From Sustainable Proteins to Food is Medicine, 6 Trends Shaping the Future of Food in 2024

11 Mins Read

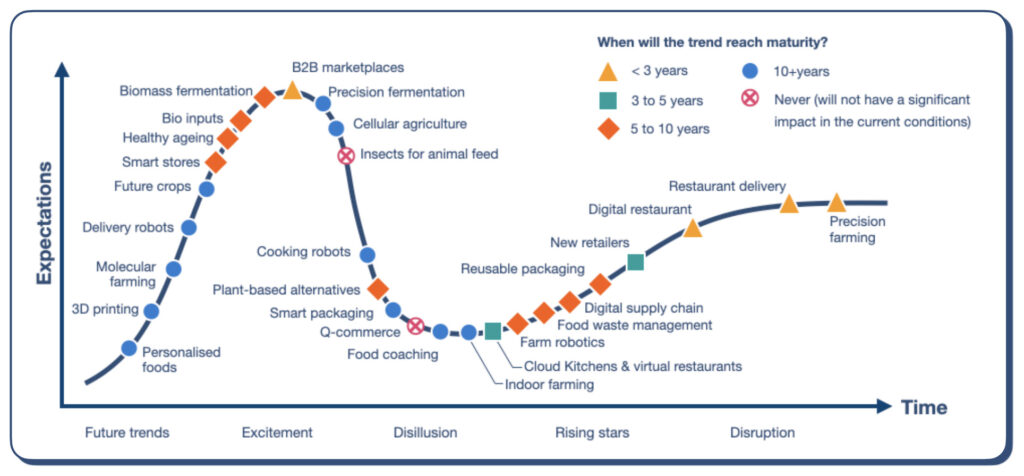

What does the future look like for food tech? French consultancy DigitalFoodLab has released its annual State of FoodTech Trends report for 2024, distilling 28 directions in six ‘mega-trends’, including sustainable proteins, food is medicine and automation.

Food tech is the future of food. That’s what DigitalFoodLab, a French strategy consultancy counting over 50 clients including the likes of Nestlé and Danone, wants you to know.

In the fourth edition of its annual State of FoodTech Trends report, the insights firm has identified 28 key things to look out for in food tech next year and beyond – divided into six broad categories – and outlines how long each will take to reach a point of maturity.

