The Ozempic Rush: 10 Things to Know About Semaglutide, Food Intake, Obesity & Weight Loss

8 Mins Read

Ozempic is everywhere right now, from newspaper headlines to household shelves. But what do Americans really think about weight loss drugs? Here are 10 things you should know.

In our food trends predictions for this year, we highlighted how Ozempic could change the food industry as we know it. The drug has taken over the cultural zeitgeist in the last year, with everyone from actors, producers, TV presenters and TikTok users singing its praises.

The brand name has become a genericised trademark – much like jelly is Jell-O and earbuds are Q-Tips. But it really is a semaglutide injection used to regulate insulin and book glucose levels in people with type 2 diabetes, a condition that plagues over 38 million Americans (or 11.6% of the total population).

What has really captured people’s attention is the drug’s ability to imitate glucagon-like peptide-1 (GLP-1), a hormone produced naturally by our intestines that signals to our body that we’re full. Essentially, it makes patients less hungry, less likely to overeat and less interested in snacking – people taking semaglutide consume 20% fewer calories on average. You can see the appeal.

The FDA hasn’t approved Ozempic for weight loss, but it has done so for Wegovy, another semaglutide medication. When this happened, demand ballooned so much that some providers turned to Ozempic when they couldn’t get their hands on Wegovy. In 2022, nine million people were prescribed Ozempic.

With roughly two-thirds of Americans overweight, and one out of three obese, this class of drugs has understandably generated a lot of interest – whether it’s people hailing their impact on weight loss, or voicing concerns about their side effects. Here are 10 things you should know about how Americans are thinking about weight loss, and how the anti-obesity market could shape up, based on a 388-person survey by VC firm Coefficient Capital and tech outlet The New Consumer, and a study by Morgan Stanley.

1. Weight remains Americans’ top problem

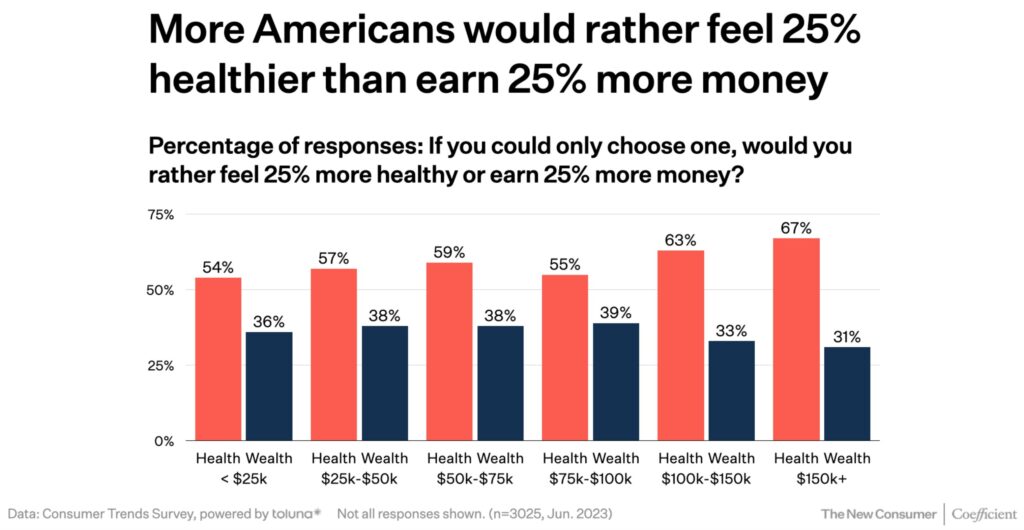

Across all income groups – from those earning less than $25,000 annually to over $150,000 – more than half of Americans would rather feel 25% healthier than earn 25% more money. And 40% of respondents are either very or extremely interested in losing weight – this is a sentiment more popular among Gen Z (49%) and millennials (48%) than boomers (27%), and women (45%) than men (35%).

Meanwhile, among consumers who are aware of weight loss drugs, 30% say they are very or extremely likely to use them, while a further 25% are ‘somewhat interested’. This is again higher among millennials (44%) and Gen Z (40%) versus boomers (10%).

