Upcycled Cacao Fruit Juice, Anyone? Investors Gave Swiss-Ghanaian Startup $15M to Scale Koa Pure

5 Mins Read

Swiss-Ghanian startup Koa has raised $15M in Series B funding to scale up its upcycled cacao business, develop more products and intensify regenerative agriculture practices to involve over 10,000 more farmers and address the climate footprint of the West African cocoa industry.

Koa’s $15M Series B round takes its total funds raised to $25M. The upcycled cacao startup makes products from the fruit of the plant, and its latest investment round involves both returning and new investors.

It was led by the Land Degradation Neutrality (LDN) Fund from global asset manager Mirova, who injected $9M (an existing investor). The Regenerative Growth Fund 1, which invests in climate tech solutions, was also a participant, alongside contributions from other new investors and support from existing shareholders, including Haltra, which led the brand’s Series A round in 2021.

“We are proud to have closed our Series B round in this challenging market environment for start-up funding, while at the same time having found once more like-minded investors that are fully aligned with our mission and ambition to expand and create more impact around the cocoa fruit,” said Fabien Nizard, head of corporate finance and investor relations at Koa Switzerland.

Cocoa’s climate question

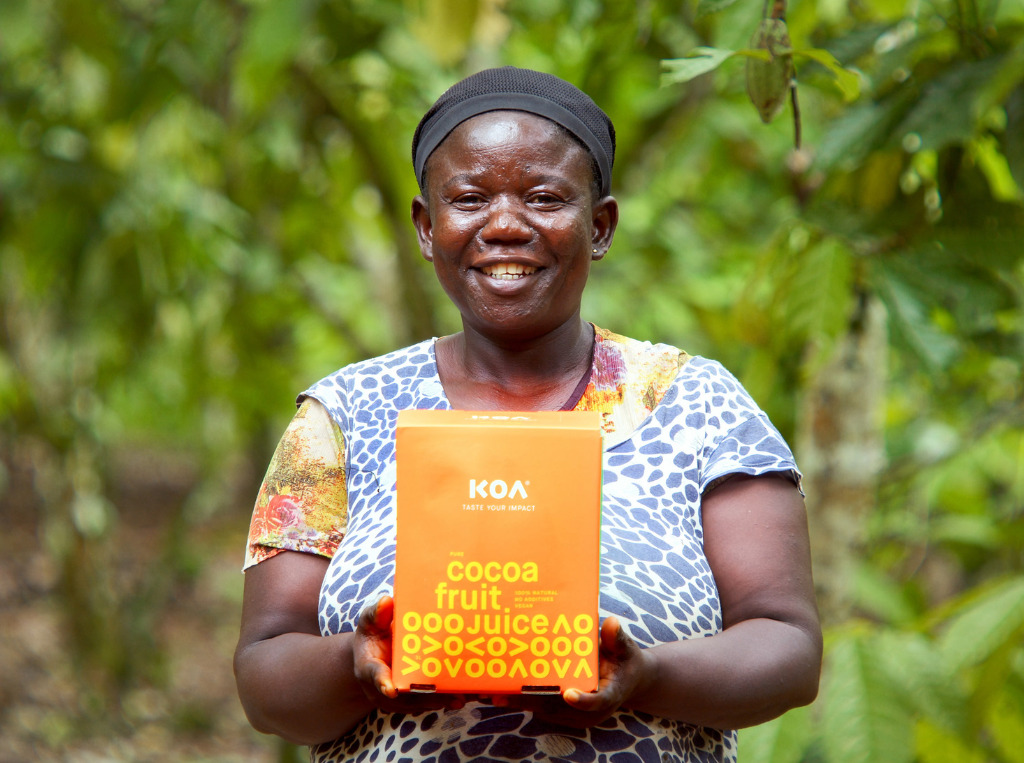

Koa makes a cacao fruit juice called Koa Pure, alongside a Koa Concentrate 72° (a reduced syrupy version of the juice) and dried cacao fruit powder for other food manufacturers. West Africa is home to the two largest cocoa producers in the world – with Ivory Coast and Ghana accounting for nearly two-thirds (63%) of the global share.

But the cocoa industry is notorious for its impact on the climate (including deforestation) and labour issues. One study found that the UK and Germany are driving deforestation primarily in Ghana and Ivory Coast, where over 85% of forest area has been lost since 1960. And in the US, the Biden administration was sued in August to block imports of cocoa harvested by children in West Africa, which has been linked to the chocolate used by brands like Hershey’s, Mars and Nestlé.

Apart from deforestation, cocoa production comes at a heavy cost to the climate. The only food worse than dark chocolate in terms of supply chain emissions is beef. In addition, cocoa beans have one of the highest carbon opportunity costs – the amount of carbon lost from native vegetation and soils to produce food.

What exacerbates this issue is the non-cocoa bit of the cacao plant. It’s estimated that 70% of the cacao fruit is wasted during production, but it’s a superfood that contains flavonoids and regulates blood pressure, prevents clots and, enhances blood flow to the brain and heart. This is where brands like Koa come in: it works closely with smallholders in Ghana to reduce on-farm food waste, generate extra income, and bring new ingredients to the food industry.

Founded in 2017, the company’s Series B round comes just months after it inaugurated a cacao fruit factory in Akim Achiase in east Ghana. The new plant allows Koa to increase its production by tenfold and generate income for 10,000 additional farmers, while the equity funding will enable it to scale its operations, develop more products and expand its distribution and marketing abilities.

“The Series B round provides Koa with the opportunity to continue our growth path with our existing operations, while at the same time allowing us to further invest into R&D and innovation projects that create a truly sustainable cocoa value chain,” said Francis Appiagyei-Poku, finance and administration director at Koa Impact Ghana.

Helping the West African cocoa industry

The Swiss-Ghanaian startup is further expanding its operations by ramping up its upcycling and regenerative agriculture practices, which it says is “a necessity in light of deteriorating soil fertility and the high carbon footprint associated with traditional cocoa farming in West Africa”.

Koa adds that there are several reasons why farmers have been struggling to uphold their yields in the face of climate change, chief among them being poverty – about a quarter of its population lives below the poverty line – and a lack of training in sustainable agriculture practices. This is why it wants to dig deep into regenerative farming, with which it hopes to increase the resilience of cocoa farms and reduce the industry’s climate impact.

In early 2022, the company partnered with Germany’s Seedtrace and South Africa’s MTN Group to create a blockchain-tech-led approach to enable “tamper-proof” transparency across the value chain. “Instead of having a person enter information on the blockchain, it links the data from mobile money transactions,” explained Appiagyei-Poku. “This combination allows us to verify additional farmer income, deliver full proof and increase trust among stakeholders.”

Koa co-founder and managing director Anian Schreiber added: “We want to get rid of long, non-transparent supply chains. Instead of claiming good practices, we put our cards on the table to let the consumers witness each transaction to farmers.”

Other companies innovating with cacao fruit include Barry Callebaut’s Cabosse Naturals (Switzerland), Blue Stripes, CaPao (both US), and Pacha de Cacao (the Netherlands). Meanwhile, some are forgoing cacao and cocoa altogether, using alternative ingredients with traditional fermentation processes to emulate chocolate, with London-based WNWN Food Labs, Italy’s Foreverland, German startup ChoViva, and US brand Voyage Foods the leading players in this space.