Global Agrifood Tech Funding Down by 50% As Deals Become Smaller and Fewer

6 Mins Read

The global agrifood tech financial landscape remains difficult, with funding in the sector down by 49.2% from 2022-23, reaching $15.6B – the lowest it has been in six years – according to a new report by AgFunder.

A lot has been written about the VC fallout with food tech in 2023, with investment seeing sharp declines as the financial landscape attempts to recover from post-pandemic windfalls. Now, a new report has revealed that funding in agrifood tech startups reached a six-year low, with companies in the sector only receiving $15.6B. This represents a fall of 49.2% from the $30.5B injected in 2022.

And while the 2018-2021 deals with sky-high valuations were never likely to sustain, investment in agrifood tech companies isn’t just lower than in previous years, its share in the overall VC landscape has also declined, representing just 5.5% of total VC dollars, versus 6.7% in 2022 and 7.6% in 2021. The annual decrease in funding is a result of fewer and smaller deals – average deal sizes were down by nearly 30% from 2022, while the median deal size also dipped by 9%. Meanwhile, the deal count shrunk by 26%.

“While some deals have been down rounds, dramatically shrinking startup valuations, deal averages and medians, there’s also been a halt to dealmaking in many instances at the early stages,” writes Louisa Burwood-Taylor, managing editor and head of media and research at AgFunder. “This is in part down to some founders’ refusals to lower their company valuation expectations but in some cases, the correction has gone too far.”

Cultivated meat a ‘category to watch’

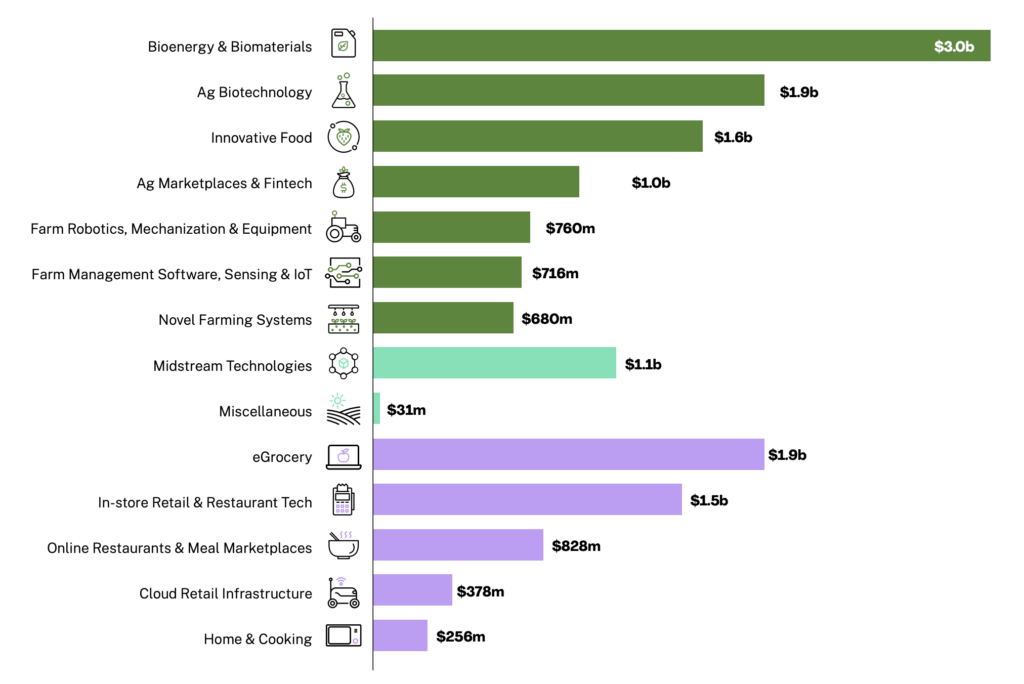

All but two categories saw funding fall last year – the two exceptions were bioenergy and biomaterials (the biggest subgroup, bringing in $3B at a 20% hike from 2022), and farm robotics, mechanisation and equipment (where investment was up by 9% to $760M).

After bioenergy and biomaterials, ag biotechnology was the second-largest category, raking in $1.9B at a 34% drop from the year before, followed closely by innovative food (which includes alternative proteins and novel food), where investment dropped by 51% to $1.9B. The latter was also home to the highest number of deals (289), representing a shift from the big checks going to alternative protein startups in 2021 and early 2022 to smaller sums across a broader range of firms.

The biggest sums were raised by meal replacement startups YFood Labs ($229M) and Huel ($83M), pea milk maker Ripple Foods ($49M), and Japanese plant-based meat company Daiz ($48M).

