3 Mins Read

Singapore-based startup Positive Energy Ltd. is a renewable energy finance platform that digitalises and simplifies green investments. Through blockchain technology, the startup is making the sourcing, funding and trading of small to mid-sized clean energy assets more accessible, faster, and economically viable for all parties involved. In the midst of our escalating global climate crisis, which is fuelled by the fossil fuel industry, experts and environmental activists alike are calling for the urgent need for a clean energy revolution. Solution platforms such as Positive Energy are helping the cause to accelerate the deployment of clean energy globally.

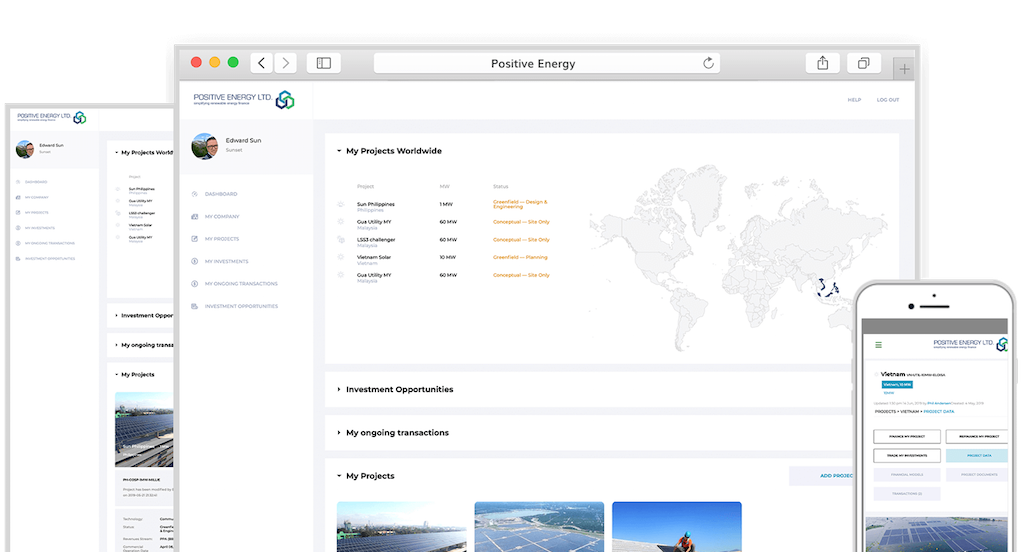

Founded in 2017 by French national Nicolas Bayen and Dutch national Vincent Bakker, Positive Energy Ltd. is a Singapore-based company working on “reimagining the energy funding process” through using blockchain technology. Employing blockchain in their free platform, Positive Energy digitises the asset finance workflow between seed-level companies and investors. This streamlined process of making the deal sourcing, matchmaking, operations, processes, transparency and security of businesses makes renewable energy financing cheaper, faster, easier and brings in better performance and profit.

“On the one hand, we help developers deploy projects twice as fast. On the other hand, we allow investors to invest twice as much capital in these projects. In the long term, it is beneficial since we are drastically improving the development of renewable energy projects,” said Bayen in an interview last year.

Traditionally, financing small to medium-sized renewable energy projects are less profitable to investors than larger-scale projects due to high transaction costs associated with less specialised investors and local banks.

Investors using the platform can easily access their large portfolio of renewable energy projects in their global clean energy listing, which include wind power, photovoltaic, solar thermal, small hydropower, geothermal, biogas, solar power, ocean energy and more. To date, Positive Energy’s platform is already being used by over 300 investors across 20 countries, and has slashed the time to finance small to medium sized renewable enterprises by 50%. By 2030, the company hopes to have helped save 20 million tonnes of carbon dioxide per year.

The mission of the company is to boost renewable energy asset investments all over the world to help combat climate change. Despite the fact that countries around the world agreed to reduce their carbon output to keep global temperatures below an increase of 2 degrees celsius, there still remains an estimated gap of 30 gigatons of greenhouse gas emissions that need to be saved to reach that target. As experts and environmental activists have reiterated time and time again, the fossil fuel industry must end and the world needs to undergo a clean energy revolution if we are to save the planet.

This isn’t the only instance of companies innovating with blockchain to make a positive impact on our planet. Circular fashion platform Lablaco uses blockchain to provide shoppers with a fully traceable history of each garment, from the environmental impact of the supply chain to who might have owned an item that was preloved. Plant-based mobile marketplace VeganNation employs blockchain to connect the vegan community to businesses, and have developed their own traceable digital currency so users can process transactions on the app’s digital wallet.

Lead image courtesy of World Meteorological Organisation.