What Do Asian Consumers Want From Plant-Based Meat? 4 Startup Founders Spill All.

10 Mins Read

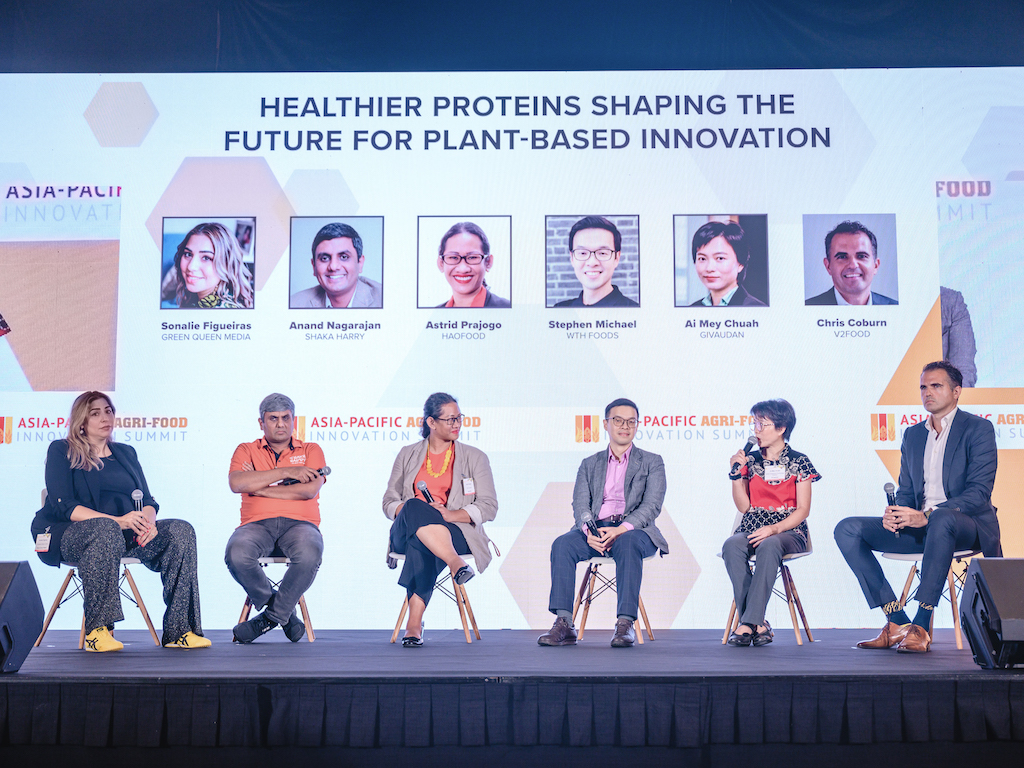

At a major APAC food tech conference in Singapore last month, I spoke to four alt-meat founders from India, China, the Philippines and Australia to find out what Asian consumers want from plant-based meat products.

Last month, as part of the Singapore International Agri-Food Week (SIAW), the Asia-Pacific Agri-Food Innovation Summit organized by Rethink Events welcomed over 1,000 global leaders to meet and learn about Asia’s agri-food system to “accelerate the transition to a climate-smart food system” as organizer Rethink Events states on the event website.

As part of the week’s programming, I chaired a discussion about the ‘Healthier Proteins Shaping the Future for Plant-Based Innovation’ on stage. Joining me were four founders and leaders from plant-based meat startups in the APAC region, each representing some of the biggest markets in India, China, the Philippines and Australia, as well as the APAC Science and Technology Director from one of the world’s leading flavour companies.

Our discussion spanned a range of topics, from how important are clean labels to whether Asian consumers are still actively purchasing these products. We talked about what factors influence decision-making, what new ingredients are being developed in the sector, and what brands can do to build confidence in the nutritional value and overall quality of plant-based products

Most of all, the question we were trying to answer was: what does the Asian plant-based consumer want? The key takeaway from the discussion is that each Asian market is unique and its consumers have very specific and very different needs.

The below transcriptions have been edited for clarity and concision.

