5 Mins Read

According to new research, none of the major G7’s stock indexes are anywhere close to a 1.5°C or 2°C pathway with activists and scientists urging the largest listed G7 companies to immediately set emissions reduction targets and increase their climate action.

Titled ‘Taking the Temperature: Assessing and Scaling-Up Climate Ambition in The G7 Business Sector’, the research was conducted by non-profit environmental data organization CDP together with the United Nations Global Compact on behalf of the Science Based Targets initiative (SBTi), a body that helps businesses place reduction targets.

The results reveal that no leading G7 stock indexes are on a 2°C pathway, much less the 1.5°C that is required, with four out of seven indexes currently on ‘disastrous temperature pathways’ of 3°C or above.

The seven G7 countries include many of the world’s wealthiest democracies, namely the U.S., U.K., Canada, France, Germany, Italy and Japan. The research reveals that the countries leading indexes are on an average temperature pathway of 2.95°C according to its constituents’ present corporate climate goals.

Stock indexes were taken into account comprising of stocks of the most significant companies listed on a country’s largest exchange, which are key to analyzing market trends.

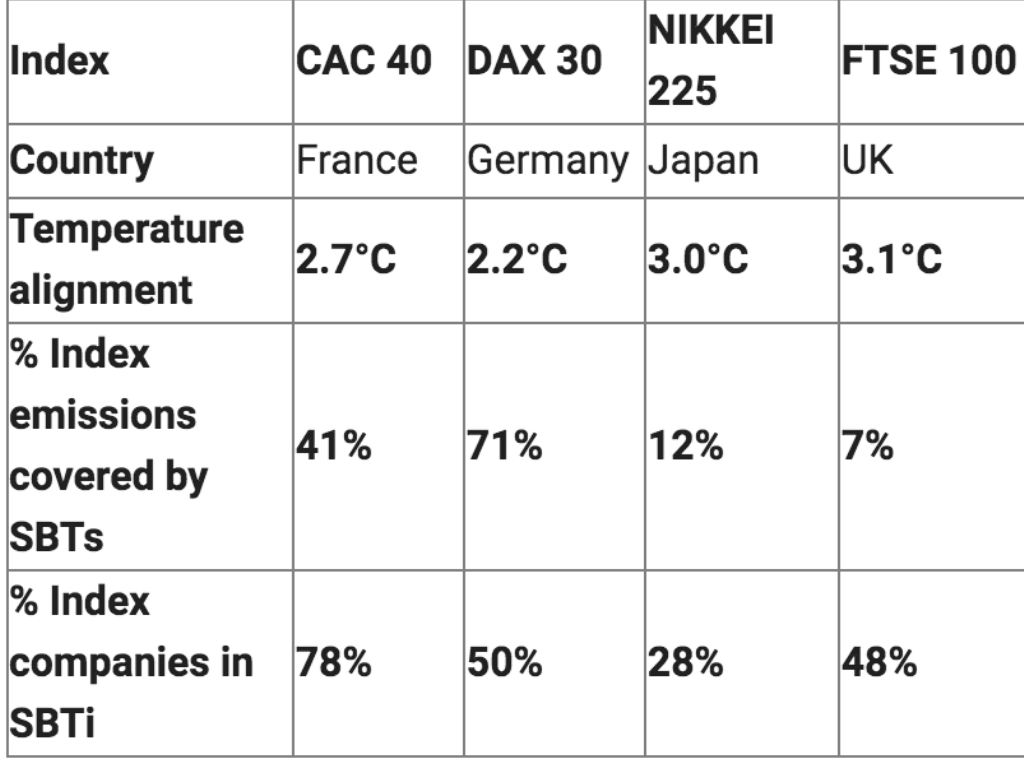

Covered by science-based targets (SBTs), G7 indexes that reported to have a higher share of carbon emissions have low overall temperature ratings. For instance, 71% of Germany’s DAX 30 companies’ emissions result in the lowest index temperature rating of 2.2°C. At the same time, less than 1% of Canada’s SPTSX 60 companies have shown the joint-highest temperature rating of 3.1°C.

