What Do Indians Want From Vegan Food? New Survey Reveals Sector Challenges & Potential

8 Mins Read

The Good Food Institute (GFI) India has conducted a first-of-its-kind survey on consumer awareness, adoption and purchase behaviour for vegan meat and dairy in India. Here are 12 key takeaways.

Two months after publishing its first State of the Industry report for the Indian alt-protein market, GFI India has followed up with a survey that provides a glimpse into how consumers think about plant-based meat and dairy.

The State of the Industry report revealed how vegan dairy reigned supreme, with alt-meat showing some promise. India’s international presence was also on the rise given the amount of export activity, while government support has been encouraging too.

GFI India aimed to identify the profile of the Indian vegan consumer through a collaborative study with Kantar World Panel, looking at who was likely to regularly purchase alt-meat, dairy and eggs, as well as pay more for these products. It is this survey that the think tank is publishing in full now, covering 2,535 Indians aged 24-60 and earning over ₹50,000/$600 per month.

Here are 12 key takeaways from the report:

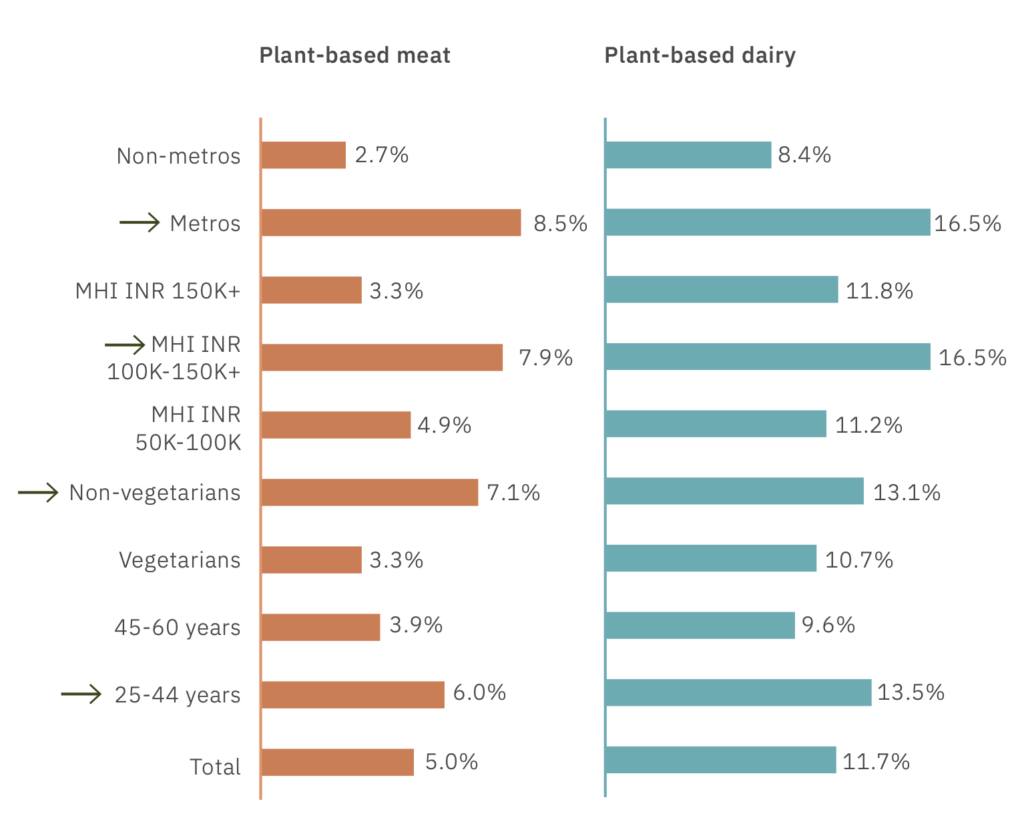

1) Awareness about plant-based meat and dairy is higher in certain quarters

Nearly half of the Indians surveyed are aware of plant-based dairy, and 27.5% know about meat alternatives. Awareness about these products is highest in metro cities and among those earning between ₹100,000/$1,200 and ₹150,000/$1,800 per month. The demographic is similarly skewed for vegan dairy too.

2) Social media drives consumer awareness

For people who are familiar with plant-based alternatives at an “unaided level”, the internet is the biggest driver of awareness, with social media platforms and website ads making up 50% and 44% of the sources for vegan meat and dairy, respectively. Word of mouth is also strong, but print ads and store posters are the least convincing sources.

