South Korea’s Simple Planet Raises $6M in Pre-Series A Round to Speed Up R&D for Cultivated Meat Powder

5 Mins Read

South Korean cultivated meat startup Simple Planet has raised ₩8B ($6M) in a pre-Series A funding round to optimise its technology for its powdered ingredient, secure regulatory approval, and expand internationally.

Simple Planet’s ₩8M ($6M) pre-Series A funding round saw participation from POSCO Technology Investment, DCP Private Equity, Hyundai Technology Investment, Prologue Ventures, Pathfinder H, and Samho Green Investment, among others.

The latest capital injection brought the South Korean startup’s total financing to ₩10B ($7.5M), after a previous ₩2B ($1.5M) round led by tofu giant Pulmuone. It will help accelerate its R&D efforts to produce ingredients like powders and fats for cultivated meat, facilitating the optimisation of its manufacturing processes, its path to regulatory approvals, and overseas expansion.

“Despite the challenging investment climate, our pre-Series funding round was overbooked,” said Simple Planet co-founder and CEO Il Doo Jeong. “We are in the process of establishing a GMP [good manufacturing practices] facility for the mass production of cell-cultured food ingredients.”

Serum-free medium drives down costs for Simple Planet’s ingredients

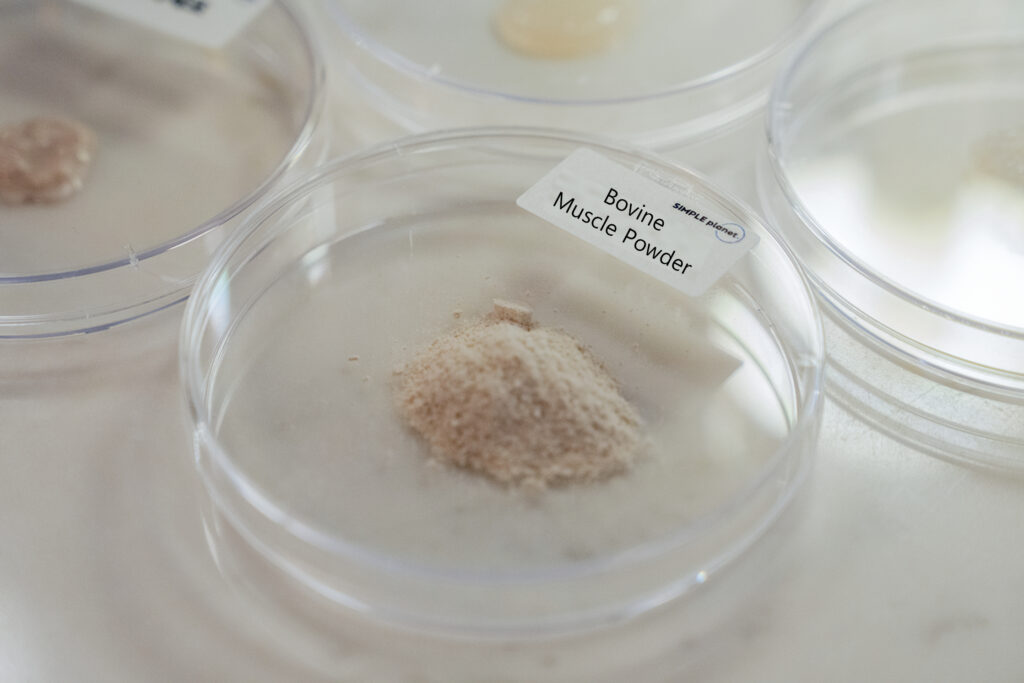

Founded in 2021, Simple Planet takes the approach of making cultivated meat ingredients like proteins and unsaturated fats in powdered or paste forms, instead of creating finished products. These ingredients are said to be highly versatile, helping absorb and improve the flavour and nutritional structure of conventional proteins. They can also be used as part of functional ingredients for seniors and infants.

