The State of European FoodTech: Funding Declines, More Deals, Alt-Protein Wins & Promising Future

7 Mins Read

Amid a backdrop of a fall in food tech investments globally, Europe also suffered a decline – but the number of financing deals went up, with food science and agtech funding on the rise, according to DigitalFoodLab’s 2024 State of European FoodTech report.

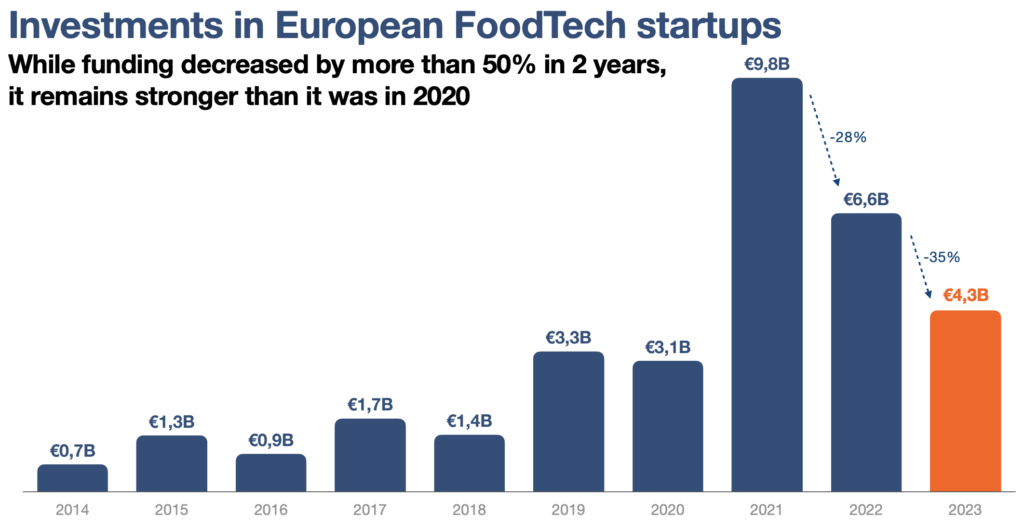

Food tech startups in Europe attracted €4.3B in funding in 2023. While this was a 35% decline from the year before – and a 56% drop from 2021 (when financing in this sector peaked) – this region is still much less affected by a lack of funding than other regions, given that global food tech investments fell by nearly 56% from 2022-23.