The report points out that cultivated meat is a sector to watch, given that it attracted just $177M in funding last year, with the top three checks going to Meatable ($35M), BlueNalu ($33.5M) and Uncommon ($30M). The most well-funded startup in this space, UPSIDE Foods, has hit pause on its plans for a large-scale commercial facility, while Eat Just similarly halted mass production plans for its GOOD Meat chicken.

The latter has been embroiled in legal battles with suppliers, and its co-founder and CEO Josh Tetrick told Axios earlier this week that reducing production costs “will require new thinking in how these facilities are built”, and that the company has “not solved for that”. He added that Eat Just is sticking to low levels of production: “I can’t emphasise enough just how small the volumes are.”

Upstream dominates downstream, while US loses global share

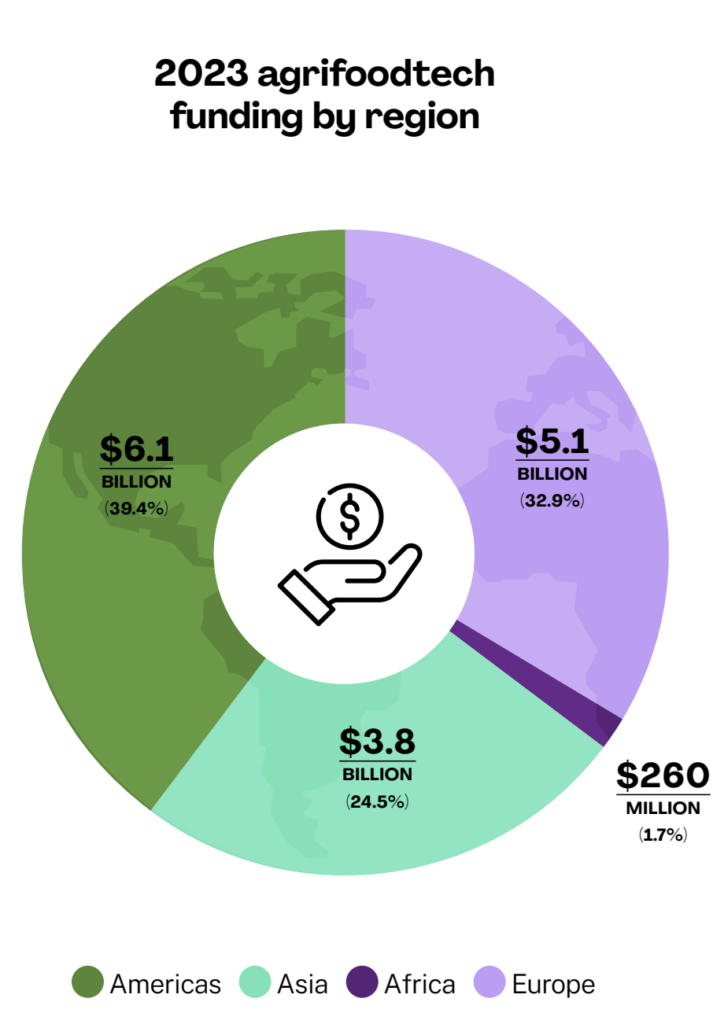

VC investment in agrifood tech was down across all global regions, although the drop in Europe was the lowest (14%). The continent was still second to the Americas in terms of absolute capital ($5.1B vs $6.1B, respectively). The US itself accounted for $5.4B of that, representing only 30% of the total (it usually has a 40% share).

Africa’s figures also fell to $260M from $752M in 2022, though this is still higher than the $193M its agrifood tech companies attracted in 2021. Asia, meanwhile, brought in $3.8B last year, a 35.5% drop from 2022, and Oceania saw a 25% year-over-year decline to $260M.

When it comes to emerging markets, India and China have lost their market share to countries like Indonesia, Saudi Arabia, Israel, Brazil and Singapore, with the two countries making up 40% of Asia’s total in 2023, versus 55% in 2021. But despite agrifood tech investment dropping by 14% in China and 78% in India, they’re still only surpassed by the UK and the US in total sums. The bright spots are in Europe, with Germany (+59%) and Spain (+348%) seeing a hike in financing in this sector.

The share of funding going to upstream startups – those operating on the farm or in primary food production – has increased in the last few years, making up 62% of the total, compared to 51% in 2022 and 30% in 2021. This includes categories like innovative food, ag biotech, bioenergy and biomaterials, as well as novel farming systems.

Consequently, downstream startups – which involve technologies removed from farms and primary production – have seen funding slow down rapidly. In 2021, companies in the food delivery, e-grocery, retail and restaurant tech, and home and cooking sectors attracted 63% of agrifood tech funding, but they now only account for 31%.

What do VC investors make of this?

