5 Mins Read

DigitalFoodLab has released its annual State Of The European FoodTech Ecosystem report. Key highlights include 2021 being a record year for total investment, median funding amounts, and number of deals secured. Globally, Europe now holds 20 percent of the food tech sector, up from 12 percent in 2021. Main drivers for growth include grocery delivery startups.

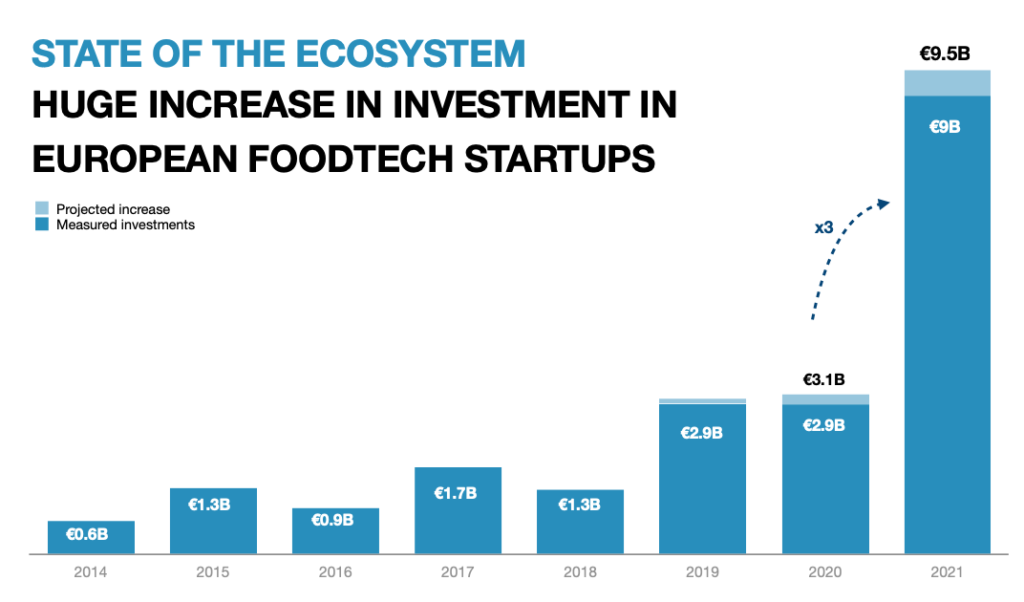

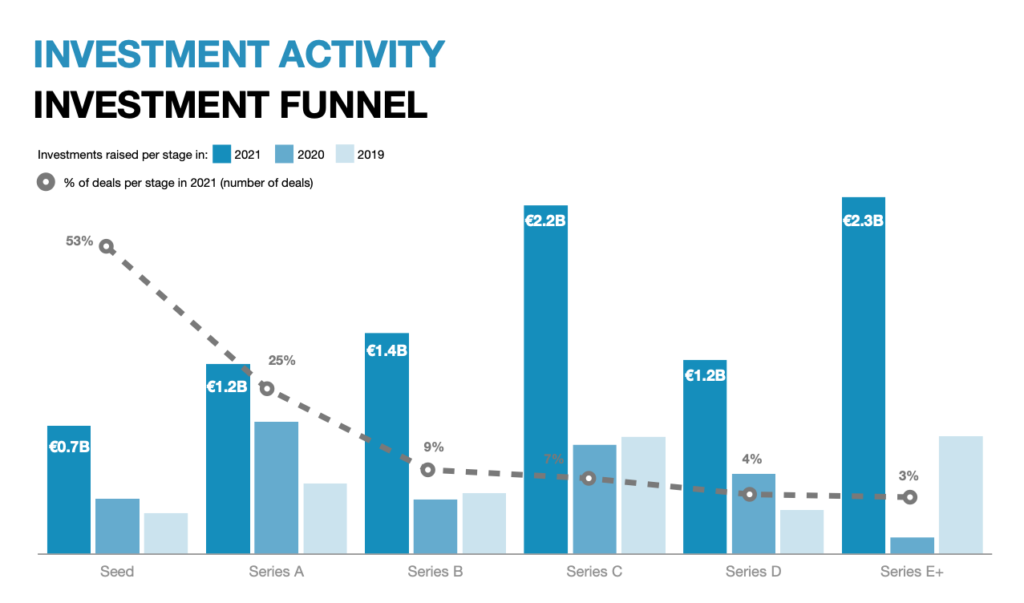

Positive figures follow what the report calls a ‘year of stagnation’. DigitalFoodLab claims the projected amount of startup investments secured in 2021 reached €9 billion, representing three times growth on 2020. 19 €100 million (or more) deals were secured, with 75 percent of all investments made into startups in 10 European cities. The median deal amount doubled from €0.9 million in 2020 to €1.8 million in 2021.

Dramatic increase in European investment

2020 saw €2.9 billion invested in food tech within Europe’s borders. 2021 netted €9 billion with more than 50 percent valued at €1 million or more. The report cites these figures as being a “good barometer of the health of the ecosystem”. It was further concluded that this would be a positive draw for future investors, leading to sustained and continued growth.

