Save Money & The Planet? Climate & FinTech Startup Creed To Debut Budget Planning & Emissions Tracking App

3 Mins Read

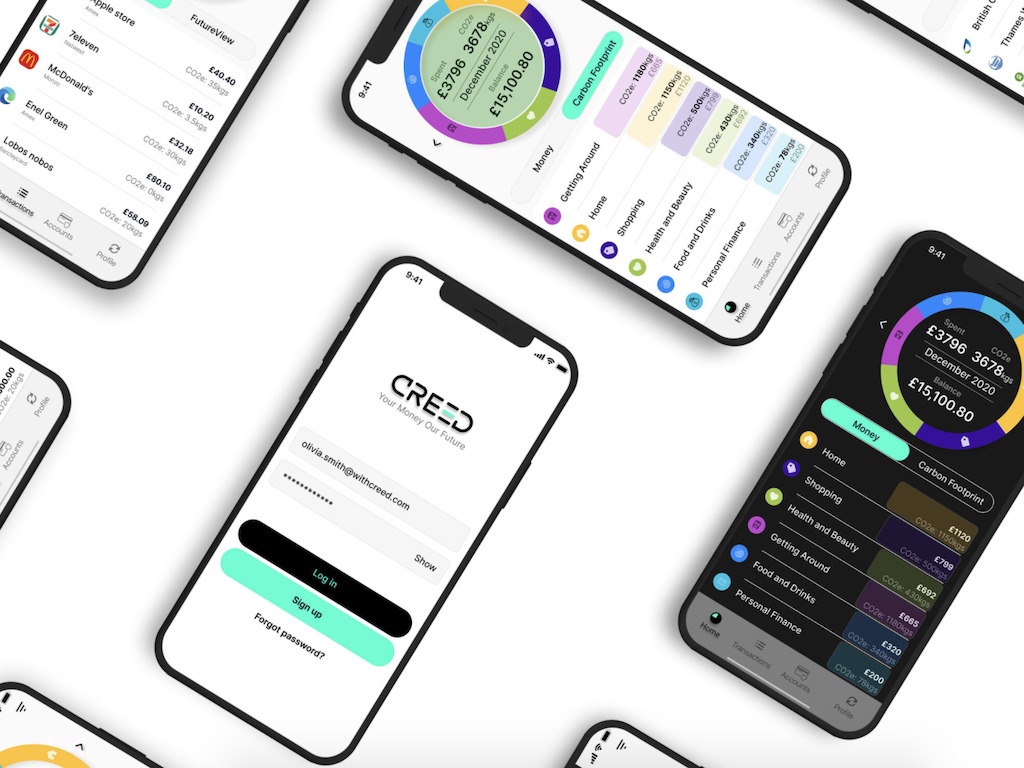

Have you ever thought about how you could make a positive impact with your money? London-based startup Creed is about to debut its new mobile app aiming to do just that, combining finance with climate impact management. Features on the platform include spending management, carbon footprint tracking, offsetting emissions and more.

Set to launch soon, the new Creed mobile app is on a mission to make saving, spending and growing your money synonymous with making a climate positive impact. How, exactly? The app lets you connect to all of your online current accounts, saving accounts and credit accounts, putting them all in one place to make it super easy to manage everything at once – from the money you spend to the footprint of all your transactions.

It breaks down where your spending leads to the greatest carbon emissions, which then also makes it easier to know how you can minimise your personal footprint. Not only does it automatically group, categorise and calculate your carbon footprint from your spending, Creed offers you prompts containing advice on how to reduce your emissions, such as choosing to walk instead of getting on a taxi, or opting into a carbon offset subscription.

More than 30 of the leading banks and credit card providers are compatible with Creed, making its coverage pretty widespread – 97% of the U.K. market, to be exact. Some of these include American Express, Barclays, HSBC, Lloyds, RBS and Natwest.

The app is built by banking veterans who collectively have over 50 years experience building secure banking applications and systems.

Creed

While it hasn’t launched yet, the startup says that 1,000 people have already signed up to register for the app, which will be available on both Apple and Android mobile devices at £1.25 (US$1.77) per week. After the launch, Creed also plans to extend its services to begin offering spending and investment tools in the latter half of 2021.

For those worried about whether the app is secure, the London startup says that it currently uses the top state-of-the-art security measures, including the same end-to-end encryption that major banks have, meaning all your data is encrypted in transit and at rest.

“At Creed, the app is built by banking veterans who collectively have over 50 years experience building secure banking applications and systems,” says the website.

The upcoming launch of Creed comes at a time when conscious consumers have been demanding greener financial services, with sustainable offerings in the industry lagging behind compared to other sectors like fashion or beauty, where climate-friendly products have been emerging over recent years.

This is really about making a positive impact with my money. Excited about what’s coming up next.

Emma

One Creed pre-registered member, Emma, described the app as “exactly what my generation has been waiting for,” adding that “this is really about making a positive impact with my money” and it makes her “excited about what’s coming up next.”

It also comes amid a major reckoning from both the general public and institutional investors alike of the impact of “where their money is going and what it’s funding,” as written in a Green Queen Media report on the top sustainability trends poised to take over this year. The trend has been fuelled by new data proving the superior risk-adjusted returns of sustainable investments in the wake of the coronavirus-related economic volatility.

Other green financial services and platforms that have emerged lately include Climate First Bank (I/O), a new values-based financial institution in Florida that integrates standard banking services with modern technology and takes an ESG-led approach to its operations, placing special focus on serving NGOs that are dedicated to sustainability.

Aspiration, a neobank offering 100% clean and sustainable financial services, has also been in the spotlight, bagging investment from Hollywood celebrity Robert Downey Jr.’s new climate tech venture fund.

Lead image courtesy of Creed.