2. A majority of GLP-1 users feel like different people (more protein, less sugar)

The survey found that 86% of GLP-1 users “feel like a different person”, with 47% describing the change as positive, and 9% as negative. Meanwhile, 12% said they haven’t found any difference.

Meanwhile, the 30% of consumers who felt different called it a neutral change. For people who experienced a shift in a good way, the sentiment was most popular among GLP-1 users who had been taking the drug for six to 11 months (59%). And of those who said no, the feeling was strongest among diabetic users (15%), versus 5% for weight-loss users.

3. Obesity medication is making Americans eat better

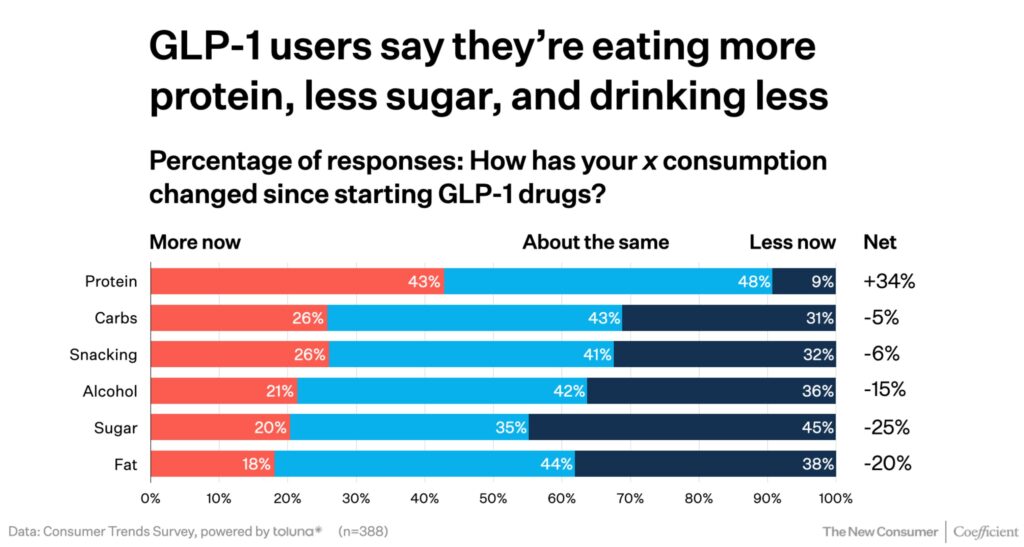

GLP-1 has apparently changed the way Americans are eating and buying food, with 43% consuming more protein, nearly a third eating fewer carbs and snacks, 36% drinking less alcohol, 38% reducing their fat intake, and 45% consuming less sugar than before. Weight-loss users are also spending 3.9% less on groceries and 2.1% less on snacks, with beans, grains, deli items, prepared foods and baked goods the most affected. But interestingly, 3.9% are buying more ice cream.

And when it comes to buying decisions, 56% and 54% are conscious of checking nutritional and calorie labels, respectively, while 48% look at ingredient lists more. Meanwhile, a third of Americans are ordering in less and 29% are dining out less (though an equal number are eating out more), with 39% cooking at home more.

4. GLP-1 users are more active and feel better

Americans who have been using GLP-1 medication for weight loss have found that they’re more active in life (42%), with exercise (41%), and sexually (29%). But a fifth also said they feel less sexually active than before. There were even larger benefits when it came to physical health (56%), mental wellbeing (46%) and social life (40%).

And among those who reported they lost weight, an average of 59% expected to lose either a little or a lot more weight than they did.

5. Americans plan to stick with weight loss drugs

There are interesting results around the frequency of use. For people using GLP-1 drugs for weight loss, 45% plan to use them long-term, but more (51%) are likely to go on and off based on their needs. For diabetics, long-term use is in the minds of 65%, while 27% plan to switch on and off.

