China Alt-Protein: 10 Things to Know About Protein Diversification in China – New Report

9 Mins Read

A new report by Asymmetrics Research outlines the opportunity for protein diversification in China, highlighting key active categories, overall trends and what’s in store for the future for alternative proteins in the country.

In August, research by Singapore-based firm Asia Research Engagement found that to align with a climate-safe future and decarbonise, alternative proteins would need to make up 50% of China’s protein consumption by 2060. It came amid a host of advancements in the country’s alt-protein sector, across cultivated meat, fermentation-derived protein, and plant-based food.

Now, Asymmetrics Research has published the third edition of its annual China Alternative Protein Products Market Landscape report, which highlights the key trends, challenges and opportunities for protein diversification in the world’s second-most populous nation.

“This year has been challenging in a China that is fraught with uncertainty – consumers, businesses and investors are generally spending more conservatively,” Huiyi Lin, chief insights officer at Asymmetrics Research, told Green Queen. “Nonetheless, there are opportunities for food products which offer good value both in cost and health benefits.”

She added: “Brands need to probe different consumer segments’ motivation and turn-off factors, and ultimately food needs to taste good. Fermentation and cell-culture protein technologies are at an early stage, the growth path would require support from regulators and commercial scaling partners.”

“In the post-pandemic era, consumers are placing greater emphasis on nutritional value and affordability,” said Jeremy Yeo, acting general manager of Beyond Meat China. “Additionally, there’s a pronounced shift towards products that prioritise health, flavour and environmental sustainability. ‘Green’ and eco-friendly options are not mere trends; they mark a profound evolution in consumer tastes and values.”

Here are 10 key takeaways from the China Alternative Protein Products Market Landscape report:

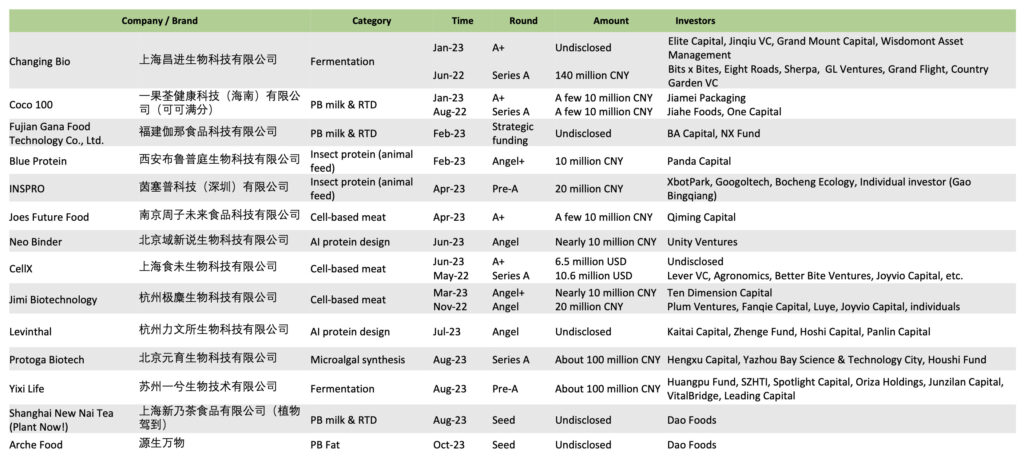

Alt-protein investment has been slower in 2023

Amid the wider investment squeeze in the global food tech category, China’s alt-protein industry has also suffered from a slower funding environment, which has been exacerbated by tough fundraising and macroeconomic conditions. Local investors are less bullish about CPG categories including food, while foreign investors are adopting a wait-and-see approach “due to geopolitical tensions, decoupling strategies and uncertainty”.

Plant-based meat – which had a relatively high deal flow in 2021 and 2022 – saw fewer investments in the past year, while larger deals have involved cultivated and fermentation startups. Interest in cultivated meat has increased due to high-level policy callouts, but it has been affected by cautious sentiments this year. Eventual investors usually tend to be experienced in biomedical fields. Additionally, Chinese meat giants are said to be paying attention to cultivated meat startups, but there hasn’t been any tangible action yet.

