8 Mins Read

It’s hard to overstate what a record breaking year it has been for the alternative protein industry over the past 12 months, most especially in Asia where Green Queen Media is based. Just a couple of years ago, there were less than on major news story to report on a week, and as we appraoch the end of 2020, our alt protein news desk regularly publishes more than one headline a day. For the past few months, the Green Queen Media team along with APAC alt protein investor & Future Food Now newsletter publisher Michal Klar have been working together to gather data from alternative protein startups across the region in order to publish the first-ever total funding estimate for the space. The numbers are astonishing.

“The data we gathered clearly shows that the alt protein sector in Asia Pacific really took off during last the past 12 months. Investors increasingly recognise stellar growth opportunities in this region,” Klar told Green Queen. “We’ll need even more startup innovation to address the great challenges of our times, like climate change and food security. I am sure amazing APAC alt protein entrepreneurs will continue to come up with transformative ideas – and investors large and small will provide them with funding necessary to scale and succeed.”

At this point, some contextualisation on why the rise of alternative proteins has been so dramatic this past year would be helpful. The pandemic has made it all too obvious how precarious our global food systems are, and how dangerous our over-reliance on industrially reared-animal protein is. The awareness of our global climate crisis is an at all time high and the connection between what’s our plate and our individual carbon footprints in terms of emissions is now clear to millions. Time and time again, scientists and researchers are confirming that the biggest impact we can have as consumers is to reduce our consumption of meat and dairy. Cue a host of bright-eyed founders launching plant-based, cell-based, whole-food and fermentation-based alternatives.

Back in January, we published the Asia Alternative Protein Industry Report – New Decade, New Protein, at the time the first ever in-depth look at the industry (ex-Pacific). We profiled just under 25 startups and the largest funding round on record at the time was a seed of US$4.6 million. Today, less than 12 months later, the rounds are in the tens of millions as money is pouring into what some see as the biggest impact investment opportunity on record. Investors of all stripes are desperate to get involved and it’s easy to see why. After all, what’s more basic and tangible than what humanity eats, and who in their right mind doesn’t want to support a global food chain that’s ethical, sustainable, healthy and safe?

APAC Alt Protein Funding: Key Stats & Totals

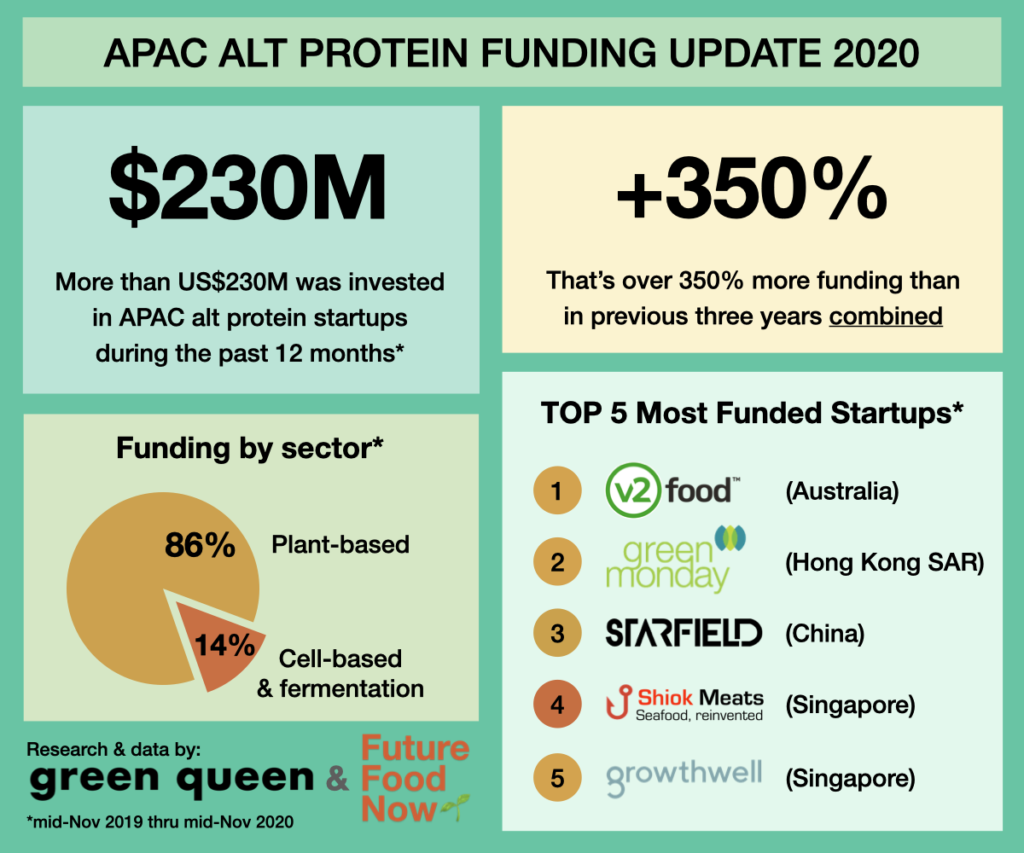

In the past 12 months, counting from mid November 2019 through mid November 2020, APAC alt protein startups have raised just over US$230 million in total from angel investors and funds, which is over 350% (4.5X) more than total funds raised over the previous three years combined.

The majority of funds went to plant-based companies with around 86% of funds, while cell-based and fermentation-based startups took in 14%. This is unsurprising, given that no cell-based products are available commercially anywhere and that regulatory frameworks are still being worked out. So far, only one fermentation tech startup in APAC has received funding.

According to the Good Food Institute, over US$1.5 billion has been invested into alternative proteins globally between January and July 2020. The vast majority of global totals belong to U.S.-based companies, with Impossible Foods accounting for US$700 million in 2020 alone, which is in line with our data, whereby a couple of larger superstar companies dominate the totals- in APAC, that’s Green Monday and v2food.

