EY Report Suggests Strong Growth For Plant-Based But Industry Faces Key Challenges

7 Mins Read

A new report commissioned by plant-based body Protein Industries Canada (PIC) has found that the global vegan market shows great potential over the next decade. But while Canada’s own alt-meat consumption has increased, major industry barriers remain.

The research was carried out by Ernst & Young (EY), and commissioned by PIC. Founded in 2018, the Canadian government-backed alt-protein organisation aims to “underpin the creation of new plant-based ingredients and food” by investing “collaboratively to accelerate innovation and the competitiveness of the Canadian plant protein sector” as one of its goals.

Much like the larger food tech industry, the global plant-based sector has faced a difficult 18 months after a few years of global hype, owing to the impact of Covid-19, supply chain disruptions, as well as inflation and the cost-of-living crisis. It has seen industry giants like Beyond Meat and Oatly experience sales declines and stock price volatility, as many companies have laid off employees, and some have shut down.

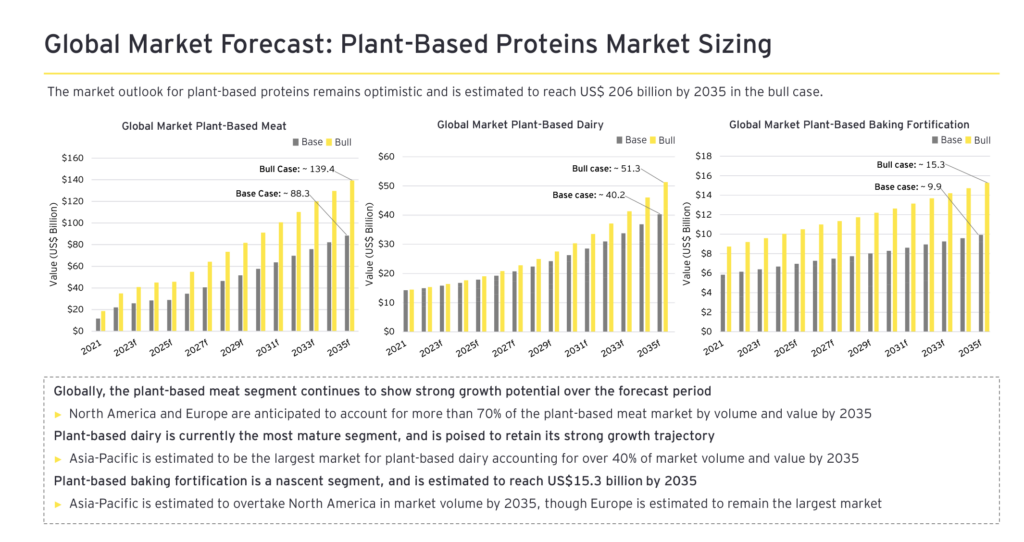

According to the PIC/EY report, there’s potential for the tide to turn here. The research’s findings suggest that the plant-based meat sector, which it claims is currently worth $16.5B, is set to grow by 16.5% annually to reach $139.4B by 2035. Similarly, alt-dairy is predicted to expand by 9.5% year-on-year from $14.4B to $51.3B, and the vegan bakery category is expected to see its value increase by 4.1% annually from $8.7B to $15.3B by the same year.

Key barriers towards consumer adoption

The report mentions that consumers’ price sensitivity towards “products lacking texture and taste parity” with conventional counterparts has increased due to inflation, but that future improvements can offset this trend. Price parity, however, remains the biggest barrier to the adoption and growth of plant-based products, with 64% of consumers who reduced their vegan protein consumption citing cost as a reason.

Taste and texture come in second on this list, a detractor for 58% of consumers, according to EY’s analysis. Other obstacles include regulatory complications around labelling – most countries, including Canada, the US and the EU have restrictions on what plant-based companies can call their alternatives on product packaging – as well as supply chain issues.

The global food and agriculture sector has been hit by disruption from Covid-19, Russia’s invasion of Ukraine and subsequent food shortages, export bans and the energy crisis, plus the effects of climate change. The latter includes widespread crop destruction, as extreme heat and water shortages could significantly disrupt the global food supply.