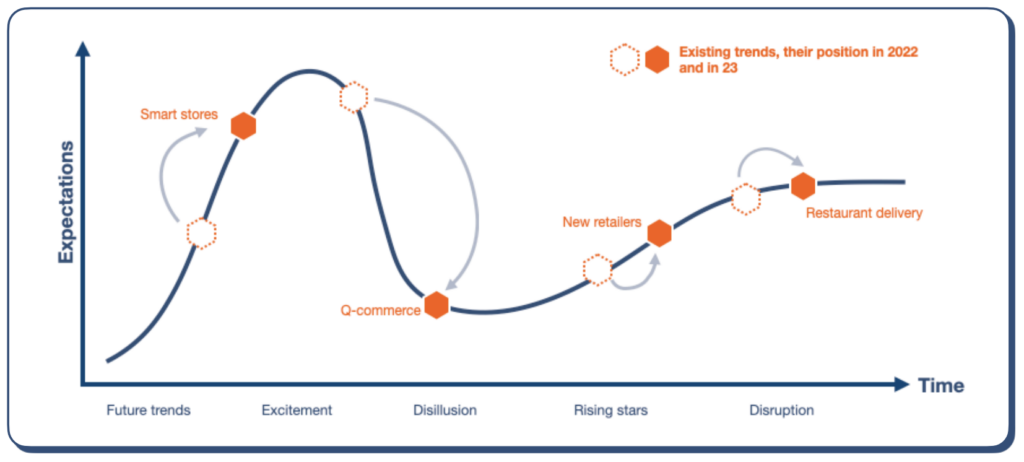

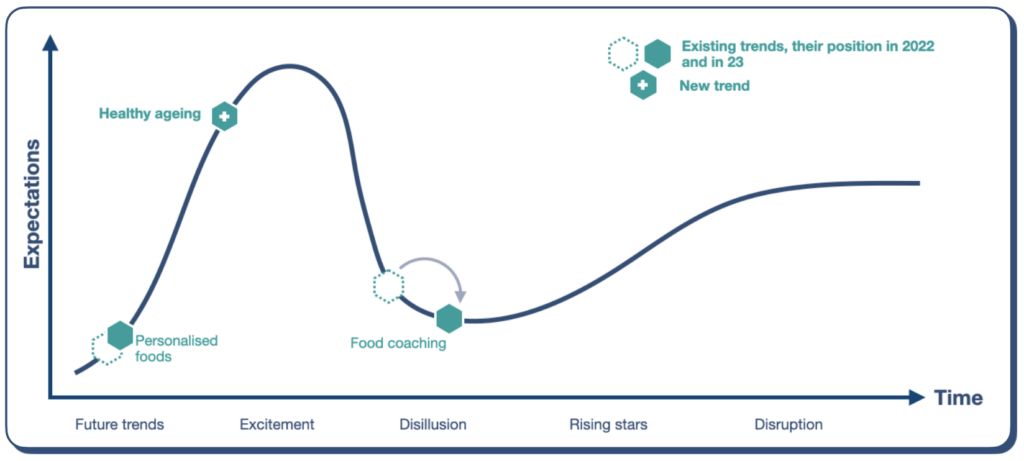

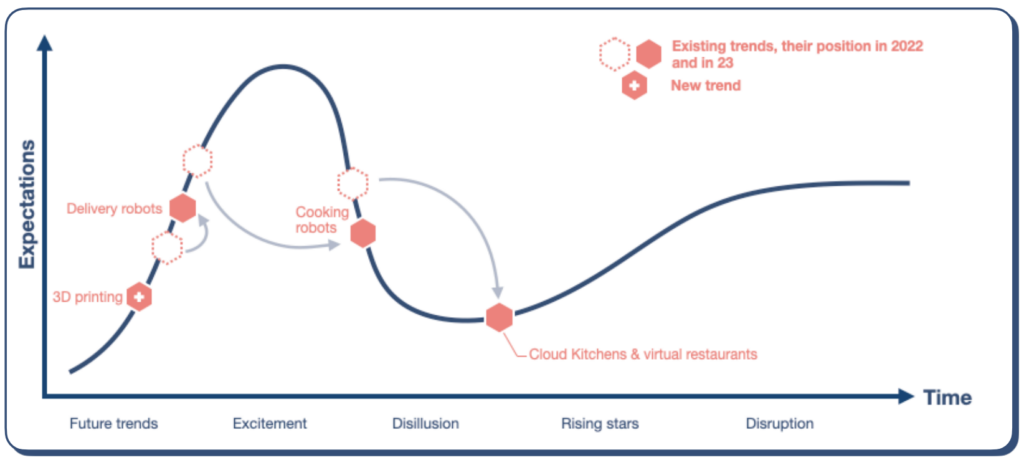

The report points out that 2024 will be an exciting yet complicated time for food tech, with an uncommonly large number of trends in the ‘disillusion’ phase, and many in the ‘excitement’ stage paving the way for disillusion. This has resulted in food trends being scattered all around a curve measuring expectations against time – tracking how a new tech becomes a trend, reaches a peak of excitement, which fades into disillusionment before its challenges are addressed, after which it becomes a disruptor seen by every observer.

Speaking to Green Queen, Digitalfoodlab co-founder Matthieu Vincent said he was most surprised at the extremes in many ecosystems, “we both super hyped up startups while at the same time, quite a lot of the companies in the space are in the disillusionment stage, which creates a strange situation where one part of the foodtech ecosystem is thriving while many startups are struggling to avoid bankruptcy.”

He added that he is most sceptical about the alternative protein trend because he has doubts about “the ability of many companies to sustain the hype.” While he is bullish on the space overall, “the problem is in the definition of ‘long-term’. We think most companies have overpromised on their ability to reach mass production fast so a period of reckoning may be coming where we’ll see which startups have the technology and the financial means to deliver in time to satisfy investors.”

Vincent noted that the trends have geographical specificities too. “In the report, trends are mapped from a global perspective, but obviously their impact and the way they will reach different markets will be hugely different. Let’s take the healthy ageing trend – if we broaden the topic to ‘healthy ingredients, this trend is far more advanced in Asia where there are already many products on the market (and regulation that is pushing the space forward, for example in China.”