These numbers drop down when accounting for side effects: 72% of Americans would use GLP-1 drugs if there were no side effects, which falls to 52% if there are side effects. Similarly, without these implications, 40% plan to start and stop based on needs, compared to 22% with no side effects.

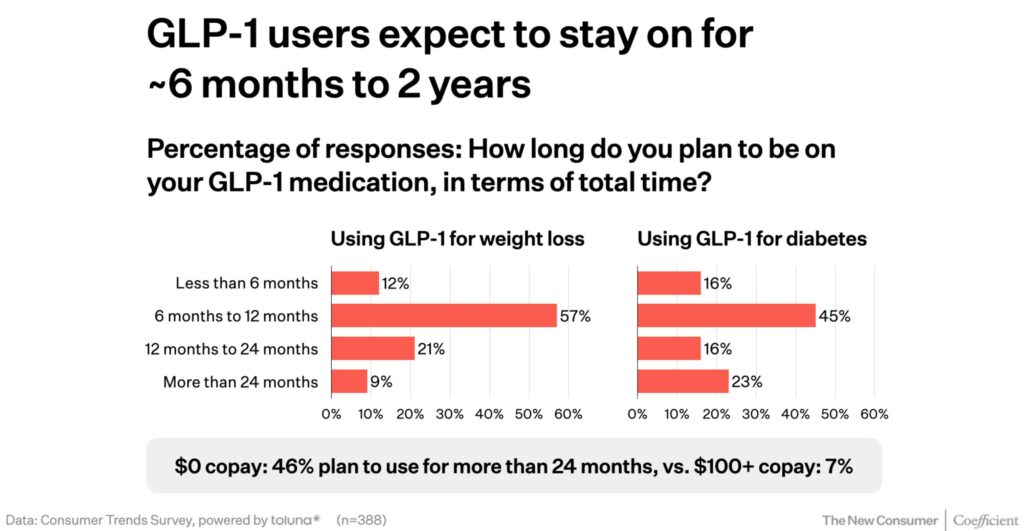

In terms of duration, most Americans want to use these medications for six to 12 months – this is the case for 57% of weight loss and 45% of diabetic users. And 23% of the latter plan to use it for over 12 months, versus just 9% of the former. Money is also a huge factor: 46% would use these for more than 24 months if there was no co-pay and full insurance coverage, but only 7% would do so on a $100 copay.

6. About half of Americans are concerned about long-term effects

Nearly half of Americans (46%) who are aware of GLP-1 drugs are very or extremely concerned about their long-term health effects, which increases to 51% for those taking the medications. Another 37% are ‘somewhat concerned’.