Anand Nagarajan, Co-Founder at Shaka Harry on Indian Consumers

On the Indian plant-based meat consumer: India is not one market. We’ve got 1.4 billion people, so it’s important not to view the Indian market as one ubiquitous market. The relationship to meat is complicated. In terms of who our consumer is, we have a very simple definition: anyone who has an affinity for the taste of meat is the consumer we’re looking for. We are going after the two-thirds of Indians who eat meat. Culturally, a large percentage of the Indian population that still consumes meat would abstain from it for close to 150 days of the year for various reasons. Some people abstain from meat on certain days. Some people will not eat meat at home. Some people only eat meat when they travel. Some people won’t eat meat on festival days. But all these people may want something that’s a familiar taste. This is where we position Shaka Harry.

On creating products for specific occasions: How do we create salience in a customer’s life, rather than trying to over-intellectualize the conversation? If something needs a lot of education…it won’t scale. We can’t educate a billion people individually. Even if I were to take the 100-200 million high-end consumer market, I can’t sit down and educate every single one of them. Instead, we focus on occasions. How do I win breakfast? How do I win school lunch prep? How do I win at a Saturday family gathering? We’re saying: here’s a very good product, it’s priced well and it is tasty. We’ll give you an occasion for when you need to have this at home. And we find that a far easier method to scale, rather than pursuing micro-markets.

On whether Indians want healthier products: Do Indian consumers want healthier products? There’s a disconnect between what the consumer tells you they want versus what they’re ready to pay for. When they go into the store, and you give them two products, one being healthier but with a 20-30% price premium, they will choose the value product. That’s what we are seeing.

On We have an entire line of clean-label products coming out soon with easy-to-read, natural ingredients. Thanks to consumer insights, we’ve developed a millet range. Millets is something that traditionally Indians have consumed a lot and consumers have very positive connotations about it. But here the point is not to mimic a meat experience. Rather we’re saying: here’s a very good product. We’re going to ‘de-junk’ your regular roti and paratha. We’re taking the gluten out. We’re adding natural fiber. The initial market response has been fantastic. So de-junking regular meals and giving consumers a superior version of everyday foods is working really well.

Shaka Harry is a plant protein company based out of India with a range of ready-to-eat products designed for the Indian palate and for Indian cuisines.

Astrid Prajogo, Founder and CEO at Haofood on Chinese Consumers

On the Chinese consumer base: Our consumer base is very interesting. They’re not flexitarian, but they’re gym-goers. So they choose our product because they are looking for specific protein with specific features- that’s one type of consumer that is pretty loyal to us. We also have the forein vegan community. Although not a large group, they have strong purchasing power. They also have a voice, which can be powerful. Finally, we have the local Chinese vegan community as well, they continue to support our products.

On what Chinese consumers are looking for from meat: We have spent the last couple of years studying how Chinese consumers approach buying meat. Not just plant-based meat, just meat. That’s what we want to understand. And taste is absolutely key, especially umami. China is the land of tasty food, every single part of the country has great-tasting food. So first: taste – they demand great taste. Second is safety. McKinsey published research earlier this year that revealed that for Chinese consumers, health and safety are the most important. Part of safety is for a product not to contain ingredients that consumers deem less safe, like methylcellulose or added gums so our definition of clean-label is free from added artificial ingredients, be it binders or perseveratives. We combine different types of plant proteins and we work with fruit fibres, so we can make a clean-label product where the cost is actually reasonable- we’re down to under $3.5 per kilogram.

Haofood is a Shanghai-based specialist in Asian plant-based meat designed for Asian applications.

Stephen Michael, Co-Founder and CEO at WTH Foods on Filipino consumers

The Philippines is a pretty sizable country- we have over 110 million Filipinos, and it’s a very meat heavy culture. As a predominantly Catholic country, we don’t have any dietary restrictions, so I’m jealous of my Thai and Malaysian friends whose vegetarian market exists already. In the Philippines, it’s almost non-existent and that’s what we are up against. Culturally and traditionally, a lot of dishes are meat-based, so putting out a plant-based meat product might not be the best idea. We’re continuously trying to figure out what the Filipino consumer wants. It seems they see something as healthy when it is local with added functional benefits in terms of beauty or physical aspects. So for example, if plant-based meat products are helpful for slimming, or if eating these products can help radiate beauty- that’s a driver. The entry point for the Filipino market is health, more than whether something is plant-based. Sustainability and animal welfare are very, very far down the list in terms of our consumers adopting plant-based meat.

