“The Data Shows That Consumers Are Committed To Incorporating Plant-Based Meat Into Their Diets,” PBFA’s Julie Emmett Talks Industry Trends

7 Mins Read

An interview with PBFA’s Vice President of Marketplace Development about the data from their latest report, the evolution of the US plant-based foods industry and where things are going next.

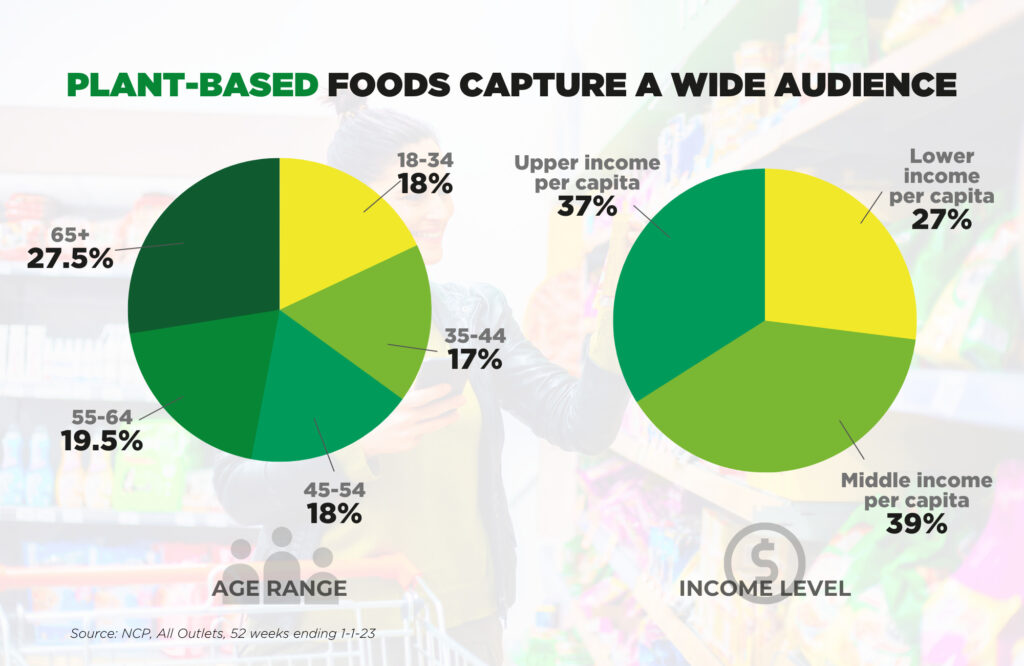

US industry group the Plant Based Foods Association released their annual State of the Marketplace 2022 Summary Report this week, and the results were broadly encouraging, with overall US plant-based sales growing 6.6% in 2022 and breaching the $8 billion milestone. The report also highlighted that 60% of US households now regularly purchase plant-based alternatives and with 80 % are repeating those purchases. I wanted to dig deeper on the data so I had a chat with Julie Emmett, PBFA’s Vice President of Marketplace Development who helped put together the report, about how the sector has evolved over the past few years, her take on upcoming trends, the future of plant-based meat and what brands can do better going forward.

Sonalie Figueiras: Given that the data is showing growth, why is the mainstream media still so down on plant-based in general?

Julie Emmett: While we certainly can’t speak on behalf of the media, we have seen patterns in coverage and think it is important to expand the view of this sector – that is it has many categories and many brands within each category that are extremely diverse. Too often a single brand is called out for a recent sales decline, which is presented in such a way as to represent the entire category performance within the sector – when in fact there are many more brands, large and small, that have grown both by repeat purchases or by new distribution. A single category of plant-based foods is being conflated with the overall industry and the scrutiny and speculation around single categories – let’s take plant-based meats, for example – tend to miss the nuance and growing variety of options available in the marketplace.

Sonalie Figueiras: How was the sector evolved over the past few years?

