6 Mins Read

Andy Shovel, co-founder of UK plant-based meat brand THIS, talks to Green Queen about the company’s new TV ad, profitability plans, and why he’s optimistic about the vegan meat industry.

THIS has just launched its first TV spot starring British food critic Grace Dent, who appears to be fooled by the ‘hyperrealistic-ness’ of the company’s pea protein sausage. The two-month-long campaign is the brand’s biggest to date, with an investment of over £600,000 across TV, out-of-home, in-store, digital, social and influencer advertising.

The 30-second commercial sees Dent participate in a pork sausage taste test, where she says she can tell the difference between traditional and plant-based pork. But as she bites into what she appears to believe is a conventional sausage, Dent is told that it’s actually vegan.

She proceeds to walk off the set disgruntled, as on-screen tiles read: “83% less fat than pork sausage” and “Can really annoy a food critic”. It ends with a voicemail from her agent played back on the screen, where he says Dent is concerned about her credibility as a food critic.

Leaning into health

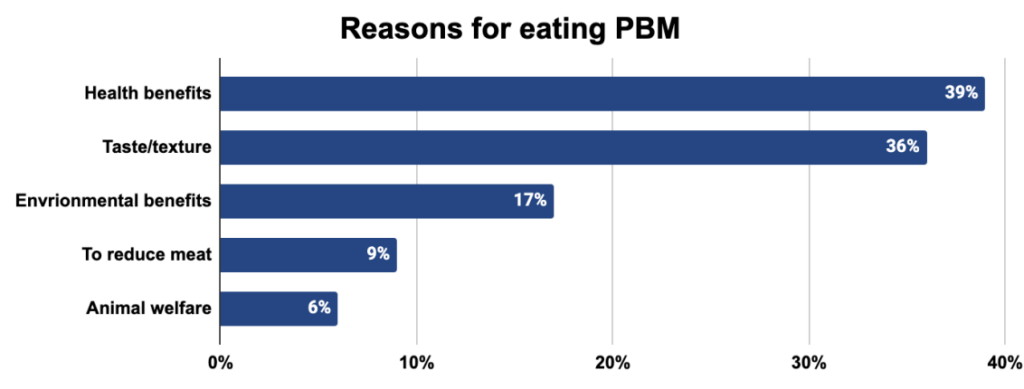

It’s a neatly packaged ad that sums up THIS’s entire brand appeal and mission to position health at the forefront of its messaging – something more and more plant-based meat brands are doing as they lean into consumer priorities. A 1,000-person survey published yesterday by Bryant Research and ProVeg International found that health benefits are the top reason for Brits to eat plant-based meat (39%), followed closely by taste (36%).

“Oh, the delicious deception!” Dent said in a statement. “Being tricked into savouring a plant-based pork sausage was certainly a revelation. The taste and texture [were] uncanny to the real deal.”

It’s important to note that despite the realness of the ad, THIS points out that this ‘deception’ was just an illusion. “Grace did actually know she was going to be trying plant-based sausages,” admits THIS co-founder Andy Shovel. “But, we’ve actually fooled a bunch of food critics in a previous social media campaign, which then spurred on the idea of entering into a partnership with Grace Dent.”

Reaching profitability and reading between the headlines

THIS’s new campaign comes just on the back of its announcement that – after four years of operations and over £38M raised in funding – it is on track for profitability by next year. Shovel told City A.M. that the company’s gross margins “massively improved” in the first half of 2023, following years of focusing on growth over profitability.

Asked how THIS got to this point, Shovel tells Green Queen it has been a huge undertaking. “We’ve looked at all parts of our supply chain to ensure we maintain THIS quality but drive a culture of continuous cost improvement, and it’s a journey that will continue,” he says.

“[The] biggest driver of this has been rationalising our supplier base and focusing on a few key partners. We’ve also set up our own UK manufacturing site, which is now fully operational and have been working hard on ramping up our volumes. As a result of our growth, we’ve also been able to unlock better costs on raw materials and packaging.”

It’s a bit of positive news in an overall bleaker time for plant-based food in the UK. Despite being Europe’s second-largest vegan market – with Brits spending £964M on plant-based meat and dairy last year – sales have stagnated and total investment in plant-based protein R&D has been overtaken by cultivated meat in the last decade. According to the Good Food Institute (GFI) Europe, plant-based sales declined by 3% between 2021-22 in the UK, with meat alternative sales sliding by 8% in the same period.

Just last week, for example, mycoprotein giant Quorn announced a loss of £15.3M in its yearly accounts, citing cost hikes, stagnating sales and post-pandemic inflationary pressures. The UK market has seen a number of vegan brands pull some products from supermarkets, including the likes of Oatly (ice cream tubs), Innocent Drinks (smoothies), Nestlé (Wunda and Garden Gourmet), and Heck (most of its meatless range).

But Shovel believes the bigger picture isn’t as despairing. “If you step back and look at it through a less press-driven lens, stripping out increased in-home consumption driven by COVID, the growth has been nothing short of huge: 47% since 2020, compared to meat, fish and poultry growing by just 8% in the same time period,” he says, citing THIS’s managing director Mark Turner.

