Half of Europeans are Eating Less Meat – But Taste & Price Are the Biggest Factors Affecting Plant-Based Alternatives

9 Mins Read

A new 10-country survey has found that 51% of Europeans are eating less meat annually, with health being the biggest reason for the decrease in consumption. However, taste and price are the largest detractors of plant-based intake for these consumers, signalling the opportunity for brands in this space.

In 2021, a pan-European poll titled What Consumers Want – funded by the EU’s Smart Protein project – provided an in-depth look into consumers’ eating habits. At the time, 46% of respondents said they were reducing their meat intake, 30% called themselves flexitarians, 45% wanted more information about plant-based meat, taste (40%) and health (34%) were the biggest factors for choosing vegan food, and price (52%) the biggest deterrent.

Two years on, a follow-up survey of 7,500 consumers conducted by ProVeg International in partnership with Innova Market Insights, the University of Copenhagen, and Ghent University, has revealed how consumer attitudes around plant-based foods have evolved in Austria, Denmark, France, Germany, Italy, Netherlands, Poland, Romania, Spain and the UK.

Today, 51% of consumers say they’re cutting their annual meat consumption, but a higher number of consumers (7%) have also increased their yearly intake compared to 2021 (5%). Meanwhile, fewer Europeans (27%) identify as flexitarian, but only 25% want more information about vegan alternatives, indicating that awareness has increased, though there’s still some way to go.

Price remains the biggest barrier towards increased plant-based consumption, though the share of consumers citing this concern has reduced to 38%. And three in 10 say alternatives don’t match their conventional counterparts in terms of flavour.

Here are the key takeaways from the Smart Protein report:

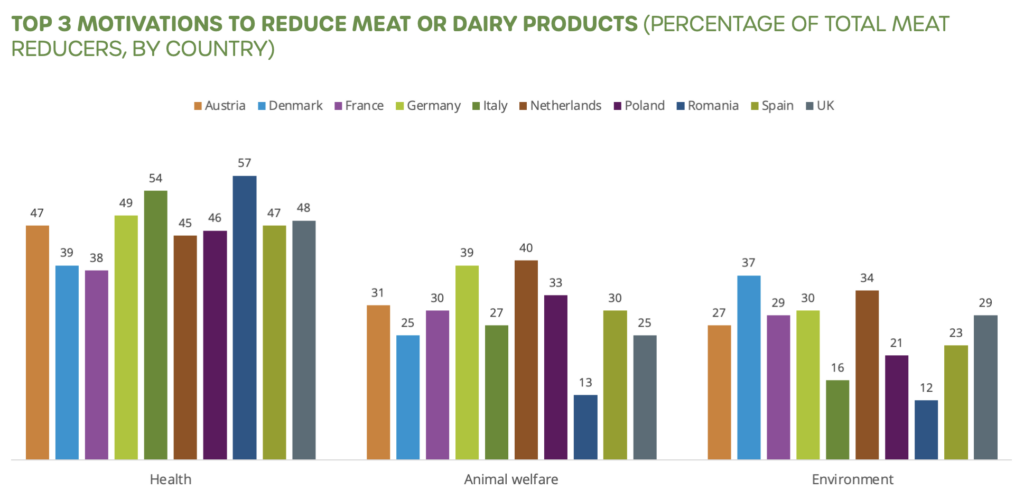

Health is the biggest driver for eating less meat

With 51% of Europeans reducing their meat intake – Italy and Germany have seen the largest fall at 59% – health is the primary reason (47%) cited by Europeans for eating less meat. This is echoed the most in Romania (57%) and Italy (54%).

Animal welfare comes next, being a reason for 29% of Europeans. Here, the Netherlands and Germany lead with 40% and 39% of consumers mentioning this factor, respectively. Environment comes in third at 26%, with Denmark (37%) and the Netherlands (34%) standing out.

This is despite multiple studies showcasing the environmental superiority of plant-based foods. Research has shown that vegan diets can reduce emissions, land use and water pollution by 75% compared to meat-rich diets, and that replacing 50% of our meat and dairy consumption can double climate benefits.

But post-pandemic, a renewed focus on health has led to an increasing number of plant-based meat brands putting the nutritional credentials of their products front and centre, including Beyond Meat, THIS and Meati.

