Hooked Foods: Swedish Vegan Seafood Startup Docks Into Germany with Plant-Based Salmon & Tuna

6 Mins Read

Months after teasing an expansion into Germany, Hooked Foods has delivered on that promise with a listing in 400 Rewe West stores across the country. The Swedish vegan seafood maker is launching four SKUs – including its Salmoonish and Toonish analogues – in Europe’s largest plant-based market.

Hooked Foods has landed on German shores with its range of vegan seafood analogues. The Swedish startup’s tuna spreads are now available in 400 Rewe West stores across the country and the company is in discussion to launch its Originals range of fish flakes (Toonish & Salmoonish) in February next year.

It caps off a year where the startup reeled in more than $1.3M in funding, including over $700,000 from a crowdfunding campaign in June. At the time, Hooked announced its intention to move into the German market, which is the largest for plant-based food in Europe. More recently, the company joined the inaugural cohort of Future Ocean Foods, a new global association of 36 companies to advance the alternative seafood sector and increase awareness about the health and environmental benefits of these products.

“At Hooked, we’re thrilled to finally bring our Swedish plant-based seafood range to Germany,” said Hooked co-founder and CEO Tom Johansson. “Our success in the Nordics has demonstrated a growing demand for innovative, sustainable alternatives, and we’re excited to introduce our iconic Swedish brand to German consumers.”

Clean-label vegan seafood

Hooked’s retail offerings include Salmoonish, Toonish and two mayo spreads made from the latter. Its vegan tuna combines a dual protein base of pea and algae with pea fibre, sunflower oil, aromas and natural colouring, while the salmon blends soy, pea and wheat protein with pea fibre, vegetable oils, algal oil, aromas, and natural colours, and is fortified with vitamins and minerals.

The former contains 17.1g of protein per 100g (versus 26g for conventional bluefin tun), while the latter boasts 17g of protein (compared to 20g for traditional salmon) – but being plant-based, Hooked’s seafood offerings contain over 3g of dietary fibre per 100g each, something that’s missing from their marine counterparts.

The relatively clean-label formulations – especially for the tuna analogue – are a win for the brand in a country whose consumers find shorter ingredient lists essential. A 1,026-person survey by retail association BVLH found that 66% of Germans would be deterred from buying plant-based products if they contained additives and extra ingredients – a number that rises to 72% for flexitarians, who would be a key target group for Hooked.

Meanwhile, the two spreads – Toonish Mayo and Toonish Curry – are a mix of its plant-based tuna (albeit with a different recipe, using soy and wheat protein) with vegan mayo and flavourings.

Hooked had already penned an agreement with sales agency Ooha, which has expertise in the German market, when announcing its crowdfunding round. “After extensive exploration and discussions with several vegan seafood companies, it became clear that Hooked possesses all the key ingredients for success,” an Ooha spokesperson said. “With their talented team, strong brand, and top-notch products at competitive prices, Hooked stands out as the ultimate challenger ready to conquer Germany.”

Speaking of price, the Toonish and Salmoonish retail at €3.19 for 180g, while the spreads set you back €2.79 for 120g. This is cheaper compared to competitors like Nestlé’s Vuna, which costs €4.29 for 175g, and BettaFish’s Tu-Nah, which is priced at €2.99 per 130g jar. Meanwhile, Revo Foods’ smoked salmon is priced at €4.49 for an 80g pack, and its tuna spread is more comparable with Hooked’s, at €2.99 for 140g.

Hooked makes its seafood analogues using high-moisture extrusion technology (HME). None of the other three employs this tech – Nestlé and BettaFish use textured vegetable protein (TVP), while Revo Foods uses fibre dispersion tech for some of its products (which involves combining plant proteins with individual fibre strands). HME allows companies to introduce more complex muscle fibres and flakiness and is typically a more expensive technology than TVP, so making its products cheaper than its competitors is a big win for Hooked.

Vegan seafood is expanding, but still has a long way to go

Conquering Germany would be a big feat indeed, given that it’s the European leader in retail sales for vegan food. The country saw purchases in this category grow by 11% from 2020-22, reaching €1.9B, according to the Good Food Institute (GFI) Europe. It’s also why Hooked chose this market for its European expansion. “We have a clear opportunity to deliver value to consumers in the market,” Johansson told Green Queen.

