Climate Tech Funding Drops 30% in 2023, Despite Overall Positive Post-Covid Trend

6 Mins Read

2023 turned out to be a shaky year for investment into the climate tech space, though overall funding has remained on an uptrend since 2020.

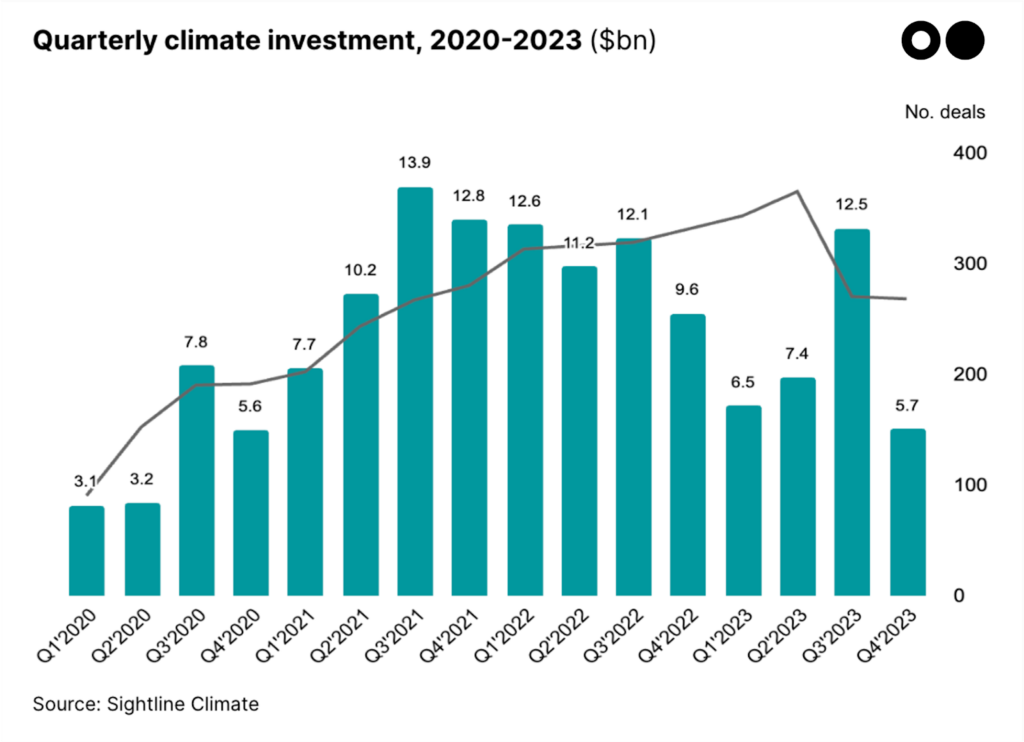

A new report summarising the key investment trends in the climate tech industry has revealed a 30% year-on-year drop in funding in 2023. Overall, climate tech venture and growth investment reached just $32 billion, marking the first annual decline in the post-pandemic era.

Describing the market as having “hit pause” in the last year, analysts say the sector has now evolved into one “more focused on large-scale deployments that approach being bankable and boring”. The annual report was published by market intelligence firm Slightline Climate (CTVC), based on data from venture capital and growth equity deals publicly announced throughout 2023.

Slower growth in 2023, transport leads the way with 6 of 10 biggest deals of the year

Despite a notable peak in financing in the third quarter of the year, which reeled in $12.5 billion, funding in 2023 was in a notable decline compared to the previous years since 2020. Deal counts also decreased for the first time since 2020, with figures down 3% year-on-year.

