Cell-Cultured Bratwurst: Clever Carnivore Raises $7M to Scale Up Production of ‘Low-Cost’ Cultivated Pork

6 Mins Read

Chicago-based food tech startup Clever Carnivore has raised $7M in an oversubscribed seed funding round to expand operations and commercialise its cultivated meat products, starting with a pork bratwurst.

Clever Carnivore has secured $7M in seed financing for its cultivated pork, adding to a $2.1M pre-seed round last year to take total investment to $9.1M. The latest round was led by Lever VC, with other participants including McWin Capital Partners (Spain), Thia Ventures (Belgium and Switzerland), Valo Ventures (Palo Alto, California), Newfund Capital (France), and Stray Dog Capital (Kansas).

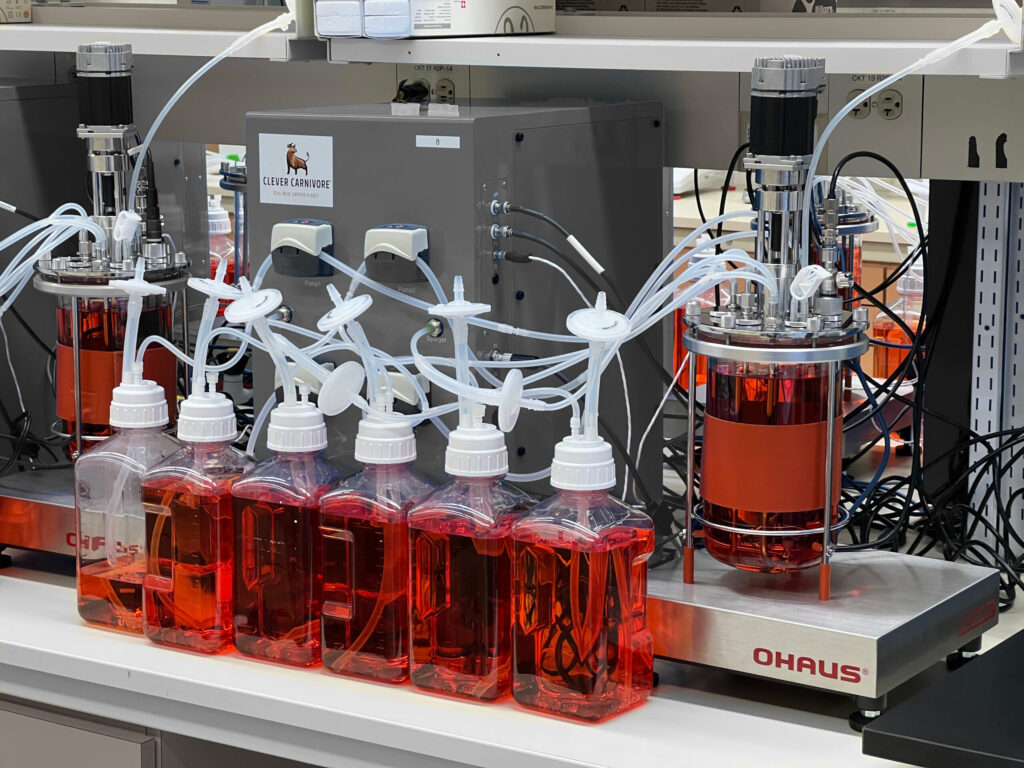

In addition to the round announcement, the company says it will relocate to a larger facility to scale up the manufacturing of meat it claims is much cheaper than any other cultured meat producer globally.

“We are delighted with the enthusiastic support from our investors in this seed round,” said Virginia Rangos, co-founder and CEO of Clever Carnivore. “This funding is a testament to the hard work and dedication of our entire team and reaffirms the confidence that investors have in our cutting-edge science, technology and business model. With this investment, we are well positioned to revolutionise the protein market and enhance the overall consumer experience.”

Founded in 2022, Clever Carnivore uses what it calls a “high-efficiency” biotech model to create “cost-competitive” cultivated pork sausages, burgers and chicken nuggets. Currently, it’s focusing on the former, with a Clever Bratwurst prototype set to be unveiled early next year.

A cost-competitive cultivated sausage

“Clever Carnivore’s approach blends breakthrough science and a demonstrated cost advantage in the cultivated meat sector,” said Pierre-Jean Cobut, entrepreneur in residence at Newfund Capital.