“Cell-based meat is gaining more attention in the capital market, and R&D and manufacturing costs will continue to fall with technological progress,” said Larry Lee, CEO of the China Plant-Based Foods Association.

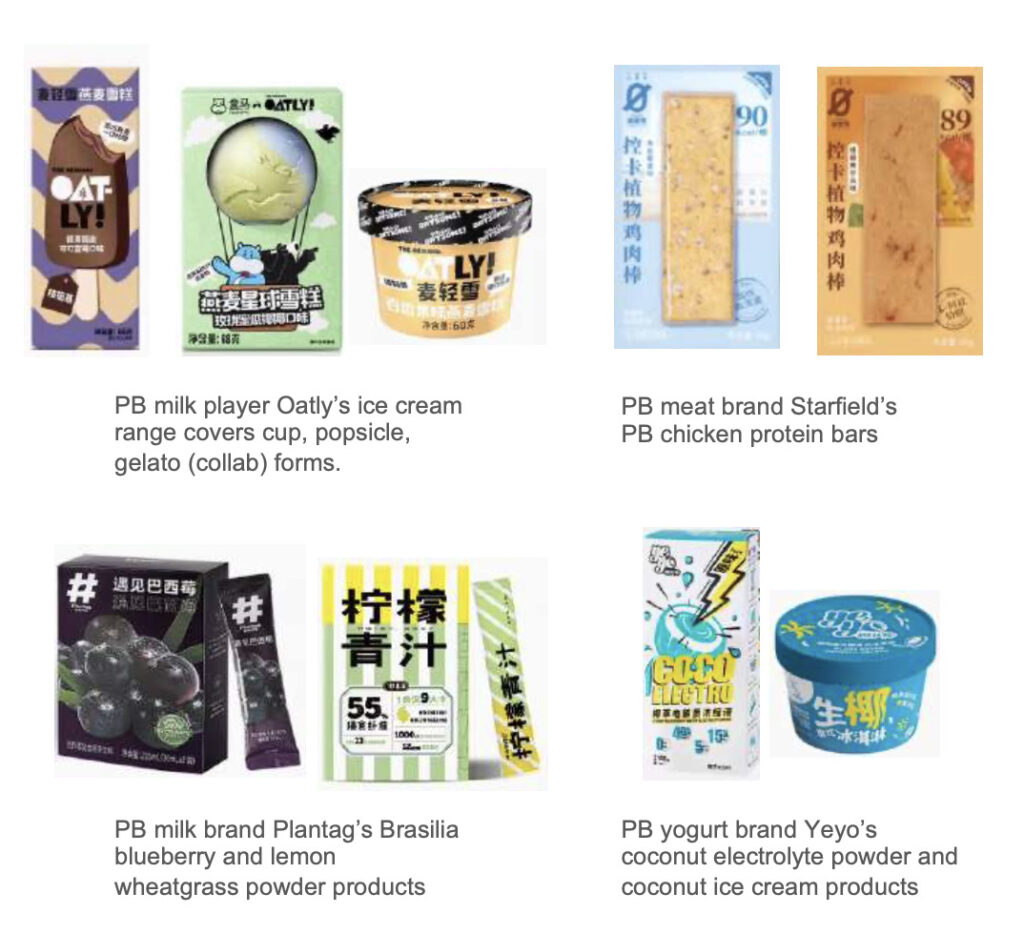

Plant-based milk, meat snacks and functional foods are key segments – but eggs and cheese are not

The report highlights a few key active categories, led by plant-based milk and ready-to-drink beverages, alt-meat snacks, SKUs and prepared meals, vegan yoghurt and ice cream, and functional protein foods. However, despite being the largest egg producer in the world, vegan egg replacement is a less active category, alongside cheese and cream.

“China’s plant-based milk market is experiencing a blend of tradition and innovation,” said Vivian Wang, founder and CEO of plant milk brand Vitalbox. “Enzymatic hydrolysis oat milk coexists with traditional soy milk and coconut milk.”

