5 Mins Read

It’s the perfect storm of market factors for a China protein revolution- a pork shortage crisis spurred on by the African Swine Fever epidemic, a trade war that has driven up meat prices, a younger generation motivated by environmental and health incentives and a growing demand for quality protein- and Silicon Valley #foodtech mainstays Impossible Foods and Beyond Meat are both staking their claim on the world’s populous country. Both alternative protein giants are eyeing the Chinese market with bullish glee, with Beyond Meat announcing that it plans to begin production in Asia as soon as next year and Impossible looking for local partners to launch within the country.

The two biggest Silicon Valley plant-based foodtech startups, both of whom have been at the forefront of disrupting the global food system and making way for a plant-based revolution, are looking to sink their teeth into the world’s largest untapped protein market: China. As the world’s most populous country, China is a massive consumer of meat, accounting for almost a third of global supply. In addition, the outbreak of African swine fever (ASF) has left the country reeling from over 100 million decimated pigs, which has caused a massive spike in global pork prices and making the need for alternative protein sources even more crucial.

While Beyond is already selling their products in Hong Kong, Singapore and Taiwan through their Hong Kong-based regional distributor Green Monday and have broken world records since going public earlier this year in May, they have yet to launch in mainland China.

READ: What’s The Difference Between The Impossible & Beyond Burger?

In an interview with Reuters, Beyond Meat’s executive chairman Seth Goldman said that the company is now looking to start production in Asia before the end of next year. He added that in order to successfully launch in a market as vast as China, the company must develop the necessary manufacturing systems, retail and supply chains and an elaborate transport system to deliver their frozen products.

“We know that to get to China and do it the right way, it’s going to take scale, it’s going to take a manufacturing presence in that area…We do hope to have something up and running before the end of next year,” said Goldman.

Beyond’s plant-based burger rival, Impossible Foods, is also looking to grab their share of the Chinese market. Earlier this month, Impossible held what was dubbed the “first” tasting of their plant-based burgers on the mainland at Shanghai’s International Export Expo, though according to local sources, the company’s meat analog is available to diners at a restaurant in Shenzhen that sources it across the border in Hong Kong.

The Shanghai tasting success has helped the company double down on their commitment to China, making it a top priority in its global development strategy. “We are communicating with Chinese companies…[who] are very interested,” founder Pat Brown told media at the Export Expo.

Like Beyond, Impossible Foods debuted their signature bleeding burger patties across hundreds of menus in Hong Kong, Macau and Singapore to great fanfare. Aside from experiencing a five-fold increase in sales in Asia alone since their inception into the region, they’ve also received huge funding from major names like Chinese VC Sailing Capital and Hong Kong’s tycoon Li Ka-shing.

Aside from looking to enterprises and local government partnerships to introduce their heme-filled burgers, Impossible are also aiming to speed up entry into China through a new Impossible Pork product. As China battles a pork shortage that will see an estimated quarter of the worlds’ pig population decimated, Impossible’s founder Pat Brown revealed that a pork analogue prototype is underway, and it’s “really just a matter of commercialising and scaling that…we want to help China solve that.”

Excitement aside, the US company is likely to face significant regulatory hurdles, thanks to their key ingredient “heme” aka soy leghemoglobin, the protein that gives the burgers the rich iron-like meat flavour and bleeding qualities. Manufacturing heme involves genetically engineered yeast and in China, GMO ingredients are banned for human consumption. This is the same hurdle the company faces in Europe, where strict EU regulations have prevented Impossible from launching there.

After Impossible agreed to take part in small animal clinical trials, the US FDA approved heme as safe for consumption. While it remains unclear whether Impossible will have to undergo similar regulatory constraints in China, Impossible is currently looking to hire country managers in Australia and Thailand, which suggests that the company is confident it can obtain food safety approvals in those markets.

READ: Regional Plant Pork Alternatives To Help China’s Pork Crisis

Aside from the two American foodtech leaders, other plant-based protein startups are aiming to break way into China. Hong Kong’s own pork alternative Omnipork, developed by Green Monday’s side venture, is set to launch in China through Alibaba’s Tmall e-commerce by the end of this month. JUST, the American vegan mung-bean based egg product, launched in China earlier this year and is now looking to set up a local production facility as well. Beijing’s own startup Zhenmeat is also capturing local consumers through their pea and fungus protein meat analogs that are tailored to Chinese cuisine delicacies, such as mooncakes and dimsum.

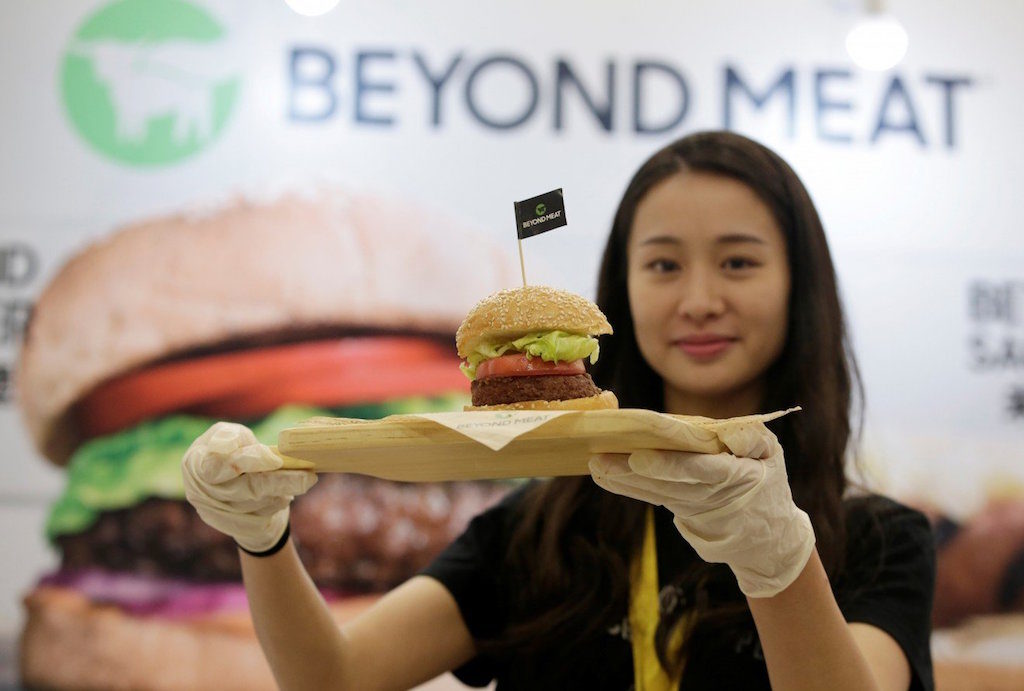

Lead image courtesy of Slaters5050.