4 Mins Read

According to new data, year-on-year funding for alternative proteins across Asia Pacific has increased by 43% and shows strong growth across all sector verticals from cultivated to plant-based to fermentation.

Encouraging growth across the APAC alt protein sector

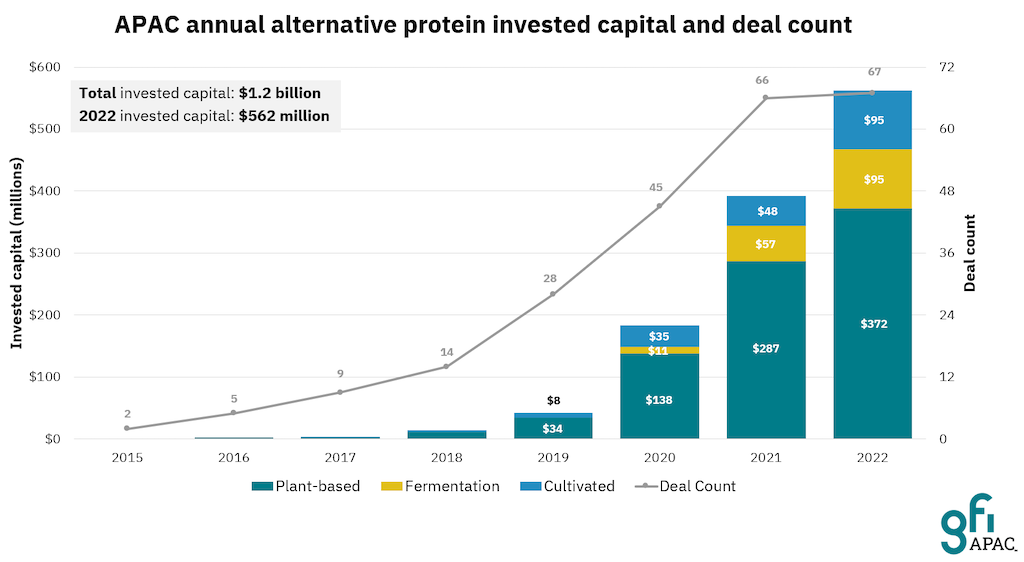

The Good Food Institute Asia Pacific (GFI APAC), a leading regional alternative protein non-profit think tank based in Singapore, has crunched the 2022 funding numbers from Pitchbook Data and has found that total investments into the alternative protein sector in the region went up by 43 percent, from $392 million to $562 million.

Plant-based food funding rose by 30 percent, from $287 million to $372 million, in large part due to Singaporean startup TiNDLE’s record-breaking Series A round. Precision fermentation and other fermentation investments went up by 67 percent, from $57 million to $95 million with Chinese company Changing Biotech coming out of stealth last August. Cultivated meat, dairy and seafood tech companies saw the biggest growth: 96 percent, from $48 million to $95 million, with Australia-based Vow breaking records with its Series A. One notable change is the classification of Singapore startup TurtleTree, which was considered cultivated in 2021 and is now being treated as a fermentation company.

On the deal count front, numbers are slightly up since 2021 for fermentation (from 9 to 14) and cultivated food (19 to 20), while plant-based saw a small dip (from 38 to 33). Overall, GFI APAC notes that the funding growth is “broad and deep, not isolated to a single country or company.”

According to Mirte Gosker, GFI APAC managing director, “building a more secure, sustainable, and just food system is not merely a choice in Asia—it’s a necessity. Conventional animal agriculture is ill-equipped to handle the escalating pressures of skyrocketing protein demand, increased climate disruption, land and water scarcity, and threats of viral outbreaks.”

China and Singapore are alt protein funding hotspots

GFI APAC highlights two countries in particular where funding growth is strongest: Singapore and China.