Alt-meat and milk brands are restructuring and diversifying

As a result of slow market penetration, high marketing costs and fundraising difficulties, the plant-based milk and meat markets have seen a reduced number of players, with many brands also restructuring adjusting their portfolios and brand positioning, and diversifying their offerings.

Echoing the global stagnation of plant-based meat, several startups in this space have downsized, suspended operations, or exited the market. Many multinational vegan players have changed team structures, personnel and strategies, but remain committed to the market. “The market will need more high quality, diversified protein products,” said Cecilia Zhao, impact programme manager at food consultancy Lever China.

“Although adoption of plant-based meat in China lags behind Western markets, there is a dedicated consumer base motivated by health, safety and dietary diversity, necessitating solutions to taste, additives and cost issues,” added Astrid Prajogo, founder and CEO of Haofood. “Targeting specific consumer groups with customised products and marketing approaches holds great promise in this evolving market.

Health consciousness is high on the agenda

Brands are honing in on the health aspects of their products – similar to the shift seen in the international market – with marketing messages a key outlet for doing so. Many plant-based milk brands highlight ‘no sugar/cholesterol/trans fat’, ‘good for brains/eyes’, and ‘high protein/calcium’ alongside cleaner labels, while some use functional ingredients like DHA, collagen and peptide to target specific consumer needs.

Likewise, plant-based meat products highlight attributes like ‘no trans fat/cholesterol’, ‘fewer calories’, ‘dietary fibre’ and ‘natural ingredients’. It chimes with the results from a 1,206-person study last year, which found that health is the stronger driver of plant-based meat purchases for Chinese consumers.

“China is promoting healthier and more nutritious food options in response to the Healthy China policy,” said David J Ettinger, chief representative officer at law firm Keller and Heckman Shanghai. “Therefore, foods offering health benefits and high nutritional value are going to likely lead the way. Chinese consumers will look to healthier options, like alt-proteins, so it will be up to the alt-protein industry to demonstrate that these novel foods provide another nutritious option for consumers.”

Prices and spending are in full focus

Across the country, many middle-income consumers are now reining in their spending on impulse purchases and looking for better value on products. Prices of pork and beef have fallen, which has ramped up the challenge for plant-based brands trying to sell to food service, which is a cost-sensitive approach. Many have lowered their product prices by 10-30% in the last year as a result.

Raw milk prices have dropped too, which means initiatives like Starbucks offering oat and almond milk at price parity are paramount. “Overall, consumers are more price-sensitive,” noted Blue Canopy Biotech’s Chenfeng Lu. “Despite this, the consumption of healthy foods is not strongly affected by the economic environment.”

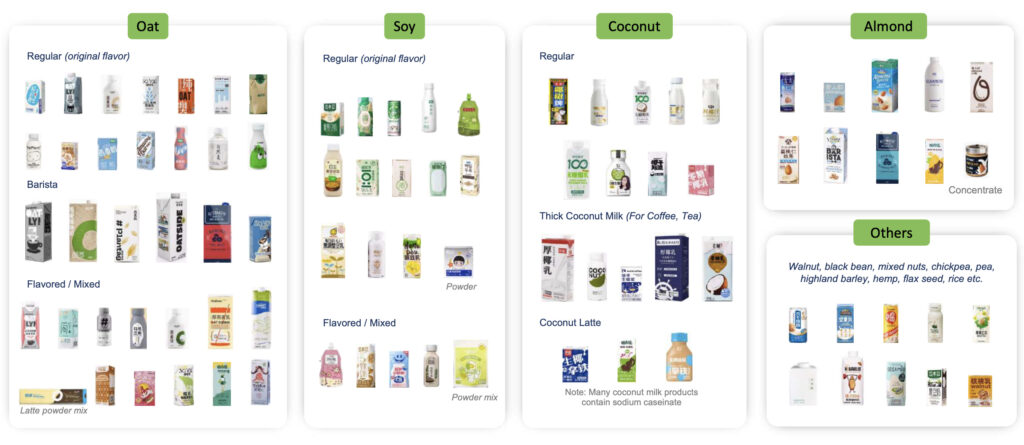

Oat milk reigns supreme

Despite soy being the traditional milk alternative in China, oat milk has really risen up the ranks and now leads the way in terms of form and flavours, with the widest product range out of all plant-based milks. This is followed by soy, coconut, almond and a smattering of others.