When Filipinos think about health, they go for descriptive words like ‘organic’ or ‘cholesterol-free’, ‘low sodium’, ‘low fat’, ‘low sugar. Adding to that, Filipino consumers want their food to be more fortified or to have a unique ingredient like a local oil. For example, we’re trying mungbeans as an additive to respond to that demand- it’s a local and natural ingredient. to add a more local and natural ingredient to that. Consumers want to avoid preservatives and flavor enhancers so they do look at the ingredient list and want a cleaner label as well. For more of our plant-based meats, we fortify with local proteins or local ingredients to give them a more local and healthier profile.

There’s actually been a bit of pushback with plant-based meats when we offer Filipino favourites like sisig and sausages and holiday hams, where Filipinos will go for the real thing instead of the plant-based version, which has been a difficult scenario. So we’re done pretending to be meat. Achieving something as close to meat as possible will require that long list of ingredients and our customers are looking at labels, and if they don’t understand certain ingredients, they deem it to be less healthy. So we are actually in the midst of a pivot in terms of products. We are decreasing the number of our ingredients for our second generation of products and we don’t try so hard to be the meat product. I believe in the alternative protein industry and I believe there will be increased demand and need for protein, so we’re looking into high-protein snacks in more shelf-stable formats. The Philippines is an archipelago shipping frozen meat across all the islands is a logistical nightmare. So it’s a triple challenge: how do you ship your products across an archipelago, while making them shelf-stable and reducing the number of ingredients so they can be clean-label?

WTH Foods is a plant-based alternative protein startup based in Manila.

Chris Coburn, General Manager APAC at v2food on Australian plant-based meat consumers

On why Australia is different from the rest of Asia: I would say Australia is a little bit different from the rest of Asia, where I think we’re still seeing animal protein as being aspirational. Consumers in the rest of the region are looking to purchase animal products now that there’s more wealth available and a growing middle class. In Australia, as in a number of the developed markets, we’re seeing this trend to be a reducetarian, where people who have reached peak meat consumption are probably looking to come back the other way. If you look at animal consumption per capita in Australia, obviously it’s at levels that are close to the UK and US, unlike the rest of Asia.

On v2foods’ Australian consumer base: I would say v2food’s consumer base is the conscious consumers, those who are looking to reduce their meat intake, so we have a different challenge to the rest of Asia. Probably half of our retail sales are from this younger demographic -the millennials / the single-income-no-kids / the double-income-no-kids / those coming into families over the next 10 years- those conscious consumers looking to reduce meat consumption and consume alternatives.

On clean labels: I think from a portfolio point of view, we’re looking at the clean-label issue in two different ways and trying to distinguish from those more indulgent occasions where consumers are looking for that great taste and probably a treat and those everyday occasions where people are looking for more healthy options. In the first group of our products, we have burgers and sausages, and we’re competing against animal protein products which are highly processed, and for those, we are really trying to drive taste as the priority for our target consumers. Our biggest fear is that sometimes our competitors’ products are not good, and consumers are having a bad experience. So we really feel like taste is important for the category of products like sausages, burgers, and nuggets.

v2food is Australia’s number-one plant-based meat company.

Ai Mey Chuah, APAC Science & Technology Director at Givaudan Singapore on Asian Consumer Tastes

Ultimately for our customers, the most important thing is taste. If their products don’t taste good, and don’t look appealing, they won’t get a repurchase by the consumers. So in our business, what we do is customize the solutions to meet the needs of their consumers from the regions that they are marketing their products to.

I would say that in APAC cost is still a very important factor. So while for our Europe and US business, clean-label and natural solutions are very important, for the APAC region cost is still the determining factor- we help our clients change their label to be more cost-effective, rather than clean-label, as our [clean-label] solutions tend to be more expensive.

Some markets like China have well-educated consumers who don’t like artificial ingredients or additives in their products, so when it comes to replacing ingredients like methylcellulose, Asia is slowly gaining traction and we have products in our portfolio like citrus fibre that can act synergistically with certain proteins to actually provide that texture that is meat-like, juicy and succulent.

Givaudan is a global leader in fragrance and flavour; the company develops tastes and scents for food companies all over the world.