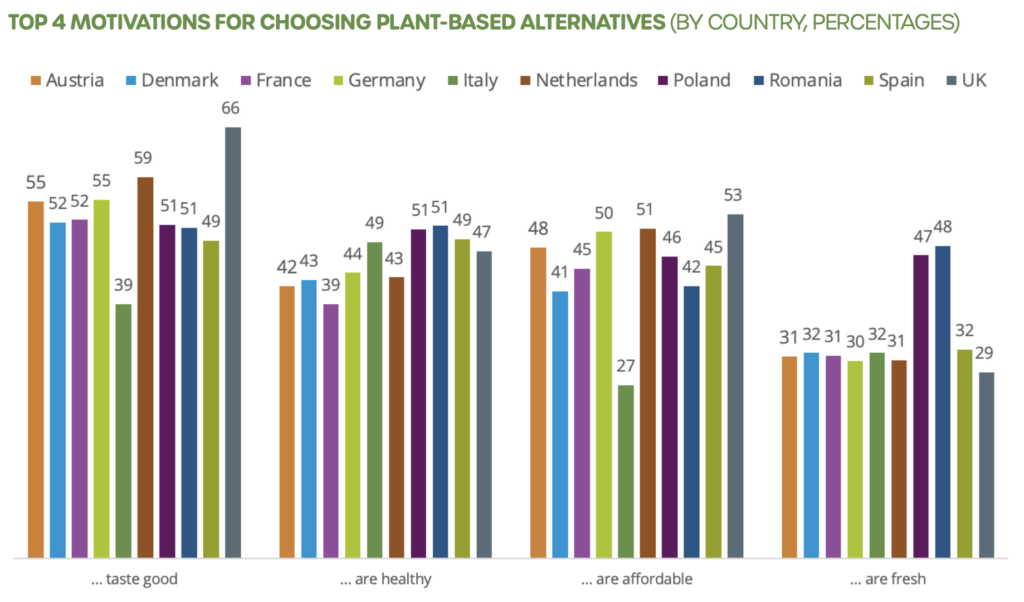

Taste is the top factor for purchasing plant-based alternatives

While health may be the key reason for reducing meat consumption, taste is an even more important factor when it comes to buying vegan alternatives, with 53% saying it’s the main reason influencing their buying decisions. it’s followed by health (46%) and affordability (45%). Freshness, meanwhile, has become more important too, with 29% citing it as a purchasing factor in 2021, and 34% doing so now.

The UK is the country most influenced by flavour and price (66% and 53%, respectively), while France and Romania lead the way in terms of health (51%), and Poland (48%) and Romania (47%) citing freshness as key.

Inflation and the cost-of-living crisis have increased food prices across the board. Despite that, more Europeans find plant-based alternatives affordable now than they did in 2021, when only 21% selected it as a factor for purchasing these.

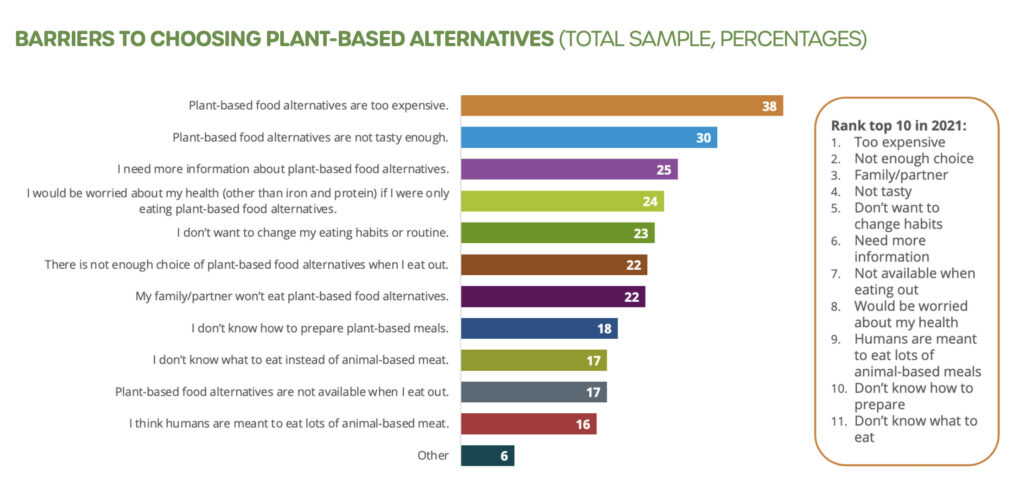

Price remains the biggest barrier

Having said that, price remains the biggest barrier – as it was two years ago – towards choosing vegan alternatives: 38% of Europeans selected this reason.

This was followed by taste (30%), wanting more information (25%) and concerns about health inadequacies (24%). While price and flavour are the two major reasons for the adoption of plant-based alternatives in the UK, they’re also the biggest factors why people avoid them (37%).