Julie Emmett: The sector has become much more diversified. A few years ago, we only reported on six categories of plant-based foods in our annual U.S. retail sales data release and now the industry has grown to nearly 20 categories – this is all only possible due to consistent consumer demand for plant-based foods. In the past three years, plant-based foods retail sales have grown by 44.5% to hit $8 billion, for a nascent industry this is a major triumph.

Sonalie Figueiras: What does the actual data say about plant-based meats?

Julie Emmett: The plant-based foods industry is an underdog that does not benefit from the same subsidies, retail space, and scale that animal-based foods enjoy – with any industry that is responding to a new consumer demand, namely wanting to eat more plants for their health, the environment, and animal welfare, scrutiny is to be expected. [In the report], we share that in the case of plant-based meats, certain data providers were reporting a steep decline in Q3 and by Q4 those numbers were flat to slightly declining. Our data is scanned sales from IRI and SPINS and also includes private label sales, and it does not align with those drastic declines. In fact, plant-based meat dollar sales have only declined by 1.3%, and while units have declined by 8.2%, they are up +21% compared to pre-pandemic levels. Trends show that consumers are committed to incorporating plant-based meat into their diets, with 17.5% of households purchasing plant-based meat and a hefty 62.5% repeating their purchases.

Sonalie Figueiras: U.S. plant-based meat sales are still flat/down. What’s your take on the future of this vertical specifically?

Julie Emmett: It is important to look at plant-based meat in the context of multi-year performance as well as this last year. In 2020, plant-based meat sales in the U.S. grew by 46%. This is enormous growth compared to prior years. For any category that experienced that level of unprecedented growth, the expectation would be to see decreasing growth rates that are more in line with years of sales before that jump, similar to what we are seeing across all sectors of food. This has not been the case for plant-based meats. Once consumers tried the options available, they continued to come back. In 2021, we saw plant-based meat maintain $1.4 billion in sales and in 2022, we saw a 1% sales decline to $1.38 billion.

Sonalie Figueiras: What are some of the major trends in this sector?

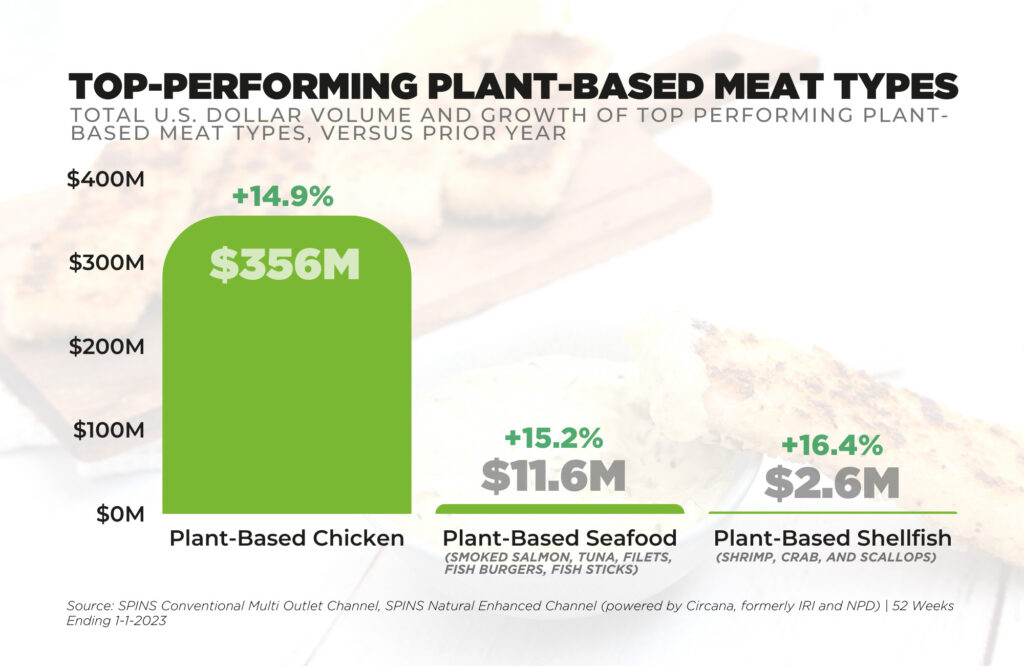

Julie Emmett: It’s critical to note that the plant-based meat category is diversifying in line with consumer interest in a growing variety of options. A few trends to watch in plant-based meat:

