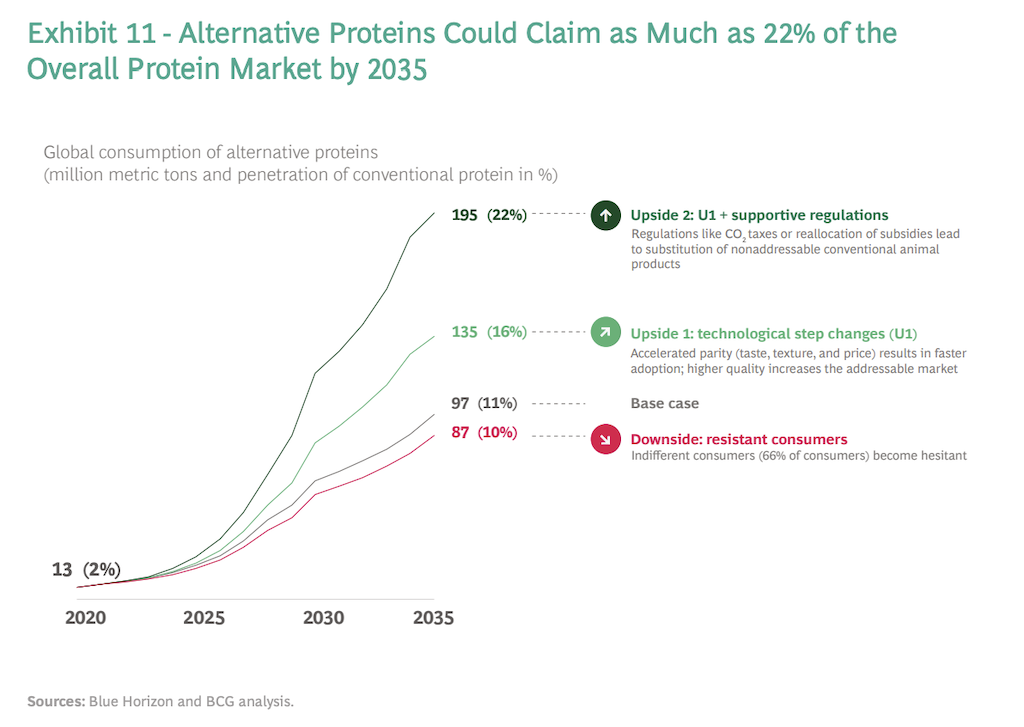

With advancements in technological innovation and full regulatory support, alternative proteins could take up as much as 22% of the entire global protein market by 2035, a new report reveals. While this “best-case scenario” will require all three pillars in the sector – plant-based, cell-based and fermentation – to reach price parity, researchers’ conservative estimates still point to alternative proteins capturing over a tenth of the market at baseline, with Asia-Pacific dominating demand growth.

New research shows that at our current trajectory, 11% of all meat, eggs, dairy and seafood eaten globally will be made from alternative protein sources by 2035 – and this figure could jump to 22% with the right regulatory support and rapid innovation to accelerate the trend. The findings were published on Wednesday (March 24) in a first-of-its-kind study by Boston Consulting Group (BCG) commissioned by Zürich-based alternative protein industry investor Blue Horizon.

According to the analysis, the alternative protein market is set to top US$290 billion by the mid-2030s, driven by “unparalleled growth” in consumer demand. That’s the conservative baseline estimate. In terms of market production capacity, it marks a jump from the current 13 million metric tonnes to 97 million metric tonnes.

By 2035, consumers can also expect alternatives for a far wider international variety of tasty, economical dishes, from Japanese onigiri and yakitori to Latin American ceviche, European beef bourguignon and American-style barbecue briskets.

Researchers cite “faster technological innovation and full regulatory support” as the key to speeding up this growth even more, which would push the market share of alternative proteins to 22% – a rate that the report says would mean Europe and North America would reach the level of “peak meat” by 2025. After that, the consumption of animal proteins declines.