3) Vegan product trials are low

Despite the relatively high amount of awareness, there’s still some way to go when it comes to adoption. Of those who are actuated with vegan alternatives, 23% have tried milk analogues, while only 11% have given alt-meat a shot. But 82% of Indians who have bought plant-based milk in the last six months say they’ll consider buying it again, with a similarly high figure (72%) for vegan meat too.

4) Trying one category paves the way for the rest

The GFI-Kantar survey revealed that 40% of respondents who tried meat analogues purchased vegan dairy as well, with 10% doing so the other way round. “Among the plant-based meat, dairy and egg [categories], plant-based dairy is the strongest entry point into the consumer’s household,” the report read. “Once consumers try plant-based dairy, they experiment with other products within the plant-based category.”

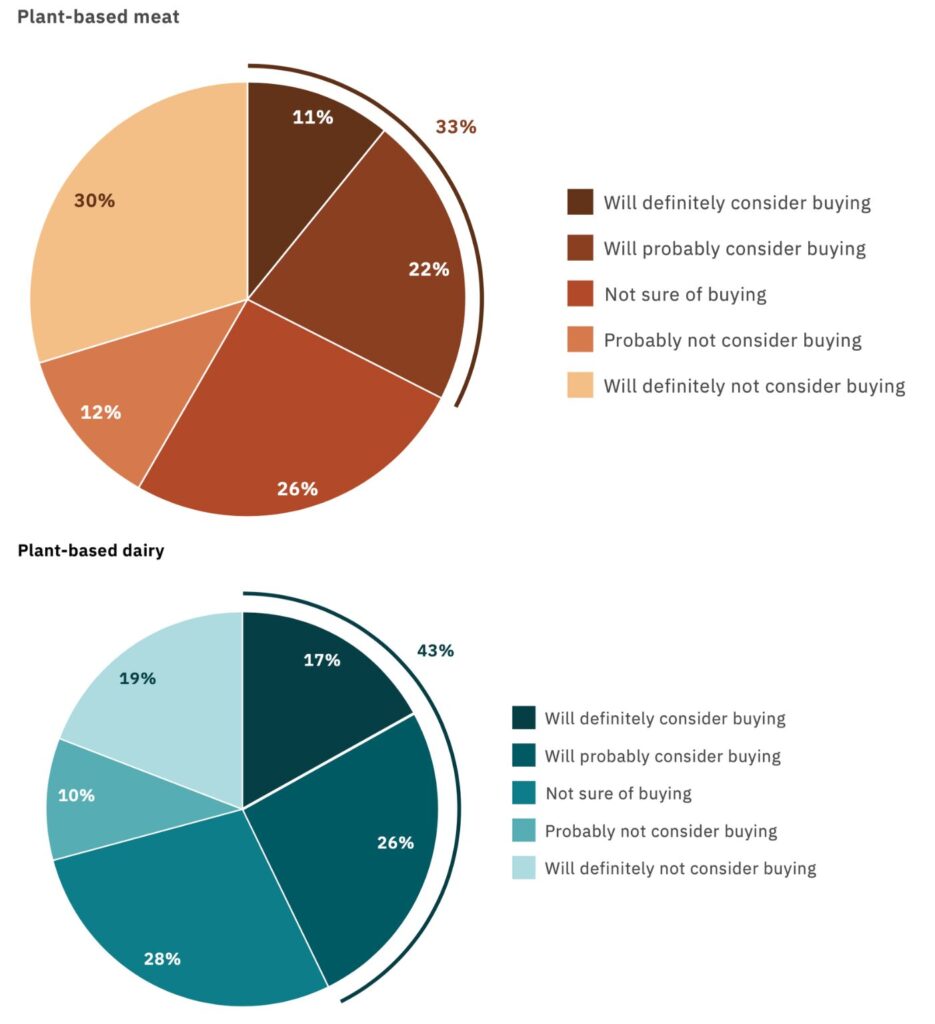

5) Purchase intent is high for both meat and dairy analogues

Of the households familiar with plant-based dairy, 43% intend to buy a product from the category again, with higher-income groups (earning over ₹100,000/$1,200 per month) and younger people (aged 25-44) showing more promise here. In terms of meat, this figure stands at 33%, with 42% of non-vegetarians likely to meat alternatives again.

6) Supermarkets rule e-commerce

Despite the boom in online shopping, when it comes to food, supermarkets are king for Indians. 57% of households bought alt-meat products from supermarkets, compared to 26% purchasing them from e-commerce platforms. This was in even starker contrast for vegan dairy: 65% in supermarkets, 18% on e-commerce.