So what does DigitalFoodLab predict the future of food tech to be? Here are the six mega-trends shaping the industry in 2024.

Food tech trend #1: The resilient farm

Agtech is a critical component of the food tech ecosystem. “Multiple trends drive us toward a more sustainable and resilient farm: the growing appetite for locally grown foods, fewer farmers and workers, energy costs, climate change concerns, notably regarding arable land, and the convergence of technology and farming,” the report states.

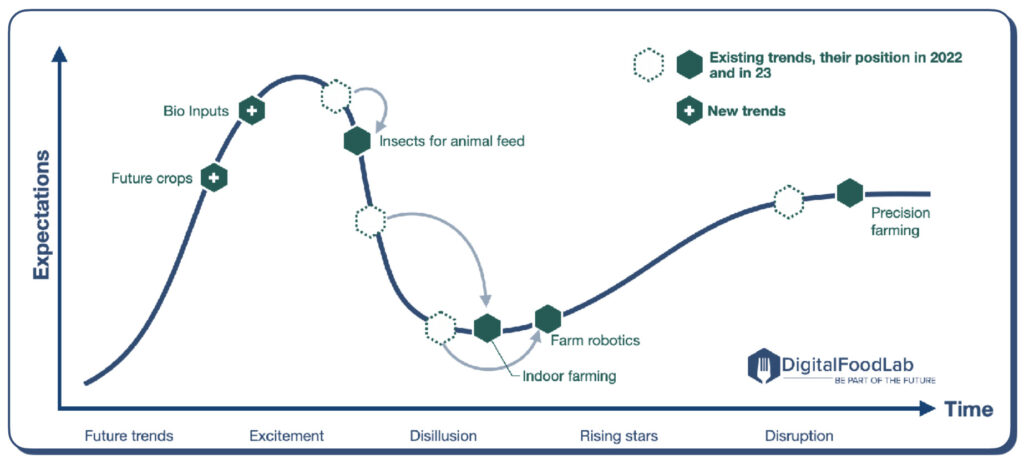

This trend is going in two directions: existing farms are being augmented as more intelligent and automated, and between urban, indoor and next-gen farms, the former is overtaking the latter in terms of hype, investments and acquisitions.

Precision farming is one of the six food trends representing the future of agriculture. A farm management concept based on data measurement and analysis, it’s a well-established ecosystem that seeks to “increase food production by improving in-farm decision-making, product traceability and quality”. While one of the oldest agtech ecosystems, it’s yet to mature, with universal access to software and tools a key challenge.

Farm robotics, meanwhile, are the first step towards autonomous agriculture, featuring AI and machine learning tech. Out of the disillusionment stage, its growth is linked to a reduced pool of skilled workers and sustainability (cutting the amount of required inputs). There’s also indoor and urban farming, which is facing a reckoning thanks in part to the energy crisis, but this ecosystem is expected to grow around business models spotlighting tech over farm operators.

In terms of insects for animal feed, there’s a growing disillusionment as industrial facilities are more complicated to run than previously thought, while a consolidation based on the type of insects startups choose is likely. One of the new trends this year (which hasn’t appeared in DigitalFoodLab’s previous reports) is bio inputs, a field where companies are developing a new generation of organic and more efficient fertilisers. It’s still in its infancy, but is being boosted by the energy crisis and rising costs of fertilisers.

The final trend (and another new one) for the resilient farm is future crops, which involve improving seed quality for disease resistance, increased yields, flowering control, nutritional enhancement and longer life post-harvest. Genetic hybridisation (crossing) and gene editing are two of the most common technologies used by startups here.