In addition, the report found that four of the seven indexes are on threatening temperature pathways of 3°C or above with fossil fuels being a major contributor to the emissions of all seven indexes, making up 70% of Canada’s SPTSX 60 3.1°C temperature rating and around 50% of Italy’s FTSE MIB 2.7°C rating.

This analysis has arrived right at the time of the upcoming 47th G7 summit that brings together the seven economies to discuss the worse societal and environmental challenges affecting the world and is set to happen from June 11–13 2021 that will include representatives of the European Union as well.

In a press release seen by Green Queen, chief of programs, UN Global Compact and SBTi board chair, Lila Karbassi said: “G7 companies have the potential to cause a ‘domino effect’ of positive change across the wider global economy. This report highlights the urgent need for markets and investors to deliver on the goals of the Paris Agreement. As the G7 meets this week, Governments must go further to incentivize ambitious science-based target setting.”

G7 companies have the potential to cause a ‘domino effect’ of positive change across the wider global economy. This report highlights the urgent need for markets and investors to deliver on the goals of the Paris Agreement

Lila Karbassi, chief of programmes, UN Global Compact and SBTi board chair

G7 ministers have urged businesses and investors to set their portfolios in alignment with the Paris Agreement goals as well as set science-based net-zero targets by 2050 at the latest. At the moment, passive investing sums up 40% of U.S. and 20% of European funds, however, passive investors are alerted to the fact that only 19% of listed companies in these seven leading indexes have climate targets aligned to the Paris goals.

Furthermore, SBTi revealed that 35 of the FTSE 100 companies have committed to aligning with a 1.5°C pathway, but still some of the largest emitters do not have ambitious climate targets in place leading to an overall index temperature rating of 3.1°C.

Ignoring climate science is like continuing smoking despite knowing the risks. Climate and environmental breakdown is the biggest health, economic and societal challenges of our time – it requires immediate action from the world’s largest companies

Alberto Carrillo Pineda, director of science-based targets at CDP and a Steering Committee member at the SBTi

Despite these findings, climate action is being adopted by several companies in the G7 countries given that out of all the corporate GHGs emissions reduction targets disclosed to CDP back in 2020, 64% of these were set by businesses headquartered in G7 countries, with 2020 especially a record year for climate targets: the annual rate of adoption of science-based targets doubled in 2020 compared to the period of 2015-2019.

Director of science-based targets at CDP and a Steering Committee Member at the SBTi, Alberto Carrillo Pineda, said: “Ignoring climate science is like continuing smoking despite knowing the risks. Climate and environmental breakdown is the biggest health, economic and societal challenges of our time – it requires immediate action from the world’s largest companies. Today’s findings highlight vital progress, but show there’s more to be done to incentivize firms to set science-based climate targets and accelerate the pathway to net-zero.”

To help governments, investors and businesses take effective climate action, SBTi has recognized four climate actions that can be worked with to align themselves with the goals through science-based targets. Firstly, they need to work together to focus on the “ambition loop”, a positive feedback cycle where private sector action and government policies go hand in hand, like the recent Executive Order on Climate-Related Financial Risk by the U.S. Government that introduced a requirement for leading federal suppliers to place science-based targets.

Then, corporations need to work towards decarbonizing supply chains with the help of suppliers and thirdly, investors should add science-based targets into sustainability-linked bonds and climate financial standards.

Finally, financial institutions should look at developing a domino effect by placing portfolio-level science-based targets and engagement with underlying assets, for instance, the CDP Science-Based Targets campaign looks at collaborating with financial institutions to invite the world’s highest-impact companies to commit to 1.5°C-aligned science-based targets.

Companies can join the existing 570 firms that have signed up to the SBTi’s Business Ambition for 1.5°C campaign to mitigate the effects of climate change ahead of the upcoming COP26 conference in Glasgow.

Recently, the U.K. decided to slash its emissions by 78% by 2035 and in the U.S., President Joe Biden says he aims to cut the country’s carbon emissions by half.

Lead image courtesy of Martin Meissner/AP Photo.