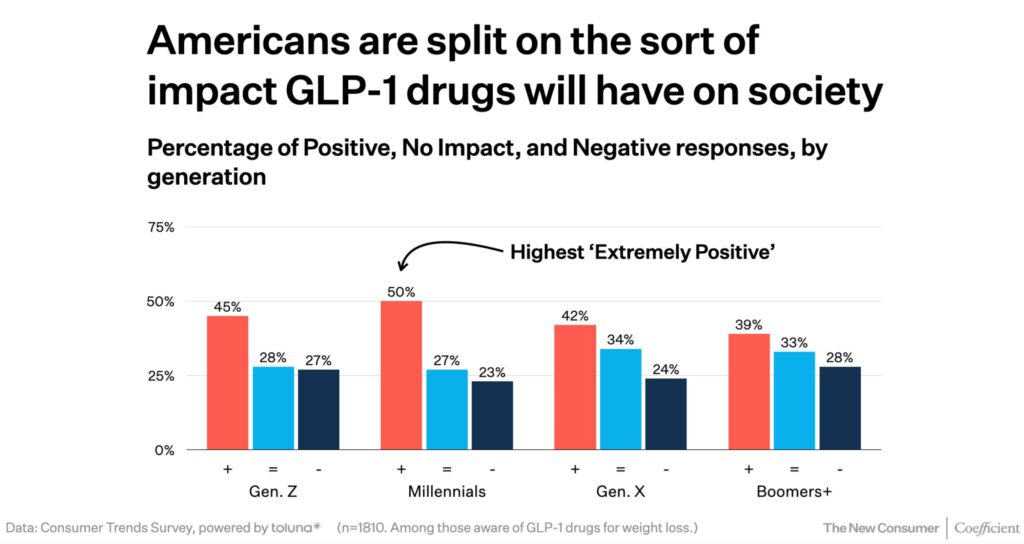

When it comes to societal impact, across generations, more respondents believe there will be a positive effect of GLP-1 drugs, though this varies from age to age. Half of millennials think it’ll be positive, while only 23% feel there’ll be a detrimental impact. The biggest split is among boomers, 39% of whom believe GLP-1 medications will affect society positively, and 28% think it’ll make things worse – a third don’t expect any change.

Overall, on a scale of zero to 10, 7.55 of Americans would recommend these drugs to others.

7. In 10 years, 24 million Americans could be prescribed Ozempic

By Morgan Stanley’s estimate, 24 million Americans could be prescribed anti-obesity medications by 2035 – equivalent to 7% of the US population. The impact of these drugs on reducing appetites and calorie intake can shape attitudes around food, beverages and restaurants. “We anticipate meaningful impact in areas such as packaged food and beverages, restaurants, grocery stores and weight loss programmes,” write the analysts.

8. Obesity prevention could be a $50B market in the US

Morgan Stanley likens the Ozempic rush to hypertension, which was once viewed as the result of lifestyle choices rather than a chronic condition. Its biopharma analysts believe obesity treatment is “on the cusp of moving into primary care management”, and noting the rise of semaglutide drugs like Ozempic and Wegovy for weight loss in the last two years, they estimate obesity revenues to exceed $50B in the US and $75B globally by 2030.

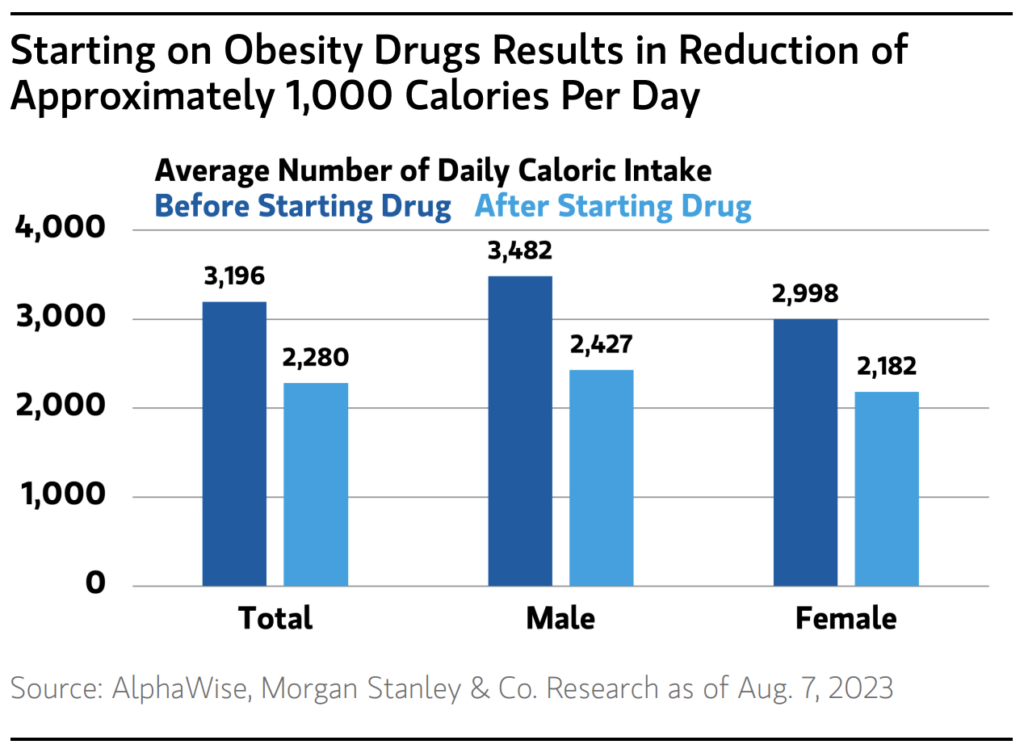

9. Starting on anti-obesity drugs could cut about 1,000 calories daily

With anti-obesity medications, patients can lose between 10-20% of their body weight through reduced appetite, but the next generation of these drugs could see even bigger outcomes, cutting between 20-30% of the daily calorie intake, alongside a decrease of 23% in daily emails and 50% in snacking.