Additionally, Germany also boasts a large flexitarian population, with some putting it as the largest in the world – estimates have ranged from 40% all the way to 55%. This is an important consumer base for brands like Hooked – according to Mintel, 90% of Germans eat fish, and 28% of people have switched from meat to seafood for health reasons (though seafood itself has problems with high mercury levels, antibiotic use, sea lice infestation, and microplastic ingestion). Take into account the 59% of Germans who want to reduce their meat consumption, and one can sense that there’s a huge opportunity.

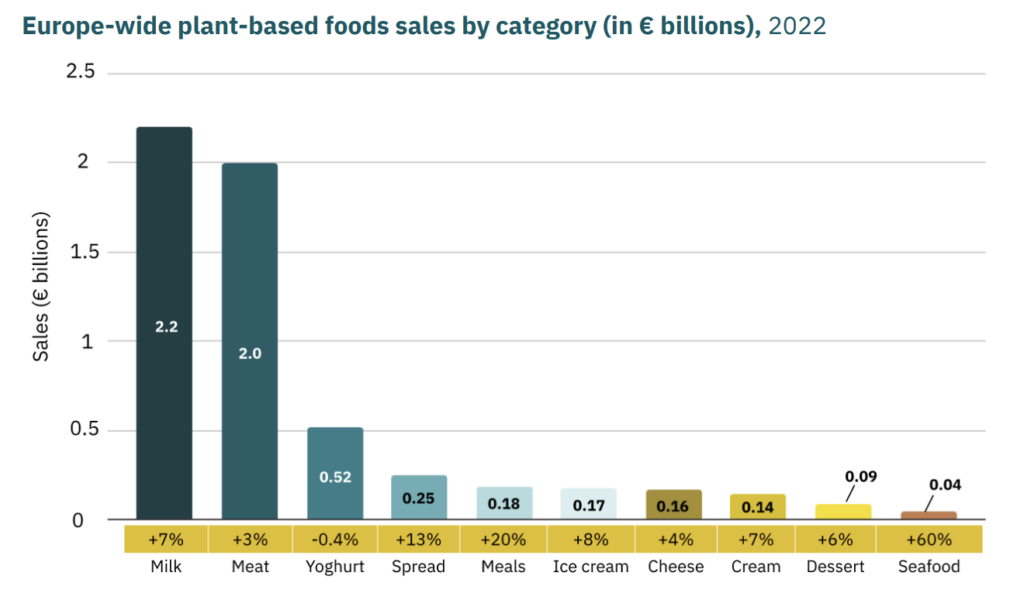

The German seafood market is set to grow by 3.2% annually to reach $9.59B in 2028. Alt-seafood players would be looking to capture a piece of the pie, after experiencing exponential growth across Europe in the last couple of years. While retail sales for meat alternatives have fallen, vegan seafood purchases increased by 60% from 2021-22 (and a whopping 326% since 2020), as per GFI analysis.

It is the fastest-growing plant-based category, as well as one of the only ones that witnessed a drop in average unit prices (down by 4% in 2022). Having said that, it still makes up for a fraction of the overall plant-based market (0.75%) in Europe, signalling that there’s still a long way to go.

The brand is looking into foodservice too. “However, we found most success with retail in the Nordics, so we will continue focusing on retail, but are of course open to partnering with forward-thinking restaurants in Germany,” noted Johansson. He added: “We are focusing 100% on Germany right now. We will start in the western region to create a success case. Once we have it, we will continue to expand to other regions in Germany. Hopefully, [by the] end of 2024, we will be on the shelves in the most important regions in Germany.”

Hooked, which launched in 2019 and has raised over $6M in total funding, will be helped in its mission to convert the 12% of Germans who eat fish thrice or more per week by the country’s plant-forward nutrition strategy. Its food and agriculture minister Cem Özdemir says the government intends to build a comprehensive nutrition strategy to promote food system changes via early education and accessibility initiatives.

Other recent seafood developments in Germany include the EU-wide launch of Nestlé’s marine-style crispy fillets and nuggets and the unveiling of Esencia Foods’ whole-cut mycelium whitefish at the Anuga food fair in Cologne. Rewe Group’s Austrian vegan store Billa Pflanzilla, meanwhile, saw the debut of Europe’s first 3D-printed meat alternative, a salmon fillet by Revo Foods.