In contrast, people in Italy and Austria are the least affected by the flavour of these products (26% each), while Denmark ranked the lowest in terms of price concerns (26%). Meanwhile, Romanian, German and Austrian consumers are most concerned about health (26% each), and France the least (20%).

“Financial considerations and perceptions could potentially be a significant hindrance to widespread adoption of plant-based diets, regardless of whether plant-based food items are actually more expensive than their animal-based equivalents, or if it is simply an issue of perceptions,” reads the report.

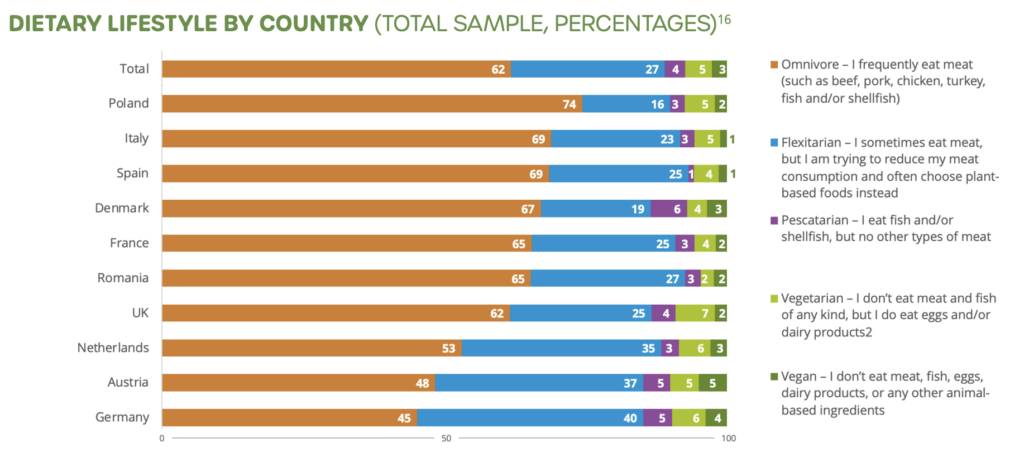

There are fewer flexitarians in Europe

The number of flexitarians across these 10 countries has witnessed a 10% drop to 27% in 2023. Germany leads the flexitarian market, with 40% identifying as such, followed by Austria (37%). These two are the only countries with fewer omnivores than other diets. Only 45% of Germans identify as frequent meat-eaters, rising to 48% of Austrians.

The latter also boasts the highest percentage of vegans (5%), followed by Germany (4%) – the total number of vegans is 3%. Meanwhile, the UK has the highest number of vegetarians, at 7%.

With 29% of boomers, 27% of Gen Xers, 28% of millennials and 26% of Gen Zers identifying as flexitarians, “the intention to reduce meat consumption transcends generational boundaries and represents a cross-generational interest”, the report says. Additionally, flexitarianism appears to be more popular among women (31%) than men (23%), while omnivore diets are more common among men (66% vs 58% for women).

Similarly, veganism is more common among women and girls (6%) than men (3%), but more men (3%) are vegetarian than women (2%).

28% of Europeans eat one vegan alternative weekly, with alt-milk most popular

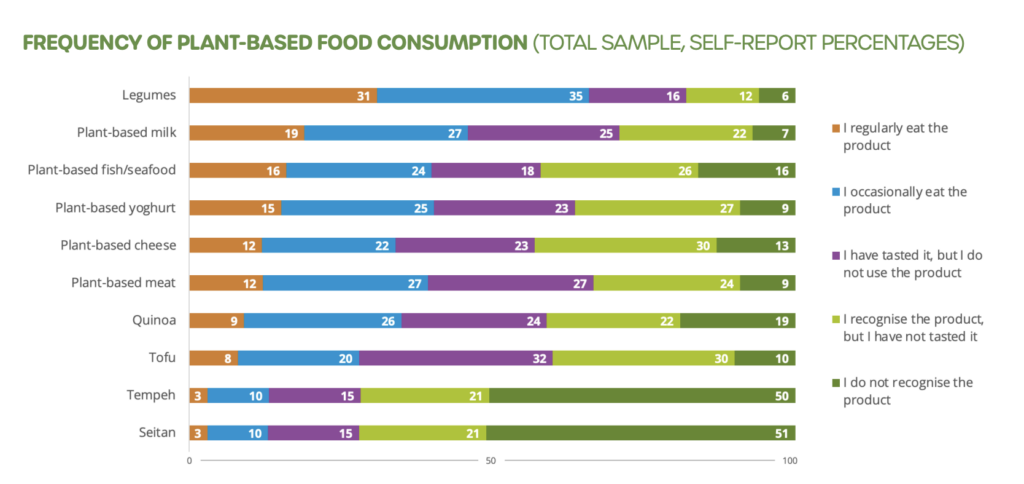

The number of Europeans who eat at least one vegan alternative each week (28%) has risen from 2021 (21%). Within the wider context, legumes are these consumers’ favourite plant-based food, with 66% eating these occasionally or regularly and 53% wanting to do so more frequently.