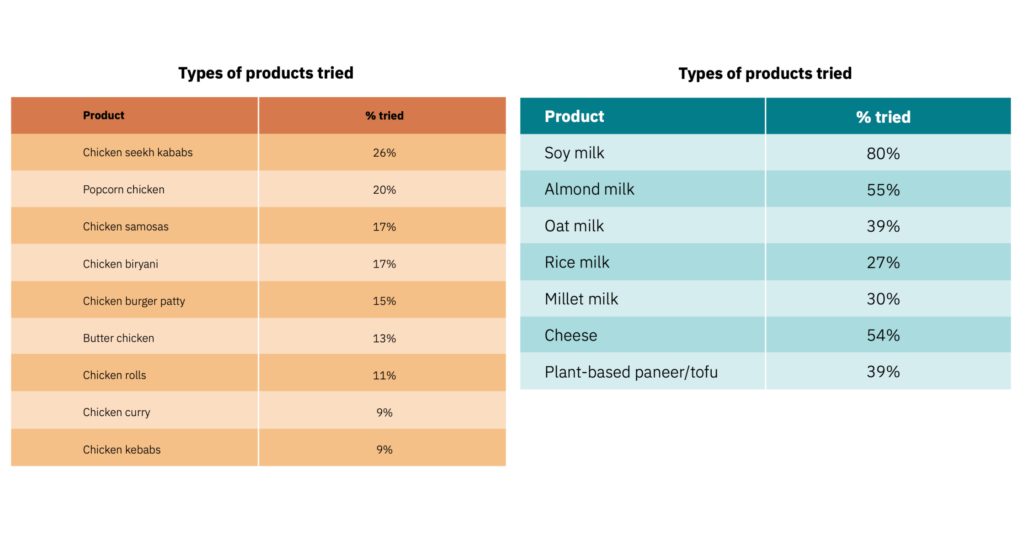

7) Chicken is the name of the game

All of the top nine alt-meat products tried by Indians centred on chicken. Chicken seekh kebabs have been sampled by 26% of Indians – the most tried meat analogue – followed by popcorn chicken (20%), and chicken samosas and biryani (17% each). Meanwhile, 72% of these consumers purchased animal-derived meat products too.

8) Soy milk is the most common, but almond is catching up

As the original (and cheapest) milk alternative, soy milk has been trialled by 80% of the respondents, with almond milk falling not behind at 55%. 39% of Indians have sipped oat milk or eaten tofu too. In terms of vegan cheese, 54% of respondents have tried it. Plus, 89% of alt-dairy consumers also buy conventional dairy items.

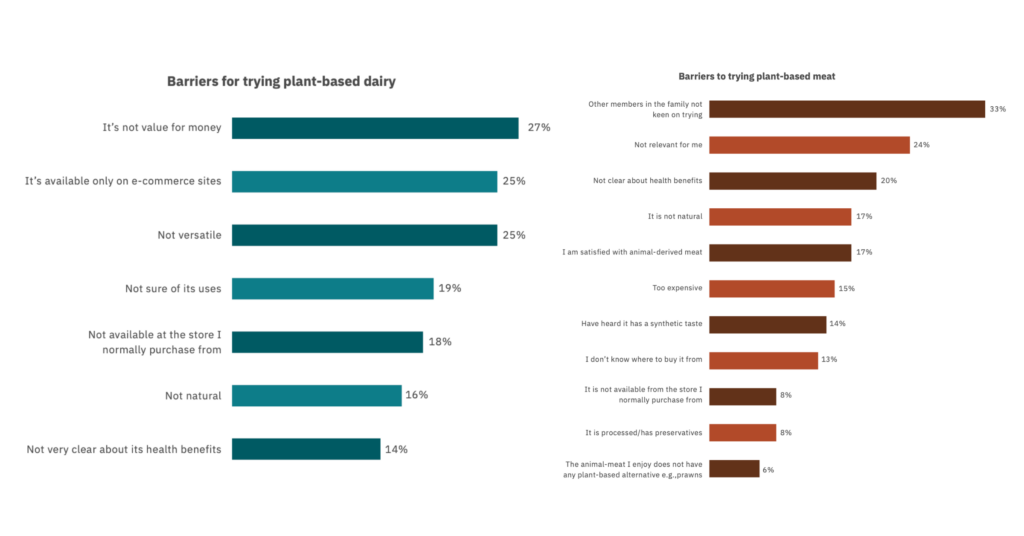

9) Nutrition, health and social factors dictate alt-meat consumption

Having a good amount of protein is the number one factor driving Indians towards plant-based meat, with nearly half (47%) citing it. Convenience (33%) and easy cooking and cleaning (30%) are similarly important. But the largest barrier deterring consumption of these products is that other family members aren’t keen on trying them, holding 33% of consumers back. For 24%, these products aren’t relevant.