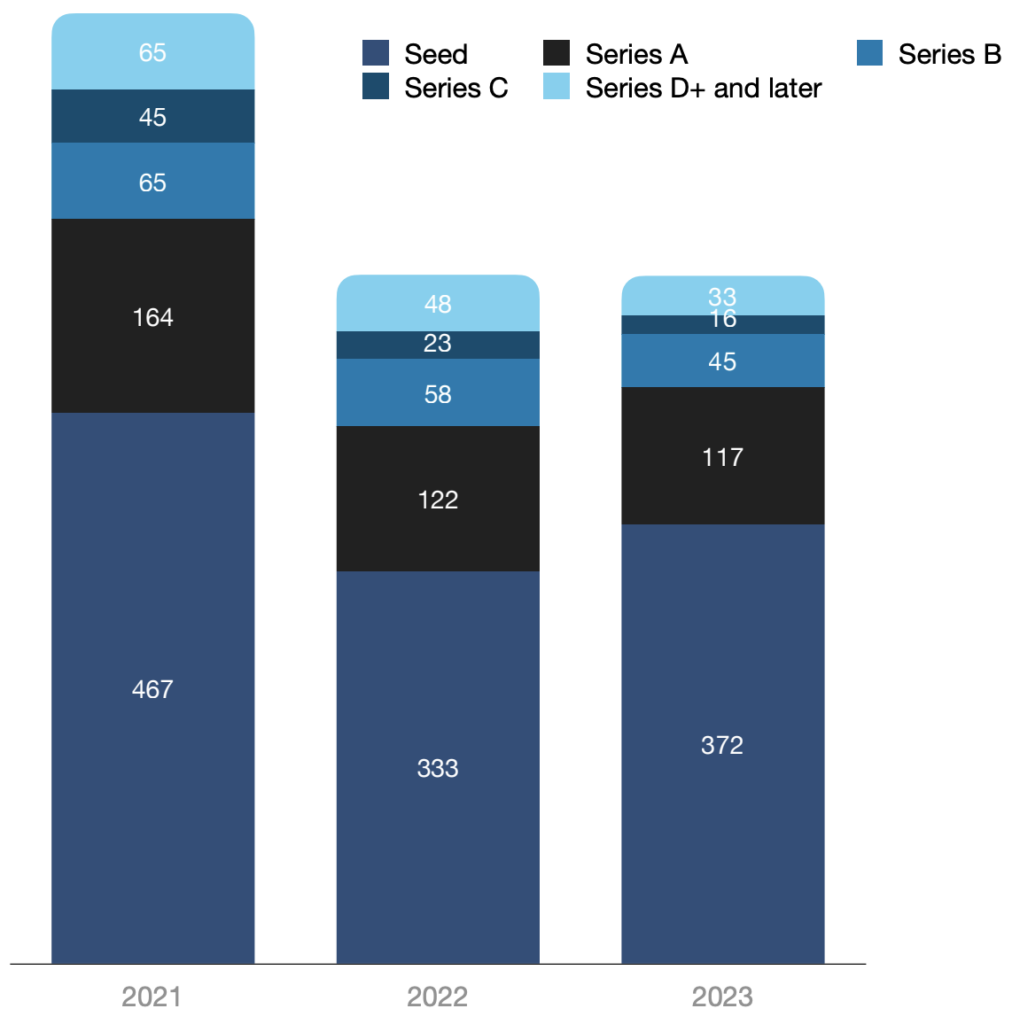

This is according to research by DigitalFoodLab for the seventh edition of its State of the European FoodTech Ecosystem report. The French consultancy revealed that despite the decline in capital, the number of deals actually increased, going up from 660 in 2022 to 690 last year, which signals that the decrease in funding is due to a drastic reduction in large deals.

Moreover, the numbers show that – given the unprecedented rise in funding in 2021, thanks to a surge in quick-commerce deals in the midst of the pandemic – food tech investments in the continent are stabilising. Last year’s total was 39% higher than 2020 levels, thanks to an uptick in Q3. Plus, Europe’s long-term share of food tech funding is on the rise – in 2020, it accounted for 14% of all capital injected into this industry, but now, that has shot up to 32%. This shows investors are “still very active in Europe” and betting on “startups with an edge to surf long-term trends”, according to DigitalFoodLab.

Here are the key takeaways from the State of European FoodTech report.

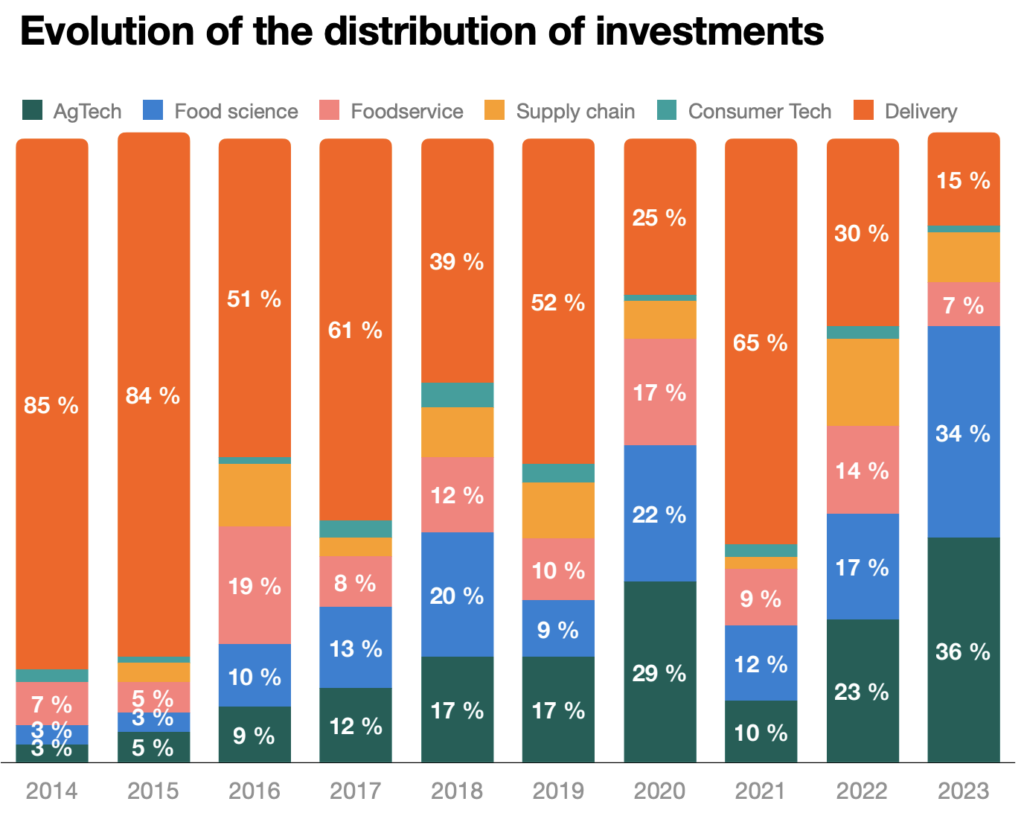

A shift away from delivery

Delivery-oriented startups – which commanded 65% of all food tech financing in Europe in 2021 – witnessed a steep 90% drop in investments in 2023. Now, this sector only commands 15% of the share, no longer a leader in the food tech ecosystem.