In the realm of alternatives, plant-based dairy is the most popular category. When it comes to alt-milk, 12% of Europeans consume these products daily, and 36% do so weekly. Similar numbers appear for vegan yoghurt (33%) and cheese (31%).

In terms of meat, plant-based poultry is the most regularly eaten meat by Europeans (27%), followed by beef (24%), fish (24%) and pork (22%). These numbers are higher than traditional protein products like tofu (20%) and tempeh (16%).

Most Europeans like eating plant-based at home

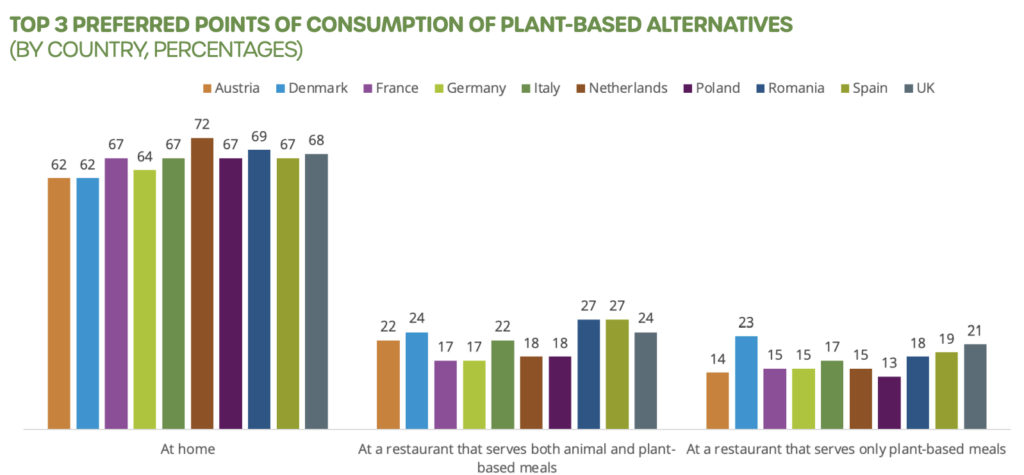

Two-thirds (67%) of Europeans prefer eating vegan alternatives at home, compared to 22% at omnivore restaurants and 17% at exclusively vegan eateries. “There is an opportunity for food companies and retailers to focus on promoting the appeal of plant-based alternatives for home cooking,” notes the report.

As for where they buy these products, supermarkets top the list with 60%, with discount retailers coming second at 41%. In terms of what people want to buy, vegan sweets and snacks (like cookies, chips and chocolates) as well as meat alternatives are the wishes of 30% of respondents. This is followed closely by plant-based milk (29%), baked goods like bread and pastries, and yoghurts (both 28%).

Consumers trust vegan food more, and social media plays a huge role

Consumers are 46% more trusting of plant-based alternatives than three years ago. The highest-scoring metrics here are safety (57%), accurate labelling (56%), and reliability (55%), while there’s less confidence about traceability (47%) and overall integrity (47%).

While 43% of consumers find plant-based protein trustworthy, this falls to 20% for cultivated proteins, 17% for fungi, and 11% for algae. “Brands that prioritise clear labelling, transparency about sourcing, and product integrity are likely to build stronger consumer trust and thus gain a competitive advantage,” says the report.

Social media plays a major role in shaping consumer opinions about plant-based foods, with 36% saying their viewpoint is influenced by the presence of a food product on social media. 37% are interested in foods and dishes shared by influencers – this can be seen in action with UK vegan fast-food chain Neat Burger’s partnership with British influencer Clare Every (The Little London Vegan) on a new product earlier this week.

Overall, 44% experience an increased desire to eat products and dishes they see on social media. However, their perceptions around the health aspects of these dishes aren’t as influenced, with only 36% selecting that reason.

Largely, online forums like Reddit (25%), blogs (28%) and social media platforms (29%) are the least trustworthy components for consumers looking for the health benefits of a plant-based food product. Health and nutrition websites (45%) and search engines like Google (44%) are the most trusted sources.

