3 Mins Read

Vestiaire Collective, the preloved fashion platform, has raised €178 million (US$209 million) in a fresh round with high-profile tech investors SoftBank and Al Gore co-founded Generation Investment Management. The new funds will help Vestiaire scale globally amid the resale fashion market boom.

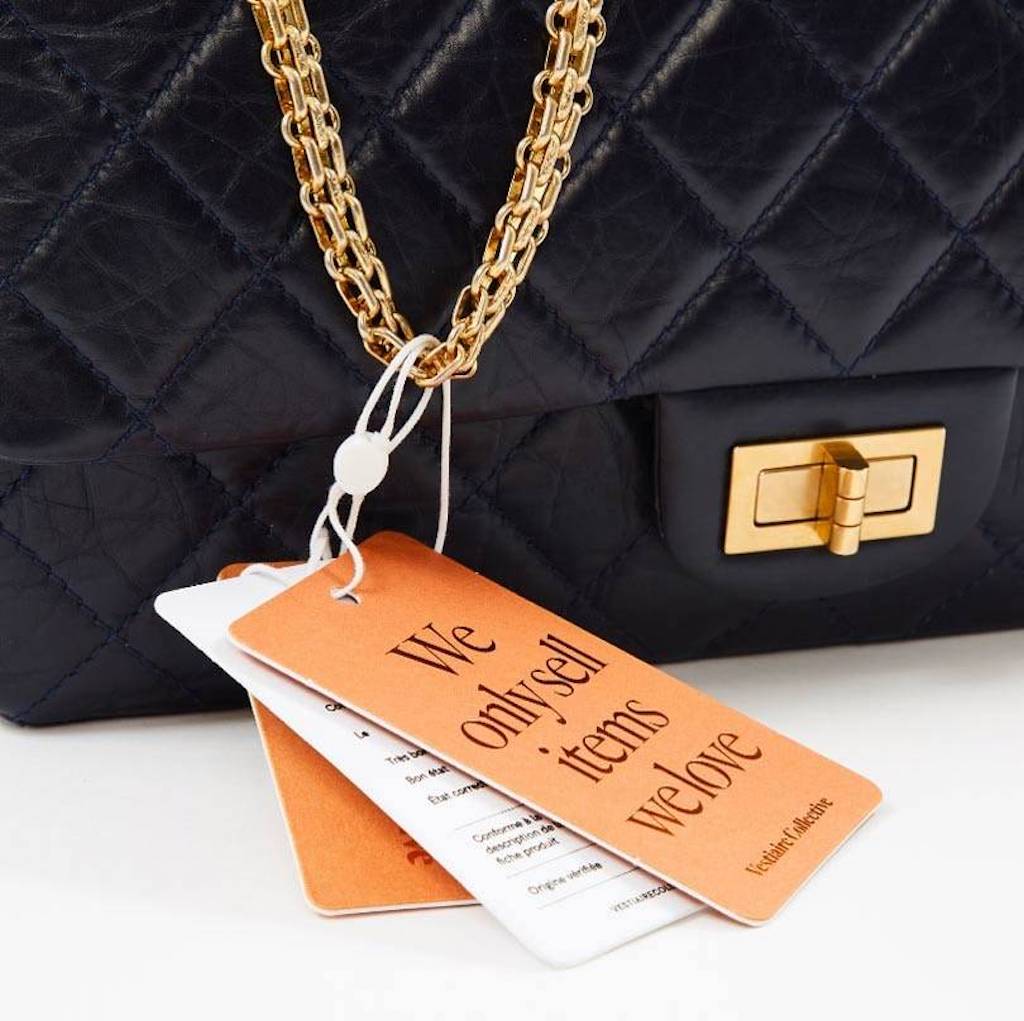

Secondhand fashion startup Vestiaire Collective has announced a new €178 million funding round. New investors included SoftBank’s private-equity arm Vision Fund 2 and Al Gore’s Generation Investment Management, alongside existing shareholders such as Bpifrance, Condé Nast and Eurazeo.

The latest capital brings the company’s valuation to around $1.7 billion. Vestiaire had raised the same amount back in March this year, in a round led by Kering and Tiger Global, which elevated it to unicorn status.

Accelerating global expansion

According to the Paris-headquartered platform, the fresh funds will enable it to speed up its global growth and capture more of the fast-growing resale market.

In a statement issued on Wednesday (September 22), the company said the “additional funding will provide considerable financial flexibility” and allow it to “further accelerate towards its long-term objectives in a highly attractive segment within the circular economy.”

The company added that the successful round solidifies its position as a leading global player in the secondhand fashion segment. “This is yet another testimony that all the attention is on us and our industry to further transform fashion for a better future. We can’t wait to tackle what’s ahead of us.”

With investors like SoftBank and Generation and their tech expertise on board, Vestiaire is likely to be able to bolster its software and scale its data innovation.

Vestiaire’s CEO Maximilian Bittner commented of both investors that “their respective experiences as preeminent global investors supporting high-growth business models will be highly valuable to us in our next phase of development.”

Resale boom

Vestiaire’s latest financing news comes as the resale fashion market continues its rapid growth. The Paris startup says orders on its platform have increased 90% globally, and in the US, the figure has picked up more than 100% year-on-year. Growth accelerated the most in Asia, where sales rose by 150%.

A report released by Vestiaire’s competitor platform ThredUp estimates that in the US alone, the secondhand market will reach $77 billion within the next five years, citing the conscious consumerism trend and pandemic-induced concern about sustainability as key drivers of the secondhand boom.

Other platforms that are leading the space alongside ThredUp and Vestiaire include Depop and Rebag, both of which have secured major funding rounds over the past two years as investment pours into the fast-growing space.

Commenting on its decision to back Vestiaire, SoftBank CEO Marcelo Claure said the startup is a “great consumer-tech company that we believe is transforming the timeless luxury fashion industry for the better.”

“Vestiaire operates at the intersection of multiple sector trends with growth in luxury retail, ongoing shift to online and a focus on sustainability. And it is doing so with a business model that is well-positioned to scale globally,” he added.

All images courtesy of Vestiaire Collective.