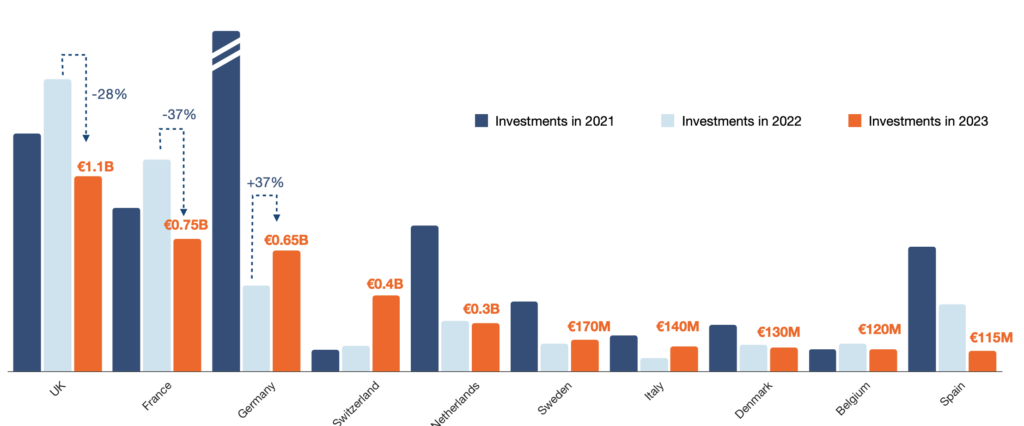

This can be seen in country-wide trends as well. Germany, known for its focus on delivery startups, pumped €3.1B into these companies in 2021, but only €650M last year. That’s incidentally also the total sum attracted by delivery businesses across Europe in 2023.

Agtech startups top the charts

It was a good year for agtech startups, the leading category for food tech funding in Europe. They accounted for €1.5B (36%) of the share, nearly 5% higher than in 2022. It includes subgroups like ag biotech (which secured the highest sum), farm management, animal feed, indoor farming, ag marketplaces, and farm robotics. Farm management startups gained the second-highest number of deals overall.

Sustainable fertiliser company Atlas Agro was the recipient of the largest capital amount in the entire food tech sector last year, securing €325M. This was twice as high as next best within the agtech category, French insect protein company Ÿnsect (€160M).

Indoor farming startups raised less money, mostly due to a transition from raising capital to create farms to raising much less cash to develop tech for others to use in their indoor farms – Italy was the notable exception here. All other categories performed well, benefitting from a sustainability push and the need for large food companies to reach climate neutrality pledges.