This amounts to consuming about 1,000 fewer calories per day, with a slightly larger drop for men than women. The analysts also forecast a 1.3% reduction in total calorie intake by 2035: “As a result, the food, beverage and restaurant industries may see softer demand and will need to adapt to changing customer preferences.”

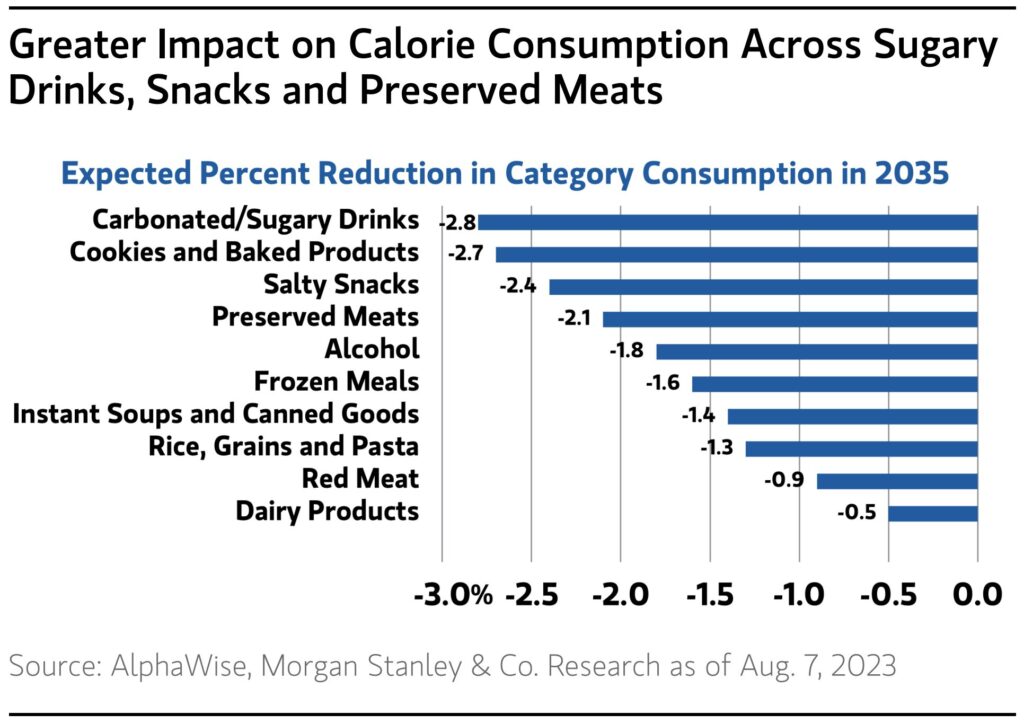

10. Sugary drinks, snacks and preserved meats face the chop

There’s an even more pronounced decline among certain food categories, with Americans set to reduce consumption of sugary or carbonated beverages by 2.8%, baked goods by 2.7% and salty snacks by 24% come 2035. Of the foods analysed, dairy (-0.5%) and red meat (-0.9%) have the smallest predicted decreases.

“Across our food, beverage, restaurant and food retail research coverage, we see companies with exposure to ‘better-for-you’ foods as best positioned,” Morgan Stanley’s analysts say. “We acknowledge that the impact in the near term is likely to be limited, given that drug adoption will grow gradually, but we could see a longer-term impact as drug prevalence increases. Moreover, we expect companies to adapt to changes in consumer behaviour through innovation and portfolio reshaping efforts.”