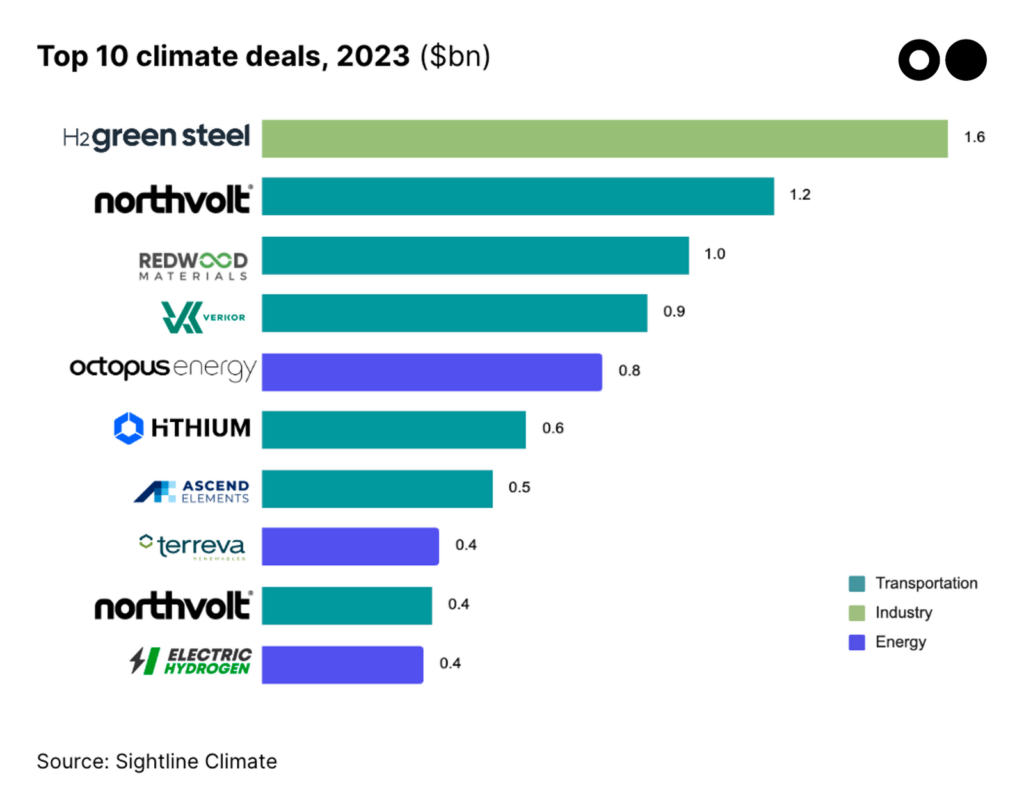

The uptick in Q3 results is consistent with prior quarterly funding trends, but last year’s was mainly a result of mega-rounds such as the H2 Green Steel and Ascend Elements deals. Described as the “mega investment drivers”, the 10 largest deals across 2023 made up nearly a quarter (24%) of total annual climate investment.

These mega-rounds were dominated by the transport sector, bagging 6 of the top 10 deals. Batteries, a subfield of the industry, led the pack, with Northvolt raising $1.6 billion in two funding rounds to scale up battery production in Europe while US battery facility Redwood Materials secured $1 billion.

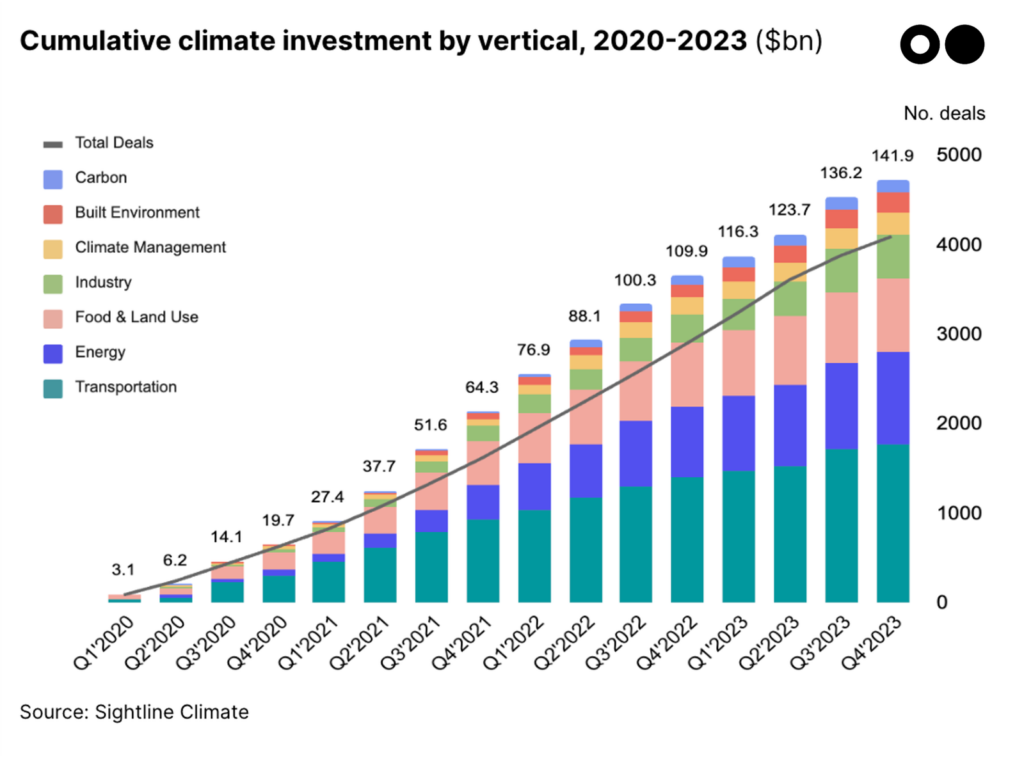

Along with the energy sector, transport and energy together bagged 60% of total investment since 2020.

Related: Can AI tech fight climate change without a mega emissions footprint?

Smaller deals, fewer rounds

Zooming in, the overall 30% drop in funding into climate tech was the result of fewer rounds and smaller sizes in the deals that did happen.

In 2023, the average deal size declined by 28% compared to the year before, while deal count fell by a smaller margin of 3%. There were fewer numbers of seed and series A rounds, down 12% and 11%, respectively. Even bigger drops were seen in later-stage deals, with series C and growth investment falling by 35% and 41%, respectively.