Food tech trend #2: Sustainable proteins

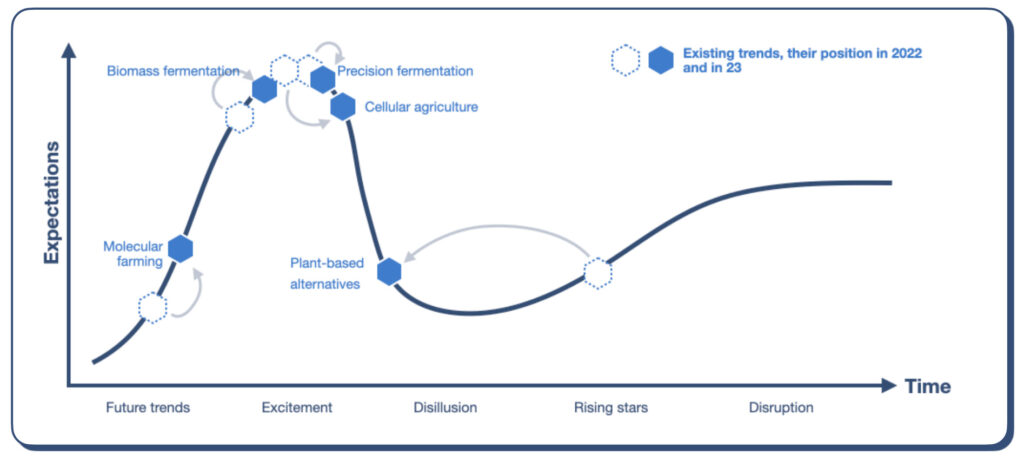

Alternative proteins have been on the rise for a while now, and for good reason. They’re much more environmentally friendly and present health benefits over animal-derived foods – and there’s the animal welfare aspect too. Even with the recent sales decline of plant-based meat, the category as a whole has been gaining traction.

There are five key directions part of the sustainable protein segment, with scale, costs, consumer acceptance and regulatory approval as the main hurdles to overcome, along with financing the industrialisation of these products. DigitalFoodLab proposes distributed production (bioreactors in the cloud, alluding to the cloud computing sector) as a potential solution.

The first trend here, of course, is plant-based protein. This trend has gone backwards from the ‘rising stars’ (overcoming disillusionment) stage to between the excitement and disillusionment phases. “We wrongly and collectively believed that plant-based products and alternative proteins, as a whole, were ready for mass adoption,” the report notes. Consumer concerns around health, taste and price are the key deterrents, but new facilities, cleaner labels and industry collaboration are markers of better things to come.

Next up is cellular agriculture – in this case, cultivated proteins – which is still in its infancy and at least three to five years away from being market-ready (apart from the very limited availability of cell-cultured meat in the US and Singapore). Mass adoption is much further away, and the key challenges (excluding regulatory approval) are lower costs, serum-free formulations, stable cell lines, better taste and texture, and scaling production. Large facilities are already underway, with several set to be operational by 2025.

Then there’s what’s known as the third pillar of alt-protein: fermentation. Precision fermentation – like cell cultivation – is hitting its peak in the excitement stage, with most companies focused on recreating dairy proteins by inserting the genetic code of the desired protein in a microorganism before fermentation. Regulatory and scale-up barriers (especially for casein) are key here, with price parity (and how to transition farmers effectively once that happens) also important.

Biomass fermentation, meanwhile, is also at this peak, with startups either using microbes that can produce proteins in an uncontrolled environment or using carbon dioxide as feed to create protein products. This faces similar challenges, notably regulatory clearance and flavourful products. Molecular farming – which involves genetically modifying plants to become bioreactors producing proteins – is highly promising and more scalable than precision fermentation or cell cultivation, but it’s still in an experimental stage, with the first large-scale demonstrations expected in the next two to three years.

Food tech trend #3: Instant retail

This trend encapsulates all innovations enabling consumers to access food quickly and efficiently from their screens, in one click, a concept that can be extended to anti-food-waste platforms, ethnic marketplaces, autonomous stores and restaurant delivery.

There are four trends here, all out of the hype phase. Smart stores, still approaching this stage, entail upstream concepts (warehouse automation), on-shelf tech (checkout-free stores) and complete automation. The adoption is very slow here, with large companies like Amazon leading the way, and the increasing need for more workers may speed this up.

Quick commerce – involving deliveries in usually less than 30 minutes from small warehouses – is facing loads of challenges, including zoning limitations and high labour costs. “If things move fast in FoodTech, nothing came close to the speed at which quick commerce startups went to the moon and are now crashing,” DigitalFoodLab noted, adding that disruption can still happen thanks to market consolidation and via delivery robots rather than the Q commerce we know today.

New retailers are reinventing grocery shopping from the ground up, considering online channels as their only focus. Some of the giants here offer identical products to incumbent retailers, but promise to do better, while smaller innovators are disrupting the market with subscriptions, reusable packaging, ‘ugly’ produce or damaged products.