There are now over 70 startups in the APAC region. Given the number of new companies that were founded in 2020, we have no doubt that when we present our funding findings for 2021, there will be even more staggering growth and far more individual deals.

Funding Highlights & Record-Breakers

Largest Single Raise in APAC Alt Protein (also largest Asia Alt Protein Raise): Green Monday, the plant-based market leader boasting an entire ecosystem including foodtech arm OmniFoods (maker of the OmniPork product series) and Green Common (retail, F&B and distribution) made history with their record-breaking US$70 million raise. Ex-Pacific, the round is Asia’s largest in the alt protein space.

Most Money Raised in APAC Alt Protein (also largest Australia/New Zealand Alt Protein Raise): In October 2020, Australian plant-based burger and mince meat alternative v2food raised US$55 million Series B, the largest Pacific plant-based meat and alt protein round in history, with notable investors such as Li Ka Shing’s Horizon Ventures and Singapore government-backed Temasek, both of which memorably backed Impossible Foods early on. This brings their 12 month investment total to US$80 million thanks to their US$25.3 million Series A from November 2019, bagging them the title of best-funded APAC alt protein startup of the year.v2food CEO Nick Hazell told Future Food Now that the company is poised for international expansion: “We have had a global view since our founding, and this investment and new backers will help us establish our business in Asia, Europe, and the rest of the world.”

Biggest Round In APAC Cell-Based: Singapore-based cultivated seafood pioneer Shiok Meats broke records with their September 2020 US$12.6 million Series A raise, the largest raise for a APAC cell-based company ever, this after announcing the largest seed in Asia alt protein last year, which also made headlines as the first major raise for an Asia headquartered cell-based startup and the first women-founded team in the alternative protein space to raise such an amount. If you’re counting (and we are), the young startup has amassed over US$20 million in investment dollars since its inception. Shiok Meats co-founder Sandhya Sriram told us it’s getting easier to fundraise in the region, stating that there is “definitely much more interest especially from Asian investors, which was not the case 2 years back.”

Second Largest Round in APAC Cell-Based: Japan’s Integriculture, whose wide range of products includes everything from cultured serum to cultivated steak, is another star in the making. After raising a record-breaking US$2.7 million seed in 2018, they closed a US$7.4 million Series A back in May 2020, at the time the largest round for a cell-based company in Asia. They also added US$2.2 million in government grant money to their coffers in September 2020 to build the country’s first cell-ag production facility.

Largest Round in China Alt Protein: the mainland’s Starfield Food Science & Technology completed a headline-worthy US$10 million Series A in August 2020 and then another Series A+ in late October (in fact they closed several rounds during the year but exact figures are undisclosed) to expand its plant-based meal alternatives in foodservice chains nationwide, making them the most well-funded Chinese alt protein startup. When asked if the company had faced any fundraising challenges, Starfield co-founder Chen Suiwen (陈穗文) told Klar in a statement that “to be honest, we did not have any challenges at the fundraising stage.”

Largest Round in Whole Foods Plant-Based: Singapore headquartered KARANA is one of the only startups in the APAC region focused on using whole plants, rather than isolates, for their meat alternative products, and in July 2020, they closed as US$ 1.7 million seed round.

Funds, Accelerators & Other Notable Investment News

Also worth highlighting a slew of new venture capital funds that launched this year with an APAC alt protein investment remit, such as Lever VC Fund (US$23 million), the India-focused Big Idea Ventures x Ashika Group Fund (up to US$ 25 million), and several mainland China food tech interested entities such as Monde Nissin-backed Bits x Bites (up to US$ 70 million), Lever VC x Brinc’s Fund (US$ 5.65 million) and Dao Foods’ New China Venture Fund (US$ 2.2 million). In Pacific, the fund to look at is Blackbird Ventures, who just closed a fourth fund AU$ 500 million (US$ 366 million) in May 2020. While they are not exclusively focused on foodtech, we’re calling them out because they are invested in most of the Pacific alt protein pioneers.

On the accelerator side, Singapore-based Big Idea Ventures, Hong Kong’s Brinc, Singapore’s GROW and Thailand’s SPACE-F continue to be the best bets for founders and young startups to get started, with Big Idea Ventures offering the most cash (US$ 125,000 per company). A few of the leading startups startups managed to fill their coffers with government grants and startups competitions, with key governmental support for cell-based pioneers such as Turtle Tree Labs in Singapore and Integriculture in Japan, hinting at a possible regulatory path forward for lab grown alternatives in the the region. Turtle Tree Labs, one of the world’s leading cell-based dairy companies, also beat out 175,000 other competitors to win Entrepreneurship World Cup (EWS) in October 2020 for their lab-grown human breast and animal milk.

While we focused on alternative protein startups, it’s worth calling out that there were a few notable funding rounds in the non-product space with Singapore’s abillionveg closing a US$3 million pre-series A for its plant-based review app and community, now counting over 250,000 members worldwide, bringing their total funds raised to US$6 million.

Notes & Methodology

- All funding figures confirmed in person and in writing with Green Queen Media’s Sonalie Figueiras or Michal Klar – some of the figures are off the record (ie not publicly disclosed) but the startups agreed to be included in the aggregate number.

- Investment funding totals do not include accelerator funding, government grants or any competition prizes.

- ATTN Editors: if you would like to publish these figures in your publication, credit must be given to both Green Queen and Michal Klar as the authors of this research and a link to this article and his newsletter included.

- Green Queen Media is a slaughter-free publication and we do not consider insect protein as part of our alternative protein coverage.

Lead image courtesy of Green Monday.