Resilience, Investment & Female Representation: The Lowdown on Spain’s Food Tech Ecosystem

6 Mins Read

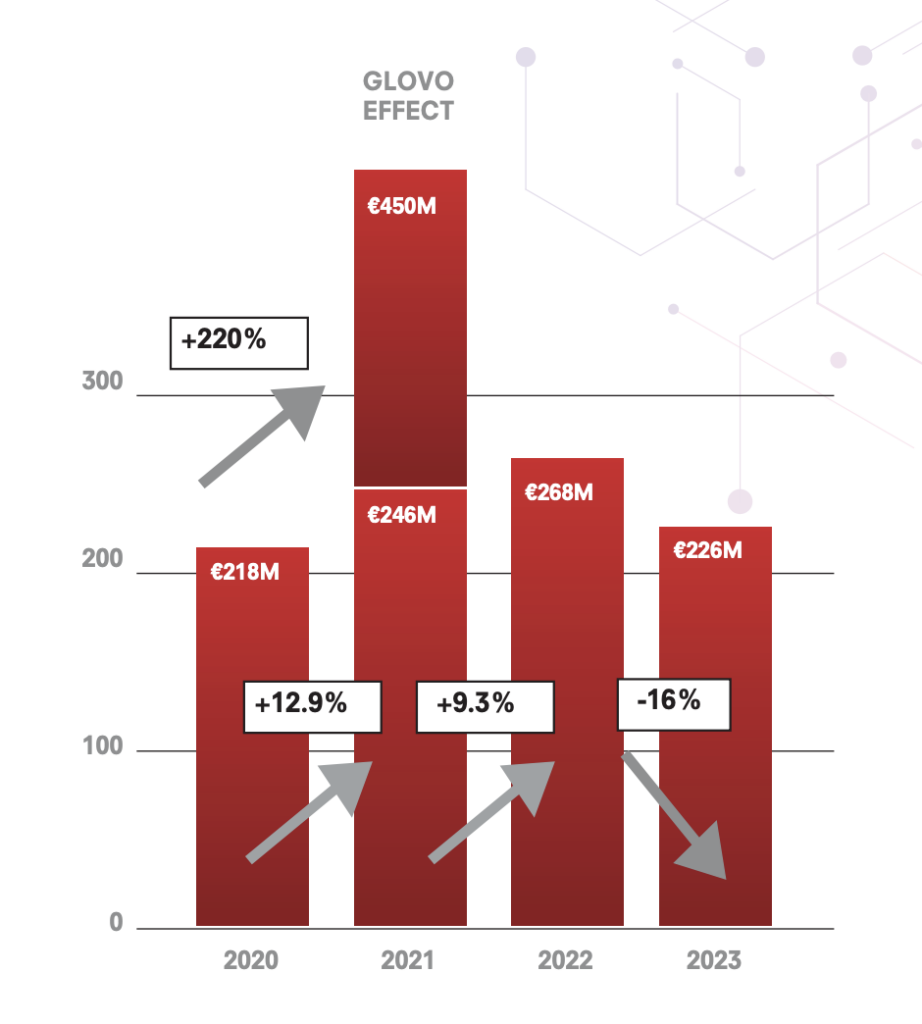

While Spain was also at the receiving end of the global drop in food tech funding, its ecosystem experienced a more moderate slowdown this year, while raising €226M and becoming one of the more attractive sectors for female entrepreneurs.

“In 2023, we reached a crucial milestone for the Spanish food tech ecosystem,” wrote Mila Valcárcel, managing partner of Madrid-based food tech accelerator Eatable Adventures. “We have witnessed the consolidation and arrival on the market of disruptive technologies in more development phases. This achievement demonstrates the great technological solvency of the Spanish ecosystem.”

Explaining why this progress is a big deal, Valcárcel pointed to the continued decline in VC investment in food tech globally – as of Q3, it’s down by 71% year-on-year and 14% from Q2. This is why the recent developments have placed Spain “in a privileged position on the international food tech map”.

Valcárcel was writing in Eatable Adventures’ latest annual report, the State of Foodtech in Spain 2023, which breaks down the makeup of the country’s food tech ecosystem, its leading categories and resiliency, as well as its prominent female representation.