The most mature trend in this category is restaurant delivery. Here, consultation is still underway, while regulations of driver status are no longer a priority outside Europe. These companies have also entered grocery delivery, demonstrating a viable profitability path, and they’re increasingly essential to foodservice.

Food tech trend #4: Food as medicine

Food as medicine has been evolving for some time now – we’ve written extensively about it too. This trend is the new avatar of DigitalFoodLab’s previous ‘food personalisation’ direction, with the convergence of health and food at the heart of things. Two of the key pillars – especially in the US – are produce prescription programmes and medically tailored meals.

These initiatives can have a “potentially massive impact”, but there are very few players. One of the sub-trends here is food coaching, “a move from services to devices”, encompassing health testing apps and diet and nutrition platforms. This is in the disillusionment stage at present, with more scientific rigour needed to reach a wider audience.

Healthy ageing includes ingredients that help us live longer. One aspect is adding new ingredients like genetically modified produce or breast-milk-derived innovations to existing foods, while the other category seeks to reduce long-term damage caused by processed foods. This segment – a new trend – is approaching the excitement phase.

One that’s far away is personalised food – supplements or meals customised for people based on test results, and evolutive micronutrition to print supplements for home or office use. Low adaptability is a key concern for the former, while high costs and unconvincing tech are currently discouraging consumers from the latter.

Food tech trend #5: Automation

The food automation sector is in limbo. “For many years, startups have used robotic arms and other complicated and costly technologies to replicate humans’ actions, but it is not working,” the report said. Now, the new goal is to scale down factories to the size of a restaurant instead of emulating chefs with robotic arms.

There are four trends at play here, with none at the hype stage. Cloud kitchens and virtual restaurants (“primarily a marketing expert that creates restaurant brands and menus”) are approaching the end of the disillusionment phase. Virtual restaurants are becoming more digital and offering their brands as a sales tool for restaurants, but the sector is compounded by influencer-owned brands. While the boom isn’t over, the report predicted that there will be a phase of rationalisation with concentration in the hands of a handful of players.

Moving from hype to disillusionment, cooking robots can include collaborative robots that replace employees for complex tasks, automated eateries, and automated kiosks and vending machines. DigitalFoodLab noted: “They don’t solve a real-world problem and are far from becoming profitable: what is the point of using a $25,000 robotic arm to serve coffee?” New solutions focus on less expensive robots (mechanical tools, really) and adapting them to humans.

Delivery robots became prominent after the pandemic, but were less successful than anticipated, with several down rounds, layoffs and shutdowns. It will take a bit of time to see robots and drones used in our daily lives at scale. 3D printing, on the other hand, is one futuristic tech finally finding its use. A new trend on the list, it’s allowing companies to display greater creativity and better define the texture or ingredients used in complex products like meat and seafood alternatives.

Food tech trend #6: The smart supply chain

The final category of food tech trends for 2024 relates to smart supply chains, driven by the fight against food waste as well as digitalisation to reduce labour costs and promote standardisation.

Digital restaurant services – facilitating booking, online order management, payment and HR management – represent the most mature trend here, with acquisitions in this space expected to continue as services become more integrated. Smart packaging is in its disillusionment stage, underlined by underinvestment despite technologies working to cut food waste, improve shelf life, and enhance safety. The real disruption may come from protective layers (which keep moisture and oxygen out) instead of the packaging itself.

Reusable packaging (a new trend separated from the smart packaging direction) involves startups managing reusable packs or developing a network of collectors combined with digital tags. Regulation is crucial here, with single-use plastic bans driving interest in these solutions.

Another new trend, food waste management techniques are being created across the supply chain – spanning foodservice, unsold food, on-shelf solutions and home appliances – with the focus being shifted from discounting to software solutions, and now expected to evolve towards retail procurement management, with food waste and merging with B2B marketplaces in mind.

These B2B marketplaces are the third new trend, with startups digitalising the supplier-store relationship through mobile apps and integrated messaging systems. There are multiple types of players here, and competition from prominent companies adds a degree of challenge. Finally, the digital supply chain is focusing on carbon counting and decarbonisation, with the main challenge involving data about livestock and agricultural production. Startups are also developing carbon credit trading platforms, while others help inform consumers about their carbon footprint through food.

It’s an extensive list with loads of innovations, potential and challenges – how will these food tech trends pan out over 2024? We’ll have to wait and watch (this space).