Global Food System Carbon Footprint Will Worsen, Transition To ‘Plant-Based Food Inevitable’ Says Credit Suisse Report

5 Mins Read

In a new report on the investment case for a sustainable food system, analysts say that the plant-based food transition is “inevitable” and will bring about new opportunities for investors and businesses across the food supply chain. Released by the Credit Suisse Research Institute (CSRI), the report also identified the wider alternative protein industry, sustainable packaging and novel farming technologies as key sectors poised for growth, predicting that the meat and dairy food replacements sector will grow 100 times by 2050.

Researchers at Credit Suisse believe that there are ample opportunities to be made as the world shifts towards a sustainable food system, in a new report published on Tuesday (June 8). The report, which examines the discrepancies between food production, food waste, greenhouse gas emissions and nutrition and health crises, estimates that these interrelated issues in the current food system amount to losses of US$13.6 trillion every year.

“Food production, and importantly consumption, needs to change significantly in order to address these challenges,” wrote the analysts, highlighting the rapidly growing carbon budget that the food system is set to take up in the coming years as the world’s population grows.

Already, food production and consumption makes up 20% of global greenhouse gas emissions, the bulk of which is driven by animal agriculture and food waste. As the planet approaches 10 billion people by 2050, food-related emissions are set to increase from current levels by 46% while land use will rise by 49%, which is “incompatible with the need to achieve a net-zero emission environment globally” by then. Existing food distribution problems will also be exacerbated without drastic change, with still 700 million people currently considered malnourished while nearly 40% of the adult population globally are overweight or obese.

“Challenges associated with malnutrition and the environmental footprint could partly be addressed by targeting food loss and waste,” said the researchers, adding that “change in diet towards one that is plant-based appears inevitable if the global food system is to become more sustainable.”

These two issues are especially relevant to richer developed nations, where countries are on average scoring “worse on diet patterns and food waste whereas emerging countries need to address food loss and general life quality.” France, Netherlands and Canada currently score the best according to the Food Sustainability Index, while Russia, Bulgaria and the UAE are among the lowest.