What Spain’s food tech sector is made up of

Eatable Adventures reports that there are a total of 420 food tech startups in Spain, with a notable spread across the autonomous communities of Madrid (representing the home of 34.2% of startups), Catalonia (30.3%) and Andalusia (9.1%). While the share of the former two has grown over the last year, the number of startups from the latter region has slightly declined.

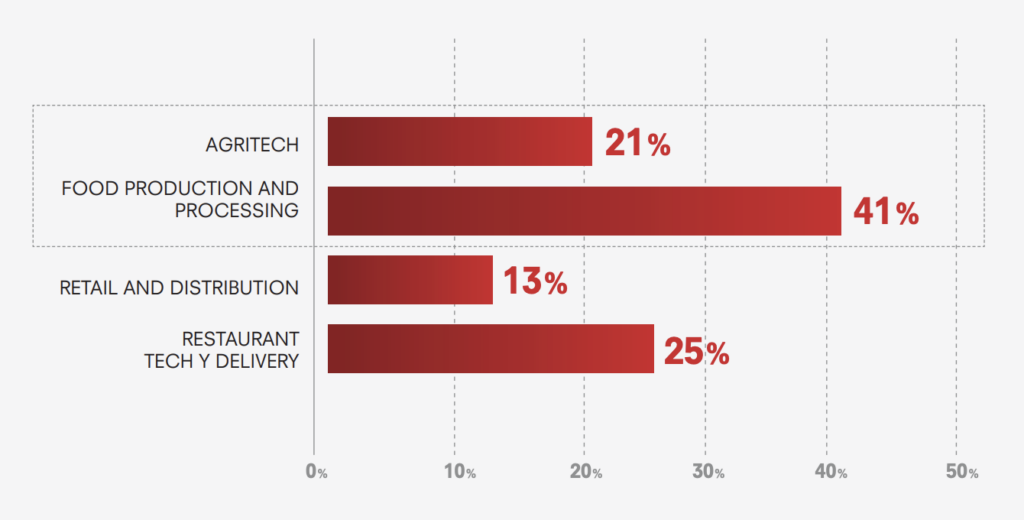

The food production and processing sector counts the most number of food tech startups here (41%), followed by restaurant tech and delivery (25%), agritech (21%), and retail and distribution (21%). Within food manufacturing and processing – whose share increased by 6 percentage points from last year – there was a 10.5-point increase in new products featuring innovative ingredients. Eatable Adventures says this surge is likely influenced by health and sustainability concerns, alongside increased interest in new technologies.

The number of agritech startups declined by 3.5 points annually, but segments like water management or robotics have shown modest growth, while crop automation systems continue to be the most prominent. “This suggests that production efficiency and optimisation remain key priorities for the agricultural sector,” the report states. Intensive cultivation systems, meanwhile, represent the fewest number of startups (1.2%).

Retail and logistics has the lowest representation, and suffered a 12-point decrease from 2022, which suggests “a change in focus or a reclassification” for startups. It’s driven by “a noticeable decline in the establishment of new sales channels, juxtaposed with a rise in the prevalence of retail analytical platforms”. Companies working with smart labels have grown by 8 points in number, representing 9.8% of the total retail sector.

Finally, the restaurant and delivery vertical has absorbed parts of startups from previous years that were classified in the retail and logistics category, “signalling a dynamic change in the distribution of entrepreneurial projects in these sectors”. Here, management platforms, online marketplaces and delivery startups rule the roost – conversely, booking platforms have declined by nearly 9 percentage points.

Women are prominent in Spain’s food tech sector

The report reveals that 59% of food tech startups in Spain have a team of one to five employees, while only 2% have over 200. In total, the sector employs 4,600 people. Meanwhile, just 7% of these businesses have four or more founders, while the average age of these entrepreneurs is 36.8.