The company has established 13 different floating cell lines so far – including cows, chickens, pigs, ducks and fish – and developed a probiotics-based serum-free edible culture medium. Apart from being controversial for its sourcing, fetal bovine serum (FBS) makes up over 80% of costs in cultivated food manufacturing, according to Simple Planet. Its technology has lowered the price of its serum-free culture by 1/60th, which – alongside controlling nutrient release and density – enables it to bring down the costs of its commercial ingredients too.

In October, the APAC Society for Cellular Agriculture (APAC-SCA) released a 1,110-person survey of South Koreans, finding that 84% of consumers preferred a plant-based growth culture for cultivated meat, although 35% wouldn’t mind seeing FBS being used, and 21% called the latter their most preferred option. “However, we see that FBS ranks lower in the preferred cultivation medium overall, suggesting that negative perception of FBS still remains among the surveyed South Korean population,” says Calisa Lim, project manager at APAC-SCA.

“We expect to accelerate the development of serum-free edible culture media, which we are also researching,” said Simple Planet’s Jeong. “Moreover, we have been collaborating with global food companies since last year to utilise cultured meat prototypes. We aim to create significant outcomes through new business planning and international expansion by building cooperative relationships with global companies.”

The startup aims to launch its high-protein cultivated meat powder both domestically and internationally, and has previously stated plans to set up branches in the US and Canada to enable faster entry. Last September, it unveiled B2C convenience food brand Balboa Kitchen, with the aim of directly incorporating its cultivated food ingredients into consumer products. Now, it is looking to aggressively expand its distribution network.

In January, it entered strategic partnerships with accelerator and investment firm Plug and Play and South Korea’s S&S Lab, which operates private-led shared laboratory IRIS lab. And last year, it linked up with Pulmuone to co-produce hybrid meat products, with a targeted 2025 launch.

Simple Planet has won plenty of recognition for its tech, including being named in the UK’s Forward Fooding FoodTech 500 list (described as “the Fortune 500 of agrifood tech”), being selected in the Sustainable Food Challenge 2023 by MassChallenge in Switzerland, and winning first place in the food tech category of US startup pitch competition WKBC and sustainability category at Singapore’s X-Pitch.

Cultivated meat on the rise in South Korea

Simple Planet is among a host of startups elevating South Korea’s burgeoning cultivated meat space. In February 2023, industry stakeholders signed an MoU to advance the country’s cultivated meat sector, and a month later, the North Gyeongsang province opened the North Gyeongsang Cellular Agriculture Industry Support Center. The 2,309 sq m facility was built over six years with a total investment of ₩9B ($7M) to develop biomaterials and support cultivated meat companies.

These developments came after the nation’s Ministry of Food and Drug Safety included official guidance for alt-protein in its National Plan 2022, covering the safety, manufacturing processes and regulatory approval of cultivated meat.

In October, South Korea’s Society for Food Sustainatech signed on to the APAC Regulatory Coordination Forum, which aims to facilitate cross-border dialogue between stakeholders for cultivated foods. On the regulatory front, the South Korean government is expected to be the next (alongside Japan) to develop a framework for companies. “Both nations are proactively seeking input from industry groups to craft clear and efficient safety review processes,” said Mirte Gosker, managing director of the Good Food Institute APAC, which co-established APAC-SCA.

The APAC-SCA poll also that 90% of respondents were willing to try cultivated meat at least once (though only 5% said they’d definitely eat it regularly). Plus, 39% were supportive of cell-based meat being sold at supermarkets and restaurants (with 14- to 29-year-olds leading the way), and just 10% were opposed to its commercialisation.

In terms of purchase drivers, price tops the list – cited by 65% of Koreans – followed by taste and texture (62%) and health/nutrition (48%). This ties into Simple Planet’s focus on cost reductions as well as flavour and nutrition (0.3g of its cultivated meat powder contains the same essential amino acids as 1kg of beef).

Apart from Simple Planet, at least eight more startups are working with cultivated meat in the country, including CellMEAT – which has created prototypes of cultured Dokdo shrimp and caviar – TissenBioFarm, CellQua, Space F, and SeaWith. Meanwhile, Korean noodle giant Nongshim invested $7.4M in food tech VC funding with a focus on cultivated meat, and CJ CheilJedang has teamed up with KCell Biosciences to build a cell culture facility in Busan.