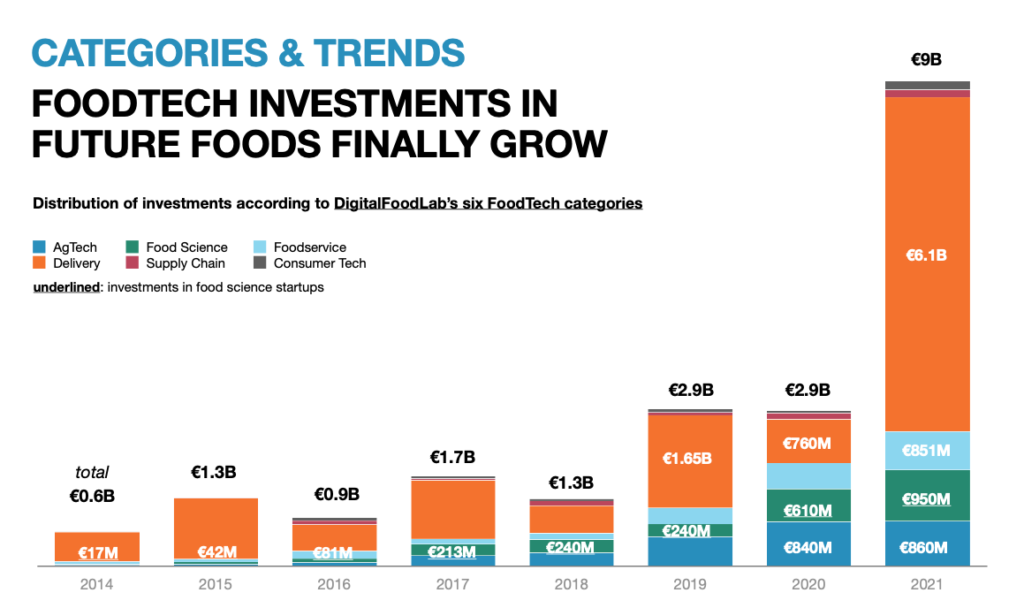

The number of active food tech startups in Europe has been shown to be growing at a steady 8 percent a year since 2017. Food delivery has been shown to be the major investment driver overall. Starting as solely meal deliveries, then switching to include grocery drop-offs, the sector accounted for 67 percent of all European food tech funding in 2021. The remaining two-thirds were largely dedicated to cloud kitchens and alternative proteins.

Regions to watch

DigitalFoodLab identifies five major hubs within Europe, connected to food tech. Berlin was highlighted as the prime location, particularly for its ability to nurture unicorns (seven startups throughout Europe reached unicorn status in 2021). As a whole, Germany claimed 31 percent of all investments in 2021.

Outside of Berlin, London, Stockholm, Paris, and Amsterdam were listed as cities driving the sector forward. AgTech, food sciences, foodservice and delivery startups are listed as sub-categories pushing investment figures higher.

Categories catching investors’ eyes

Startups are aiming to disrupt the status quo. This takes the full food tech value chain into account with alternatives to conventional agriculture, food production and distribution being offered. Distribution has snared the lion’s share of 2021’s funding.

“Investments in grocery delivery startups are the main contributor to this impressive growth. While a large share of that money went to quick-commerce startups, many other types of startups have raised funding to disrupt the way we think about groceries. The speed at which this ecosystem is developing is unprecedented and its impact will be far from marginal. It could change the food retail landscape much sooner than initially anticipated (and beyond e-commerce).,” the report states.

In 2021 food science accounted for €950 million of total food tech funding in Europe. This was up from €610 million the previous year. CPG startups registered the most increase year-on-year, but alt-protein bagged an extra €41 million in investment.

This accounts for the rise in startups looking to leverage plant-based, precision fermentation, cellular agriculture, biomass fermentation and molecular farming techniques.

The report notes that taking any market share away from animal meat will require vast resources, but highlights that reduced production costs of cultivated options could mean price parity with meat in five to 10 years, resulting in future investment impact.

Coming up close behind food science is food service, with a particular focus on the digitisation of the restaurant sector. Following the Covid-19 outbreak that crippled much of the global hospitality sector, new startups are looking to futureproof their models through increased online presence and less reliance on human resources.

Foodservice robotics took the majority of investment, with €334 million of a total €851 million for the category. Despite still proving popular in the U.S., cloud kitchens and virtual restaurants have not translated into long-term investments within Europe. Digital at-table payment systems are showing recovery after a slump in 2020.

The report highlights that Europe is a leader in limited food tech trends but those it does push forward are niche and interesting to investors. Molecular farming, biomass fermentation, Q-commerce, insects for animal feed, deliveries and new retailers feature prominently. Moreover, figures indicate that investors are looking to get onboard at earlier stages, leading to a doubling of the meridian deal amounts observed in 2020.

Report conclusions

Growth across the board in terms of investments secured, number of deals agreed and startups reaching unicorn status lends itself to optimism. Europe remains behind the U.S. for food tech investment but demonstrates versatility and creative entrepreneurial spirit. The report does add a word of caution, however.

When looking at acquisitions in 2021, of 23 significant takeovers, nine saw European startups bought by non-European companies. This has led to questions about where investment value is really going. Such acquisitions, particularly of small direct-to-consumer brands by large corporations, are expected to continue in 2022.

Global steps forward

2021 proved to be a record year for APAC, as well as Europe. The former netted a significant increase in alt-protein sector investments, compared to 2020. It has been heralded as a region contributing significantly to the global space.

Israel has reported vast growth in 2021, thanks to its burgeoning alt-protein sector, largely led by cultivated developments. An undisputed force within the cellular industry, the country saw a 450 percent increase in alt-protein investments. This translated to a total of $623 million, up from 2020’s $114 million. The increase propelled Isreal to the number two spot, second only to the US’s alt-protein sector.