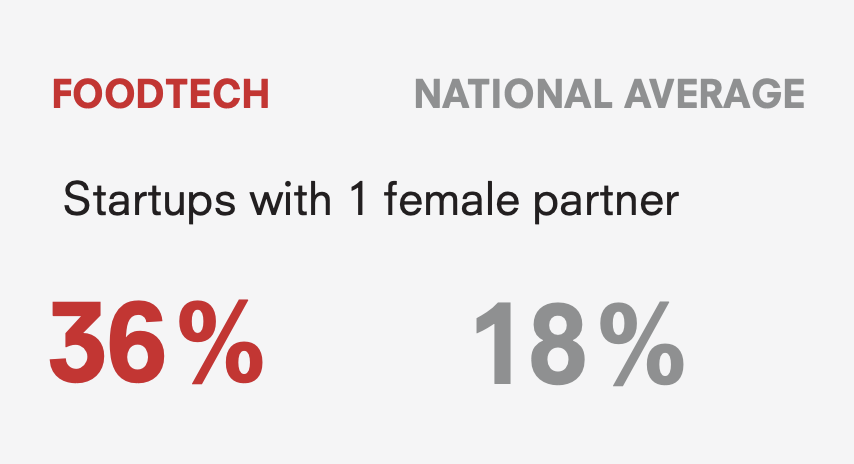

Moreover, 36% of startups feature a woman as a partner, double the national average of 18%, according to Eatable Adventures. While there’s certainly a need for further growth here, this is still much better than elsewhere. Across Europe, in terms of female-led businesses, for example, only 1.8% of startups attracted funding in 2021. And in the US, women represented less than a quarter of the C-suite in the food industry in 2017.

“This trend is also mirrored in the composition of teams, with nearly 40% of startups having more than half of their staff composed of women, a highly positive figure compared to the national average,” the report states. Some of Spain’s women-led food tech startups include algae protein producer Poseidona, food 3D printer maker Natural Machines, and cultivated meat company BioTech Foods (owned by JBS).

The tech development of startups is, of course, a huge marker of their success. According to the State of Foodtech in Spain 2023 report, 28% of surveyed startups have at least one patent, while 35% use trade secrets – a 5-point increase year-over-year. And when it comes to technological maturity, most of the businesses display a “considerably high level of development” – but the challenge is to maintain constant innovation and remain relevant in a competitive and ever-evolving environment.

A resilient food tech ecosystem

As mentioned above, despite the global funding slowdown, Spain’s food tech sector faced moderate headwinds. Eatable Adventures states that while investment reached €27.4B in 2022 around the world – it fell by 61% from Q2 2022 to 2023. Spain, meanwhile, saw food tech startups rack up €226M in funding this year, only a 16% decrease from 2022, which “points to the strength and resilience of the ecosystem at the national level”.

There was stability in pre-seed and seed funding rounds, with 39% of Spanish food tech startups in the seed phase (representing the higher share), followed by 29% in the pre-seed stage. Key national investors include Capsa Vida, which has backed the likes of baïa, entomo agroindustrial, GrinGrin, and nucaps; BeHappy Investments, which has supported Harbest Market and Hunty; and Clave Capital, which has invested in Deep Detection and Groots. Eatable Adventures itself has funded Bio2Coat, mmmico and Néboda through its Spain Foodtech acceleration programme.

On the international front, ProVeg Incubator welcomed Poseidona and Gimme Sabor into its 11th cohort, while Big Idea Ventures invested in vegan cheesemonger Väcka. Cocoon Bioscience raised €15M with support from North South Ventures from the US, and Newtree Impact – already an investor in Cubiq – joined Heura’s €2.7M funding round.

“We have not only witnessed the resilience of our ecosystem but also the consolidation and market launch of disruptive technologies, as has been the case of the arrival to the retail channel of the first 3D bio-printed vegetable bacon by Cocuus and Foody’s,” said Valcárcel.

She called for further investment into the category. “If we want to be truly competitive against the most developed international ecosystems We need to be more ambitious and have a vision of the future of this sector that is so strategic for Spain. It is essential to put greater effort into investment and collaboration with the industry, but also to have greater support at the institutional level and to have a strategy aligned between territorial and national initiatives.”

Alex Holst, senior policy manager at GFI Europe, added: “Placing Spain at the forefront of protein diversification and food innovation will involve establishing clear policy direction from governments, mobilising public investment in open-access research and development and industry expansion, and allowing farmers and rural areas to take advantage of the benefits of these emerging sectors.”