● Frozen meats: Frozen plant-based meats now make up 63% of plant-based meat sales. Consumers looking for lower prices may be increasing their focus on frozen options, paired with their interest in convenience.

● Clean label: Plant-based consumers report health as their primary motivation for choosing plant-based meats. Brands are responding quickly with highly sought-after products like burgers with less saturated fat and clean-label steak.

● Diversification: The plant-based meat category is expanding to include a growing variety of format types (the total number of plant-based meat items grew by 5.1% in 2022), such as plant-based chicken, nuggets and wings, deli slices, filets and whole cut meats, crumbles, and seafood (including plant-based fish options, shellfish, and more). As well as options that have been around for decades such as tofu, tempeh and seitan, which continue to grow.

Sonalie Figueiras: Why are consumers purchasing plant-based meats? What’s motivating this group of people?

Julie Emmett: We know the number one thing that motivates consumers to purchase plant-based meats is their health benefits. Brands are responding quickly with highly sought-after products like burgers with less saturated fat and clean-label steak as well as adding flavor like teriyaki, curry and lemon herb. And consumers are responding in kind: Many plant-based meat segments such as filets, steaks, cutlets, deli slices, nuggets, tenders, chunks and strips, are growing in both dollars and units, demonstrating consumer adoption of many different varieties of plant-based meat.

Sonalie Figueiras: What is something that has surprised you about the plant-based industry, as you have put together this report?

Julie Emmett: In speaking with our members who have weathered the challenges of limited ingredient supply due to supply chain disruptions or inflation, what stands out are the stories of resilience in the plant-based foods industry. Most of our members are start-ups, operating with lean teams and budgets, and they have managed to not only survive the market ups and downs of the past few years but thrive and innovate to create more sustainable foundations for themselves. We’d love to see narratives shift to more of those stories and showcase brands who’ve pivoted to sourcing regional ingredients for their foods and improving the resilience and sustainability of their companies. On the retail and foodservice side as well, we see dedicated partners who know plant-based foods are what their consumers are looking for and they’re going out of their way to invest in research (Kroger is a great example, see here and here) and partner with us to demonstrate their thought-leadership (see the quotes from foodservice operators in our recent report).

Sonalie Figueiras: What can plant-based brands do better? What can they address to have an even broader appeal to mainstream consumers?

Julie Emmett: Our consumer data has shown over the years that personal health remains the top reason why people are interested in plant-based foods, including meats. In PBFA and 84.51’s recent “Unmet Needs: Insights and Solutions” report, consumers noted plant-based options can have ‘too much sodium’ or be ‘too processed,’ which stands out most for consumers aged 55-64. Consumers want nutrient-dense foods with new/exciting flavors and better texture. Based on these insights, consumers would like to see more unique or bold flavors–not just with standard American foods but global cuisines such as curries, enchiladas, and tamales–in addition to more plant-based options for prepared meals to improve accessibility and convenience.

Sonalie Figueiras: What about nomenclature and wording on product labels? What tracks the best, according to your research?

Julie Emmett: Another recent report PBFA produced with Datassential found that consumers gravitate towards certain terms or labels more than others. Consumers indicated their preference for “plant-based” rather than “vegan” or “vegetarian.” PBFA and 84.51’s recent “Unmet Needs: Insights and Solutions” report also revealed that having more promotions or trials in-store would encourage consumers to try new plant-based products. Therefore, plant-based brands could potentially reach a wider range of consumers through thoughtful labeling and creating awareness of their new products through promotions.