Oat milk’s utility in coffee is a big reason for its dominance. Most barista milk products that highlight ‘frothability’ as a key feature are oat-based, and thanks to brands like Oatly and Luckin Coffee, tier 1 and 2 cities have seen oat (and coconut) become common latte choices – though the report highlights an expansion of B2B applications beyond coffee as a key challenge.

“The market is still in its early stage,” said Oatly China’s sustainability director, Chloe Lin. “It is crucial to educate and guide consumers, listen to local consumer needs, work closely with upstream and downstream value chain, and conduct in-depth research in raw material quality, processing technology, production equipment, product taste and nutrition.” (The company has had its share of struggles in China recently.)

Education and regulation remain major hurdles for fermentation

Both biomass and precision fermentation have attracted interest, but product application needs to be stepped up, and production needs scaling. Most companies are focused on a single type of fermentation tech, but firms like Changing Bio and Blue Canopy are among the few working with both precision and biomass fermentation.

Some startups do have a diversified portfolio, with products and applications in cosmetics, industrial and biomedical sectors too. The report calls for increased application for B2B consumers, including functional products and blended meat (like Mush Foods is doing).

Precision fermentation, in particular, needs increased consumer awareness and regulatory approval, especially when it comes to GMOs. In May 2022, China’s National Health Commission approved single-cell green alga Chlamydomonas reinhardtii as a new food raw material in May 2022 – a positive sign, albeit for a non-GMO ingredient.

Cultivated pork and traditional meats are high-priority

As the world’s largest pork producer, it’s hardly a surprise that pork is the most popular cultured meat being produced in China, followed by chicken, beef and seafood. Companies like CellX and Joes Future Food are making cell-cultured pork, while Jimi Biotech makes cultivated chicken.

Additionally, some producers are making high-priced animal parts used in traditional Chinese cuisine, such as deer antlers (Jimi Biotech) and fish maw (Avant Meats).

Cost and regulation are key barriers for cultured meat

As is the case globally, scaling up production and reducing costs are the main obstacles facing cultivated meat (alongside regulatory approval). CellX opened a 2,000-litre pilot facility in August, while Joes Future Food produced pork fat in a 500-litre bioreactor in September. Meanwhile, some are developing serum-free or non-animal culture media to reduce costs – Jimi Biotech’s serum-free medium is made from soybean and corn extracts.

Meanwhile, China doesn’t have a clear regulatory framework, something that’s still under review by the National Health Commission and China National Center for Food Safety Risk. This is why some companies are focusing on Singapore or the US – the only two countries that have approved the sale of cultivated meat.

Policy support for alt-protein in China has increased

Government support for alt-protein has become more prominent in the last two years in China, with measures being formed at local, provincial and regional levels. In February, for example, the annual Central No. 1 Document mentioned a diversified food system of animals, plants and microorganisms.

In May 2022, the country’s 14th five-year plan for bioeconomy development highlighted an advancement of synthetic biology, and exploration of man-made protein and novel foods – two months after President Xi Jinping called for a Grand Food Vision that included the plant-, microorganism- and animal-based protein sources. And in December 2021, the 14th five-year plan for agricultural and rural tech development called for research in cultivated meat, synthetic egg and dairy, and recombinant proteins.

“Government guidance and policy support is necessary – it would be best to have subsidies for start-ups and R&D institutions to raise the level of innovation,” said Lee from the China Plant Based Foods Association. “Investors should be more patient, avoid following trends blindly with unrealistic expectations of rapid returns. Companies should focus on the product based on consumer needs, step up R&D, improve product quality and differentiation.”

“In the post-pandemic slower growth environment, alternative protein players with products in the market need to provide tasty and high-value offerings, which fulfil specific consumer segments’ health and nutritional wants,” added Huiyi. “In the longer term, new technologies of fermentation and cell-based culture, and blended products hold interesting possibilities.”