EY says funding is another key hurdle. Last month, a Stanford University study revealed that livestock farming receives 1,200 and 800 times more funding than plant-based and cultivated meat in the EU and the US, respectively. Meanwhile, 97% of all research and innovation spending in the EU (and 95% in the US) between 2014 and 2020 went to animal farmers, aimed at improving production.

Earlier this week, analysis by Pitchbook found that investors are deserting food tech, despite a survey by alt-protein think tank the Good Food Institute (GFI) last December revealing that 87% of investors expected to make alt-protein investments in 2023.

Asia-Pacific plant-based milk is slated for growth, but dairy consumption is also rising

The report focuses on Asia-Pacific as a key region for this sector’s growth. It points to higher instances of lactose intolerance in Asia and population increases as major factors for this. While there is no research proving an increase in lactose intolerance, studies have found that lactose malabsorption is prevalent in at least 70% of people of East Asian descent.

According to EY’s calculations, per capita GDP in the East Asia and Pacific regions has now surpassed the global average, pointing to an increase in incomes and willingness to pay for plant-based alternatives, which are often more expensive than conventional counterparts in this part of the world.

The report estimates that Asia-Pacific will be the world’s largest market for plant-based dairy, accounting for 40% of the total sector by 2035. It’s expected to overtake North America in the vegan bakery category, although Europe is tipped to remain the largest market for this.

But current headlines are in contrast with this forecast. For example, leading oat milk player Oatly saw a 15% drop in quarterly sales in Asia this year. While the company had been expanding in Asia, with a new factory announced in China and a joint facility in Singapore – when it launched in the Lion City in 2020, its own survey had found that a third of Singaporeans hadn’t heard of plant-based milk – a slower-than-expected recovery from Covid-19 in China has seen the brand slow down new product development and eliminate certain SKUs across Asia.

And while China’s population has a high prevalence of lactose intolerance, the country is now the largest importer of dairy in the world. That’s after it’s expected to become the third-largest dairy producer across the globe, with annual demand predicted to expand by 2.4% until 2032, according to Rabobank. The Chinese government actively encourages dairy consumption, “with national guidelines suggesting a daily dairy intake of between 300-500g/person”.

China is now the world’s third-largest dairy consumer. Between 2019 and 2021, household dairy consumption rose by 11.8% year-on-year to reach 42.3kg, according to government data. Additionally, Asia is home to India, the biggest milk-drinking country globally. So while EY’s projections certainly paint a positive picture, fundamentals suggest challenges ahead on the consumer adoption front.

Canada’s plant-based industry

In terms of Canada – whose plant-based industry was a big focus of EY’s research, the report suggests the country has what it takes to be a leader in the plant-based protein space. This includes a “mature agricultural sector” and a “strong financial sector, stable economy, and well-developed capital markets”.

Last year, a third of Canadians said they tried a plant-based meat alternative, while 42% reported consuming a vegan dairy substitute, according to research by Dalhousie University. Meanwhile, 31% said they consume alt-meat at least once a week, and half said the same for plant-based dairy. Another survey revealed that Canadians eat alt-protein (7%) more than pork (5%) or seafood (4%) in a typical week.

But Canada has its own hurdles to overcome. EY points to increased policy and infrastructure support, as well as more investment in the sector. There is also the regulatory question: as mentioned above, plant-based manufacturers are restricted by labelling laws in Canada. Currently, they aren’t allowed to use terms like ‘milk’, meat’, ‘cheese’, etc. on vegan product labels.

And while there are some proposed changes, they are still restrictive. Novel protein products would need to use the term ‘simulated’ and match certain nutritional levels, while alt-meat made from traditional vegan protein like tofu must have clear labels to identify the base ingredient, and won’t be allowed to be fortified with added nutrients.