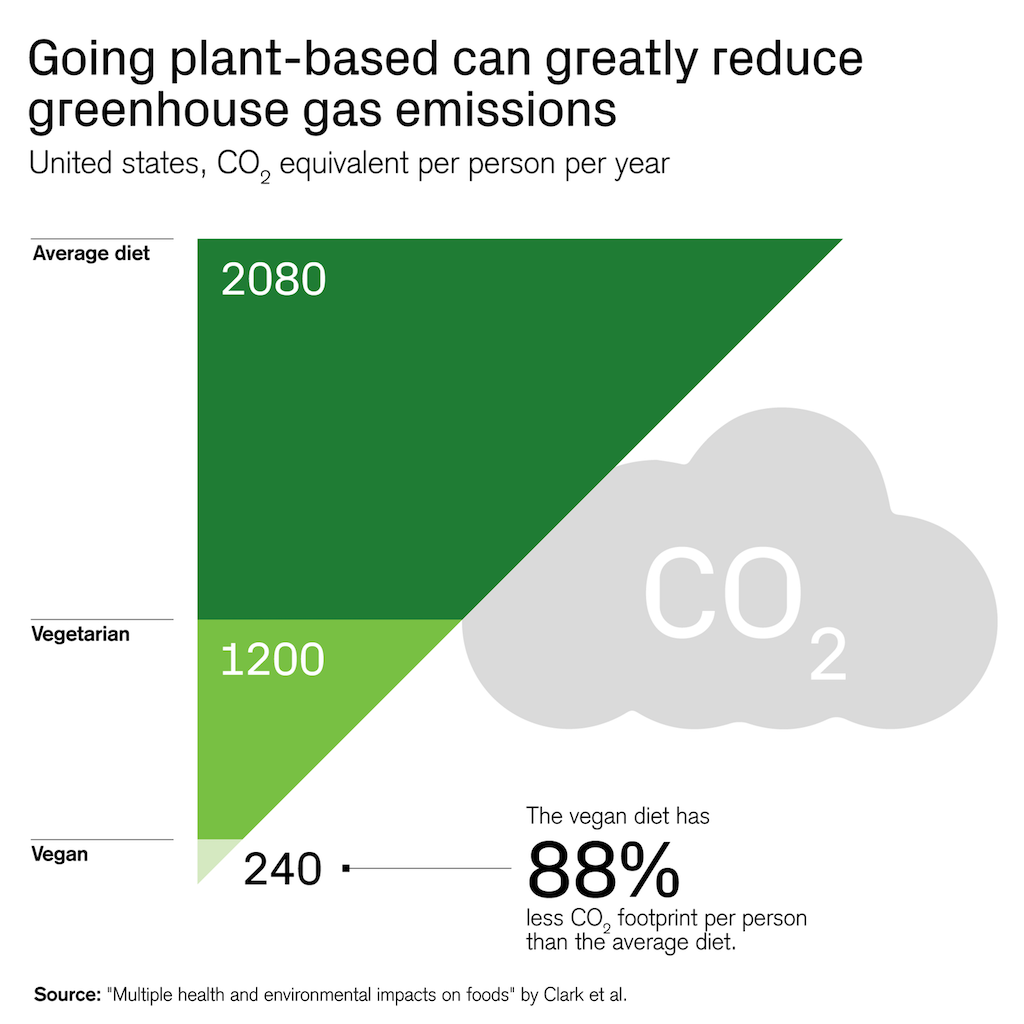

With the “inevitable” shift towards plant-based, given that such diets are on average 90% lower in terms of emissions-intensity, Credit Suisse researchers believe there will be strong investment opportunities in the alternative protein space, predicting that the market for meat and dairy substitutes will grow 100 times later from its current US$14 billion to US$1.4 trillion by 2050.

“We see strong growth potential for alternative animal-protein products,” said the report, referring to plant-based products, as well as cell-cultured and fermentation proteins. “There could thus be many interesting investment opportunities in this space in coming years.”

“Despite the involvement of more than 600 largely small and private companies in this field…[we] expect the traditional food companies to play a key role as they steadily transition their operations towards healthier and alternative food products,” added the authors.

Michael Strobaek, global chief investment officer at Credit Suisse, says that understanding these trends will be vital for companies and investors to both manage their risk and gain a first-mover advantage in fields set to be vital to building a healthier and sustainable food system.

“I am convinced that investors play a significant role in catalysing these emerging trends in how they deploy their capital,” commented Strobaek.

Researchers note that over the past few years, the plant-based industry has already “provided relevant end-markets that have experienced substantial growth,” demonstrable through the rising popularity of vegan diets, citing the record level of sign-ups for the Veganuary campaign to the fast-growing share of self-identified vegans in a number of countries.

In the U.K., for instance, those practicing a plant-based diet have increased four-times between 2015 and 2019, many of them belonging to the increasingly influential eco-conscious Generation Z demographic of young shoppers.

Flexitarians are also a major driver of demand for alternative protein products, with a recent Euromonitor survey estimating as many as 42% of global consumers are now practicing part-time plant-based diets.

“We believe that this growth is likely to continue and probably accelerate as the focus on a more sustainable food system intensifies further,” according to Credit Suisse, echoing the assessment that Ernst & Young analysts made in a April 2021 report that advised food businesses to align themselves with alternative protein to “stay ahead in the food value chain space.”

As sustainability continues to become an issue of focus in the food industry, the Credit Suisse report further highlights the digitalisation of agriculture, smart packaging, and circular food models such as upcycling food byproducts as key segments of growth.

“Further productivity improvements across the food supply chain and in both developed and emerging economies can be achieved by large-scale adoption of new technologies,” wrote the analysts, listing vertical farming and precision agriculture among the report’s 70 identified digital technologies poised to carve out new business opportunities for ESG-forward investors.

“New technologies will need to accompany behavioral change. A shift in diet alone will not be enough in itself to make the food system wholly sustainable,” explained Eugène Klerk, head of global ESG research at Credit Suisse. “Our report thus highlights an array of technological solutions that have the potential to improve productivity, expand the product offer and crucially reduce waste.”

Lead image courtesy of Tofurky.