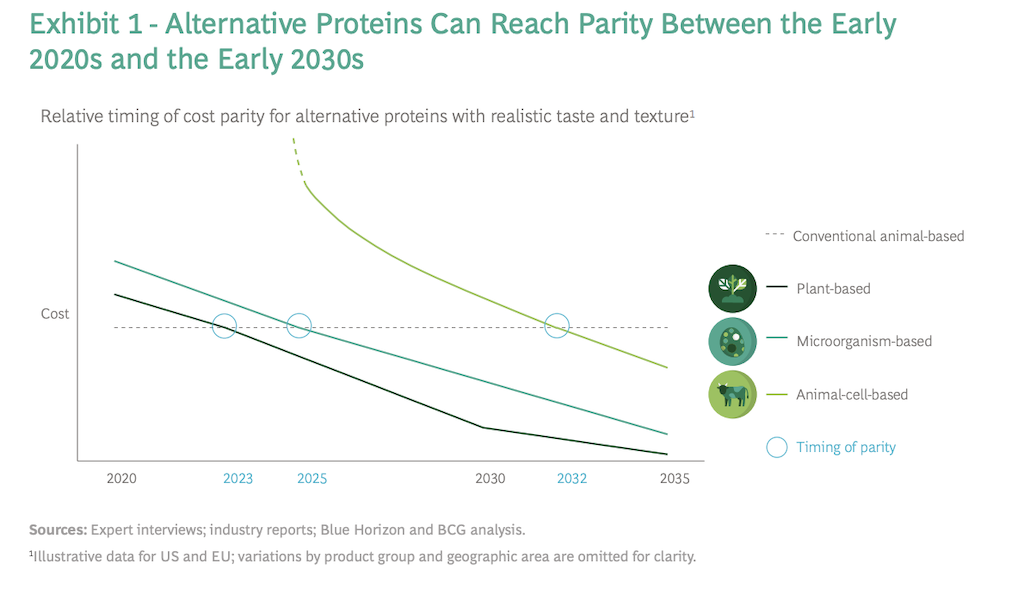

Alternative proteins must taste and feel as good as the conventional foods they replace and cost either the same or less.

“Food for Thought: The Protein Transformation” (2021, BCG-BHC)

What will be critical to drive the faster adoption of alternative proteins is price parity, the report emphasises, in addition to rivalling the taste and experience of real animal meat.

“Alternative proteins must taste and feel as good as the conventional foods they replace and cost either the same or less,” said the authors, who predict that cost-competitiveness will come in different stages for the various segments of the industry.

While plant-based alternatives are at the forefront of the race and are set to reach price parity within two years – if not sooner – fungi, yeast and algae proteins that make up the fermentation-based space are in the running for price party by 2025.

We expect parity to spur a new wave of growth, catapulting what is a fairly nascent market today into the mainstream, yielding significant environmental benefits, and facilitating even faster growth.

Benjamin Morach, Managing Director & Partner, BCG

Meanwhile, cell-based alternatives will be the same price as conventional meat by 2032, closely matching the estimates made in a recent Good Food Institute (GFI) cultivated meat report that sets the timeline for 2030.

“Alternative proteins could soon match animal protein in taste, texture, and price. We expect parity to spur a new wave of growth, catapulting what is a fairly nascent market today into the mainstream, yielding significant environmental benefits, and facilitating even faster growth,” commented Benjamin Morach, managing director and partner at BCG.

The largest opportunity lies in Asia-Pacific…driven by a large and growing population that is consuming more proteins as it becomes wealthier.

“Food for Thought: The Protein Transformation” (2021, BCG-BHC)

Crucially, the projected rate of alternative protein growth will mean huge environmental savings. According to the report, the estimated shift to plant-based meat and eggs alone is set to eliminate more than one gigaton of carbon dioxide by 2035 – enough to match the annual carbon footprint of Japan – as well as 39 billion cubic metres of water.

The BCG-Blue Horizon study also provides insights into which regions will drive the alternative protein trend, highlighting the Asia-Pacific as the “largest opportunity” in the future, despite North America and Europe currently dominating the industry as the most “mature markets”.

“The largest opportunity lies in Asia-Pacific, however,” wrote the authors. “Growth in that region is being driven by a large and growing population that is consuming more proteins as it becomes wealthier; the market will account for two-thirds of global consumption by 2035.”

In order to get to double digit protein market share, Asian markets will have to migrate to ‘alt protein 2.0’ products. This already started with regional startups like OmniFoods, Next Gen Foods, Shiok Meats.

Michal Klar, Founder, Future Food Now

Speaking to Green Queen Media, Asia-focused alternative protein investor and Future Food Now founder Michal Klar said it is “great to see the report is calling Asia-Pacific as the largest and the fastest growing alternative protein market,” but noted that the “numbers seem to include first generation ‘mock meat’, which does not have mainstream appeal.”

“In order to get to double digit protein market share, Asian markets will have to migrate to ‘alt protein 2.0’ products. This already started with regional startups like OmniFoods, Next Gen Foods, Shiok Meats and many others,” Klar continued. “I am confident Asia-Pacific entrepreneurs and innovators will make it happen.”

There is a real opportunity here for investors to make their moves early and become integral players in the future of food.

Björn Witte, Managing Partner & CEO, Blue Horizon

For investors, the protein transformation marks a “prime ESG opportunity,” notes the report, citing the enormous capital inflows into the industry helping to fuel companies’ scale-up, ongoing R&D and technological innovation.

“The alternative protein arena is wide open, and progress is happening fast. There is a real opportunity here for investors to make their moves early and become integral players in the future of food,” said Björn Witte, managing partner and CEO at Blue Horizon.

Lead image courtesy of Tofurky.