10) Protein, health and affordability key for vegan dairy adoption

Protein content is most important to Indians (52%) when it comes to alt-dairy too, highlighting a gap in messaging and marketing around plant-based analogues. For 43%, the fact that they’re healthy is key. On the other hand, over a quarter of Indians (27%) find these products too expensive, while 25% say an exclusively e-commerce presence is a hurdle, reiterating Indians’ reluctance to buy groceries online.

11) Health and nutrition remain paramount for Indians

It is general consensus that for Indians, health is the biggest driver for vegan food consumption (over environmental or animal welfare reasons). This is reflected by GFI India’s poll, which shows that being healthy and nutritious is important for 64% and 60% of alt-meat consumers, and 66% and 58% of plant-based dairy users, respectively.

12) Taste is a huge barrier for repeat purchases

As in other countries, flavour carries a huge influence on Indians. Poor taste attributes (and high costs) deterred many from buying plant-based meat and dairy again, with texture and dryness also cited as reasons for alt-meat. Meanwhile, ‘naturalness’ and the addition of artificial flavours and preservatives are other reasons here. Finally, not being compatible with coffee and/or tea is another issue, exhibiting consumers’ need for more barista-friendly milk alternatives in India.

“To encourage trial and repeat purchases, it is crucial for manufacturers to focus on the trifecta of taste, affordability and convenience,” says Rajyalakshmi Gummadi, market and consumer insights advisor at GFI India. “Like any new category, initiatives, including sampling, online campaigns, social media engagement, and strategic retail displays, can contribute significantly to greater awareness and broader adoption. Our goal is to empower manufacturers and industry players with essential consumer insights that can drive the advancement of the sector in India.”

India is ‘quintessentially flexitarian’

Asked why people say plant-based alternatives are not relevant to them, Gummadi tells Green Queen: “Meat and dairy have been an integral part of consumers’ lives for generations. Dairy is consumed by both vegetarians and omnivores and is driven by health and nutrition. Meat consumption is still aspirational in India – it is consumed not only for taste but also for nutrition/protein content.

“With the increase in affluence, the per-capita consumption of these categories is on the rise. On the other hand, consumer awareness of animal cruelty and the impact of animal agriculture on the planet is limited. This, coupled with the current product range of plant-based meat and dairy, which scores low on taste, price, and convenience compared to the animal-derived counterparts, makes the category not so relevant for consumers. Creating awareness of the benefits of plant-based products along with working on taste, price, and convenience is the key to the category growth.”

Gummadi also touches upon why Indians have a greater preference for buying groceries at supermarkets over e-commerce channels, compared to products like clothes, books and medicines. “Many food items in India, including fruits, vegetables, and staples, are not standardised, and consumers are conscious about picking and choosing the right quality rather than ordering them online,” she explains. “The convenience of having a supermarket/grocery/kirana [corner] store in every neighbourhood, along with the option of browsing through a large variety, adds to this.”

She calls India’s population “quintessentially flexitarian”, with most Indians consuming meat daily, weekly or occasionally. “On most occasions, meat is consumed as one component of a diverse plate (thali), rather than as a standalone entrée or the meal’s centrepiece. While per capita consumption is low, the demand for conventional meat, seafood, eggs, and dairy is expected to increase further with rising incomes in developing countries like India,” Gummadi notes, citing a UN FAO report predicting that India’s poultry consumption is set to grow by 850% by 240.

“In India, meat consumption is not homogenous and changes from region to region based on tradition, access, affordability, and local supply chains. Cultural, and religious differences also play a part in people’s consumption of animal products, particularly beef and pork. Other times, people don’t consume meat on certain days, festivals, or during specific seasons.

“These nuances and sensitivities pose a challenge for the alternative protein sector but, at the same time, present an opportunity that is unique to India – to diversify regional formats, provide alternatives for those who abstain on certain days, and options for mixed groups of vegetarians and non-vegetarians and those who would like to experiment with meat-like textures for the first time.”

A 2019 cross-country survey by GFI India found that 63% of Indian consumers are “very or extremely likely” to purchase plant-based meat, while the latest Kantar study shows a 72% repeat purchase intent for those who have tried meat alternatives.

Reflecting on this, Gummadi says: “The Gen Z and millenial generations are increasingly making lifestyle choices that reflect their values around planetary health and sustainability. These young consumers, who will be the biggest age group by 2040, are shifting rapidly toward smart protein for various reasons, including health, lifestyle choices, animal welfare, and environmental concerns, among others.”

This story was updated on January 16 to add GFI India’s interview with Green Queen.