“There’s been a lot of doom and gloom in the headlines due to declines of a few players, when in fact better-tasting stronger brands like THIS have been able to grow – we are 50% up year-on-year at the moment,” Shovel adds. In the long term, he remains bullish about the segment, noting that health, environment and ethics are reasons that “matter loads and aren’t going away”.

Optimism for the category and Dutch focus

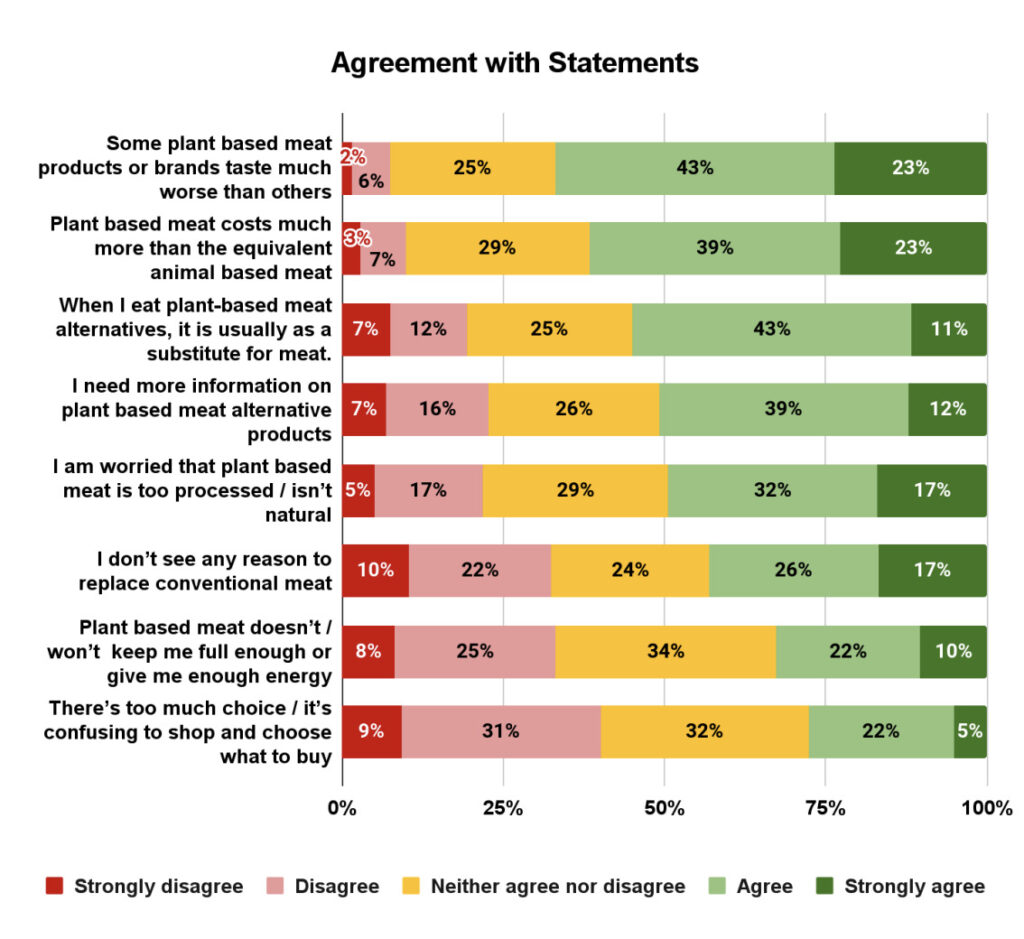

“I am actually really excited about the stage the market is entering,” he says. “For too long, there’s been too many brands with wildly varying product quality, that have put off meat reducers from truly believing in the category. It’s also been confusing to shop – no supermarket needs to list 15 types of plant-based sausage.”

But there are mixed sentiments regarding this, at least according to data from the Bryant Research/ProVeg International survey. It revealed that while 27% said there’s too much choice and it’s confusing to shop for plant-based meat in the UK, it was the statement most disagreed with in the study.

On the contrary, the research shows that along with health, taste is paramount to consumers in this category, with 51% citing taste and textural reasons for reducing their vegan meat consumption. It follows further analysis by the Kerry Group last year – covering 1,500 consumers across four countries (including the UK) – which revealed that flavour is key to consumer preference.

It’s along these lines that Shovel says: “We’re now at a stage where the sector is consolidating and poor-quality brands are coming out the market, with more brands consumers can trust and shelves that are way easier to navigate. Finally, I’m excited about finding other ways to service the 58% of UK consumers who are actively reducing their meat intake – beyond just meat alternatives.” [We haven’t verified this number.]

As for THIS, where next? It recently launched vegan roast chicken and chicken and bacon pie, and made its first splash into international waters by launching in the Netherlands. “It’s an interesting market as most brands there still cater to just vegans and vegetarians with very green branding and messaging – not too dissimilar [to] where the UK was when we first entered the market, so it feels prime for disruption,” explains Shovel.

But instead of “scattergunning into loads more countries”, it wants to dig deep into its Netherlands operations for now. “A recent GFI report revealed that the Dutch have the highest consumption of plant-based foods per capita. So for now, we really want to establish ourselves there as it’s no small project,” he says.

“Longer term,” he adds, “no region is off the table!”