Cost of Living: Has the UK Media Narrative Around Plant-Based Affected Consumer Sentiment Over Prices?

8 Mins Read

Several mainstream UK outlets have run stories about the decline of the plant-based sector, ascribing it to dwindling demand and increased prices. Is the media narrative influencing consumer sentiment against vegan products and affecting sales?

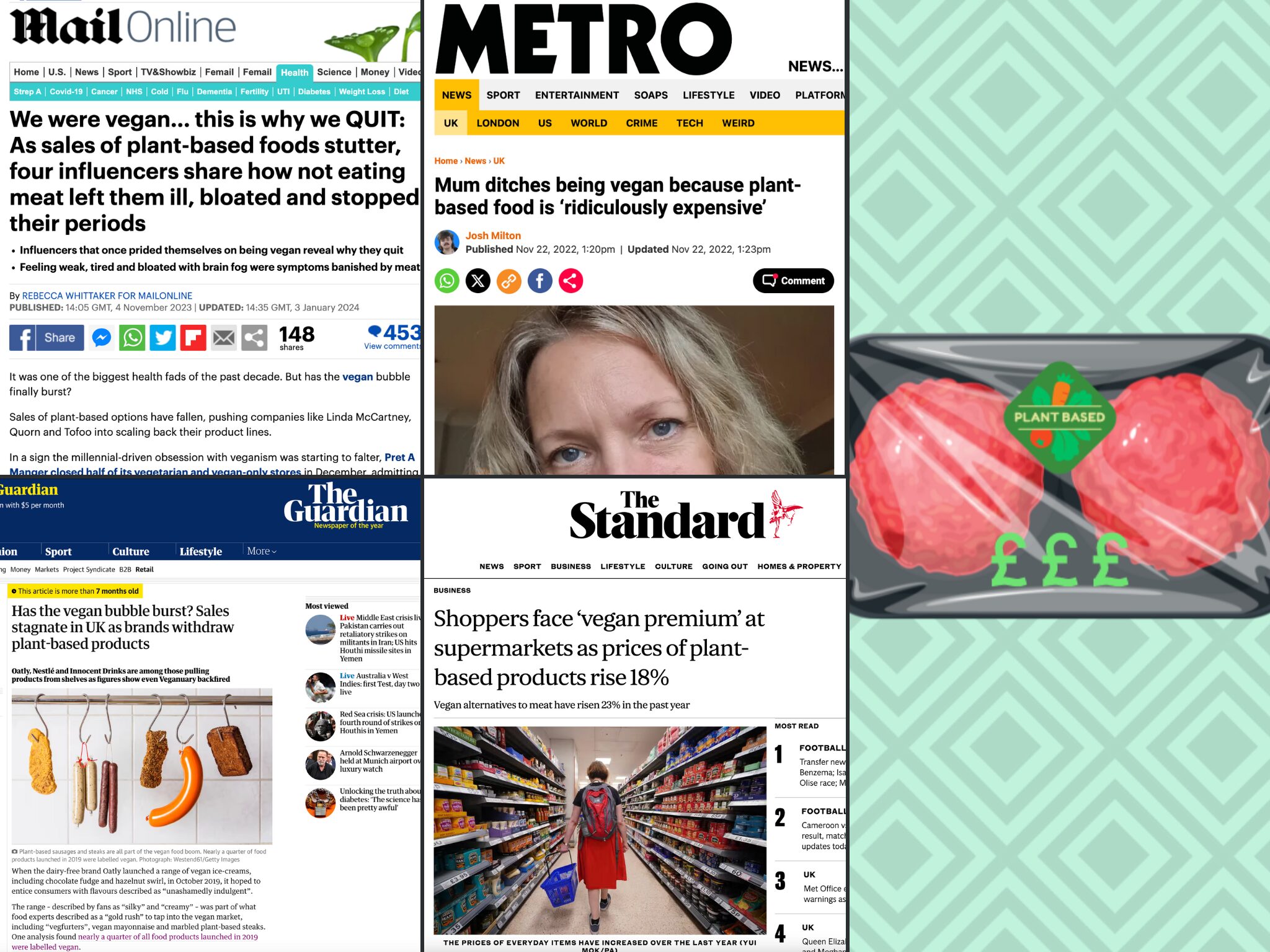

“Mum ditches being vegan because plant-based food is ‘ridiculously expensive’”

“Shoppers face ‘vegan premium’ at supermarkets as prices of plant-based products rise 18%.”

