HackCapital Launches As A Game-Changing Platform For Climate Finance

3 Mins Read

From the “world’s largest” popular Hack events including ClimateHack and FoodHack that take place across more than 40 cities, the funding arm HackCapital has emerged from stealth mode.

HackCapital is positioning itself as a groundbreaking investment platform dedicated to revolutionizing financing for private companies focused on impact planetary solutions.

Co-founded by industry angel investors Arman Anatürk, Camille Bossell, and Emilie Dellecker, HackCapital says it empowers founders, fund managers, and syndicates in the ClimateTech sector to raise capital from their networks.

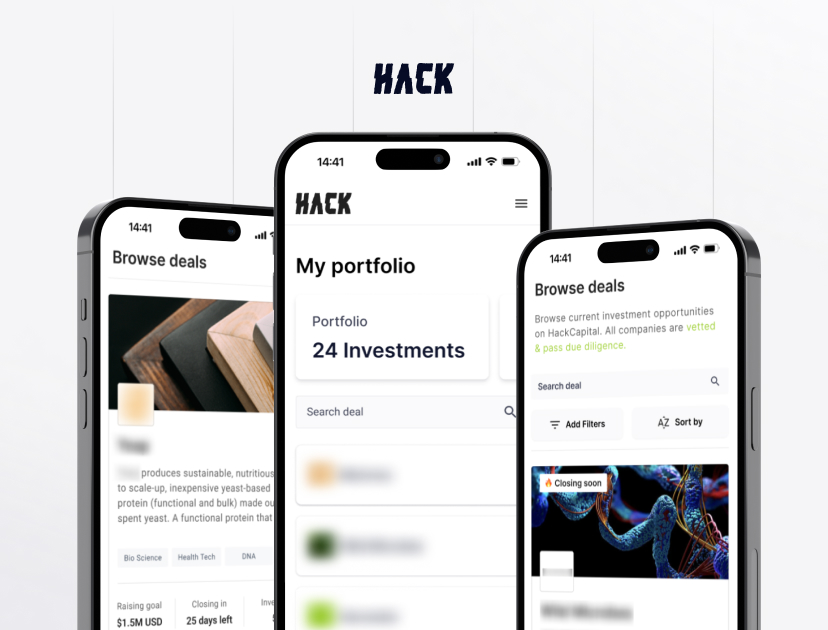

HackCapital

HackCapital has already facilitated the pooling of capital into rounds for more than 30 startups and funds, connecting them with its extensive investor network. Among the companies benefiting from this platform are Arkeon, an Austria-based firm that converts CO2 into climate-positive ingredients, Tandem Repeat from the US, which pioneers self-healing biomaterials, and Bioraptor from Israel, a cutting-edge AI-driven startup in deep tech.

“HackCapital was created to address the biggest need of our community; mobilizing capital towards private companies and funds active in the impact sector,” Arman Anatürk, CEO and co-founder of HackCapital, said in a statement. “We see ourselves as the enabler of the ecosystem, being the financial platform behind the best founders and fund managers to help them do more of what they do best.”

According to recent United Nations estimates, between 2015 and 2030, as much as $7 trillion in funding will be required annually to achieve the Sustainable Development Goals (SDGs) on a global scale. HackCapital says it plays a crucial role in bridging this funding gap by providing a new avenue for financing through small-ticket accredited investors while simplifying the complexities typically associated with fundraising from multiple investors across different regions.

HackCapital offers a range of capabilities from roll-up vehicles for founders raising their next round, feeder funds for managers seeking their next venture fund, and to micro vehicles for first-time asset managers aiming for a quick setup and deployment. These solutions leverage automation and digitization to expedite and streamline the process of raising and deploying significant capital for sustainability and health-focused builders and capital allocators.

A platform for ‘unparalleled flexibility’

HackCapital is aligned with “industry-leading venture firms” such as Siddhi Capital from the U.S. and FoodLabs from Germany, both of which were early investors in HackCapital during its pre-seed round last year.

Emilie Dellecker, Co-Founder of HackCapital, shared the inspiration behind building the platform, saying, the co-founders built HackCapital for “ourselves first.” She says that’s because they saw so many great companies at the HackSummit events and Meetups, which, she says, have gone on to become some of the biggest successes in the industry. “I wish back then I had the means and the knowledge to write the first checks to these founders — and I’m sure others in our community would have done so, too.”

Unlike similar investment tools that rely on Special Purpose Vehicles (SPVs) with limitations on the number of investors, HackCapital has devised a novel E.U.-based structure that eliminates the need for SPVs altogether. This groundbreaking approach significantly reduces the time and cost associated with pooling capital and allows for an unlimited number of investors to participate.

“The primary objective was to create a structuring platform that offers unparalleled flexibility without compromising security,” says Bossell, “Co-Founder of HackCapital, emphasized the importance of establishing a robust legal framework that exceeds industry standards. “After careful consideration, Luxembourg was chosen as the ideal location for setting up our investment platform. Luxembourg stands as the second leading fund administration hub globally, following Delaware, and boasts a digital-friendly environment. Moreover, the securitization regulation under which we operate has the potential to revolutionize access to private market impact investments.”