Lever VC managing partner Nick Cooney added. “We’ve been tracking and investing across the global cultivated meat sector since the first such company launched eight years ago, and we haven’t seen anyone come remotely close to Clever Carnivore’s astoundingly low current cost of production, a testament to the company’s phenomenal science.”

Clever Carnivore’s R&D is headed by co-founder Paul Burridge, who has over 20 years of research experience in cell line development and growth media optimisation. The company has been able to optimise its growth media to support its unique cell lines, achieving a significant reduction in cell culture media costs – “one to two orders of magnitude lower than any other cultivated meat company globally”.

“Paul’s experience with cell line development and low-cost media, coupled with Clever Carnivore’s cells’ superior growth performance in animal component-free media, places Clever Carnivore in a unique position to rapidly iterate and evolve their production processes and product formulation in a cost- and time-efficient manner,” said Subodh Gupta, partner at Valo Ventures.

Speaking to the Chicago Business Journal last year, Rangos explained: “We have what amounts to – at this point – a $10 burger, and as we continue to scale, we’ll bring that cost down considerably. We’re hoping to eventually get — and we think this is quite practical — to a $1 burger, essentially.”

This is crucial, given that cultivated meat needs to reach production costs of $2.92 per pound to be price-competitive with traditional meat, according to Reuters. And while players in this space have been able to cut production costs by 99% in less than a decade, analysis by McKinsey has found that it will still take until 2030 for it to reach price parity with animal-derived meat.

This is a challenge Clever Carnivore’s investors believe it is primed to overcome. “What was missing up to now was the technology to make products that will provide the same taste and nutrition as meat from farmed animals, and at a truly competitive price,” said Thia Ventures managing partner Bart Van Hooland. “Clever Carnivore has what it takes to bridge that gap, and they move very fast.”

Chicago’s growing importance as alt-protein hub

The producer, which unveiled a 4,200 sq ft square-foot facility at Chicago’s Lincoln Park, will use the new funds to relocate to a larger plant by the end of the year. This will allow it to scale up production of its “low-cost, top-quality” meat with 500-litre bioreactors and add in test kitchens, with the company saying its growth has “already surpassed the capacity” of its inaugural lab.

Chicago – historically a meatpacking capital in the US – has recently seen a flurry of alt-protein activity to make the city a pioneer for protein diversification. This is a trend being seen across the state of Illinois, where the iFAB Tech Hub, which works on precision fermentation crops like soy and corn, was named one of 31 new Regional Innovation and Technology Hubs by the Biden-Harris administration. Most notably, the Greater Chicago area is home to the new 187,000 sq ft large-scale manufacturing facility being built by cultivated meat pioneer Upside Foods.

Upside had chosen to locate its factory here due to the region’s legacy in meat production, a shared commitment to innovation and sustainability, strategic geographical advantages (it’s situated at a major transportation crossroads), and its talented workforce. “This new facility is a significant investment in our communities – creating new good-paying jobs while advancing our ambitious clean energy goals to create a more sustainable future,” Illinois governor JB Pritzker said about Upside’s under-construction plant.

Upside is also one of only two companies (alongside Eat Just) to have received regulatory approval from the USDA for the sale of cultivated meat. This is a path all cultured meat producers will need to take, including Clever Carnivore. Rangos, who herself is a vegetarian, hopes the company can be part of the solution to the food system’s biggest challenges.

“It sounds funny on the face of it, but it makes all the sense in the world because there are a lot of problems with the current factory farming industry, one being [the] use of resources, and two the ethical treatment of animals,” she told the Chicago Business Journal. “I think there are a lot of vegetarians who would be interested in solving some of these problems.”

The cultivated meat sector is a burgeoning market with over 156 companies globally and investment of $2.9B since 2014, according to alt-protein think tank the Good Food Institute. The category raised nearly $900M in 2022 but has faced a slowdown thanks to the global decline in food tech funding. But it has been boosted by the recent regulatory approvals in the US, which followed Eat Just’s maiden clearance in Singapore back in 2020.

A number of companies are working on cultivated pork – most pertinently, Singapore-based Meatable, which has filed for approval in Singapore to do the same in the US, in preparation for the launch of its hybrid (part-cultivated, part-plant-based) pork sausage in 2024. Other players include Czech startup Mewery, UK-based Uncommon and Ivy Farm Technologies, China’s Joes Future Food Tech and CellX, and Australian producer Magic Valley, among others.