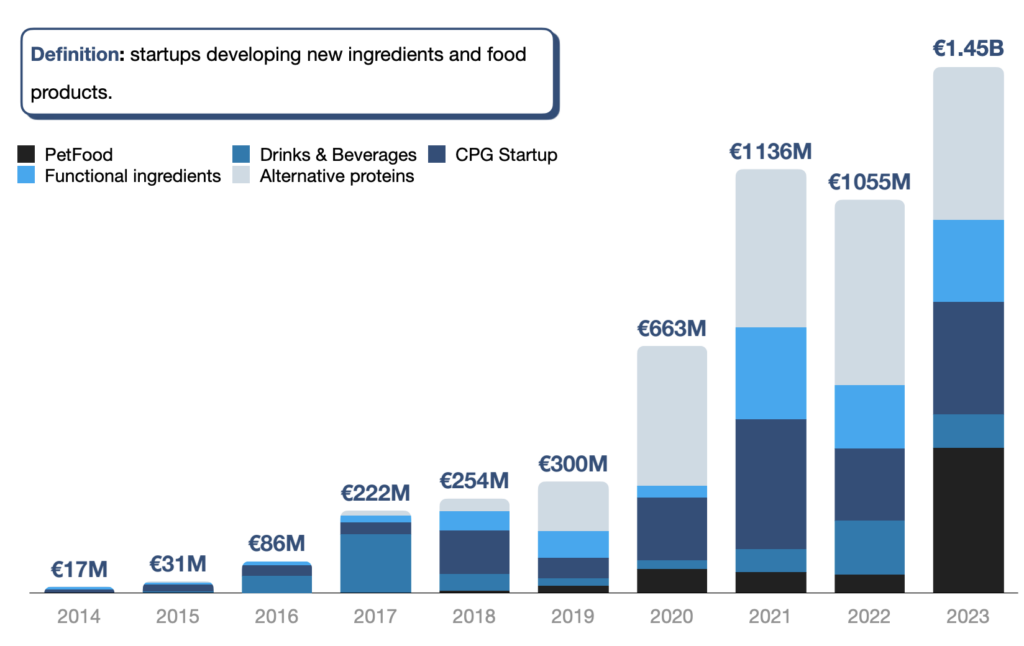

Alternative proteins attract more investment

Despite sales declines in many countries and a weakening of consumer confidence due to their association with ultra-processed foods and successful misinformation campaigns from the livestock industry, the European alternative protein sector actually saw a hike in investor interest, as part of DigitalFoodLab’s food science category (which also includes pet food, functional food, beverage and CPG startups).

Investment in this category reached an all-time high, amounting to €1.45B (a 37% rise from 2022). These companies’ total funding share was closely behind agtech businesses at 34%, with CPG startups seeing the highest number of deals, and alternative protein coming third on that list. The latter additionally secured the second-highest amount of money in Europe’s food tech sector last year, followed by pet food startups – thanks to deals for Enough (€43M), Myriameat (€43M), Umiami (€35M), Meatable (€33M) and Moolec (€30M).

Capital injections mostly happened in the second half of 2023 in this category. “There was a wave of doubts about the potential of alternative proteins that was resolved by the decrease in inflation,” states the report.

UK maintains its continental stronghold

Despite a 33% year-over-year drop in funding, the UK is still far ahead of the rest in Europe, with startups here attracting €1.1B in investment last year – compared to 2020, that’s a 48% hike. This was driven by the food science category, which attracted half of this total sum, and 67% of the deals – thanks in large part to the €320M investment round (and acquisition) in fresh dog food startup Butternut Box.

The UK is followed by France (€750M) and Germany (€650M). “The French and British ecosystems have done surprisingly well in 2022 and are still above where they stood in 2020,” the report notes. London and Paris remain in a tight race as the top hubs for food tech financing, with the latter just barely edging the British capital.

Early-stage startups are more attractive

There was a notable shift in the distribution of investments across company stages. Early-stage startups experienced a much smaller decline (12%) than late-stage, post-Series A companies (49%). In fact, the number of investments in younger companies increased, with seed deals up from 333 to 372. DigitalFoodlab calls this “proof of entrepreneurs’ and investors’ appetite to bet on food tech”.

Last year was the first time in 10 years Europe didn’t produce a unicorn (a privately held company with a valuation of over $1B). However, there were two IPOs: Moolec and salt alternative company Microsalt. But they have had mixed fortunes, with the former losing more than 80% of its share price since trading on the Nasdaq in January 2023, and the latter gaining by more than 50%.

Regulation remains a thorn in the flesh

Looking at the positives, DigitalFoodLab noted how external investors are now betting on European startups. “While unfortunate in its success, the emergence of quick-commerce in Europe helped to put the old continent on the map,” the report states.

Moreover, European-headquartered companies are now investing and partnering with local players, instead of looking to the US first. And public money has helped national ecosystems emerge pre- and post-pandemic, as well as helped many startups avoid bankruptcy. “Now, plans to boost the bioeconomy (with applications in agriculture and food such as bioinputs and proteins) will be critical for the next stage,” it suggests.

That said, there is certainly room for improvement. Beyond a few companies (mostly D2C brands), it’s “extremely hard” for most startups to grow across borders. There also needs to be coherence between national and EU-level plans. “Most countries support innovation, but they do it with different schemes, each requiring startups to submit lengthy applications,” explains the report. While things are moving in the right direction, it notes that it isn’t yet obvious for European entrepreneurs to know where to establish their startups.

Finally, regulation remains a “cloud in the sky”, with progress slower than in other continents. While it has boosted some categories – like plastic alternatives – it is “hindering innovation in alternative proteins”. This is most prominently seen in Italy’s cultivated meat ban, and several EU countries’ attempts to restrict these novel proteins before they even enter the market.

“European consumers are less keen than others to experiment with new food technologies, and the fact that the regulation is quite stringent may have some positive aspects,” said Matthieu Vincent, partner and co-founder at DigitalFoodLab. “I’d even say that there is no reason to be worried. Actually, startups in precision fermentation, biomass fermentation, or cellular agriculture don’t have the volumes to sell their products on a meaningful scale.”

He added: “As for plant-based regulation on naming, that’s something we can also observe in the US, where this debate is getting more political. It shows a growing gap between supporters (Northern Europe countries) and others.

“Again, I am not too worried. As for other food trends, when alternative proteins will get more adopted in Northern Europe, the trend will emerge in Southern Europe and then politicians will follow consumers on this topic.”