Does Your Bank Support Fossil Fuels? Make 2024 the Year You Move Your Money

4 Mins Read

With online bank-checking tool Bank.Green, you can figure out whether you’re banking with fossil fuel backers.

2024 might just be the year when more of us can choose wisely when it comes to where we bank. Thanks to a sustainable banking campaign called Bank.Green, people can search whether they are supporting banks that continue to invest in dirty energy despite the climate crisis.

Bank-checking tool

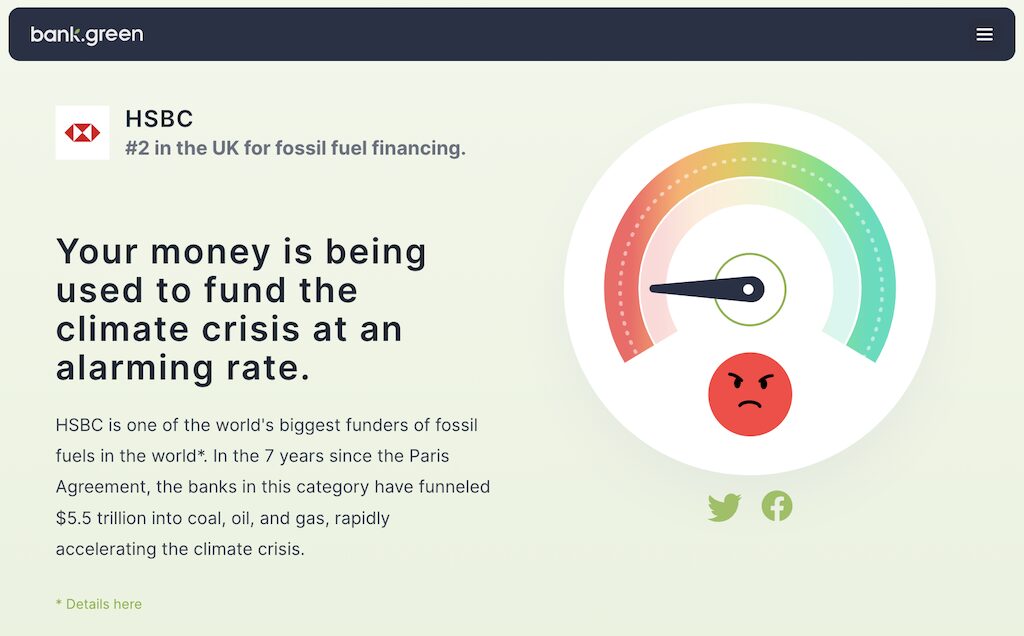

The bank-checking tool, which was first launched in 2021, allows users to search up their bank, generating a result on a red-to-green metre. There are multiple categories, ranging from Worst and Bad to OK, Good and Great. At the top of the green scale are banks rated Great, which have agreed to not provide any financing to fossil fuels and have backed up their claims with third-party verification.

Most of the data comes from investigations by NGOs such as the Rainforest Action Network, BankTrack and Reclaim Finance, as well as Bank.Green’s research.

If you search for HSBC, Bank.Green gives a red rating and provides information about the US$144.9 billion the corporation has funnelled into coal, oil and gas between 2016-2022. The bank also holds the title of being the second most generous financier of fracking in the UK and the largest backer of coal within Europe.

Related: HSBC’s greenwashing tactics – the banking industry’s dubious sustainability claims

Where you put your money matters

The reason why your banking choices matter is because the money entrusted to banks is currently being used to fund dirty energy and other climate-wreaking projects.

“Without your money, banks cannot make these loans and investments,” reads Bank.Green’s explainer. “It is up to you to choose – safeguard your money with banks that support fossil fuels, or those that do not.”

The impact of the banking industry reemerged in the headlines lately, thanks to award-winning actress Olivia Coleman’s satirical video campaign produced by Make My Money Matter. In the advert, the actress starred as Oblivia Coalmine, a “latex clad oil exec paid for by our pensions”. In the UK, £88 billion of the nation’s pension savers money is used to back fossil fuels.

As a non-profit organisation, Bank.Green hopes to raise awareness about the banking industry’s role in the climate crisis. According to data from the Banking on Climate Chaos report led by global environmental NGOs including the Sierra Club and the Rainforest Action Network, more than $5.5 trillion has been poured into the fossil fuel industry between 2016-2022.

Just 60 of the world’s top banks were responsible for the staggering figure, with names like HSBC, SMBC of Japan and ING among some of the worst offenders. The latter, ING based in the Netherlands, invested more than €7 billion between 2016-2017, as per data from Fair Finance International.

Related: How to get your portfolio into climate shape

What is a sustainable bank?

But all this scrutiny amounts to little real impact unless consumers make the change. Unless banks face monetary pressure to halt their investments in fossil fuels, it is unlikely that the industry will move towards greener practices.

Bank.Green says that it hopes to help guide money away from unsustainable banks by generating practical solutions, like switching to what it has dubbed a “fossil-free bank”. Under the non-profit’s Fossil-Free Banking Alliance, banks that have ended their connections to coal, oil and gas are identifiable with a certification badge.

Among some of the banks certified include the online-only Clean Energy Credit Union based in Colorado, and Texas-headquartered Green Dot, currently the world’s largest prepaid debit card company by market cap.

“There are a lot of fossil-free banks out there that don’t have a way of shouting about it yet,” said Bank.Green co-founder Zak Gottlieb, at the time of the alliance’s launch in late 2022. “Fossil Free Certification is the simplest way to signal to customers, professionals in the banking sector, and the general public that a sustainability-conscious financial institution is putting its money where its mouth is.”

However, fossil-free banking options remain sparse in places like Asia. Hong Kong, for instance, is devoid of a single bank certified under Bank.Green’s scheme. In these cases, the non-profit advises consumers to apply pressure through a pledge or raise sustainability concerns directly with their financial provider.