“Has the vegan bubble burst? Sales stagnate in UK as brands withdraw plant-based products”

“As sales of plant-based foods stutter, four influencers share how not eating meat left them ill, bloated and stopped their periods”

I could go on and on. These are headlines from four prominent British newspapers – Metro, the Evening Standard, the Guardian, and the Daily Mail – ranging from November 2022 to November 2023, all highlighting the sales decline of vegan products in the UK over the last couple of years, as a result of the cost-of-living crisis and resultant inflation.

It’s not untrue – plant-based meat alone has seen sales drop by £38.4m, with volume down by 4.2%. But it’s the way these headlines are presented that is problematic. It’s not just plant-based food that has faced a windfall. While fresh meat was among the fastest-growing grocery categories in the UK last year, with sales swelling by £352.5M, this was doubtless due to the hike in prices of meat too.

A spending calculator by Sky News, which takes into account figures from the UK’s Office for National Statistics, reveals that prices of beef mince are up 7%, bacon is 12.4% more expensive, and pork sausages cost 11.4% more compared to December 2022. It also shows that meat-free sausages are 3.4% cheaper.

Plus, the UK is consuming less meat and dairy than ever recorded, a trend attributed to inflationary pressures. But the sensationalised manner of reporting undertaken by many media outlets, including some of the aforementioned ones, begs the question: have consumers turned away from plant-based partly due to the narrative built around them?

A new 2,000-person survey by Opinium, on behalf of British-Irish law firm Browne Jacobson, has found that 39% of UK adults are discouraged from buying plant-based products due to the cost, with 54% finding them more expensive. We asked a few experts about this outlook, and how consumers really feel about the issue.

Are consumers worried about vegan food prices?

Opinium’s research was carried out to see whether consumer habits are being driven by the cost-of-living crisis, issuing a call to action for plant-based manufacturers to have strategies to expand market share and diversify product portfolios.

“There is a growing body of evidence showing that cost remains one of the main barriers preventing consumers switching to a plant-based diet, such as last year’s Smart Protein Project survey, which found that although more than half of European consumers are eating less meat, 38% found plant-based products too expensive,” says Helen Breewood, research and resource manager at the Good Food Institute Europe.

Chris Bryant, co-founder of London-based insights firm Bryant Research, calls this a “pretty positive” explanation of the plant-based slowdown. “Stakeholders on our side are looking to this narrative to explain some otherwise-concerning retail numbers for the category,” he reveals. A 1,000-person survey carried out by his agency last year suggested that price was the second-most common reason for the reduced intake of meat alternatives in the UK.

Matthew Glover, co-founder of the newly formed Vegan Food Group (formerly VFC) and the Veganuary campaign, agrees that there is some truth to the argument. “It’s clear from the data that consumers are increasingly buying on promotion, or choosing private-label options,” he notes, before adding: “But this is happening across most categories due to the cost-of-living crisis, so not necessarily just a plant-based issue.”

And that’s a point lost in the media narrative – as well as the Opinium research, which didn’t ask participants if they were quitting expensive foods to save on costs. “The rise in the cost of living affects consumers’ approach to many products – both food and non-food items, and both plant-based and meat products,” explains Peter Rixon, senior PR manager for ProVeg International. “However, statistics from the UK’s Department for the Environment, Food and Rural Affairs (Defra) issued late last year shows that the rise in the cost of living is specifically causing people to reduce their meat consumption.”

It’s not just plant-based prices – meat was hit harder

It makes for a more optimistic narrative, as Bryant puts it. “It is true that plant-based meat is more expensive than conventional meat,” he notes. “But food inflation has hit conventional meat much harder than plant-based meats, because animals require more agricultural resources.” This means that while inflation has hurt short-term alt-meat sales, it’s likely to benefit the category in the long term, as it has closed the price gap with conventional meat.

How about private label, then, as Glover mentions? “With UK data showing supermarket own-label sales grew twice as fast as branded goods last year, we’ve seen British supermarkets take the opportunity to help make plant-based food more affordable by launching a range of own-label products over the last few weeks,” says GFI Europe’s Breewood. “Retailers are increasingly seeing the value of this market, and we hope this trend will continue beyond Veganuary.”

