3 Mins Read

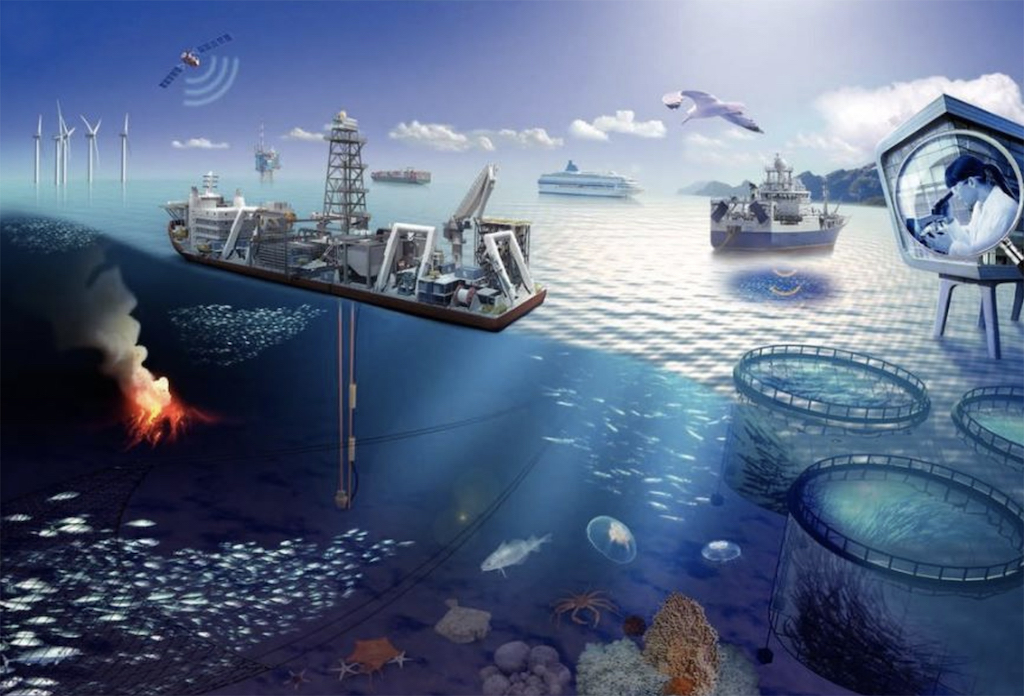

The Asian Development Bank (ADB) has called on Asia to begin focusing on building a new sustainable “blue economy”. The region’s development bank says that in order to preserve livelihoods and the planet, the continent must begin preserving the marine ecosystem and move away from the current “ocean economy” that exploits natural resources. It has proposed several financial initiatives to assist with the transition.

ADB says that immediate action must be taken against the current “ocean economy” that relies on destructive fishing and pollution practices. Instead, a new “blue economy” must be built, defined by the bank as the sustainable use of ocean resources for economic growth. It is characterised by a balance between livelihoods and marine ecosystem health.

Billions of people in Asia-Pacific – particularly poorer nations and vulnerable coastline communities – depend on healthy ocean ecosystems for their incomes, food and health. Due to climate change, pollution, destructive fishing and rapid coastal urbanisation, the productivity of our oceans has become increasingly threatened.

According to ADB’s 2019 ocean report, over 60% of the 8 million tonnes of ocean plastic waste comes from Asia, along with agricultural toxic pollutants and untreated wastewater. Meanwhile, global heating is causing rising sea levels, flooding and acidification, and unless immediate action is taken, we are looking at 90% of coral reefs disappearing and loss of all fish stocks within decades time.

In order to transition to a more sustainable “blue economy”, ADB announced several financial initiatives amounting to US$5 million over the next five years. These include “blue bonds” that will invest in coastal pollution projects, circular economy, green ports and marine renewable energy in order to generate new jobs and stimulate sustainable economic growth in ocean-dependent Asian communities.

ADB will also launch sustainability-linked loans to provide finance with the achievement of environmental targets, ocean risk insurance, and payments for ecosystem services (PES), which monetises the benefits of marine management and protection.

“The action plan is also to ensure that the United Nations Sustainable Development Goal 14 – Ensuring the livelihoods, health, resiliency, and food security – of billions of people in the region, are met,” said the bank in a statement.

Earlier this year, ADB launched a new venture platform to support and invest in startups in Asia offering tech-forward impact solutions to contribute to ocean protection and other Sustainable Development Goals (SDGs). Called ADB Ventures, the US$50 million inaugural investment fund under ADB Ventures has a 17-year fund life, and will specifically target early stage and growth stage cleantech, agriculture technology and health technology businesses that are working on climate and gender innovations.

With sustainability and awareness about ocean pollution reaching all-time highs in Asia, other funds are too looking to divert finances to address environmental crises. In December 2019, the Circulate Capital Ocean Fund (CCOF) was launched by Singapore-based Circulate Capital and is dedicated to alleviate the net financing gap of between US$28 to US$40 for each tonne of plastic waste to be collected and recycled across the five biggest ocean polluters in the world – China, Indonesia, Philippines, Thailand and Vietnam.

Lead image courtesy of Unsplash.