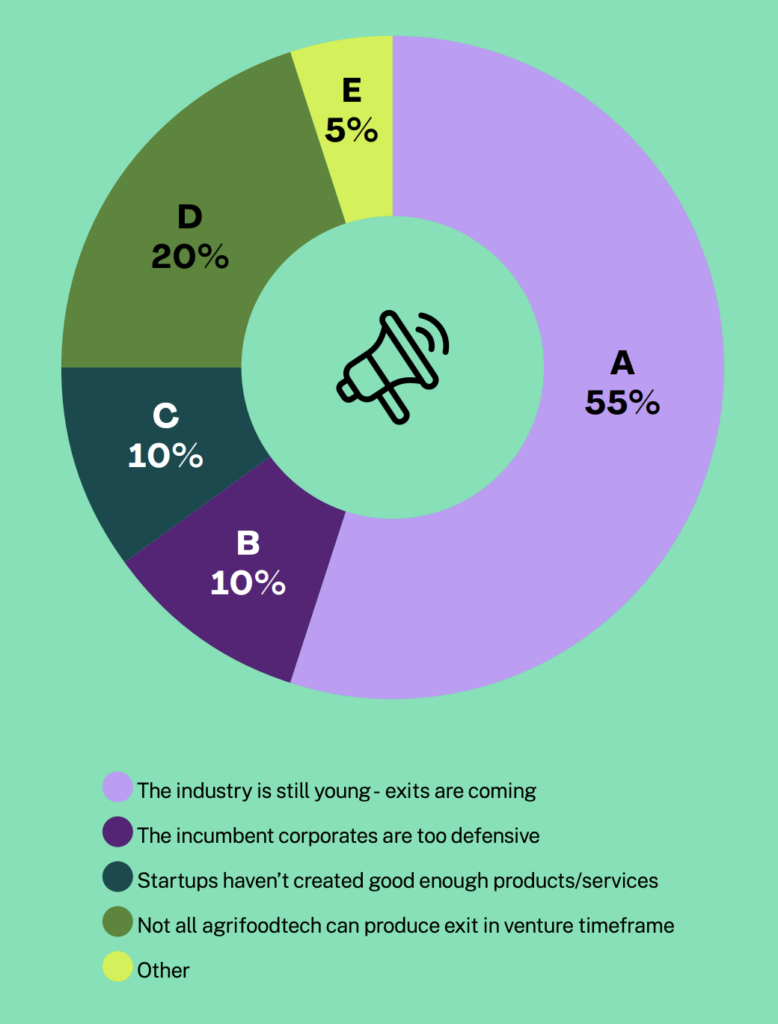

AgFunder polled 27 agrifood-focused VC firms about the funding landscape, finding that 15% believe alternative protein will garner the most funding in 2024, particularly cultivated meat and precision fermentation. “The caveat is that most of those respondents are deeply invested in alt-protein,” adds the report. Biotech and biological inputs (15%), health and nutrition (14%), and food delivery (12%) were the other popular choices.

“Too many people celebrated failures rather than learning from them, and in the end, we – the planet, humanity – actually need to be collectively successful,” Yoni Glickman, managing director of FoodSparks, PeakBridge and EIT’s agrifood tech seed fund, when asked what was most frustrating about the sector in 2023. “Perhaps a more controversial take is on founders, who are still not realistic about valuations.”

Investors are worried about the impact of conflicts around the world, including the Israel-Hamas war and escalating tensions between China and Taiwan, as well as climate change, the direction of political discourse, and the economy. “Several global factors are all contributing to one central concern: food security. Climate change, geopolitical shifts and conflict all remind us how crucial an issue this is and will continue to be, and it’s one we are deeply driven by,” said Peakbridge founding general partner Nadav Berger. “Democratising food sources, mainly with local production, is one key to addressing this on a practical level.”

Matilda Ho, founder and managing director of Shanghai-based VC firm Bits x Bites, outlined the need to transition from disruptive to transitional, sustainable innovation. “In 2024, you can’t keep losing money and expect to stay in business. We need to set a more realistic expectation and go back to the fundamentals,” she said. “True innovations for food come in step changes, and take time to build.”

Expanding on this, she added: “At the end of the day, the innovation that transforms the food industry doesn’t need to be fast and furious/quick and dramatic. We’d prefer to take a more humble mindset, and make it more gradual and less obvious.”

Reflecting on the overall figures, Burwood-Taylor acknowledged: “This might read as depressing news, and it should.” She warned that we’ll be seeing more companies shut down over the next few months. Within the alternative protein sector alone, for example, New Wave Foods, Ordinary Seafood, New Age Eats, Nowadays and Plant & Bean were forced to cease trading over the last 12 months.

“2024 is going to be a painful year for many, especially the more mature agrifood tech companies,” she said, before adding: “But it will also be an incredible year to invest in new companies that have been forced to rethink their business models and take a leaner approach; that’s healthy for the market and for valuations.”