Greenwashing Risk: 64% of Agrifood Companies Have No Regenerative Agriculture Targets – New Report

5 Mins Read

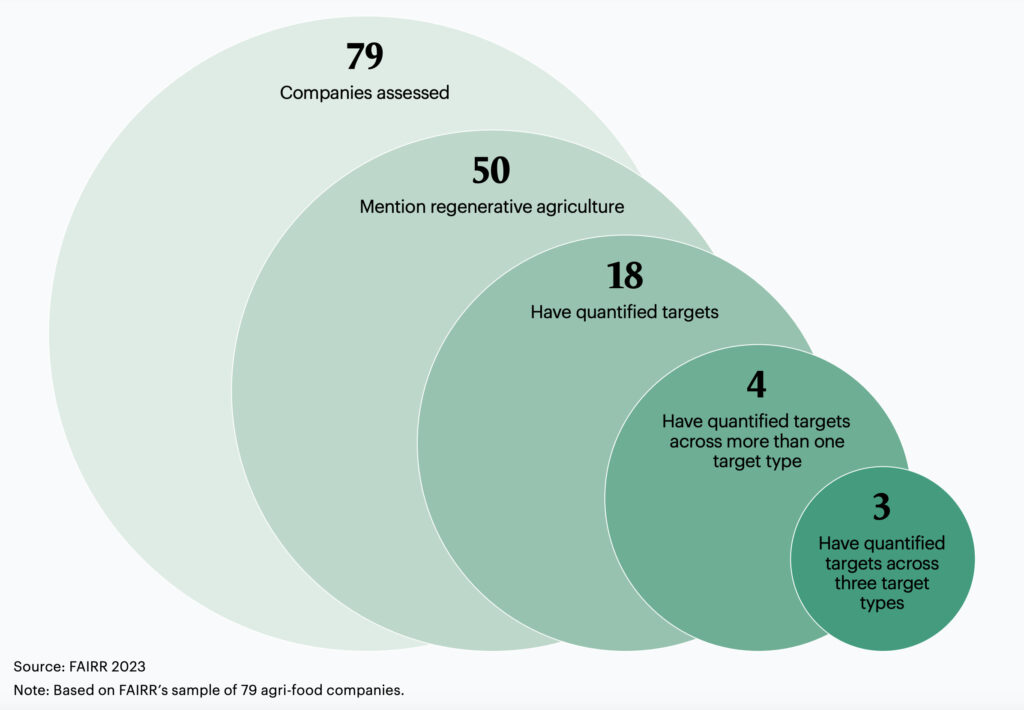

While a majority of the food and retail sector’s giants believe regenerative agriculture can be a solution to the climate crisis, 64% of them have not put targets in place to achieve these ambitions, according to a new study. Meanwhile, only 8% have committed to supporting farmers to incentivise the uptake of these regenerative practices.

The report, titled The Four Labours of Regenerative Agriculture and conducted by investor network FAIRR, found that 50 of the 79 agrifood firms (63%) – which are worth a combined $3 trillion and represent one-third of the sector – recognise regenerative agriculture as a solution to climate change and biodiversity loss. But of these 50 firms, 32 (64%) have not outlined any quantitative company-wide targets related to such farming methods, including Chipotle, Domino’s and Bunge.

Meanwhile, only 36% of these companies have quantified targets for regenerative agriculture, while just 16% that mention regenerative agriculture discuss metrics and data. And of the 18 companies that set quantifiable targets, only four have set outcome-based targets, with farmer-based targets the least cited in regenerative commitments overall.

Additionally, only four of these 50 companies (8%) have made financial commitments to support and incentivise farmers to uptake regenerative agriculture – though small donations to specific projects are excluded from the report. These include Nestlé (which has committed $1.2B to these practices), PepsiCo, JBS and Sodexo – the latter’s Good Eating Company will earmark 15% of its food budget for regenerative agriculture.

The analysis does highlight a few positive examples of regenerative agriculture commitments by agrifood companies. These include Danone, which has pledged to source 30% of key ingredients from farms transitioning to regenerative farming by 2025, as well as General Mills, which says it will introduce regenerative agriculture on one million acres of farmland by 2030. Meanwhile, Walmart collaborated with PepsiCo with an aim to eliminate four million tons of greenhouse gas emissions through the former’s regenerative agriculture programme.

“Only four of the 50 companies assessed by FAIRR have committed to de-risking the transition through some sort of financial support for farmers,” said FAIRR’s thematic research and corporate innovation director Jo Raven. “Without adequate support for farmers, there can be no successful regenerative agriculture. Investors will want to see concrete action being taken to enable a just transition and ensure farmers do not bear the burden of change.”

Regenerative agriculture needs a standardized definition

A major hurdle holding regenerative farming back is the lack of an internationally agreed definition. This kind of agriculture is said to nurture soil health, improve the water cycle, reduce dependence on chemicals, boost the ecosystem, and strengthen farms’ resilience to climate change. The lack of a clear definition makes it hard to substantiate regenerative farming claims, leads to a considerable variation in how companies report the practice’s benefits and creates risks for any incoming regulation.

This is further exacerbated by the lack of a stated definition of the outcomes firms are looking to achieve. The report found that ‘soil health’ and ‘carbon-related’ outcomes were the two most cited sustainability outcomes, followed by ‘improving water use and quality’, ‘biodiversity’ and ‘reduced use of agrochemicals’. Meanwhile, social outcomes related to farmer incomes, just transition and other economic themes (often called ‘livelihood’ in corporate disclosure) were the least cited.

This analysis aligns with research from non-profit the Food and Land Use Coalition earlier this year, which called for an outcomes-based framework to measure and assess regenerative farming, given the inconsistent understanding of what the practice means and can achieve. “Regenerative agriculture can build resilience to climate change, improve soil health, and make land management sustainable in the long run,” noted Alessia Lenders, head of impact at SLM Partners, part of the FAIRR investor network.

“It can also unlock financial opportunities for farmers through premium pricing on regenerative products and reduced input costs. Supporting farmers through this transition is crucial as farmers are ultimately the ones who can deliver positive outcomes to soil health, climate, biodiversity, and water.”

Tackling greenwashing

Incoming regulation can help to keep companies accountable and put a stop to greenwashing. The EU’s Green Claims Directive is due to come into force in 2026 and mandates that companies must substantiate any marketing claims about regenerative agriculture. If they don’t, they could be charged a non-compliance penalty of up to 4% of their annual turnover.

The UK is also seeing similar guidance implemented, with the UK Advertising Standards Authority noting that any company making environmental claims must fully verify and substantiate them. The Competition and Marketing Authority’s Green Claims Code – launched last year – provides a framework for businesses to supply more transparent messaging about their sustainability claims.

Earlier this week, the Taskforce on Nature-Related Finance Disclosures – which enables companies to manage and disclose climate-related risks – named a few key risks food companies should be reporting against. These include nutrient pollution, loss of pollinators and poor soil health – biodiversity risks that regenerative agriculture practices are designed to mitigate.

“Increasing uptake of regenerative agriculture practices is key to addressing the climate and biodiversity crises,” said Raven. “Transitioning away from conventional practices towards regenerative practices creates risk for farmers as it will likely require significant upfront investment, such as new machinery, agronomic support and experimentation, and could impact short-term productivity for farms.”

Jeremy Coller, founder and chair of the FAIRR network, added: “FAIRR’s research shows there are more promises than progress in the agri-food sector. Investors will want to see measurable targets that match companies’ stated ambitions on regenerative agriculture if they are to ensure they don’t fall foul of anti-greenwash regulations.”