ProVeg’s Rixon, meanwhile, offers the example of Lidl in Germany, where the discount retailer announced plans to align the prices of its vegan own-label Vemondo’s products with their animal-based counterparts. “We have welcomed this approach and are excited to learn that more retailers in Germany are following this example, such as Aldi Süd. We hope this picks up across Europe, including the UK,” he states.

The Opinium survey wasn’t without limitations – the questions didn’t differentiate between whole-food plant-based products and meat and dairy analogues, so it’s hard to gauge what consumers thought of when answering them.

“The Smart Protein survey also found that, in certain parts of Europe, a growing number of people are eating products such as legumes and quinoa as well as plant-based meat and dairy products,” explains Breewood. “However, the increasing popularity of plant-based analogues suggests they offer an easy switch away from conventional meat and dairy, particularly for consumers who value the convenience these products can offer.”

Are price hikes a result of the agenda-setting theory?

Within the muddled media landscape, Bryant offers an alternative perspective: “The idea is that the plant-based slowdown (which undeniably has happened to some extent in the last couple of years) is due to temporarily tough economic conditions, rather than a fundamental shift in consumer interest/attitude towards the category.”

Breewod believes the prices of vegan food are driven by the sector’s infancy, along with a lack of infrastructure dampening companies’ efforts to scale up, which would, in turn, help reach price parity with meat and dairy. “However, it is also possible that unhelpful and misleading narratives are causing some people to think twice before switching to plant-based foods,” she adds.

Asked if ProVeg believed media coverage has an influencing effect on plant-based price hikes, Rixon says the organisation “can not say whether, and to what extent” that is true. “The UK media narrative is mixed,” he offers. “With peer-reviewed journals regularly producing papers on both the health and environmental benefits of plant-based foods, we see corresponding reports in UK media that reflect those findings. There are also, of course, media reports that seek to promote meat and dairy products.”

Glover has a similar viewpoint. While unsure that the agenda-setting theory is at play here, he’s certain that the narrative has helped “dampen interest”. “The meat and dairy industries have got their act together over the past few years, and they’re winning the hearts and minds PR battle unfortunately,” the Veganuary founder explains.

“They have a 100-year start [and] deep pockets, and consumers want to believe that eating animal products is okay,” he adds. “Commercially, they have everything stacked in their favour with economies of scale, favourable subsidies, and retailers happy with lower margins for animal-based, compared to plant-based.”

How can vegan brands bounce back?

So, how can vegan companies fight back? “With hindsight, the plant-based sector should have invested in checkoff programs to counter the meat/dairy misinformation campaigns to try to level up the playing field,” notes Glover, who recently revealed that he is now working on such a programme.

According to Browne Jacobson senior associate and food and drink head Sam Sharp, consolidation is key. “There is potential for increased M&A activity in areas of the plant-based market that are showing resilience or growth, such as indulgent categories or products offered by discount retailers,” he says. “Companies might look to acquire or invest in brands that have successfully navigated the current economic climate or are aligned with consumer trends towards healthier and more sustainable options.

A recent report by Oghma Partners revealed that M&A activity in the wider food and beverage sector increased in 2023, despite inflationary pressures and VC uncertainty. Deal count was up from 74 in 2022 to 116 in 2023 – a 57% jump – while the estimated value climbed by 20% to reach £2.1B.

There have already been some major acquisitions this year, involving industry leaders like v2food (Australia), Next Level Burger and Nutpods (both US). But perhaps even more eye-catching is the deal involving Glover and co-founder Adam Lyons, who turned their vegan chicken startup into a holding company on the back of purchasing Meatless Farm and Clive’s Purely Plants. Now, the company plans to diversify and expand to reach £25M in sales for 2024 in its pursuit of becoming “a vegan Unilever”.

“We are already one of the most diversified players in the category with VFC, Meatless Farm and Clive’s under our umbrella, but it won’t stop there,” Glover said earlier this month. “We are actively reviewing strategic acquisitions to add to the group in 2024, building upon a successful 2023 trading year.”

It seems his company is heeding Browne Jacobson’s advice. Will it translate to more products, lower prices, and happier consumers?