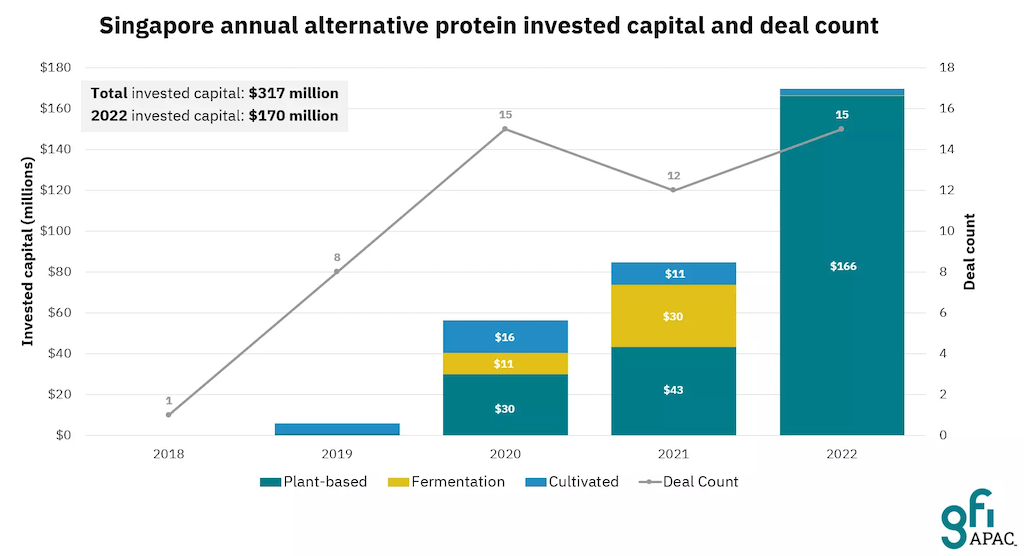

Singapore, which the report calls out as “the only country on Earth where products from all three pillars of alternative proteins are approved for commercial sale”, saw total investments in alternative protein double, from $85 million in 2021 to $170 million in 2022.

2022 was a big year for alternative proteins in China too. In January, cultivated meat was included in the Ministry of Agriculture and Rural Affairs five-year agricultural plan for the first time, and President Xi Jinping referred to alternative proteins as key for national food security in a March speech. Perhaps as a result of this, alt protein investments showcased significant growth, funding between 2021 and 2022 rose 6x, from $24 million to $152 million.

GFI APAC underscores the link between public government support towards future food technologies and funding in the space.

According to Matthew Spence, managing director and global head of venture capital banking at Barclays, “Deep institutional investments from sovereign wealth funds, pension funds, and creative capital sources are key to propelling the global alternative protein sector forward and sustaining a building boom big enough to meet this moment.”

APAC funding is outpacing the global industry

Globally, venture funding is down across all sectors and food is no different. Rising inflation, supply chain disruptions, an energy crunch, and the Russia-Ukraine war have affected the food sector, both regionally and across the globe. Raw material and ingredients prices are up, as are the costs of production, transportation and distribution.

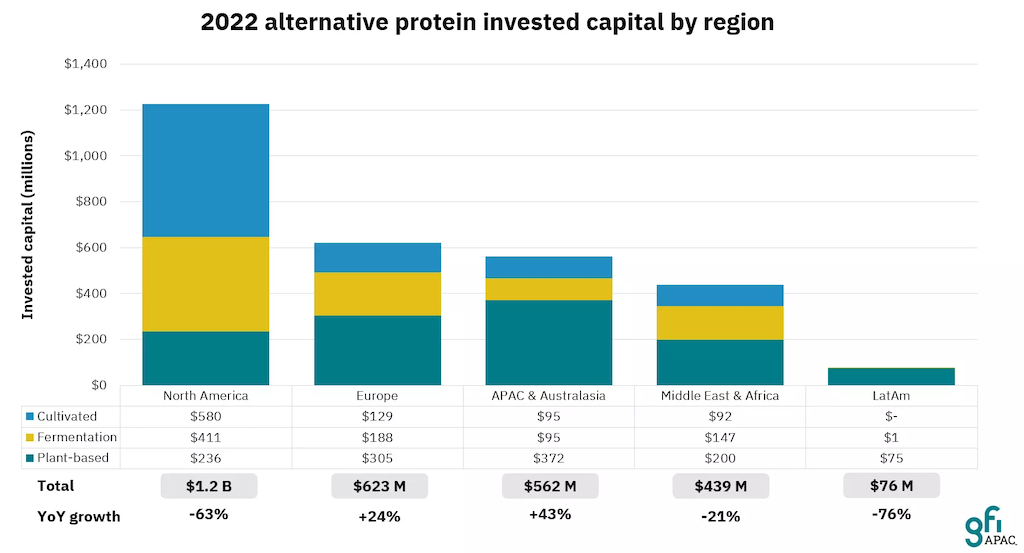

Investors are understandably cautious and increasingly conservative, and much of the food tech funding froth of 2020 and 2021 has dissipated in terms of deal count, deal size and valuations. According to GFI APAC, worldwide alternative protein investments are down 76%, from $5.1 billion in 2021 to $2.9 billion in 2022.

Notwithstanding all this, GFI APAC says investors see the bigger picture, citing a survey showing that 99 percent of participants are optimistic about the long-term potential of the alternative protein industry with 87 percent planning to make investments in the sector in 2023.

The data also shows that APAC is growing in importance comparatively. 2022 marked the first time that alternative protein investments from outside North America accounted for the majority share of the global total with Asia exhibiting the most growth at 43 percent, compared to 24 percent for Europe and a 63 percent decrease in North America.

As I wrote about Green Queen‘s APAC Alternative Protein Industry Report 2022, regional startups “have been going from strength to strength, hitting major milestones, attracting significant government support and raising record funding rounds.” I further called out the need for diversity and broader representation in media. “Our report illustrates the importance of reporting and media representation. Western-centric media would have you believe that alternative protein is an industry in trouble. In reality, the sector is headed for boom times in Asia and beyond.”

As Gosker says, “with the global economic downturn starting to make deals more affordable, there is a huge opportunity for forward-thinking investors to reap rewards as Asia’s food future evolves.”