“Growth funding shrank as a share of overall funding, making up 39% of total funding in 2023, compared to its 50% share in earlier years,” the report states. “Many companies suffering valuation overhangs from previous earlier rounds are opting to extend runway and grow into their prior valuations rather than attempt to raise more large rounds.”

The primary reason for the sluggish numbers was rising interest rates and growing supply chain costs, which analysts believe made 2023 a difficult year for firms to kickstart production. In some cases, project cancellations occurred, further deterring investors from opening up their wallets in late-stage rounds.

Climate tech funding ‘down, but not out’

Though the numbers suggest a bleak future, analysts maintained an overall balanced outlook, attributing the trends to the broader economic landscape.

“In 2023, a challenging macro environment marked by higher interest rates and a cautious private investment market raised the hurdles for deployment,” the Sightline Climate report authors shared. “Now looking forward, interest rates are expected to come down, rules around policy incentives and regulation are emerging, and international competition has become a driving force for climate tech.”

If we look at the current figures against 2020 numbers, most verticals are still green, a sign of encouraging growth overall. Since 2020, around 2,600 climate tech firms have raised over $142 billion of venture funding across 4,156 deals.

Food and land use was the only sector where investment was lower in 2023 compared to three years ago. At the current rate, analysts believe that food and land use investment will be outstripped by industry in 1-2 years unless the space sees a major change of headwinds in favour of climate-friendly solutions for nature restoration and livestock.

Related: What will shape the Future of Food in 2024?

Climate activity is still up: 36% increase in 2023

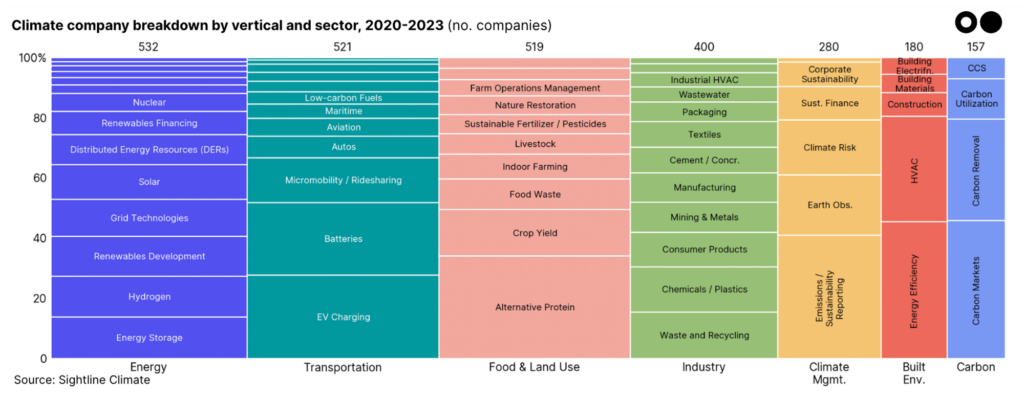

Another area of light is total activity rates, which jumped 36% from 1,910 active climate tech startups in 2022 to 2,589 by December 2023.

“So while total investment is down, activity in the climate ecosystem is way up,” says the report, which detailed the energy sector as one which saw the most movement.

Interestingly, deal activity is indicative of global emissions, which is not the case when we look at the actual amounts invested. In other words, activity in each climate tech sector is aligned with global emissions, while funding numbers showed a mismatch, with transport relatively overfunded and energy and industry being underfunded.

For example, transport is responsible for 15% of total GHG emissions, but reigned in roughly 37% of private funding for the last 3 years. Energy and industry, on the other hand, were underfunded mainly due to the slower pace of innovation in industrial decarbonisation, though these imbalances are slowly evening out in 2023.

“In 2023 we witnessed a positive tick in the right direction, with increased investment in Industry and in non-renewable Energy sectors such as Hydrogen and Energy Storage.”

Corporates buy-in, fewer repeat investors

According to the report, the number of investors who deployed capital on 5+ deals in 2023 declined by 25% year-on-year. This trend was consistent across all verticals and was a continuation of the negative repeat investor figures recorded in the 2022 annual report.

In 2023, the number of general climate investors went down by 4% to just 833 unique investors, with the biggest drop in investor interest in the food and land use sector.

Meanwhile, big corporates made a splash in headlines, demonstrating their huge buying power and bagging most of the leaderboard spots in the most active climate acquirers of the year.

Oil giant Shell, for instance, bought out 7 climate tech firms since 2021, including Davion, Daystar Power and Inspire Clean Energy. Its rival BP also bought 5 companies since 2020, including Archaea Energy, Amply Power, and Open Energi.

“Acquisitions are seen as a way for corporates to transition their offerings for the new climate economy,” commented the report authors.

Other major acquisitions include Schneider Electric’s buy-out of 4 tech companies in the energy, transport and climate management space, as well as Nasdaq’s investment into Metrio Software, Puro.earth and OneReport, all climate software names.

Aside from acquisitions, corporates also poured capital into late-stage and growth rounds, with Aramco Ventures launching a $1.5 billion Sustainability Fund and names like Microsoft appearing among the largest mega-rounds of the year.