Pricing in misinformation risk

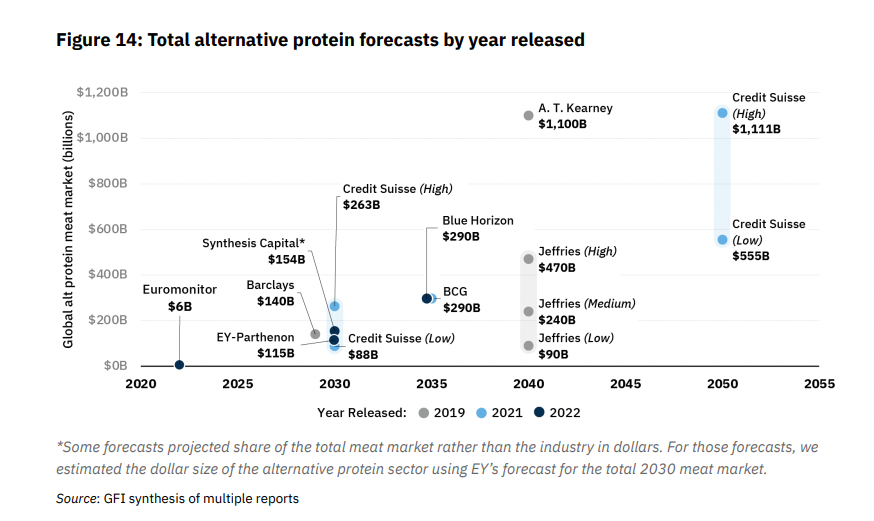

The positive global forecast and contrasting current challenges (many of which EY says are short-term) add to a growing body of fluctuating predictions about the alt-protein industry. GFI has compiled a host of different projections to show the difference in alt-protein forecasts over the next two decades.

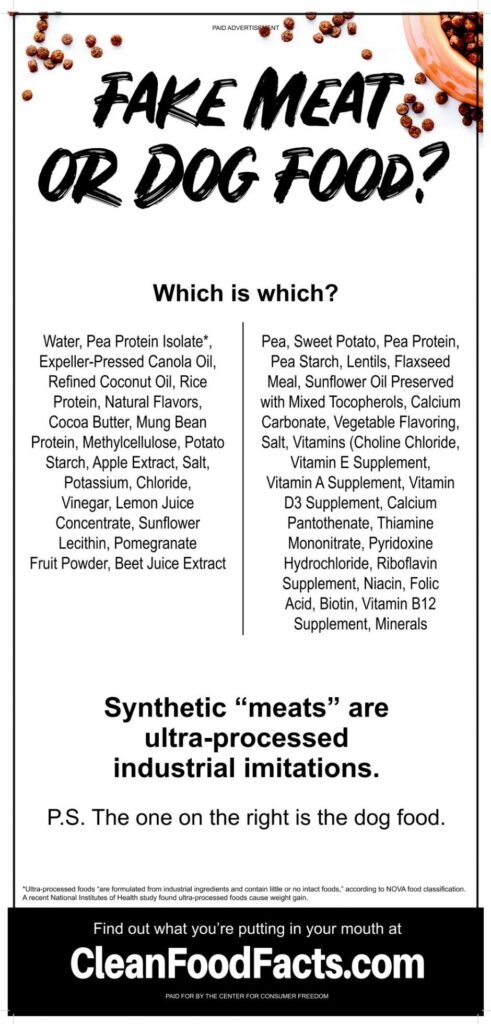

Moreover, it’s unclear if the report authors factored in the risk of misinformation. As The Spoon’s Michael Wolf writes: most industry reports “do not attempt to assess or quantify the increased risk to the alternative protein industry from industry and product-related misinformation”. Lobby groups linked with meat and dairy companies have a history of acting against the plant-based industry via smear campaigns and commercials.

Big Dairy is about to go big again. The California Milk Processor Board, the body behind the popular and influential Got Milk? ad campaign, released a new commercial drive last month, titled ‘Everyone Wants to be Milk’. It seemingly poked fun at plant-based alternatives by imagining milk made from salmon, octopus, cranberries, ghosts and aliens, among others, and urging consumers to “get real”.

Such consumer-aimed campaigns can be highly successful and pose a risk for vegan brands as a whole hoping to welcome more shoppers to the category. While the EY/PIC forecast is hopeful, the global plant-based industry has a fair few struggles to overcome.