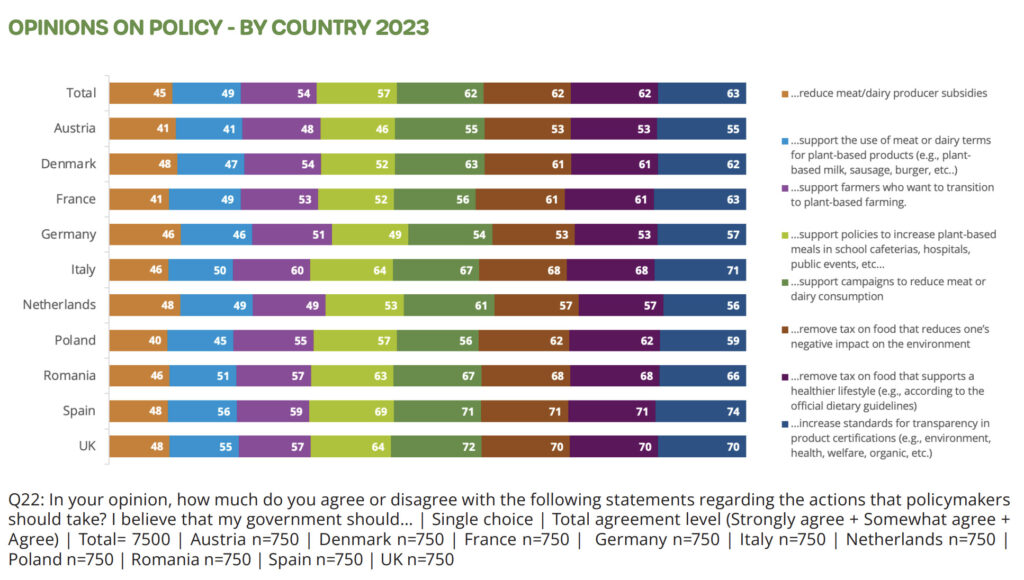

Europeans want equal subsidies and sustainable food taxes removed

When it comes to policymaking, more than six in 10 Europeans support removing taxes on food that’s healthier and more sustainable. Additionally, 45% want to see the playing field levelled in terms of subsidies – in the EU, meat and dairy farmers receive 1,200 times more public funding than plant-based producers, and 50% of the income of livestock farmers comes directly from subsidies.

The survey also found that 63% of consumers want more transparency in product certifications (such as environment, health, welfare, organic, etc.) – this ties into the EU’s recent efforts to curb greenwashing. Its proposed Empowering Consumers for the Green Transition directive will ban companies from promoting misleading claims about their products’ eco credentials.

Moreover, 58% support measures that help farmers transition from animal to plant-based agriculture, and 49% are in favour of using conventional terms like ‘milk’, ‘meat’ and ‘cheese’ to refer to alternatives. “There is a clear and resounding response from a vast majority of European consumers for policymakers to support the shift of Europe’s food system in a more sustainable and healthy direction,” concludes the report.

Time for governments to step up

“As stated in the Farm to Fork Strategy, alternative proteins, such as plant, microbial, or marine proteins, is one of [the] key areas of research for a sustainable, healthy and inclusive food system,” said Cindy Schoumacher, policy officer at the EU Commission, the legislative arm of the bloc.

It must be noted that the body was recently the subject of an investigation by journalists, which found that it faced intensive pressure from meat lobby groups on the EU’s proposed ban on caged farming, which has subsequently been put on hold and in limbo.

“The aim is to stimulate food consumption that is sustainable in both health and environmental aspects, highlighting the importance of plant-based diets,” added Schoumacher. “The Smart Protein project is providing key information to fill knowledge gaps on alternative proteins and contributes to the achievement of the objectives of the European Green Deal.”

In a separate investigation, however, climate media outlet DeSmog revealed how deep ties between agriculture lobby groups and a group of influential EU politicians are attempting to suppress two key pieces of legislation from the Green Deal.

On the new Smart Protein report, Helen Breewood, research and resource manager at the Good Food Institute Europe, said: “With so many people still saying these products are too expensive and aren’t tasty enough, businesses and governments need to invest in the research and infrastructure needed to bring prices down and improve quality, making plant-based foods more appealing and putting them within the reach of a wider group of consumers.”

ProVeg International CEO Jasmijn de Boo added: “Increasing numbers of people are choosing to reduce their meat intake, and policymakers and industry can use this knowledge to make respective decisions on the production and promotion of plant-based foods.”